Table Of Contents

Difference Between CFA and CAIA

The full form for CFA has Chartered Financial Analyst offered by the CFA Institute, and it is a three-year course that one can qualify in three levels. In contrast, the full form for CAIA is Chartered Alternative Investment Analyst offered by the Chartered Alternative Investment Analyst Association and one can qualify it in two levels.

Getting confused between two courses can be a nail-biting experience. Any decision can turn against you in the future. So, what is one expected to do in such a situation? Does that entirely mean that one should look for a third option? That is, of course, not needed and you can solve confusion with a little bit of straining your eyes with reading exercises and working out your mind with logic and facts. So, if you are confused between which course to opt for, the CFA exam, or CAIA certification, I believe you need to read this article before making a decision carefully.

It is important to choose wisely, especially between a choice like CFA and CAIA, as both are very similar and find a lot of takers from professionals determined to establish themselves in the field of investment or financial analysis.

Table of contents

What is CFA?

CFA is the professional certification program conducted by the CFA Institute (formerly the Association for Investment Management and Research, or AIMR) for investment and financial professionals. The course is recognized and respected in the corporate world for its strong foundation of advanced investment analysis and real-world portfolio management skills that boost career prospects for investment and management professionals.

The program module is structured in a format that meets the demand of the global investment industry. The course keeps on evolving and adds to the new practices of the industry. However, it covers the broad topics relating to investment management, financial analysis, stocks, bonds, and derivatives and provides a generalist knowledge of other areas of finance.

What is CAIA?

The Chartered Alternative Investment Analyst is a designation offered by the CAIA Association on successfully clearing the CAIA exam- an exam conducted by the institution to award the designation to investment professionals. The designation is achieved by clearing two exams organized by CAIA. The successful passing of the exam by a candidate gives them the recognition of being a specialist in the field of alternative investments such as hedge funds, private equity, real estate investment, and venture capital.

This designation is globally recognized as a benchmark for professionals wanting to achieve a distinction in alternative investments. It enables a professional to understand a portfolio from the investor's perspective, implement diverse strategies, learn the fundamentals of alternative investment classes, and apply the asset-allocated information to achieve result-oriented decision-making.

CFA vs. CAIA Infographics

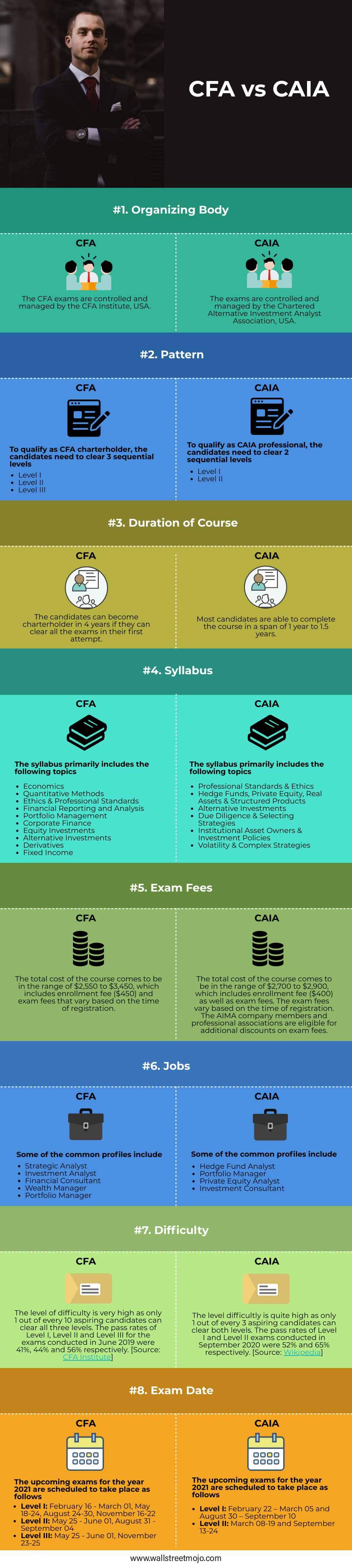

Let’s see the top differences between CFA vs. CAIA:

Exam Requirements

| CFA | CAIA | |

| To qualify for the CFA program, a candidate must have a bachelor’s (or equivalent) degree or be in the final year of his bachelor’s degree program (an update is required on attaining the degree to qualify for Level II) or a minimum of four years of professional experience. The CFA certificate is only awarded after a candidate attains four years of experience, even after clearing the exam. | To appear for the CAIA exam, candidates must have at least one year of professional experience and a bachelor’s degree. |

CFA vs. CAIA Comparative Table

| Section | CFA | CAIA |

|---|---|---|

| Organizing Body | The CFA exams are controlled and managed by the CFA Institute, USA. | The exams are controlled and managed by the Chartered Alternative Investment Analyst Association, USA. |

| Pattern | To qualify as CFA charter holders, the candidates need to clear three sequential levels.

| The candidates need to clear two sequential levels to qualify as CAIA professionals.

|

| Duration of Course | The candidates can become charterholder in 4 years if they can clear all the exams in their first attempt. | Most candidates can complete the course in 1 year to 1.5 years. |

| Syllabus | The syllabus primarily includes the following topics.

| The syllabus primarily includes the following topics.

|

| Exam Fees | The total cost of the course comes to be in the range of $2,550 to $3,450, which includes an enrollment fee ($450) and exam fees that vary based on the time of registration. | The total cost of the course comes to be in the range of $2,700 to $2,900, which includes enrollment fees ($400) and exam fees. The exam fees vary based on the time of registration. In addition, the AIMA company members and professional associations are eligible for additional exam fees. |

| Jobs | Some of the common profiles include

| Some of the common profiles include

|

| Difficulty | The difficulty level is very high as only 1 out of every ten aspiring candidates can clear all three levels. The pass rates of Level I, Level II, and Level III for the exams conducted in June 2019 were 41%, 44%, and 56%, respectively. | The Level of difficulty is quite high as only 1 out of every three aspiring candidates can clear both levels. The pass rates of Level I and Level II exams conducted in September 2020 were 52% and 65%, respectively. |

| Exam Date | The upcoming exams for the year 2022 are scheduled to take place as follows.

| The upcoming exams for the year 2022 are scheduled to take place as follows.

|

Why Pursue CFA?

The CFA study program covers almost the entire subject in its entity, but it skims through the topic giving an overall outlook to the student. It also covers alternative investments but not in detail. However, CFA is a global brand, and the institute enjoys a large membership base. Therefore, this designation is considered the preferred course to achieve a better and broader scope in traditional investment.

CFA should be the ideal course for you if you are looking to carve out a niche in the traditional investment roles, such as fund managers and security analysts. In addition, the certificate program does not enjoy a high rate of passing and therefore has prestige associated with it, which makes a professional stand out in the eyes of his employer.

CFA is cheaper than other international certifications, gives you a good grounding base about the financial markets, and improves your expertise and knowledge.

You may look at a detailed note on the CFA examination guide for further details.

Why Pursue CAIA?

CAIA is a perfect course for those individuals who wish to fill the educational gap to rise quickly in the alternative investment field. The CAIA designation holders are relatively less than CFA charter holders and give a good chance to stand out from the rest in the job market.

CAIA has been seeing tremendous growth in the last few years, and anyone interested in a specialization should prefer this course. The pass rates for CAIA are quite high; however, it does not directly open the doors to big opportunities.

However, CAIA helps achieve more client base and professional networking connections through membership in global chapters.

Conclusion

You have all the necessary information in this article, and it's time you weigh your options carefully and decide. After all, you alone are responsible for shaping your career. We wish you all the luck and hope you find greater success in whichever course you opt to study.

Recommended Articles

This has been a guide to CFA vs. CAIA. Here we discuss the key difference between them and infographics to help you choose the right career. You can learn more from the following articles –