Table Of Contents

What Is Cash Concentration?

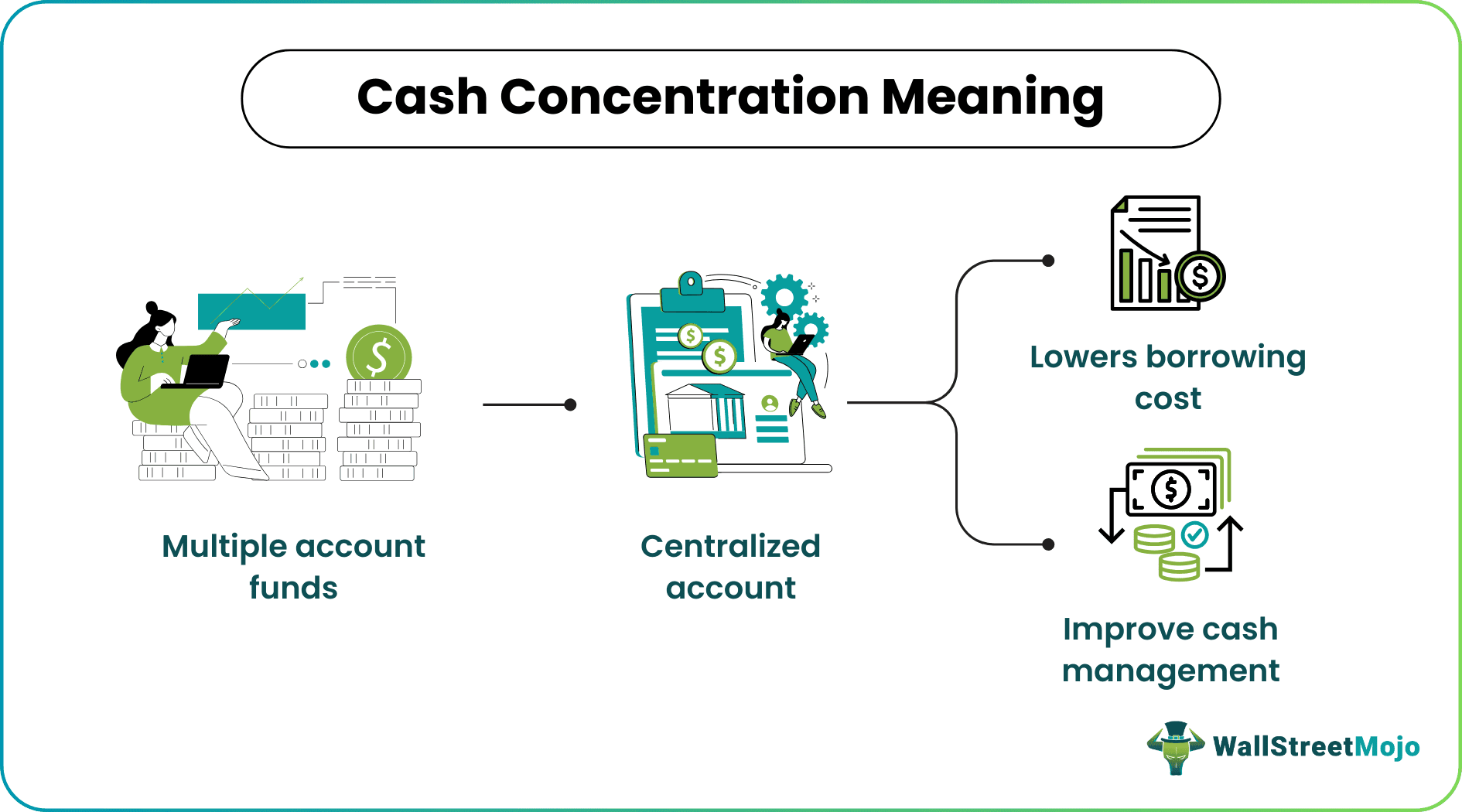

Cash Concentration refers to a corporate technique of treasury management where all funds across various accounts get transferred into one main account. It helps reduce fees, allows smaller cash balances, puts excess cash in short-term investments and thus enhances the overall cash management efficacy.

It prevents companies from borrowing money from outside to grow their business or meet financial obligations. Cash concentration is done through the National Automated Clearing House Association (NACHA) cash concentration and disbursement facility. It increases the investment potential of such companies.

Key Takeaways

- Cash Concentration is a treasury management method consolidating funds from multiple accounts into a primary one, cutting costs, optimizing cash usage, and bolstering cash management efficiency through investments.

- Strategies used include- consolidating accounts, automating transfers, centralizing cash, and optimizing collections to enhance efficiency, reducing idle cash through electronic methods.

- It improves liquidity, reduces borrowing costs, increases investment returns, streamlines cash management, enhances cash flow visibility, optimizes liquidity handling, and enhances cash administration effectiveness.

- It involves consolidating physical funds into a single account for better expense control, while pooling consolidates interest statements from all bank accounts without physical cash movement.

Cash Concentration Explained

Cash concentration is the method of consolidating funds kept in multiple accounts of various banks into a single centralized bank account. Businesses having offices at multiple places or subsidiaries commonly use it to exercise greater visibility and control over their cash resources. As a result, overall cash management efficiency improves while maximizing available liquidity and minimizing idle balance.

The working of this process utilizes cash concentration disbursement which is the consolidating of funds from different bank accounts into a central core account through methods like ACH cash concentration or physical cash concentration account. It may involve the physical transferring of funds or the notional pooling of funds by offsets and netting to develop a virtual pool without physical movement to a central account. It has various usability depending on the various factors. Centralized cash management benefits large-sized companies by having its operations dispersed geographically.

Another factor, significant cash fluctuation, must be used. Furthermore, a company utilizing electronic banking solutions and has robust financial systems can go for it. The modern financial world already has it as its integral part. Companies distribute resources efficiently and enhance returns with their use. Reduced reliance on borrowings or external financing has strengthened the economic shock-absorbing capacity of corporates. It has also led to innovative financial products and services, leading to highly efficient and liquid financial markets.

Strategies

A popular method that helps companies maximize their cash management is cash concentration. However, without knowing the exact strategies given below, it isn't easy to achieve the following:

- Complete Decentralization: Each branch or subsidiary is in charge of managing a separate bank account, providing cash control autonomy.

- Centralization of Funds: Combining funds from several accounts into one main account for effective use and administration.

- Cash Sweeping: To maximize cash use, automatically transfer excess money from several accounts into one main account.

- Using Cash Concentration and Disbursement (CCD): Combining and allocating money more effectively by using electronic financial transfers between business accounts.

- Technology-Driven Solutions: Putting in place digital tools and systems to aggregate cash across accounts and monitor it in real time.

- Optimization through Virtual Accounts: Utilized virtual account management to separate financial flows inside a single physical account.

- Analyzing Idle Balances: Finding dormant balances to reduce borrowing rates and efficiently use idle cash.

- Centralized Collection System: Create a centralized process to gather cash receipts from sales, receivables, and investments, enhancing collection efficiency and deposits.

- Short-Term Disbursement: Ensure bills are paid when due, reducing idle cash in the central account, optimizing investment potential, needing precise forecasting and discipline.

- Minimizing Float: Examine payment processing durations and seek electronic methods to minimize float, speeding up fund availability for utilization by reducing clear times.

- Utilizing Sweeps: Set up automated sweeps to move surplus cash from operational to central accounts at scheduled intervals, swiftly utilizing idle cash.

Examples

Let us use a few examples to understand the topic.

Example #1

To fulfill urgent treasury demands, Citi launched 7-Day Sweeps, which expanded cash concentration beyond business days. This automated system optimizes risk reduction and liquidity management for businesses that operate around the clock, particularly in the IT and e-commerce sectors. The program adapts to changing business models, rapid payments, and changes in consumer behavior.

It improves efficiency by centralizing positive balances and automatically financing negative ones. Citi intends to expand the availability of this service to more markets when it launches in the US and South Korea. The partnership signals a wider industry trend toward tech-driven financial operations by emphasizing the transition to smart treasury and the adoption of digitalization and technology for effective cash flow and risk management.

Example #2

Suppose Alex, a small business owner at XYZ Ltd., uses cash concentration for effective cash flow management. Alex automatically moves money from the company checking account to a high-yield savings account at the end of each day. They aim to maximize interest revenues on idle cash holdings by consolidating funds overnight. This approach maximizes profits while maximizing liquidity.

Hence, it ensures that extra money isn't sitting around and instead put to use, creating more revenue. By using this strategy, Alex successfully uses cash concentration to improve financial efficiency and provide larger returns on the capital that the company has available, which helps XYZ Ltd.'s finances remain stable and expand.

Benefits

It has many benefits for multinational corporations and companies having subsidiaries. The benefits are listed below:

- Improved Liquidity: Facilitate easy access to capital for business operations, lowering dependency on outside finance.

- Reduced Borrowing Costs: Lowering interest expenses is achieved by reducing the need for external borrowing and using readily available cash.

- Increased Investment Returns: Additional funds might be invested in short-term securities or other products to increase revenue.

- Streamlined Cash Management: Simplifies financial reporting, budgeting, and forecasting.

- Enhanced cash flow visibility: Centralizing funds into a singular account provides a clearer understanding of a firm’s complete cash status, enabling better-informed financial decision-making.

- Improved handling of liquidity: Cash concentration aids in pinpointing dormant balances spread across several accounts, empowering firms to optimize cash allocation and reduce borrowing expenses.

- Heightened effectiveness in cash administration: Through centralizing cash operations, enterprises can efficiently oversee and regulate their cash reserves, resulting in more effective utilization of cash assets.

Cash Concentration vs Notional Pooling

Cash Concentration

- Involves collecting funds in physical form from various locations into a single account for better control over expenses.

- Leads to a far more controlled and centralized approach to cash management.

- Offers greater visibility and cash balance management.

- Aids in lower borrowing costs and higher returns on net credit positions.

- Streamlines multiple accounts throughout currencies.

- Involves physical cash movement

- Has the potential to optimize interest owing to consolidation.

- Intercompany transactions involved

- Simplifies adherence to reporting and regulations.

Notional Pooling

- Involves consolidation of interest statements form all bank accounts without any movement of physical cash.

- Leads to a highly flexible and decentralized approach to cash management.

- Allows every entity to function having its credit lines in the absence of any real cash movement.

- Eliminates the need for intercompany funds transfer.

- Reduces the number of accounts a company holds.

- Utilize only virtually merged balances without any actual cash or funds

- No optimization of funds.

- Individual legal entities have separately maintained balances.

- Needs accurate reporting and accounting