Table of Contents

Cash And Carry Arbitrage Meaning

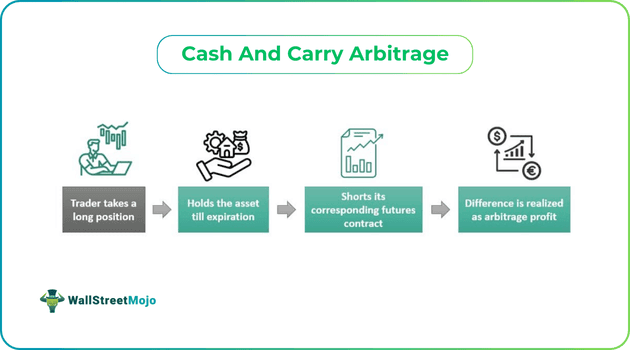

Cash and carry arbitrage refers to a trading strategy that exploits market discrepancies and the mispricing of the underlying asset. It involves taking a long position on a commodity or stock and shorting it in the futures contract.

There are different types of associated costs that an arbitrageur has to incur. When the assets are commodities like oil or wheat, there is a holding or carrying costs like storage and insurance costs. When it is a stock or security, there are financing costs or margins, and varying carrying costs affect the profit margin.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Key Takeaways

- Cash and carry arbitrage is the trading strategy associated with commodities stock and other assets, allowing a trader to use mismatched pricing in futures contracts.

- It combines taking a long position and shorting the corresponding futures contract associated with the underlying asset.

- The holding cost for different assets varies, affecting the profit an arbitrageur can make through trading with the strategy.

- The technique is also referred to as basis trading, with its opposite counterpart known as reverse cash and carry arbitrage.

Cash And Carry Arbitrage Explained

Cash and carry arbitrage is a profit-making method utilized by traders in both stock and commodity markets, capitalizing on price differences. In essence, arbitrage involves buying for less and selling for more. When applied to spot and futures markets, traders purchase an underlying asset when its corresponding futures are overpriced. They then wait to realize the price difference as profit.

Cash and carry arbitrage explains the determination of price discrepancies and then uses them to make a profit. However, a trader employing this strategy cannot buy and sell instantly and has to wait until the expiration date, which makes the trader hold and carry the asset for a certain time. Carrying assets is not free but comes with additional costs like insurance, storage, financing, and transaction expenses. For different assets and commodities, the holding cost varies.

Indeed, the carrying cost is pivotal in deciding whether the trader will realize a profit or incur a loss in the strategy. The carrying cost may go beyond the lock-in price, in which situation, holding the asset will cost a trader more than they will ever make from shorting it. It is not easy to take advantage of the corrections in the pricing in the market. Therefore, traders looking forward to indulging in such techniques must take calculated risks and have a good risk appetite.

Examples

Let us consider some examples to understand the concept better:

Example #1

Suppose Fiona is a stock market trader and arbitrageur. Fiona has been seeking stock for a long time. Currently, the share is trading at the price of $99, but its one-month futures contract is offered at the price of $117. In addition, Fiona, as an arbitrageur, has to incur the monthly carry costs, insurance, and storage expenses that shall amount to $4.5.

To capitalize on this price difference, Fiona initiates a long position by buying the stock at $99. Simultaneously, she sells the one-month futures contract and initiates a short position at $117. After factoring in the associated costs ($99 + $4.5), Fiona's net cost becomes $103.5.

Upon the expiration date, Fiona delivers the asset against the contract. Consequently, Fiona's profit from applying the cash and carry arbitrage strategy amounts to $117 - $103.5 = $13.5.

Example #2

In 2015, the oil markets experienced a notable phenomenon where traders took advantage of high prices in oil futures contracts. They purchased surplus oil, shipped it, and stored it in Cushing. Cushing's oilfield was discovered in 1912 and produced 430 million barrels of crude for the next five decades. One of the reasons it attracts crude more than other locations is when future markets are favorable for cash and carry arbitrage.

The oil fields are a delivery point for US light crude futures physical settlement under the New York Mercantile Exchange (NYMEX) rules. After all the factors of a cash and carry strategy are perfectly placed, it becomes a riskless source of arbitrage profit. Yet, traders prefer to store oil close to the NYMEX for convenience and risk elimination for physical delivery. From November 2014 to mid-2015, stocks at Cushing have risen 30.5 million barrels (128%) compared to 79 million barrels (21%) across the US. The crude stocks along the US Gulf Coast account for half of the unrefined oil storage for America.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Cash And Carry Arbitrage Vs. Reverse Cash And Carry Arbitrage

| Aspect | Cash And Carry Arbitrage | Reverse Cash And Carry Arbitrage |

|---|---|---|

| 1. Futures Position | Traders buy futures | Traders short (sell) futures |

| 2. Spot Position | Traders short the current market price. | Traders take a long position in this approach. |

| 3. Market Condition | It establishes the scenario of contango. | In this technique, the scenario is called backwardation. |

| 4. Reason for Execution | It is performed when future contracts are overpriced. | It is applied when future contracts are underpriced. |