Table Of Contents

What is Capital Structure?

Capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan (debt) from outsiders. It is used to finance its overall operations and investment activities. The owner’s capital is in the form of equity shares (common stock), preference shares (preference stock), or any other form that is eligible to control the entity's retained earnings of the entity. Debt capital is in the form of the issue of bonds or debentures of loans from a financial banker. Capital structure is a very critical factor in the case of project financing. The bankers are concerned about the initial percentage of funding to the proposed project and usually assist with up to 70% of the project cost.

Key Takeaways

- Capital structure refers to the composition of a company’s sources of funds, a combination of owner’s capital(equity) and loan (debt) from outsiders. One may use it to finance overall business operations and investment activities.

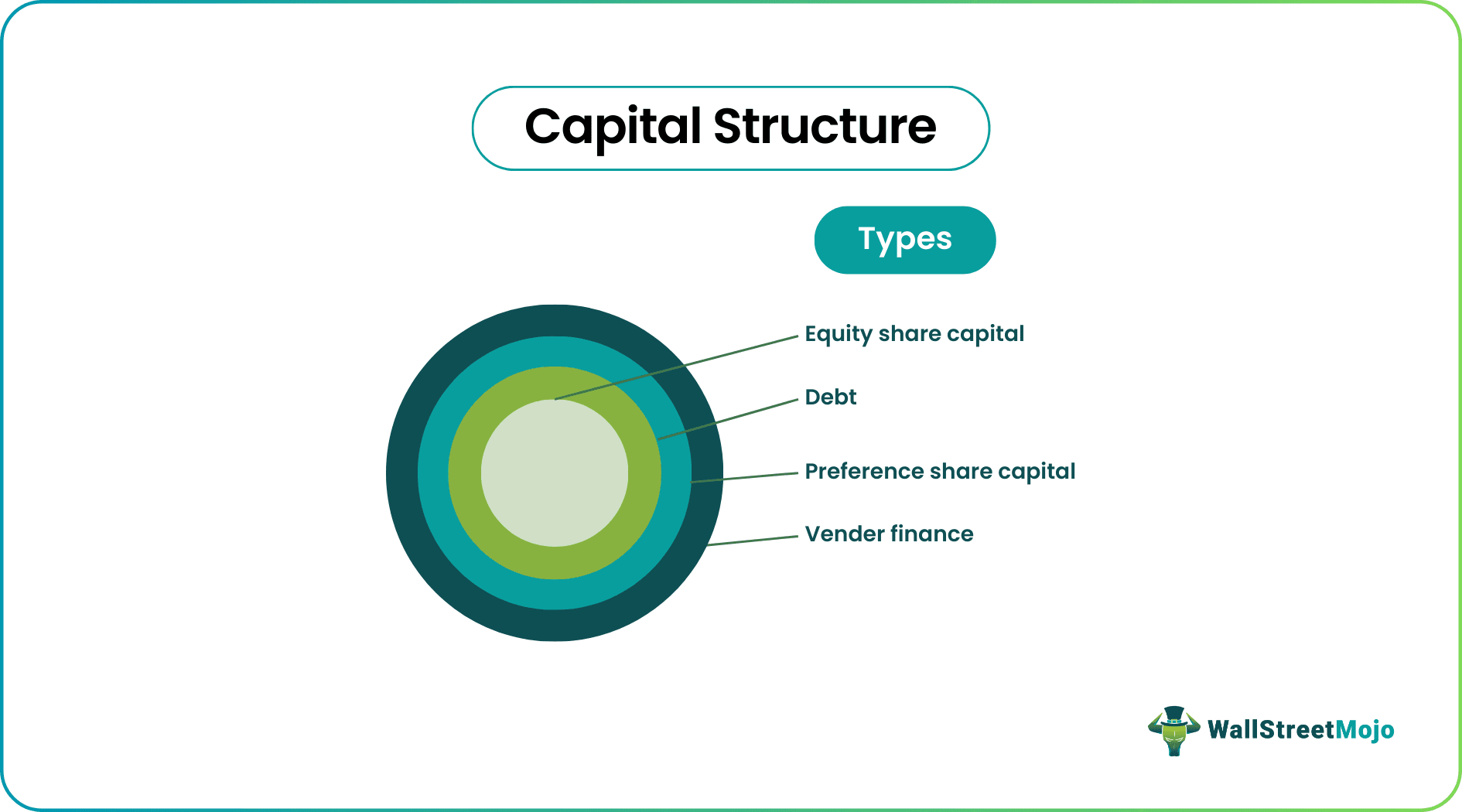

- The types of capital structure are equity share capital, debt, preference share capital, and vendor finance.

- In addition, it ensures accurate funds utilization for business. The right capital structure level decreases the overall capital cost to the highest level. Also, it increases the public entity’s valuation.

- If the debt-equity ratio is low, the firms may borrow the new debt amount. If the company has adequate cash reserve, it can repay the existing debt and borrow the new debt capital at a reduced interest rate.

Capital Structure Explained

Capital structure is a specific mix of equity and debt used to finance a company’s operations and assets. From a corporate finance perspective, equity capital provides a more long-term and flexible source of finance for the company’s growth prospects and daily transactions. An optimal capital structure comprises of enough balance between equity and debt. Debt for an organization includes all short-term and long-term loans that the company has to repay. Equity is the combination of common and preferred shares and their retained earnings.

Let us understand the intricacies of this concept through discussions about types, formula, examples, and importance.

Formula

The formula of capital structure formula quantifies the amount of equity and the amount of outsiders' capital at a point in time. We can do such calculations as a percentage of each money to the total capital or debt-to-equity ratio.

Let us calculate capital structure using the Debt/Equity formula.

A company with a higher debt-equity ratio is a highly leveraged company.

Examples

Let us understand the concept in detail through the couple of examples with calculation below which will help us understand the optimal capital structure.

Example #1

A company has proposed an investment in a project with information about its project cost. The project will be financed 20% by the common stock, 10% by the preferred stock, and the rest by the debt. The company intends to understand its calculations.

Solution:

Debt Equity will be:

Debt Equity Ratio = (1794/769) = 2.33.

Example #2

The capital structure of the entity over the projected years is as follows: -

Note: The debt-equity share has been reducing over the years since the reserves increased, and the company can repay its debt holders.

Types

Based on the nature of business, management style, and the risk appetite of the organization, the capital structure theory might differ. Let us understand the different types through the discussion below.

#1 - Equity Share Capital

- It is the most common form of the capital structure, wherein the owner’s contribution is reflected. It is the first amount the owners introduce into the entity’s business.

- The equity shareholders have the right over the business's retained earnings after paid preference shareholders.

- Retained earnings are nothing but an accumulation of profits over the years. In the entity's liquidation, the equity shareholders will be the last people to be paid.

#2 - Debt

- Debt is the amount borrowed by the entity from the outsiders for business. The debt holders are liable to pay interest before paying taxes to the government.

- Interest payable to these holders is called a cost of debt. In the case of a new business/project, the cost of debt is the minimum percentage return to be achieved from the project each year. In the case of well-settled enterprises, the cost of debt is treated as a part of the financing cost and shown separately in the financial statements of an entity.

- Usually, only the long-term debt is treated as debt for the company and displayed under the heading “non-current liabilities.” Short-term debt is treated as current liabilities and not calculated by the debt-equity ratio.

- In liquidation of the entity, debt holders can prefer payment before the entity’s shareholders.

#3 - Preference Share Capital

- Preference share capital is a mediatory form of capital wherein they are shareholders of the entity with a preference over the common stockholders.

- Here, preference means preference in the case of dividend payment and preference over capital repayment (in case of liquidation of the entity).

#4 - Vendor Finance

- Vendor finance is the least known form of the capital structure wherein the suppliers will provide the goods on long-term credit to the entity.

- The standard credit period is around 60 days to 90 days. In the case of vendor financing, the goods are supplied with a long period of credit to the entity.

- It reduces the cost of finance for the structure since the interest meter starts after the credit period and at a lower interest rate than normal debt capital.

Importance

Let us understand the importance of the capital structure theory through the points below.

- Business increases when it has a higher amount of funds for disposal. Debt provides higher leverage for the entity and is therefore essential to increase the return on capital employed.

- The market always rewards a balanced capital structure, reflected in the share price.

- It further ensures the appropriate utilization of funds for business.

- The right level of capital structure minimizes the overall cost of capital to an optimum level.

- The appropriate capital structure level increases the public entity's valuation.

- If the debt-equity ratio is lower, the firm gets the flexibility to borrow the new amount of debt.

- If the company is flooded with sufficient cash reserves, it can repay the existing debt and borrow new debt capital at a reduced interest rate.