Table of Contents

What Is Cash Application?

Cash application refers to the process of linking appropriate payments that are income to the payments that are outstanding on the company’s part. In simpler terms, it is the procedure that matches payments from customers to the outstanding payments they are intended for. Incorporating cash application software allows for higher productivity and avoids manual errors and tedious tasks.

The process provides real-time insights and increases accuracy. However, complications like lockbox fees can lead to the company incurring a high cost of doing business. Nevertheless, the process is significantly helpful in terms of maintaining and reviewing the financial records of a company. Therefore, the business can achieve efficient cash flow.

Key Takeaways

- Cash application is the cycle of assigning payments received from clients to an open invoice that corresponds with the amount sent.

- These payments are usually attached with a piece of information referred to as remittance advice.

- The remittance advice specifies the details of the payment. If the client has combined two invoices or sent an amount that does not match a single invoice, it is explained.

- Following the process diligently helps with efficient cash flow and helps significantly with regulatory compliance and financial reporting.

- However, there are a few challenges, like the invoice amounts not matching, the unavailability of customer data, and the need for a central communication channel.

How Does Cash Application Work?

Cash application is the procedure that corresponds a customer payment to the invoice that is paid in the seller’s accounts receivables. The process is an irreplaceable part of the accounts receivable management process.

In straightforward terms, the process is a matching mechanism. It helps accountants file payments received in the proper accounts. In the pre-internet era, an accountant would have multiple checks, a receipt book, and a ledger of balances. The accountant would physically cross-check the check amount and the outstanding balance of the particular ledger.

While it might seem like an uphill task before the internet, it is quite the inverse. After the internet or online payments were introduced, it was simpler to match payments. In the modern day, there are multiple sources of payments, and without a cash application specialist incorporating a system, the accounts receivable management system would be a disaster.

It is also essential to understand the context within which this system operates. In the flow of business, the inflow and outflow of goods hardly ever wait for the flow of payments or the processing of the same. In the case of B2B (business-to-business) transactions, where credit is involved, having a system to track payments becomes even more critical.

Given the transactional delays, variations in amount, and multiple such ledgers, it becomes essential to incorporate a system that can avoid manual errors, improve productivity, and avoid monotonous tasks within the organization.

Process Steps in Cash Application

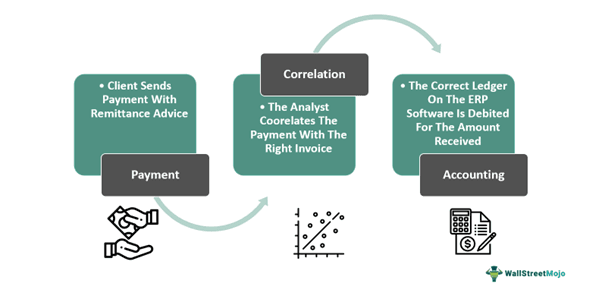

Cash application software follows a three-step process. It is as mentioned below.

- Payments and Remittances: Payments that are received from customers come with advice known as remittance advice, as mentioned earlier. This advice informs the receiver about the reason why the payment was made or for which invoice the amount was sent. Payments can be made through paper forms like checks or electronic means such as credit cards, ACH, BACS, or other forms of payment. The payment received is also accompanied by information about the amount to make it easier for the analysts to correspond it to the correct bill. The information can be through a memo, an email, or through the company’s portal.

- Invoice Matching: Once the payment is received, the cash application specialist or analyst cross-checks the advice from the buyer and finds corresponding invoices. However, it is essential to note that this process can prove to be complicated even with detailed advice, as a single payment can include payments for multiple invoices. In other cases, the amount might not match the amount of any invoice. Therefore, the analyst must ensure that the correct ledger is deducted only for the amount received and balance the remaining amount.

- ERP Posting: Once the invoice matching procedure is done, the analyst or the specialist can list the payment and deduct the relevant ledger account. If the company does not have an active ERP system, they can always post it on a spreadsheet application like MS Excel or Google spreadsheet. However, these can have a higher probability of errors in comparison to ERP systems that have separate ledgers for each client or customer.

Elements

Multiple elements come together to form an instant cash application system. They are:

- Payments: Payments refer to the outflow of funds from the buyer to the supplier. These payments could be in the form of paper payments like checks or through electronic modes of transfer like wire transfer or ACH.

- Invoice: An invoice is the actual bill that triggers a requirement for a payment to be made from the buyer’s end. A specialist understands the amounts received and links them to the corresponding invoices with the help of remittance advice. Once the invoice and amounts match, the specialist enters the details into the company’s ERP (Enterprise Resource Planning) system.

- Remittance Advice: Remittance advice, commonly known as remittance, is the information that describes the reason a payment was made. The advice concerning remittance is to mention the invoice number or specifications about the amount being transferred. In other cases, remittance advice could also be a memo with a check or even an email to mention the specifications of the payment.

Examples

The understanding of any concept can be multifold if a tinge of practicality and real-life application is added to the mix. The examples below are an attempt towards that.

Example #1

Mitchell is an instant cash application analyst of a laptop manufacturing company. It is his job to ensure the payments received are in correspondence with the invoices and that the correct ledgers are debited on the ERP system. However, M/S PQR, one of their clients, sent $100,000, which did not match any of the issued invoices.

Upon checking the remittance advice sent through email from PQR’s accounting team, they mentioned that the $100,000 was for two invoices of $40,000 and $60,000, respectively. After finding the mentioned invoices, Mitchell matches them and passes the relevant entry to debit the correct ledger.

Example #2

Emily is the head of the accounts receivables department. She and her team ensure that all invoices are correctly entered into the system, payment follow-ups are prompt, and payment entries are perfect.

Ricky, one of the members of her team, was responsible for all payment-related conversations with ABC & ABC Bros., one of their biggest clients. Ricky usually used to receive an email as remittance advice to help him correlate the payment with the invoices.

However, this time, the AR team received a $25,000 payment but no remittance advisory to accompany it. After hours of refreshing his emails and not finding any communication from ABC & ABC, he incidentally opened one of the messaging apps to find that the communication was uncharacteristically sent through WhatsApp instead of email.

The AR team then confirmed that payment and deducted the relevant ledger.

Importance

Cash application software plays an indispensable role in the financial management process. From the foundational functions to more complicated ones, this process solves most problems regarding payments, conciliation, and compliances. The points below explain each of these critical points.

- Any business would always want to have impeccable cash flow to ensure there are no delays in payments from their end and ensure that the company’s financials are on the growth path all the time. For that objective to be fulfilled, a cash application plays a vital role in ensuring correspondence with every transaction.

- Account receivables and payables are managed efficiently, which allows management to forecast financial requirements and plan other investments to ensure the funds are optimally used.

- With proper documentation that comes as a pre-requisite to fulfill the function, it makes financial reporting more manageable for the accounting team.

- The accuracy in maintaining accounts and prompt follow-up improves customer satisfaction and improves the overall relationship with them.

Challenges

Even a cash application specialist finds a few factors challenging to the process. The points below specify the challenges of the process in detail.

- One of the most common challenges in the process of matching payments and invoices is that the payment received might be different from any invoice amount. Clients might club two or more invoices and pay them together. Moreover, if they fail to provide remittance advice, it becomes even more challenging to correlate the payment.

- Sometimes, an amount without any correlation to an invoice amount or even data that does not match any client might get credited. In cases such as this, it is better to have a system that uses machine learning or artificial intelligence to do the guesswork and re-confirm with the client.

- Many a time, customers might not be able to arrange funds for the entirety of an invoice. Therefore, they might send an amount that is short of an invoice amount. It is a challenge to correlate to the closest possible invoice and account for the remaining amount as well.

- As remittance advice is optional, clients might sometimes omit to provide any information. As a result, there might be confusion regarding which invoice corresponds to the payment, especially in the case of multiple invoices having the same amount.

- Different clients might provide information regarding the remittance through different means. Therefore, the cash application analyst or specialist might need help to keep track of all avenues.

How to Improve?

The instant cash application process in itself is tedious. Therefore, there is a definite need to spend time and effort to ensure the process is improved. While different companies might follow unique approaches, the points below can be common points of reference.

- The foremost step to improve the usually manual and tedious task is to digitize the process by investing in software that shall reduce the need for human interference.

- Establish a central communication channel or develop a portal for making payments and communicating the same with the team as well to avoid confusion and the requirement to track multiple channels of communication.

- An excellent system without an equally trained team might be of no use. Therefore, it is essential to make sure that the team is equipped with the knowledge to tackle different situations.

- Set a clear resolution channel as well. There must be a transparent process to follow in case of confusion or disputes.

- They make sure that the process is reviewed regularly to cover any gaps or find avenues to improve it.

- Exemplary documentation must be non-negotiable in the process to ensure regulatory compliance and financial reporting becomes easier by a mile.