Table of Contents

What is Cash Handling?

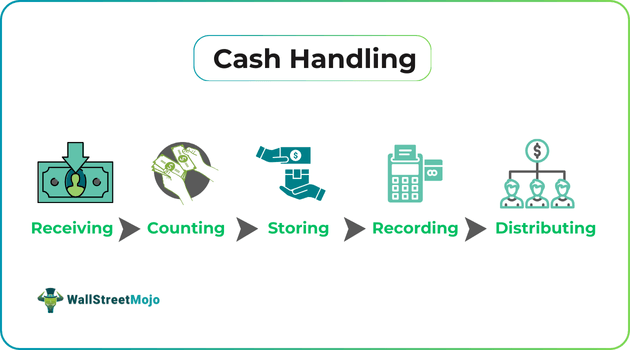

Cash handling is the systematic management of cash transactions within a business or organization in a way that facilitates compliance, accuracy, and security. Receiving, counting, storing, recording, and distributing cash are a few of the most important cash handling skills. Ensuring this aspect of business is critical as it prevents errors, fraud, and, most importantly, theft.

Wherever there is cash handling, there is a significant risk of internal theft, where an employee may be involved in stealing cash from the register. A study found that about 75% of managers steal from cash registers, which results in a loss of revenue by 5%. Therefore, ensuring sufficient measures are taken to prevent leakage is vital.

Key Takeaways

- Cash handling is receiving, documenting, and accounting for cash transactions in a retail business. It is an integral part of the business to master as there are multiple points where internal and external leakages can occur.

- Internal thefts from cash registers have resulted in losses beyond billions of dollars in the United States. About 75% of employees steal from cash registers.

- Incorporating a foolproof system allows the business to improve transparency with its teams and, more importantly, stakeholders.

- Efficient systems to handle cash can help reduce risks, improve efficiency, and facilitate analysis and growth of the business.

Cash Handling In Retail Explained

Cash handling in the retail sector is the process of receiving, documenting, storing, and disbursing cash in a way that reflects the revenue generated and promotes the security of the cash flow.

The most common type of risk concerning cash in a retail organization is internal theft from cash managers. Internal theft is reported to result in a $4 trillion global GDP yearly. However, it is important to note that the chances of internal theft are reduced significantly wherever there is a cash handling policy.

Despite the digitization of major processes, the retail sector still depends largely on cash. Since there is a large volume of cash transactions daily, it increases the risk factor immensely. Retail organizations must have a well-established written policy that mentions rules regarding documenting cash movement, where they are supposed to be kept, reporting authorities, and deposit rules.

Companies can always utilize the latest technology to protect cash from being stolen. Smart safes, integrated POS systems, and cloud video security systems can provide businesses additional security.

Procedures

The exact procedures may vary from organization to organization. However, a few of the most common and prominent procedures are:

- The first procedure that has to be followed to ensure that all employees follow the cash handling policy is to ensure that each cash transaction is documented in the format directed by the manager.

- Until the cash is deposited, it must be placed in a secure location clearly defined for employees of different shifts.

- The cash collected is used for various purposes within the organization. Therefore, it is ideal that cash must be segregated for different purposes and kept separately from other cash. It is most commonly used to segregate petty cash.

- The funds must be balanced regularly to find discrepancies in the accounts and the actual cash.

- If discrepancies are found, the organization must have an established reporting system to raise the issue and take remedial action on priority.

- One person taking care of the whole process may be taxing for anyone. Therefore, it is important to delegate tasks to different employees. Activities like handling & collection, accounting, and closing figure verification are exclusive duties, and exclusive employees must handle them.

- Surprise audits and checks must be conducted to prevent discrepancies and boost accuracy.

Examples

Now that the theoretical aspects of cash handling charges and skills are covered, it is time to explore the practical applicability aspect of the concept through the examples below.

Example #1

ABC Hypermarket is located right outside a gated community that holds 400 units of residential apartments. Therefore, they experienced a high volume of cash transactions. Their first-shift cashier, David, counted the cash, documented the amount and handed over the second-half duties to Aaron daily.

While it was company policy to count cash during the beginning and end of shift, Aaron skipped the step as customers were always waiting and thought it was pointless. David took advantage of this behavior and pocketed $200 from the register.

Upon finding the difference at the end of the day, Aaron reported it to the store manager, who found through the CCTV that David had stolen from the register. He was given a final warning, and Aaron was also instructed to count cash twice daily and not skip steps in the process.

Example #2

Fuelled by technological advancement in the cash-handling space, the cash-handling device market is set to grow rapidly. It is forecasted to grow globally to $18.4 billion by 2032. In 2023, it was estimated at $11.3 billion. Therefore, this market is predicted to grow at a CAGR of 5.5% between 2024-2032.

Digitizing these critical functions of a business allows the stakeholders to conduct thorough analyses, avoid leakages, and improve efficiency.

Best Practices

While giving customers the best shopping experience is extremely important, protecting employees, cash, and the bottom line is also important. Below are a few cash handling policy best practices that may put most organizations at ease with handling this aspect of business.

- The first step most businesses make is they limit the number of people that handle the cash counter. For employees who do, there must be a clearly defined protocol and a senior who can be contacted to clarify doubts.

- Even when business is brisk and busy, cashiers must be trained to identify counterfeit notes by touch, feel, or appearance to avoid unnecessary complications.

- It is vital to verbally confirm the cash received and the change given to the customer to ensure no confusion.

- The cash must be counted before the shift starts and after the shift ends to ensure no gaps or differences between shifts.

- Technology not only eases the cashier's job but also reduces the loopholes that can be exploited and cause internal thefts.

- Whenever there is a discrepancy when counting cash, it must be immediately reported to the immediate manager to ensure timely action can be taken.

- At the end of every working day, the cash must be accounted for, stored securely, and secluded before being deposited or distributed as payments.

Importance

The importance of efficient cash handling skills has been mentioned multiple times in the article. However, a few of the most important points are discussed below.

- Effective handling ensures that the business experiences significantly less risk of losses and theft. In 2017, the retail industry lost over $36 billion in employee theft in the United States of America. Effective cash handling can avoid such losses altogether.

- Transparency is a direct by-product of the cash-handling process. Automated processes and clear documentation give stakeholders a clear idea of their financial position and if there are any leakages.

- Apart from being a risk-reducing factor, it also streamlines processes and ensures that everyone knows what they are supposed to do and what has to be avoided at all costs.

- Especially for busy retail businesses, these discrepancies can cause delays and downtimes, which may be extremely detrimental to overall customer satisfaction. Therefore, effectively handling cash can help businesses with uninterrupted operations.

- It is a win-win for everyone involved. It allows businesses to make more money, customers to enjoy great service, and employees’ best interests to be accommodated.