Table Of Contents

What Are Cash Reserves?

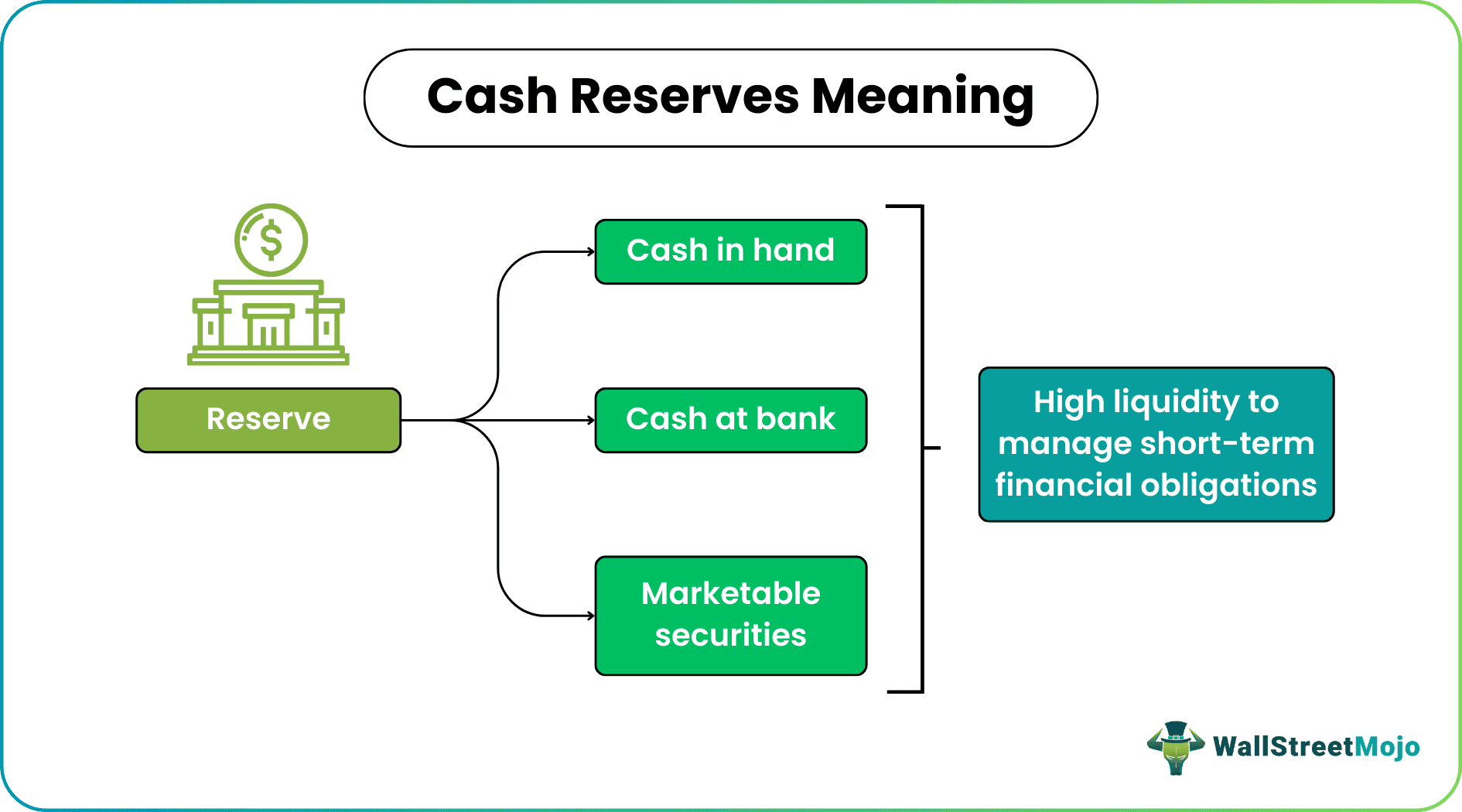

Cash reserves refer to the most liquid asset held by individuals, companies, banks, or other entities that can be used to meet short-term obligations arising in emergencies. Though holding large amounts of cash in hand or bank is not advisable, one should always set some money aside.

Cash reserves include cash deposited in the bank, cash held in vaults, and highly liquid investments with short maturity periods, such as treasury bills and money market funds. Along with serving its purpose, when invested in liquid instruments, it can also earn a constant source of income.

Key Takeaways

- Cash reserves refer to the total amount of liquidity an entity holds that can finance the most urgent or short-term obligations without raising the need for borrowed credit.

- The concept is important for companies, individuals, and banks. Though, for the former two, the number of reserves held depends on the entities’ estimation and contention.

- For banks, the requirement is based on the custodian of cash reserves or the central bank, which mandates a reserve ratio. The commercial banks should hold reserves with themselves, as well as with the central bank.

Cash Reserves Explained

Cash reserves are one of the many ways to manage assets. Money or cash is a current asset and is highly liquid. That is, if a person owns only a car as an asset, they would first have to sell the car and convert the asset into cash or borrow loans to finance any other activity. It might take some time, especially if a commercial entity were to do this, as it would lead to reduced responsiveness and increased debt.

However, it doesn’t mean that a person or organization should hold cash vaults. Cash can be held in any liquid form. For example, debt instruments with short maturity periods of less than three months or stocks can be easily converted to cash. These assets can play the dual function of meeting urgent short-term obligations while generating investment returns.

The concept is mainly related to businesses and banks. The perfect mix of current assets can help companies manage their expenses and plan their operations accordingly. Some companies maintain specific months of operating expenses in reserves. It is based on careful estimations of the emergency obligations that might arise.

The reserves of multinational corporate giants like Apple, Microsoft, etc., run in billions. For example, Apple's cash reserves estimate around $200 billion, while Meta Platforms Inc. has $60 billion in reserves.

On the other hand, banks must maintain a certain percentage of their deposit liabilities. A bank’s deposit liabilities are the amount it receives from its customers, which it would have to pay back in the future. Therefore, it is a liability for the bank. Each country’s central bank specifies this amount as the cash reserve ratio.

The central bank is the custodian of cash reserves, as commercial banks are mandated to maintain a certain portion of their reserves with the central bank. However, the banks will be allowed to withdraw the required amount from the reserve in case of emergencies and pay back when the cash requirement is less.

Individual Cash Reserves

Considering individuals, everyone has some liquid cash. It might not be as high as reserves held by businesses or banks. However, currently, with the rise of mobile payment apps, the cash held by people is much less. Mostly, cash is held at the bank in a savings account. It would earn them some interest on their deposits.

But some individuals do not want to hoard cash or earn little sum in interest. Hence, they invest in marketable securities. Stocks, bonds, and other liquid investments can greatly add to reserves and earn investors higher returns.

Cash reserves are necessary. Nevertheless, it is important to understand the difference between holding and hoarding. Entities should estimate the optimum amount of reserves. And even with the reserves, they should manage the most profitable proportion of instruments and liquid cash. Otherwise, it would lead to missed out profits and opportunities.

Examples

Check out these examples to get a better idea:

Example #1

Here’s a hypothetical example of a commercial bank X. The central bank of the country requires a reserve ratio of 10%. However, half of this should be held with the central bank and the other half with X. The total deposits in the bank amount to $2 billion. Hence, $200 million will be held in reserves, $100 million each with the central bank and X.

Of this, only $20 million is available as liquid cash, i.e., currency. So the bank has invested the rest in other investments to earn returns. It would be a source of income for the bank and help it pay off the interest on deposits.

Example #2

Vedanta Resources is a mining company headquartered in London, England. The company’s rapid expansion in recent years and acquisitions have led to an $11.6 billion debt. Analysts have noted the firm’s consistently weak liquidity position. Along with this, the company also has $900 million bonds maturing in early 2023. Thus, the management has decided to seek shareholders’ approval to withdraw money from its reserves and into the balance sheet for funding the debt repayment.

Cash Reserves vs Savings Account

Cash reserves and a savings account might sound similar. But the difference between them is large. So let’s distinguish between the two.

- Reserves consist of many components – cash in hand, cash at the bank, high liquidity instruments, etc. The cash at the bank is usually deposited in the savings account. Hence, it forms a part of the reserves.

- Not all channels of high liquidity (or constituents of cash reserves) have the potential to earn returns. For example, holding cash in hand doesn’t make returns, while investing in an asset does. Similarly, depositing money in a savings account earns interest for the depositor. Though the income received might not be high, it also serves the purpose of liquid cash that can be used for urgent requirements.

- Cash reserves apply to companies, banks, and individuals alike. However, a savings account applies to companies but mostly to individuals.