Table Of Contents

What Is Carry Trade?

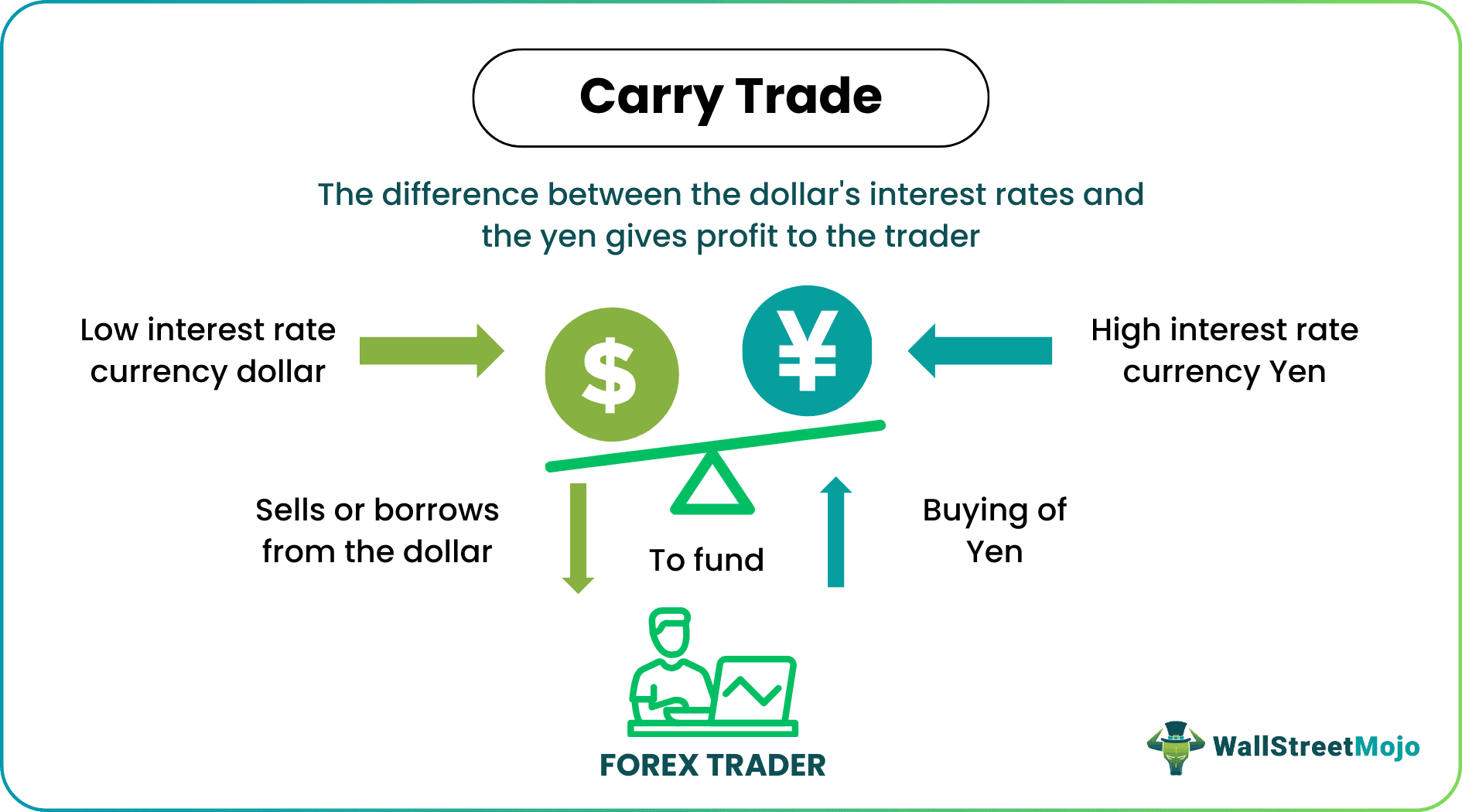

Carry trade refers to an investment strategy where investors either sell or borrow assets at a lower rate to buy another asset giving a higher interest rate. It obtains profits from the difference in the interest rate on selling the higher rate of interest-yielding assets, mostly in the foreign exchange market.

It entails huge risks for investors, so only deep-pocketed investors can use this strategy. It poses a risk when the purchased assets fall in price steeply. Also, when the currency of sold or borrowed asset differs from the bought asset, apparent exchange risk creeps into the currency used in the trade. As a result, it never gets hedged out of higher costs or neutralizes the profits.

Key Takeaways

- Carry trade means an investment strategy where traders borrow certain money by selling assets with a low-interest rate for investing in assets that give a higher interest rate.

- It allows the traders to profit through the difference in interest rates between the two-currency helping them overcome the daily hurdle of buying low and selling high to gain profits in the foreign exchange market.

- Since currency prices remain highly volatile, they pose a great risk to investors as any time the currencies mat steep dive into low prices.

- The formula for calculating daily profit based on the interest of carrying trading depends on selecting the appropriate currency pair and their respective price movements and interest rate differences.

How Does A Carry Trade Work?

Carry trade could be defined as holding one's forex trade for a day because one currency has higher rates than another to profit from the interest rate difference between both currencies. It simply means one buys high-interest currency as compared to low-interest currency. Typically, one places the proceeds if the second currency has a better interest rate. The money could be invested in assets with a second currency value, including stocks, bonds, commodities, or real estate.

As long as one holds the trading, one gets the appropriate profit that the brokers calculated on the interest rate difference. However, the payment would only take place if the trading takes place in the direction of an interest-positive trend.

It works simply by borrowing one currency, for example, the US dollar, which has a low-interest rate, and utilizing the number of borrows to buy another currency, the Japanese yen having a high-interest rate. As a result, one gets to pay a lower interest rate on the borrowed currency, i.e., the dollar, while simultaneously collecting a higher interest rate on the other currency yen. Hence, the difference between currency rates, the dollar, and the yen, is that one gets the desired profit.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Strategy

Carry trade strategy enables traders to bypass the difficulty of daily buying low and selling high assets in the market. Moreover, it becomes quite profitable to earn daily profits by traders using the strategy. The strategy works best when the markets have stabilized over time. The strategy instructs the traders to:

- Go for long a basket containing high-yielding currencies.

- Go for short a basket containing low-yielding currencies.

After that, they need to borrow or sell the low-yielding currencies to buy high-yielding currencies to obtain profits on their interest rate differences. Moreover, one must remember that the trade gets profitable only when the additional interest rate on high-yield currency is not neutralized by the depreciation of other currency to an extent more than the increase in the additional rate of interest paid on it.

How To Calculate Carry Trade In Forex?

One has to look for appropriate currencies like the New Zealand dollar/Japanese yen or the Australian dollar/Japanese yen for carrying trading.

- First, the pair has to decide which currency gives a higher interest rate and which has a lower interest rate.

- Secondly, the currency pair must not be volatile and be stable over a long duration; otherwise, one might face losses.

- Thirdly, the interest rates must be on the rising or remain stable when going for carrying trading.

- Fourthly, one must use the below carry trading formula:

Daily interest = NV × (IR Long currency - IR Short currency)/ 365 days × currency pair quote

Where,

IR = interest rate,

NV = notional value

The above formula greatly depends on choosing the right currency pair, as the profits depend on their price movements and a difference in the interest rate between the pairs. One can also conduct the strategy in gold carry trade where traders borrow gold at a low gold lease rate and use it to fund other high-yielding assets to profit from their interest rate difference.

Example

Let us look at an example to understand the concept much better. For instance, trader Alex holds both types of currency where:

- The British pound has a six percent interest rate.

- The US dollar has a three percent interest rate.

Therefore, as long as Alex holds the trade on the market, the broker pays the difference in the interest amount between the two currencies. Hence, a three percent difference in the interest rate gets paid as profit to investor Alex every day on a cumulative basis. Thus, Alex uses the carry trade strategy to earn huge profits.

Another example is accepting a credit card with a 0% cash advance rate to invest the borrowed funds in securities with a greater yield. This strategy is an excellent illustration of carrying trade. One might make money using this carry-trade method, or they might lose money.

Risks

Every trading on the market carries some risks with it. Hence, currency carries trade or carry trade strategy carries the below risks:

- First, currency prices tend to be quite volatile.

- Nervous, fluctuating markets affect the currency pairs badly.

- By managing risks, traders can gain all their earnings.

- Carry trade unwind brings in many risks as the funding currency unexpectedly and quickly strengthens aggressively.

Currency risk in a carry trade is hedged rarely because doing so would either increase costs or make the positive interest rate differential ineffective. Instead, currency forwards, or contracts that lock in the exchange rate for a specific period in the future, are typically used.

For instance, the Japanese yen carry trade surpassed $1 trillion in 2007 as a result of the yen's use as a currency for borrowing due to its nearly low-interest rates. However, as the world economy deteriorated during the 2008 financial crisis, practically all asset values fell, unraveling the yen carry trade. In response, the carry trade increased by as much as 29% against the yen in 2008 and 19% against the dollar by 2009.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Trading in forex means investing in high-yielding currency funded by selling or borrowing low-yield currency. A trader tries to capture the difference between the rates to get substantial profits.

One can carry on the trade by purchasing high-yielding currency funded by low-yielding currency and then get profits from the difference in their interest rate.

Everyone knows that carrying trade involves foreign currency exchange where one borrows the money using one low-yield currency to purchase high-yield currency and obtains profit on their interest rate difference. Therefore, the currency one borrows in the Japanese yen is termed yen carry trade.