Table Of Contents

What Is Cash Flow From Assets?

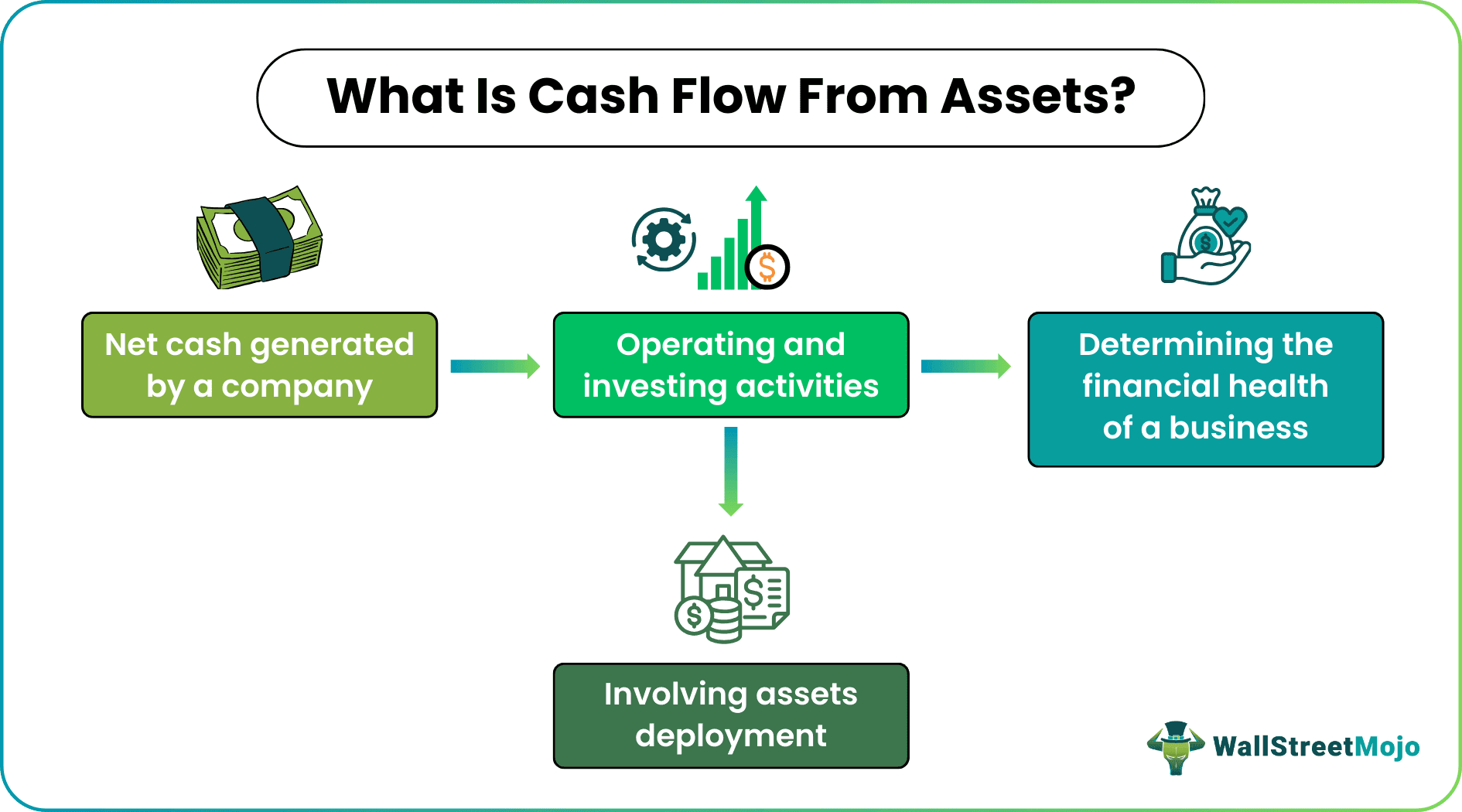

Cash Flow From Assets refers to the accounting measure that assesses the money derived from or consumed in the business's operating and investing activities performed by utilizing the company's assets. However, it doesn't consider the cash flow from financing activities such as issuance of stocks or buyback.

It is a critical metric for managers, investors, financial analysts, and other associates for gauging the financial stability of a business entity. It thus determines the efficiency of the firm in generating income from its business operations and its competency in investing in assets. A positive cash flow reflects the company's solid financial position.

Key Takeaways

- The cash flow from assets refers to an accounting metric that determines the income a company generates from its business operations and investments by efficiently employing its short-term and long-term assets.

- Its formula is Operating Cash Flow - Net Capital Expenditure - Change in Net Working Capital.

- It serves as a critical measure for investors, managers, and analysts to ascertain the financial health and return potential of a company.

- A positive CFFA indicates a stable investment opportunity, while a negative value may signify that the business is investing more in capital projects or assets.

Cash Flow From Assets Explained

Cash flow from assets signifies the company's efficiency in engaging its short-term and long-term assets for producing income from its ordinary business operations. There are the following different kinds of asset utilization encountered in business setup that help it generate significant cash flows:

- Real Estate: The fixed assets like land, buildings, and plants facilitate the firm to execute regular business operations and yield profits while spending on its maintenance and repairs.

- Machinery and Factories: The company's factories and machines demand an initial and ongoing investment for uninterrupted manufacturing of goods or provision of services for profit making.

- Stock Dividends: The organizations buy the stocks of other companies to earn dividends.

- Asset Rentals: Firms like the real estate trust often invest in properties or other assets to rent them out to make money. Others may rent out vehicles for income.

- Royalties: The business entities can even generate earnings in the form of royalty income from their intellectual properties like business formulas or brand names.

The companies often adopt various strategies to ensure a positive cash flow from assets. Some of them include the following:

- Speeding up the accounts receivable process by offering early payment incentives to the customers.

- Providing vacant or unused portions of the premises or assets on rent for additional income.

- Employing just-in-time methods or other inventory optimization techniques to reduce the cost of holding it.

- Enhance operations through improved supply chain management and lean manufacturing techniques.

- Investing in diversified investment opportunities for curtailing risk.

- Checking on irrelevant or unproductive expenses without affecting the product's quality.

- Opting for bulk discounts on material and negotiating favorable credit terms with vendors.

- Finding better investment opportunities for higher interest income.

- Liquidating obsolete and useless assets.

How To Calculate?

The cash flow from assets accounts for the outflow and inflow of funds from operating and investing activities (but not the financing sources). Let us now understand its step-by-step evaluation below:

- The foremost step is to gather information on the various operating and investing activities of the business from the cash flow statement and the other financial statements.

- Next comes the computation of the operating cash flow (f) that determines the company's profitability or income derived from the core business operations. Here, one can use the formula: Operating Cash Flow = Net Income + Non-cash Expenses.

- In this step, one needs to gauge the net capital expenditure or spending (n) of the company, i.e., the change in net assets in a particular accounting period. It is evaluated as: Net Capital Expenditure = Ending Value of Net Fixed Assets - Beginning Value of Net Fixed Assets + Annual Depreciation.

- The next step is to find the net difference in working capital (w), i.e., the inventory, accounts receivable, and accounts payable of the business. The formula is: Change in Net Working Capital = Current Period's Net Working Capital - Previous Period's Net Working Capital.

- Finally, the cash flow from various assets can be obtained as the difference between them. The final formula being - Cash Flow From Assets = Operating Cash Flow (f) - Net Capital Expenditure (n) - Change in Working Capital (w).

Examples

Firms consider various financial and accounting metrics to determine the actual position of the business's health; one such measure is the cash flow from assets. Given below are its practical implications:

Example #1

Suppose ABC Ltd.'s financial statements for the year 2023 provide the following details:

Net Income = $1,00,000

Depreciation = $5,000

Beginning Value of Net Fixed Assets = $240,000

Ending Value of Net Fixed Assets = $260,000

Current Period's Working Capital = $1,50,000

Previous Period's Working Capital =$165,000

Determine the firm's cash flow from assets during 2023.

Solution:

Cash Flow From Assets = f - n - w

Operating Cash Flow (f) = Net Income + Non-cash Expenses

= $1,00,000 - $5,000 = $95,000

Net Capital Expenditure (n) = Ending Value of Net Fixed Assets - Beginning Value of Net Fixed Assets + Annual Depreciation

= $2,60,000 - $2,40,000 + $5,000 = $25,000

Change in Net Working Capital (w) = Current Period's Net Working Capital - Previous Period's Net Working Capital

= $1,65,000 - $1,50,000 = $15,000

Cash Flow From Assets = $95,000 - $25,000 - $15,000 = $55,000

Thus, ABC Ltd. generates $55,000 as cash flow from assets during the financial year 2023, signifying its strong financial position and stability.

Example #2

Alstom, the French TGV train maker, is considering a capital increase, job cuts, and asset sales to address concerns over its high debt and negative free cash flow. The company's shares fell around 10%, prompting it to aim for a €500 million to €1 billion asset disposal program and reduce staff by 1,500.

The plan emphasizes cutting net debt by €2 billion by March 2025. The chairman and CEO, Henri Poupart-Lafarge, is to resign from the post of chairman, while Philippe Petitcolin is proposed as the new chairperson. Also, the firm would not be distributing any dividends for the current fiscal year.

Importance

The cash flow from assets is a crucial financial measure used by various parties associated with a business organization, including senior-level executives, investors, and analysts. It is significant for the following reasons:

- Analyzes financial health and stability: The assessment of a company's efficiency in utilizing its assets for its operations and sensibly investing in various short-term and long-term assets helps to figure out the overall financial position of the business.

- Determines operational efficiency: This metric gauges the ability of a company to derive income from its regular business operations by employing its assets.

- Gauges ability to invest in assets: Also, it accounts for the cash flow from investing activities to analyze a business's competency to acquire new assets and utilize them for generating income.

- Ascertains liquidity: It even assesses the business's ability to fulfill its short-term liabilities from the cash it generates from regular operations.

- Facilitates investor decision-making: The investors use the cash flow from assets to identify the company's financial insights by understanding the capability of a business to manage its funds, run its everyday operations, and generate income.

- Aids in finding the firm's value: Further, it ascertains the enterprise value of the business, which determines the profit a company generates for its shareholders and creditors.

Frequently Asked Questions (FAQs)

Suppose the company's operating cash flow falls short of the aggregate amount of the net capital spending and change in net working capital. In that case, the resulting cash flow from assets is negative. Such a value signifies that the company is spending more on long-term projects compared to its operating income in a given period. However, it exposes the investors to a higher risk.

No, the free cash flow is different from the cash flow from assets. While the former depicts the inflow and outflow of funds during the execution of operating and investing activities, the latter emphasizes the net cash remaining after the company meets its operational and Capital investing (in assets) needs.

The cash flow from assets (CFFA) can be alternatively termed as the free cash flow to the firm (FCFF).