Table Of Contents

Certificate of Deposit (CD) Definition

A certificate of deposit (CD) is an investment instrument mostly issued by banks, requiring investors to lock in funds for a fixed term to earn high returns. Certificate of deposit rates essentially require investors to set aside their savings and leave them untouched for a fixed period. This is usually a preferred mode of short-term investment for investors.

As a reward, the issuing financial entity offers premium interest rates. Coupled with the power of compounding, investment earnings multiply with time, indicating higher the maturity tenure, the greater the returns.

Key Takeaways

- A certificate of deposit is defined as an investment vehicle that locks invested funds for a fixed tenure and offers safer but lower rates of return as compared to stocks or bonds

- Banks and credit unions mostly issue them in exchange of an interest income.

- The tenure of CDs ranges from a couple of days, a month, six months, a year, five years, to ten years.

- Interest rates offered could be fixed or floating and are usually paid monthly or semi-annually. Banks and credit unions adjust rates periodically as per changes in the Federal Reserve Rates.

- They come at a low risk, with some being insured by government bodies. There is also a lack of liquidity, as any withdrawal before maturity usually calls for a penalty.

- There are many types of CDs in the market, with some being traditional types, liquid CDs, jumbo types and broker CDs, etc.

Certificate of Deposit Explained

A certificate of deposit account is a kind of fixed tenure investment instrument offered by banks, credit unions, and brokers working for a financial entity. Usually, a CD is understood as a kind of savings account that offers a higher interest rate than an ordinary savings account.

Although this edge over savings accounts comes at the cost of a lack of liquidity. While an ordinary bank account has no rules against using the deposit money as and when needed, CDs typically don’t allow withdrawals before the tenure ends. This hinders liquidity if an investor runs into a sudden cash requirement. The only way to withdraw the funds is by paying a penalty fee.

At the end of the term, investors receive the original investment value along with compounded interest earnings. Add to that the safety and low risks they bring; CDs still remain a highly sought after investment. An investor can look through the web or visit a bank to learn about the various types of CDs offered. Maturity terms, interest rates, minimum balance requirement, penalty fees will all vary with the financial entity.

As such, one must jot down monthly financial requirements and a comfortable investment amount to set aside. Based on the above information, it will be easier to zero in on the product suited to one’s needs.

History

The history of the certificate of deposit (CD) traces back to the early 1960s when financial institutions introduced this financial instrument as a secure savings option for customers. Banks initially developed CDs to attract deposits for a fixed period, offering higher interest rates than traditional savings accounts. The first CDs featured fixed maturities and interest rates, providing a predictable return for depositors. Over the years, CDs evolved with variations such as adjustable rates and early withdrawal penalties. Despite changes in the world of finance, the certificate of deposit account remains a popular choice for investors with a low-risk appetite and seeking stable returns with a guaranteed principal.

Features

Let us understand the features that define the certificate of deposit rates through the explanation below.

- Eligibility – A CD is usually issued by banks to individuals, mutual funds, trusts, companies, etc.

- Maturity Period – The investment is locked in for a fixed tenure. Normally, tenures vary amongst different types of CDs, with some having a maturity of a couple of days, a month, six months, a year, or five years. It could also be longer, depending on the bank.

- Fixed Amount – The initial amount of investment, which will be referred to as the principal here as well, is fixed. Many banks often put forth a minimum investment requirement. The amount also varies as per financial institutions.

- Interest Rates – Investors earn interest in exchange for their investments. Rates could be fixed or floating. Interests are usually paid monthly or semi-annually. Banks and credit unions adjust rates periodically as per changes in the Federal Reserve Rates.

- Average Percentage Yield (APY) Usually, the longer the fixed tenure, the higher will be the rate. Moreover, due to compounding and an absence of withdrawals, interests keep accumulating on the principal amount. With the interest charged on the accumulating principal each time, it reaps higher earnings. Some online banks offer high-yield certificates of deposit with annual percentage yield (APY) as high as 0.60%.

- Negotiable– Some CDs are negotiable, i.e. they can be sold in the secondary market.

- Low Risks – CDs come with very low risk and are highly safe investment since they are not that prone to fluctuations affecting stocks or bonds.

- Insured – Moreover, a federally insured bank offering CDs comes with insurance up to $250,000.

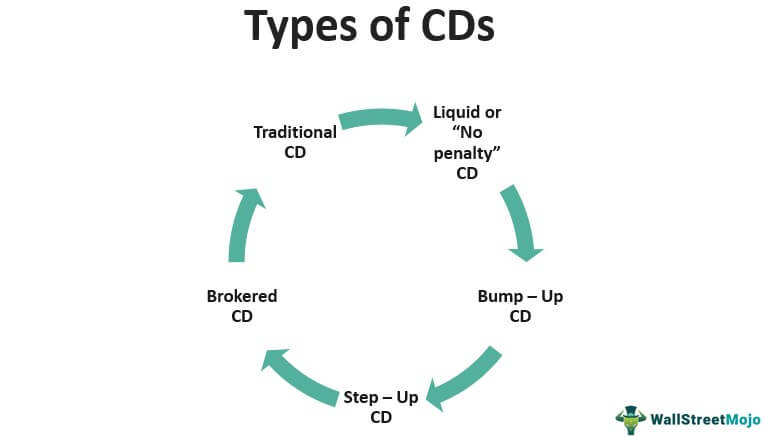

Types

With the evolution in the world of finance, certificate of deposit accounts also underwent a series of modifications. Let us understand the different types of CDs through the discussion below.

- #1 – Traditional CD – It is an age-old type of CD that comes with a fixed rate of interest, strict penalty on early withdrawals and federal insurance. Think of it as a fixed deposit.

- #2 – Bump-Up CD – Under this type, if the CD interest rates increase after buying a CD, then Bump-up CD gives an option to raise the interest rate. To exercise this option, the same needs to be informed by the depositor to the bank in advance. Bump up CD also pays lower interest compared to the Standard CD. You'd have to wait for a rate hike by the bank to enjoy higher earnings. In case the rates aren't increased, you'd be stuck with the initial rate.

- #3 – Step-Up CD – The step-up Certificate of Deposit works similar to the bump-up type. Although the incremental interest rate hikes happen on their own accord from the bank's end. A depositor doesn't need to personally ask the bank to raise the rates up. Hikes may be given effect with six months, nine months, or even one year in case of long term CD.

- #4 – Brokered CD – Brokered CDs is acquired through brokerage accounts. Brokers could represent a bank or financial entity. Sometimes multiple banks collaborate with a single agency. They offer ease in acquiring a CD since a broker takes care of the process. This CD offers better rates, but the risk is more as compared to a standard CD as they are negotiable and can be traded in the secondary market. Federal agencies often warn against illegitimate brokers disguised behind fake ids. As such, it is a must to confirm the validity of the agency they are representing before taking the plunge.

- #5 – Liquid or “No penalty” CD – The liquid CD allows the depositor to withdraw the money during the tenure without payment of any early withdrawal penalty. It is flexible enough to shift the funds from one CD to a higher paying CD. Liquid CDs pay less interest compared to the fixed period standard CD.

- #6 – Others – There are several other distinct types of CDs available in the market suited to inidividual needs such High-yield, Jumbo, IRA based, etc. Since terms of a CD varies vastly amongst banks, reading the fine print will help not missing out on any details that could bring down your earnings. Additionally, an investor can quickly compare possible earnings by using any relaible certificate of deposit calculator.

Examples

A real-world example of a certificate of deposit rates could be those offered by commercial banks such as the Bank of America, Fidelity or Discover Bank, etc. For example, one of Bank of America's products comes with a minimum balance of $10,000 with an option to choose terms between 7-35 months.

Let us look at some practical examples of the Certificate of Deposit to understand the concept better.

Example #1

Joe invested $5,000 in CD with a bank at a fixed interest rate of 5%. The term of maturity was 5 years. The returns and maturity value of the CD are calculated as below:

| Year | Amount | Interest |

|---|---|---|

| 0 | 5000 | 0 |

| 1 | 5250 | 250 |

| 2 | 5513 | 263 |

| 3 | 5789 | 276 |

| 4 | 6078 | 289 |

| 5 | 6382 | 304 |

Since the principal amount is $5,000, and the maturity proceeds are $6,382. The return on the CD for the period of 5 years is $1,382.

Example #2

Tom invested $10,000 in a CD account with a bank. The interest rate was fixed at 5%, with the maturity being 5 years. Unfortunately, Tom had to withdraw the sum prematurely towards the end of 3rd year. As an early withdrawal penalty, Tom had to pay 6 months’ interest. Calculate Tom's earnings and penalty charges.

| Year | Amount | Interest | Early Withdrawal Penalty |

|---|---|---|---|

| 0 | 10000 | 0 | |

| 1 | 10500 | 500 | |

| 2 | 11025 | 525 | |

| 3 | 11576 | 551 | 276 |

In this case, the principal invested is $10,000 and the maturity proceeds at the end of the third year are $11,576.

The total returns for the period are $1,576. Since Tom withdrew money before the maturity, he had to pay a penalty of $276 (6 months interest = 551/2 = 276).

What is Negotiable CD?

Let us understand how negotiable CDs are distinct from the traditional ones through the points below. These points shall also make its intricacies crystal clear as well.

- A negotiable certificate of deposit (NCD) is a money market instrument representing a time deposit with a financial institution.

- Typically issued by commercial banks, thrift institutions, and credit unions to raise short-term funds.

- NCDs have fixed maturity periods, ranging from a few days to several months, providing a short-term investment option.

- Unlike traditional CDs, NCDs are negotiable, meaning they can be bought and sold on the secondary market before maturity.

- The interest rates on NCDs are usually higher than those on traditional CDs, reflecting the liquidity and marketability of these instruments.

- Investors can access funds before maturity by selling the NCD in the secondary market, offering liquidity compared to traditional CDs.

- While considered relatively low-risk due to the backing of financial institutions, NCDs still carry some risk, particularly related to interest rate fluctuations and the issuing institution's creditworthiness.

Advantages and Disadvantages

Every concept or phenomenon have two sides of the coin and certificate of deposit account is no different. Let us understand the advantages and disadvantages through the explanation below.

Advantages

- The risks are low with CDs as compared to other instruments such as stocks, bonds, etc. Being kept with banks, they are relatively safer from market fluctuations which stocks are prone to. Moreover, many have federal insurance coverage.

- CDs offer better returns for the amount deposited than the traditional savings account.

- Some online banks and institutions offer very high-yielding products that an investor can explore to make better returns.

- Post maturity, a depositor has the option to reinvest their funds using rollover options into a new CD.

Disadvantages

- It is not a liquid asset as the funds are blocked for a fixed duration. Any withdrawal of deposit before maturity, in most cases, will occur at the cost of a withdrawal penalty.

- With low risk, the returns are highly low as compared to stocks, or bonds.

- When the interest rates are fixed, it does not take into account changing inflation rates which offsets gains as compared to the cost.

Certificate of Deposit Vs Bond

Let us understand the differences between certificate of deposit rates and bonds through the comparative points below.

Certificate of Deposit

- Issued by banks, credit unions, and financial institutions.

- It typically has a shorter maturity period, ranging from a few days to a few years.

- Offers fixed or variable interest rates, often lower than bonds, reflecting the shorter term.

- Generally, less liquid than bonds, with penalties for early withdrawal.

- Non-negotiable in the secondary market; investors usually hold until maturity.

- Lower risk due to the backing of the issuing institution; considered a conservative investment.

Bond

- Governments, municipalities, or corporations can issue it.

- It can have short, medium, or long-term maturities, ranging from a few years to several decades.

- Typically, it offers higher interest rates compared to CDs, reflecting the longer-term commitment.

- Generally, they are more liquid than CDs and tradable on the secondary market.

- Bonds are negotiable, allowing investors to buy and sell in the secondary market.

- Risk levels vary depending on the type of bond. For instance, government bonds are considered low-risk, while corporate bonds carry higher risk depending on the issuer's creditworthiness.