Table Of Contents

What Is Chapter 9 Bankruptcy?

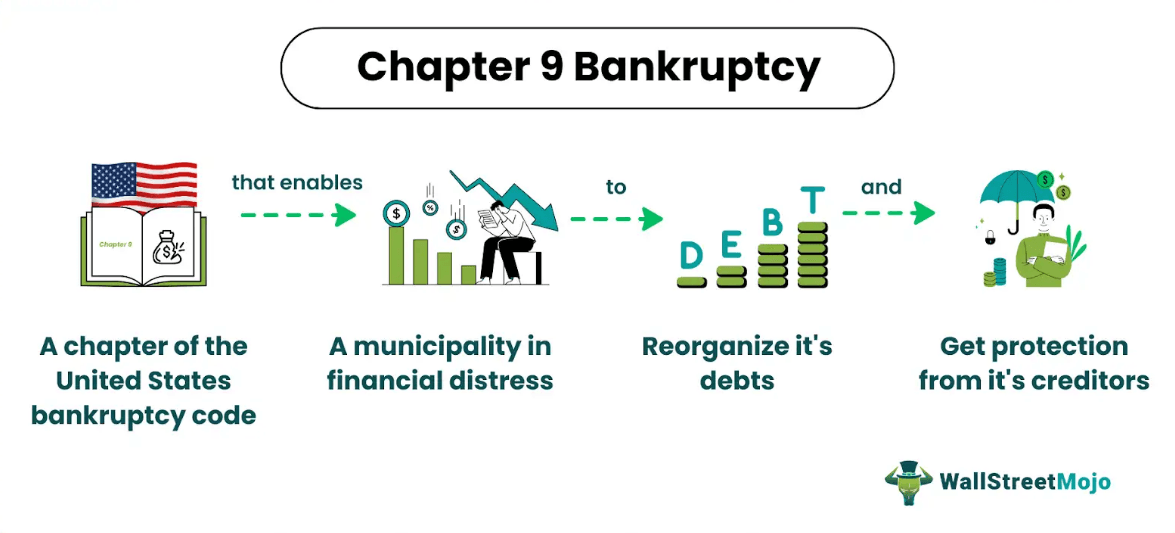

Chapter 9 bankruptcy refers to a proceeding that safeguards financially distressed municipalities from creditors by adjusting or reorganizing their debt. It enables countries, cities, and other municipalities to escape from financial turmoil through a plan without selling their assets.

The filing procedure can damage the reputation of a community pursuing this kind of relief. Moreover, it can be costly and involve a lot of paperwork. That said, in a few cases, the municipality does not have any choice when it does not have the capacity to pay money to its creditors.

Table of contents

- What Is Chapter 9 Bankruptcy?

- Chapter 9 bankruptcy refers to a chapter in the U.S. Bankruptcy Code that provides struggling or insolvent municipalities with relief by shielding them from their creditors and enabling them to reorganize the debt yet to be repaid.

- The Chapter 9 bankruptcy timeline depends on the law of the state in the U.S. Typically, the duration of the entire process may range from a few months to multiple years.

- Per the U.S. Chapter 9 bankruptcy Code, municipalities may include cities, towns, villages, taxing districts, political subdivisions, etc.

- One of its key advantages is that a bankruptcy court’s involvement is negligible.

Chapter 9 Bankruptcy Explained

Chapter 9 bankruptcy refers to a procedure specifically designed to protect municipalities from creditors by creating a plan to adjust their debts. It aims to negotiate a debt repayment plan between creditors and the municipality.

Such a plan may involve reducing the interest rate or principal on the outstanding borrowings, extending the loan repayments’ timeline and term, in addition to refinancing the borrowings by availing of a new loan. One must remember that the entire procedure may last up to a number of years; the Chapter 9 bankruptcy timeline depends upon the debt amount and the case’s complexity. Also, individuals must know that the Chapter 9 reorganizations trigger an automatic stay. Under specific circumstances, this stay safeguards the municipality’s officials as well.

Per the Chapter 9 bankruptcy code, municipalities may include any of the following:

- Villages

- Towns

- Cities

- Countries

- School districts

- Political subdivisions

- Municipal utilities

- Taxing districts

The procedure varies from one state to another. While some states allow a municipality to declare bankruptcy independently, some require a municipality to take certain measures before filing. That said, some states do not allow it at all.

A municipality must file the required paperwork with the bankruptcy court’s clerk. This can move a case forward. That said, if a municipality fails to fulfill the set requirements or has additional options available that are suitable, courts may decide that the filing is improper.

Requirements

Municipalities must fulfill the following requirements to file for bankruptcy under Chapter 9:

- A municipality has to be insolvent. In other words, it should not have any debt it can reasonably afford to repay.

- They must have the authorization to file it under state law.

- A municipality should have made or must have the will to work with the creditors to come to an agreement regarding how to reorganize the debts.

- Municipalities should have a workable debt adjustment plan or be at least willing to develop a reorganization plan.

Process Steps

Let us look at the filing procedure steps in detail.

#1 - Conducting Bankruptcy-Related Activities Before Filing

Before filing a bankruptcy petition, municipalities may need to carry out pre-bankruptcy activities, for example, negotiating with creditors. After they fulfill such requirements, they can file it. That said, one must note that if municipalities fail to meet the state’s requirements, they typically need to defend the state’s objection to the filing.

#2 - Selecting Bankruptcy Judge

In Chapter 9, a court clerk does not assign cases to a specific judge. The chief judge of the court of appeals located in the district where the case started selects a judge to look after the case. This is because such cases can be extremely complicated. Moreover, they may include elements of politics.

#3 -Triggering Automatic Stay

As noted above, filing Chapter 9 bankruptcy triggers an automatic stay, which stops the actions related to collecting debt from the municipality. Halting the collection efforts gives the municipality some breathing room, enabling it to assess its finances and determine the ideal plan to reorganize the debts and move forward.

#4 - Filing Chapter 9 Plan

In the next step, the municipality needs to file a plan to set forth how it will reorganize the debts within bankruptcy limits. Moreover, one must remember that the bankruptcy court has to confirm the plan. Neither the court nor the creditors can indirectly control a municipality’s affairs by proposing an adjustment plan that would determine the debtor’s future spending decisions and tax.

#5 - Discharge

Post-confirmation of the plan, the municipality gets a bankruptcy discharge and deposits the necessary properties or assets with the disbursing agent appointed by the court.

Examples

Let us look at a few Chapter 9 bankruptcy examples to understand the concept better.

Example #1

As of May 16, 2023, reports suggested that Hazel Hawkins Memorial Hospital would decide whether it would file Chapter 9 bankruptcy at the forthcoming San Benito Health Care District board meeting. In November 2022, the fiscal emergency declaration of the hospital authorized a filing under Chapter 9.

However, at that time, the district chose not to pursue bankruptcy in favor of creditor negotiations and financial stabilization efforts for the short term.

According to the district, since then, it has recorded cost savings, prepayments, and loans worth more than $11 million, which will provide support to the district till summer. The hospital’s decision to place the filing on its agenda is part of its continuous efforts to boost the finances prior to a potential strategic collaboration with an organization that is larger. The district has been engaging in negotiations with vital constituents, and it will continue the procedure of identifying a partner.

Example #2

Chester, a city in Pennsylvania, initiated the filing procedure for Chapter 9 bankruptcy on November 10, 2022. According to officials, the city was broke. Moreover, it was expected to fall into a deficit worth $46 million on a budget of $55 million. Approximately $39 million out of that budget was from the past-due pension payments.

On account of the financial crisis confronted by the city, removing employee healthcare, reducing its expenses concerning medical benefits, and minimizing the debt-service costs and pension were possibly on the chopping block.

Advantages And Disadvantages

Let us look at the benefits and limitations of this bankruptcy proceeding.

Advantages

- If a judge thinks the settlement is rational, a settlement might be imposed against creditors’ will.

- The interference of bankruptcy courts is minimal with regard to the running of local governments.

- A municipality need not fulfill the debt obligations after filing Chapter 9. Moreover, it halts every lawsuit.

- If creditors receive a payment within 90 days prior to bankruptcy, undoing the same is possible. Payments concerning bonds are not a preference.

- The rejection of municipal contracts, including union contracts, is possible.

- Creditors cannot submit any plan that competes with the municipality’s plan.

Disadvantages

- The filing process can be time-consuming and expensive.

- Predicting the outcome of the process can be challenging as one cannot say for sure what the bankruptcy judge would do.

- A municipality must consult the Department of Community and Economic Development or DCED before filing bankruptcy. In many cases, it has to approve the bankruptcy.

- Cramdown is impossible unless a class of creditors accepts it.

Chapter 9 Bankruptcy vs Chapter 11 Bankruptcy

Understanding Chapter 9 and Chapter 11 bankruptcy codes can be challenging for someone new to the field of finance. That said, understanding their key differences can help one avoid any sort of confusion concerning the two concepts. So, let us find out how they differ from each other.

| Chapter 9 Bankruptcy | Chapter 11 Bankruptcy |

|---|---|

| The Chapter 9 bankruptcy code applies to specific types of government entities. | Chapter 11 bankruptcy enables individuals and businesses to reorganize their debt. |

| In this case, there isn’t any provision that allows for a debtor’s liquidation. | It has provisions that enable a debtor’s liquidation. |

| The Tenth Amendment in the United State Constitution imposes limitations on bankruptcy courts’ involvement. | There are no such limitations in this case. |

Frequently Asked Questions (FAQs)

The key difference between Chapter 9 and Chapter 7 bankruptcies is that the former applies to persons with a lot of credit card, medical, or any other form of consumer debt. On the other hand, Chapter 9 applies to municipalities that have to reorganize and restructure their debt.

Yes, one must note that a municipality can choose to file for bankruptcy under Chapter 9 multiple times if the law of the state allows it. Also, individuals must remember that typically, a municipality must wait for a certain duration between the filings.

Per law, credit reporting organizations may not show a bankruptcy case on an entity’s credit report once ten years pass from when the bankruptcy case was discharged or filed.

Recommended Articles

This article has been a guide to what is Chapter 9 Bankruptcy. We compare it with Chapter 11 bankruptcy and explain its examples, advantages, and requirements. You may also find some useful articles here -