Table Of Contents

Capitulation Meaning

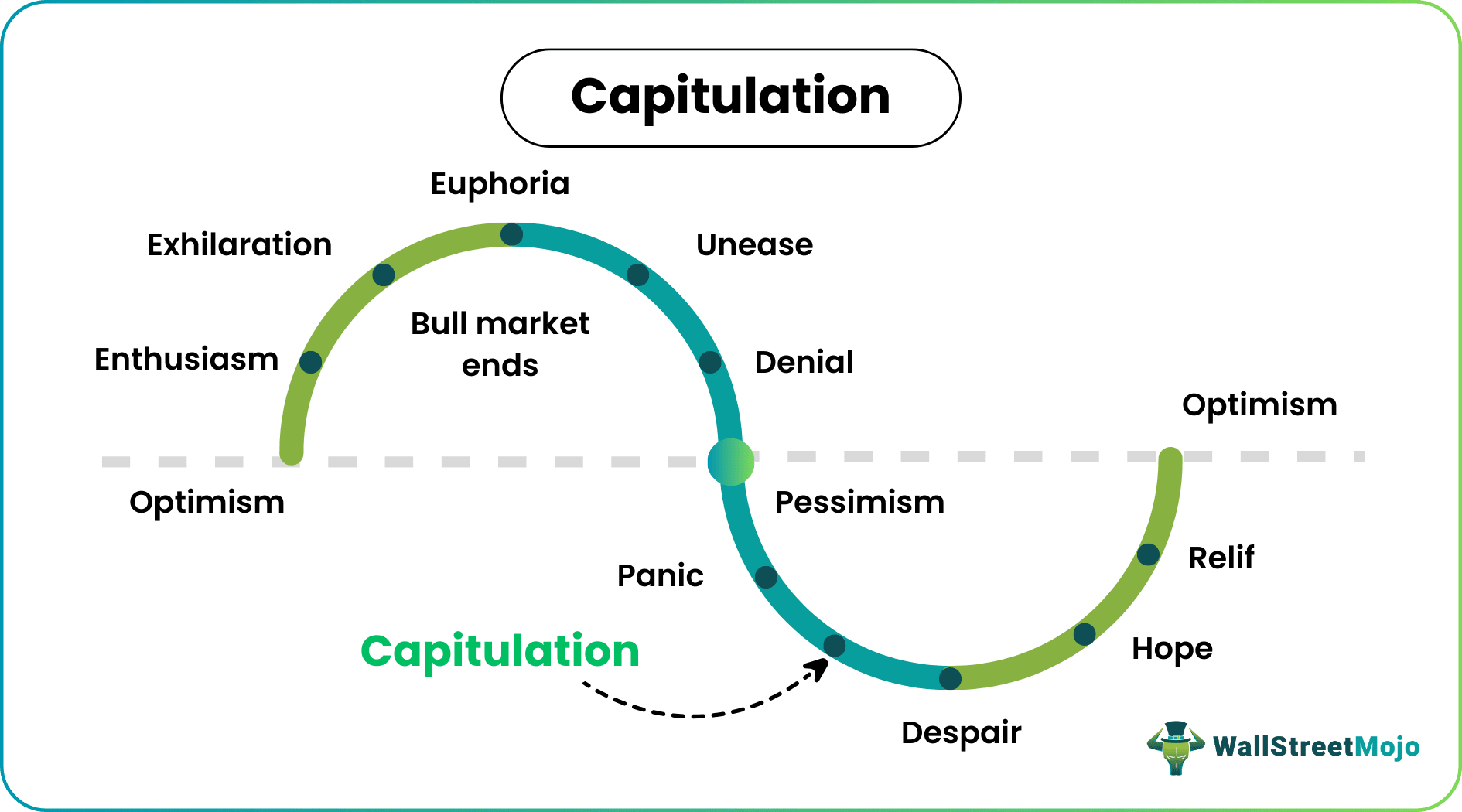

Capitulation refers to the large-scale sale of securities in a declining market. For example, investors face extreme pressure in a bearish market to exit their stock positions. But this triggers a steeper price drop.

It does not apply to all investors. Some stay bullish, and some see it as an opportunity. In addition, others focus on long-term plans; they do not panic and hold on to their positions. Stock market capitulation was witnessed in the 2008 market crisis and other major stock market crashes.

Key Takeaways

- Capitulation occurs when too many investors sell stocks simultaneously. Such an overreaction is usually brought out by widespread panic. Investors crumble under pressure and exit their market position.

- Stock market capitulation is witnessed during stock market crashes or bear markets—a high trade volume is its characteristic feature. Conversely, stock price declines exponentially when panic hits the streets.

- Once it sets, the capitulation phase is there to stay. Markets take a long time to recover from such lows.

- The entire concept revolves around human behavior—the percentage of people susceptible to pressure outweighs the percentage of people who remain calm. After all, whenever money is involved, the stakes are high.

Capitulation In Stocks Explained

Capitulation in stocks is a scenario where people give up and run away, fearing the foreseeable outcome. The term is commonly used in the context of wars and politics—one nation surrenders to another—soldiers flee in retreat. Stock market capitulation, too, is similar.

In a declining market, prices plummet rapidly—each investor reacts differently. Finally, there comes the point when a large proportion of investors feel that the ship is sinking. At this point, investors undergo immense pressure to exit their position. And ultimately, the majority of investors surrender to the falling prices. But this triggers a chain reaction; it instills fear in steadfast investors. Ultimately those investors also sell their holdings. This phenomenon elucidates a rapidly declining stock price that eventually hits rock bottom.

The capitulation definition suggests that this scenario is usually witnessed only during financial crises or stock market crashes. It is very evident in stock market crashes of the past. Again, it is a vicious circle—fear feeds fear. After all, the stakes are high; financial losses directly impact everyone involved—no one wants to see their portfolio declining. Most exit early to curtail losses.

But there are a few investors who do not panic. Some investors reduce margins in a rapidly declining market by employing the “buy the dip" formula. Contrarian investors even try to take advantage of an already grim predicament. They make plans for long-term wealth creation by staying bullish on selective stocks.

The onset of such a rapid decline can be foreseen by following certain indicators. The exit of institutional investors is one such sign. In addition, it highlights price volatility—the onset of a bear market.

The capitulation in stocks trading concept revolves around the fear of loss and extreme pressure—a common human reaction to external pressure. Hypothetically though, if investors do not exhibit such paranoia and hold on to their assets, stock market capitulation would not exist. Nonetheless, in real-world scenarios, one has to expect panic and overreaction.

Crypto capitulation is similar to financial crises witnessed in equity markets. It is onset by a large number of investors exiting at once. Panic decisions harm crypto more than the actual price fall. It triggers more overreaction. Ultimately prices hit rock bottom.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Now, let us look at some market capitulation examples to grasp the concept better.

Example #1

Let us assume that there are one hundred investors in the stock market. Suddenly, prices drop, and this new trend continues day after day. The stock market crashed. Eventually, there comes the point where there is widespread panic. Out of 100 investors, 70 give up. They surrender to the downward spiral and exit their positions.

Unfortunately, this triggers a chain reaction—the first phase of panic furthers prices down. More and more investors exit till the stock hits rock bottom. Panic and overreaction are the most common response to financial crises. Nonetheless, it is not necessary that all investors would feel the same way. In the above example, the remaining 30 could have stayed still.

And some did exactly that. Ten out of the remaining 30 see this as a potential opportunity. So they apply the “buy the dip” formula. Ten others remain bullish (selective stocks). And the remaining ten are indifferent owing to their long-term investment plans.

Example #2

Now let us look at a real-world example to understand how this predicament plays out.

The Bank of America conducts a monthly survey on global fund managers. The July 2022 reports revealed very low expectations as far as economic growth is concerned. As a result, the market condition resembles capitulation.

The survey covered a large sample size—comprising investors with over $800 billion in assets. Most of these investors believe that equity allocation levels resemble the 2008 financial crisis (responsible for the collapse of Lehman Brothers).

The survey unravels dire pessimism among investors. A market capitulation phase is imminent and might last for a considerable time. The poll was conducted between July 8 and July 15—not long after the U.S. shares posted record-low price drops since 1970.

Amidst immense pressure, investors now prefer companies that shore up balance sheets over those that spend more capital. Nevertheless, the poll did uncover some bullish sentiment—a small group of investors anticipates a trend reversal.

How Long Does Capitulation Last?

The duration of the process of strategic capitulation is highly influenced by various factors. Therefore, providing a specific period for which it will last in the stock market is impossible. Some factors that should be looked into to make some assessments of the duration are as follows:

- Market conditions – The market condition has the highest effect on the process. If market recovers quickly after a severe downturn, then capitulation will also come under control very easily. Otherwise, it may continue longer than expected.

- Investor sentiments – The investor psychology play a very important role in the process of strategic capitulation. If the investors can recover from their negative perception or sentiment faster and regain their confidence in the market potential, then situation will improve sooner.

- Government policies – Sometimes the central bank or the government may intervene and introduce stimulus packages or reduce interest rates to boost investor confidence in the market. This successfully brings out the market from the state of capitulation.

- External factors- Any unexpected news of any natural calamity may make capitulation trading persist for long.

- Company performance – Even in a bearish market, if the company is able to show a successful performance and exceed customer expectation, them investors may become bullish about that individual company and start investing in it. As more and more companies continue with this trend, it affects the entire market, bringing it out of the negative sentiment.

Thus, capitulation is a very complex procedure where various factors come into play to influence the market, which leads to either continuation or end of the capitulation trading process.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Crypto capitulation is similar to financial crises witnessed in equity markets. It is onset by a large number of investors exiting at once. Again, the first wave of exits shows widespread panic among investors. But panic decisions harm crypto more than the actual price fall. It triggers more overreaction. Ultimately prices hit rock bottom.

It is defined as a state where investors exit the market following a widespread price decline. Typically, this is caused by a stock market crash or a bear market. Fear is the predominant investor reaction, but there are outliers. Therefore, investor reactions cannot be projected precisely.

The indicators are as follows -

• Oversold market.

• Volatility spike.

• Sheer panic among investors.

• Rapidly plummeting prices.

• Too many investor exits.