Table Of Contents

Cash Reserve Ratio Meaning

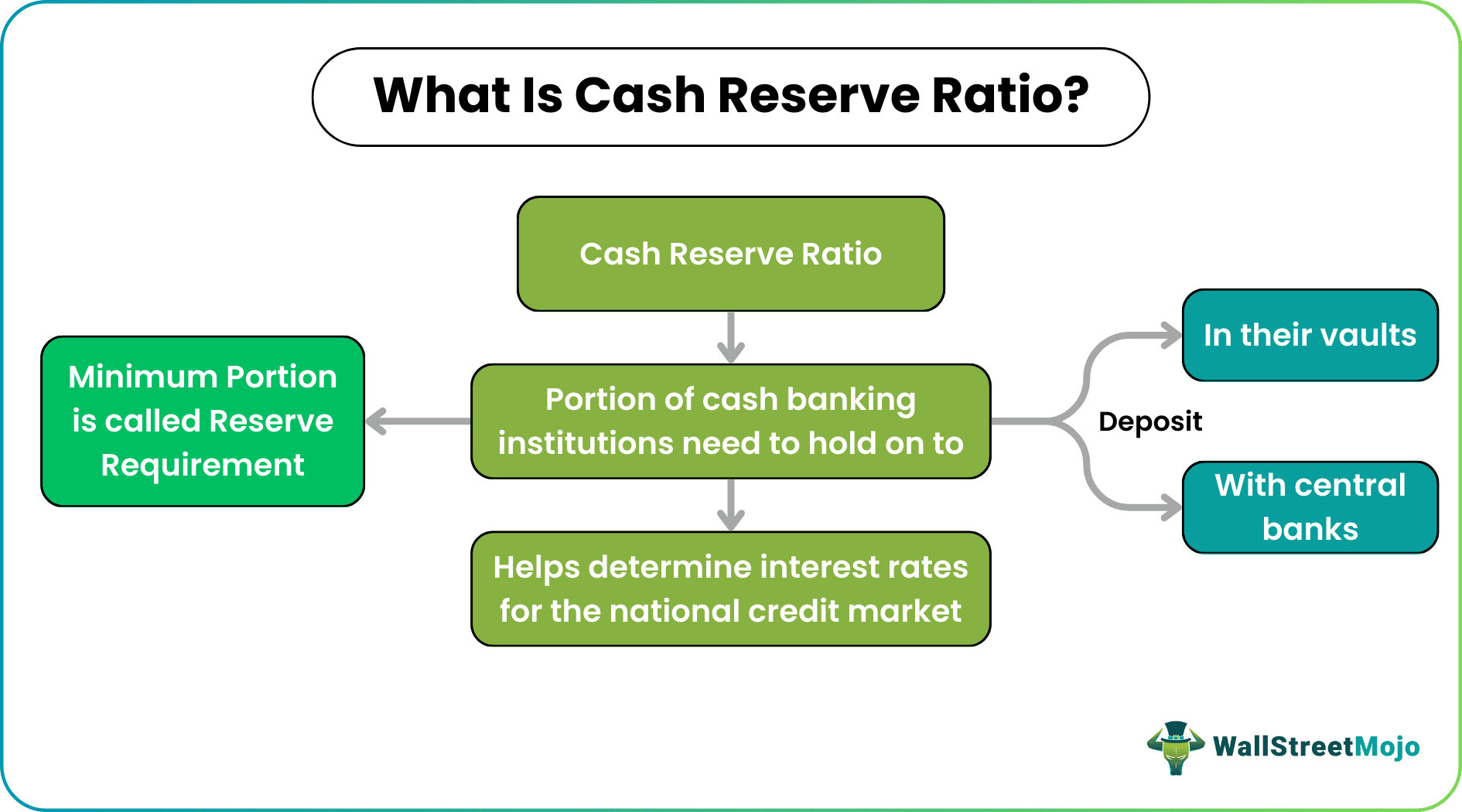

Cash Reserve Ratio (CRR) is the amount of cash banks need to hold on to without being allowed to invest or lend it for interest. Also known as the reserve ratio, this percentage lets the commercial banks find out the portion of monetary reserves they need to keep with their respective central banks.

A central bank increases this portion of cash reserves when it aspires to limit the use of funds to be lent out or invested. On the other hand, it lowers the cash reserve ratio if it desires to encourage lending and investment in the market.

Key Takeaways

- Cash Reserve Ratio (CRR) is the rate based on which the central banks decide on the cash reserve requirements that commercial banks need to fulfill.

- When the banks across the nation held the reserve portion of cash, it becomes inaccessible to them.

- In the United States, the Federal Reserve sets the CRR for the American banks.

- The ratio helps central banks to fix an interest rate at which the funds would be provided for investment and lending purposes.

How Does Cash Reserve Ratio Work?

The cash reserve ratio is the portion of the cash that the central banks ask respective commercial banking institutions to keep aside and not use for lending or investment purposes. The minimum portion of the money to be held on to is known as the reserve requirement. The commercial banking institutions might reserve the cash in their vaults or deposit it with the central banks.

The nations' central banks have different parameters based on which they decide the amount to be kept aside. Thus, the cash reserve ratio of RBI in India will differ from that of the Federal Reserve in the United States.

In the US, Regulation D of the Federal Reserve Board guides the reserve requirements for banking institutions. Based on the same, the American banks fulfill their depository and lending functions. The ratio is computed from time to time; hence, it never remains the same. The central banks send the updated reserve requirement guidelines to these institutions, making them effective per the notifications received.

Considering the level of inflation and liquidity in the economy, the central banks may increase or decrease the reserve requirements, ultimately leading to lending at higher or lower interest rates, respectively.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Formula

The formula used for calculating the cash reserve ratio is given below:

CRR= Reserve Requirement / Deposits

Examples

The following examples will help define the cash reserve ratio even better. Let us have a look:

Example 1

Suppose the Federal Reserve specifies the CRR as 9%. In such a scenario, a banking institution with a deposit of $100 million can easily calculate the reserve requirement to put in their vault or deposit with the Reserve.

Based on the formula above, the bank derives the equation for finding out the reserve requirement when deposits and ratios are already provided:

Reserve Requirement= CRR * Deposits

= 9/100*100 million

= 9 million

Thus, the banks would require holding on to $9 million, which would further be unavailable for lending and investment purposes.

Example 2

When CRR is applied, it helps in multiplying funds. Let us check how so in very simple terms. If a bank has a deposit of $100 million and the reserve ratio is 5%, it holds on to $5 million but lends and invests the rest 95% deposits, which account for $95 million. This 95% of the fund comes back to the bank in the form of more deposits from the citizens. Then, the banks access 95% of that total amount, which returns to the bank again as deposits, and the cycle continues. Meanwhile, it keeps aside the 5% every time as per the central bank's guidelines.

Here, the banking sector's 5% ratio becomes a money multiplier.

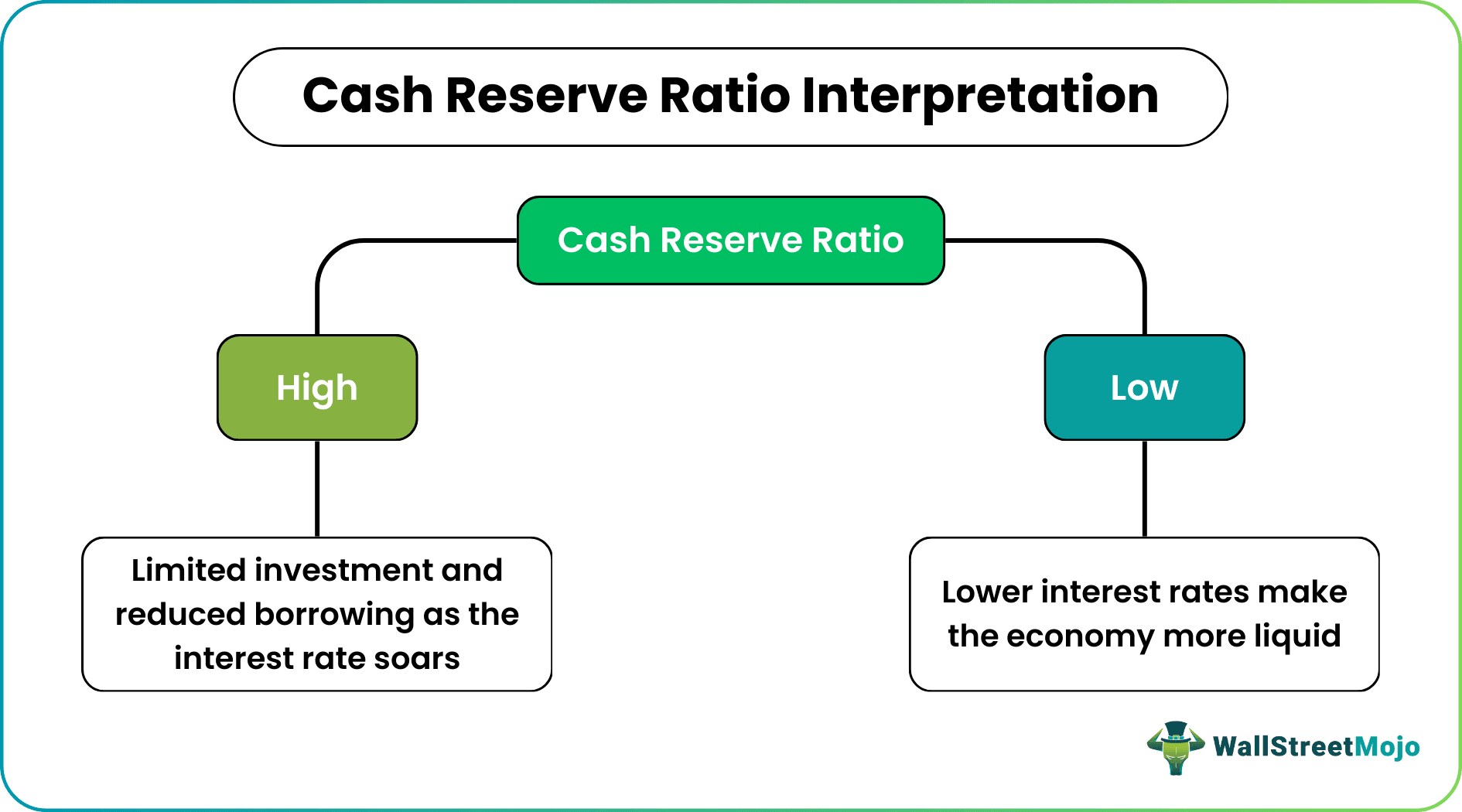

Interpretation

When the CRR is low, the economy is more liquid. On the contrary, a higher ratio increases the interest rate, and the cost of borrowing increases significantly. Plus, a higher ratio implies that the banking institutions have to hold on to more funds, making the cash inaccessible.

This, in turn, negatively impacts the economy as the investment would be limited, and the funds available for lending would be insufficient. Therefore, as the money supply minimizes, the economy slows down.

Importance

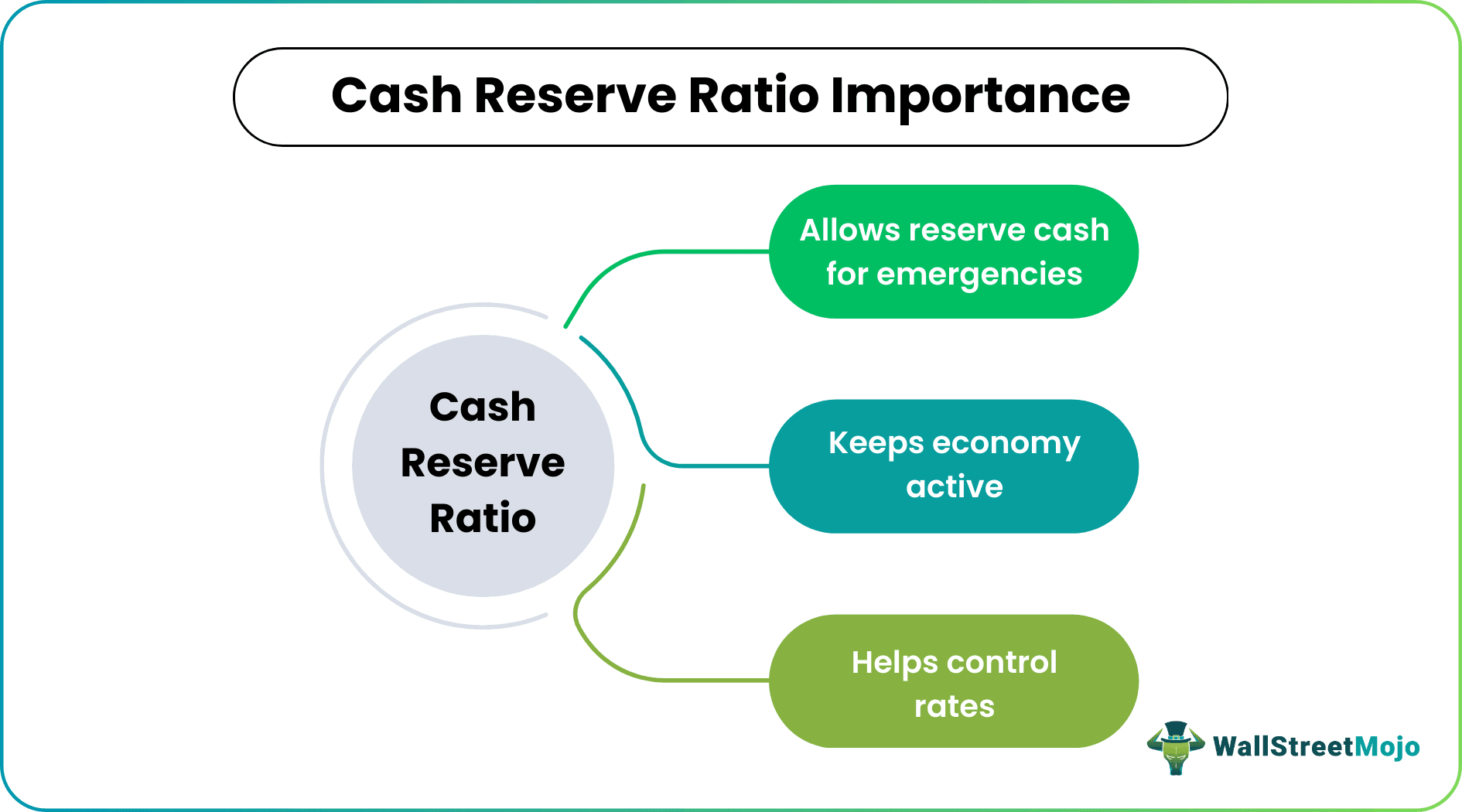

The reserve ratio helps banks and lenders obtain base rates at which they would lend money to loan seekers. The banking institutions, therefore, are not allowed to finance any borrower below that base rate. As the rate fixed by the central banks is the same for all lenders, the national credit market becomes more trusted and transparent.

When banks source deposits from the public, the key goal of the bank is to lend and, in turn, to earn a spread. Banks may like to maximize their lending to maximize their profit and keep their idle cash sitting on the balance sheet at a minimum. If most of the funds are lent out, and in an emergency or situation where there is a sudden rush to withdraw funds, the banks will struggle to meet their commitments or, in other words, their repayments.

Against those deposits, ensuring some liquid money is the main purpose of CRR, while its secondary objective is to allow the central bank to control rates and liquidity in the economy. Interest rates swing up or down in the short term depending on how much liquidity the banks can lend. Too much money flow or spike in money lending will lead to a collapse in the rates, and too little will lead to a spike.

Cash Reserve Ratio vs Statutory Liquidity Ratio

The cash reserve ratio and statutory liquidity ratio (SLR) are similar as the central banks provide guidelines to ensure the economy has enough reserve resources. However, these two are not the same and have multiple differences to take note of.

Let us have a quick look at the distinction between the two through the table below:

| Category | Cash Reserve Ratio | Statutory Liquidity Ratio |

|---|---|---|

| Definition | Central banks ask commercial banks to keep only cash as reserves. | Central banks ask commercial banks to keep cash, gold, and other liquid assets as reserves. |

| ROI | Banks do not earn returns | Banks earn returns on the assets held |

| Function | Maintenance of liquidity in the credit market | Looks into the bank’s credit expansion and solvency issues |

| Reserved by | Reserves can either be kept by banks themselves or central banks | Reserves are kept by the banks themselves |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.