Table Of Contents

What is Cash Flow from Financing Activities?

Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity shares, preference shares, issuing debt, debentures, and from the redemption of securities or repayment of a long term or short term debt, payment of dividend or interest on securities.

It is the last of the three parts of the cash flow statement that shows the cash inflows and outflows from finance in an accounting year; Financing activities include cash inflows that are generated from getting funds like inflows from receipts from the issue of shares, receipts from a loan taken, etc. and cash outflows that are incurred while repaying such funds such as redemption of securities, payment of dividend, loan & interest repayment, etc.

In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock and the payment of dividends. It reports the capital structure transactions. Items are found in the balance sheet's long-term capital section and the statement of retained earnings.

List of Items included in Cash Flow from Financing Activities

Common items included in the cash flow from Financing activities are as follows –

- Cash dividend paid (cash outflow)

- Increases in short-term borrowings (cash inflows)

- The decrease in short-term borrowings (cash outflow)

- Long-term borrowings (cash inflows)

- Repayment of long-term borrowings (cash outflow)

- Share sales (cash inflows)

- Share repurchases (cash outflow)

It is of the view for many investors that cash at the end of the king.

If a company has surplus cash, it can be assumed that it operates in the so-called safe zone. Suppose a company is consistently generating more cash than the cash used. In that case, it will come out in the form of dividend payments, share buybacks, reduction in debt, or case of acquisitions to grow the company inorganically. All of these are perceived as good points to create good stockholder value.

Let us look at how this section of the cash flow statement is prepared. Understanding the preparation method will help us evaluate what all and were all to look into so that one can read the fine prints in this section.

Video Explanation Of Cash Flow From Financing Activities

How to Calculate Cash flow from Financing Activities?

Let’s assume that Mr. X has started a new business and has planned that he will prepare his financial statements like income statement, balance sheet, and cash-flow statement at the end of the month.

1st month: There was no revenue in the first month and no such operating expense; hence, the income statement will result in zero net income. In cash flow from financing activities, the cash would increase by $2000, as that is Mr. X's investment in the business.

| Cash from Financing activities (end of the first month) | |

| Investment by Mr. X (Owner) | $ 2,000 |

if you are new to accounting, you can also look at the finance for non-finance tutorials.

Cash flow from Financing Activities Example

Let’s take an example to calculate Cash Flow from Financing activities when Balance Sheet Items are provided.

Below is a balance sheet of an XYZ company with 2006 and 2007 data.

Also, assume that the Common dividends declared - $17,000

Calculate Cash Flow from Financing.

To prepare the cash flow from Financing, we need to look at the Balance Sheet items that include Debt and Equity. Besides, we need to include the cash dividends paid as cash outflows here.

- Bonds - the company raises bonds and results in the cash inflow of $40,000 - $30,000 = $10,000

- Common Stock - Change in common stock balance = $80,000 – $100,000 = - $20,000

- Please note that we do not make the changes in retained earnings as retained earnings are linked to the Net Income from the income statement. It is not a part of financing activities.

- Cash Dividends Paid = - Dividends + increase in dividends payable = -17,000 + $10,000 = -$7,000

Cash Flow from Financing Activities Formula = $10,000 - $20,000 - $7,000 = $17,000

Apple Example

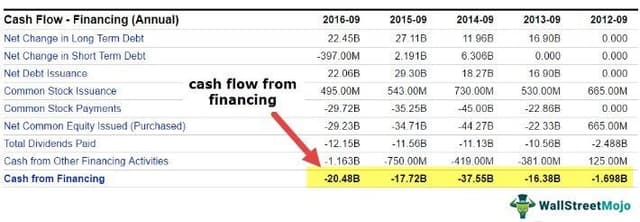

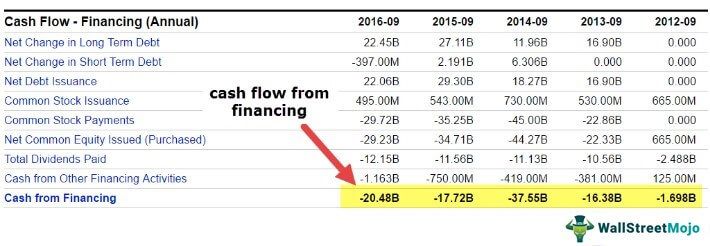

Now let us take an example of an organization and see how detailed cash flow from financing activities can help us determine information about the company.

source: Apple 10K

This article is another major component of cash spending, and investors look at it in detail. It is indicative of the kind of financing activity undertaken by the company in a particular area. In FY15, Apple incorporation spent $20,484 million in financing activities. A few observations from the above cash flow from financing activity parts are:

- The company has been a steady dividend payer. In the last three years the company has been paying a dividend of over $11000 million each year. Investors who don’t wait for capital appreciation can earn money from the steady dividend paid by the company every year.

- One more important factor to see is the repurchase of shares. The repurchasing of shares is indicative of the fact that the company has been generating steady returns. The company is generating ample cash and is using the same to buy back stocks. Over the last three years, the average repurchase amount has been over $35,000 million.

- The third most interesting thing from the above statement is that the company has been taking long-term debts. It might be one of the ways the company is financing its activities. However, as an Apple incorporation, which is sitting on a pile of cash, it would be interesting to question why such an entity will take on more long-term debt. It can be either a business decision or is it because borrowing rates have been at an all-time low, and the cost of financing through equity is not feasible. Also, note that the company, on the one hand, is repurchasing shares, and hence taking more money from the equity market can be counterproductive.

Amazon Example

Let's now look at another company’s cash flow from operations and see what it speaks about the company. It is the case of an e-commerce venture Amazon Inc. The company, for years, didn’t generate accounting profit, but investors kept putting money into the company on the backdrop of the sound business proposition and huge cash generated from operations.

source: Amazon 10K

The above image is a historical representation of the cash flow from its financing activities of Amazon. We note the following about Amazon's Cash Flow from Financing activities calculations –

- Cash outflows were majorly related to repayments of long-term debt, capital lease obligation, and financial lease obligation.

- Proceeds from Long-term financing have continuously been positive and very high. It is indicative of the fact that the company has continuously been borrowing long-term debt.

- Repayments of long-term financing show a huge cash outflow. It is indicative of the fact that the company has been extensively paying off its long term debt. If we see the two in conjunction, one can see that the company has been taking a stable long-term debt position and is paying an equal amount back to banks as part of its debt-repayment schedule (in 2014). Investors can explore this option in more detail to see whether the company is financing its debt by taking more debt.

JPMorgan Bank Example

Till now we have seen one product and one Service Company. Now let us have a look at one of the banking majors. It will give us good coverage of how companies classify different functions under 'cash flow from financing activities.'

source: JPMorgan 10K

Since this entity is a bank, many line items will be completely different from what it is for others. Many line items are only applicable to banks or companies in financial services. A few observations from the above statements are:

- The bank has been buying many federal funds for the last three years. It is more because of how the economy is shaping up. The government is mopping up funds and issuing new debt in the market. Banks are picking up this debt, and hence fund outflow as many federal funds are being purchased.

- The economy has turned a circle, and banks can pay steady dividends. The quantum of the dividend has been steadily increasing over the last five years. It is indicative that banks are now out of turmoil, which they faced in 2008-2009.

Most Important - Download Cash Flow From Financing Template

Download Excel Examples to Calculate Cash Flow From Financing

What Analyst should know?

Until now, we have seen three companies in three different industries and how cash means different things for them.

For a product company, cash is the king. For the service company, it is a way to run a business, and for a bank, it is all about cash!

These three companies have different things to offer in the cash flow from financing activities part of the cash flow statement. However, it is crucial to understand that the statement should not be singled out and seen. They should always be seen in conjunction with other statements and management discussion & analysis.

Also, note that cash flow for financing trends could be identified and extrapolated to estimate the company's funding requirements in the future (also, look at – how to forecast financial statements?)

Conclusion

Investors used to look into the income statement and balance sheet for clues about the company's situation. However, over the years, investors have now also started looking at each of these statements alongside the conjunction of cash flow statements. This helps in getting the whole picture and also helps in taking a much more calculated investment decision. As we have seen throughout the article, we can see that cash flow from financing activities is a great indicator of the core financing activity of the company.

Suppose a company is consistently generating more cash than the cash used. If the company has surplus cash, it can be assumed that it operates in the so-called safe zone. In that case, it will come out in the form of dividend payments, share buybacks, reduction in debt, or case of acquisitions to grow the company inorganically. All of these are perceived as good points to create good stockholder value.