Table of Contents

What is Capital Requirements Directive (CRD)?

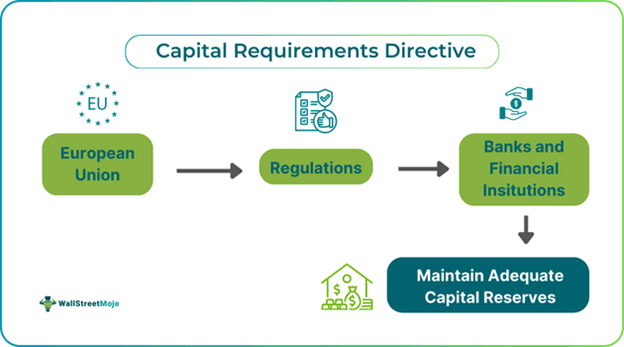

The Capital Requirements Directive (CRD) is a set of regulatory guidelines published by the European Union (EU) for banks and financial institutions. The primary purpose of the CRD is to establish minimum capital requirements to help these institutions cope during financial crises.

The first version of the EU's capital requirements directive emerged in the 2000s. Since then, there have been five iterations: CRD I, CRD II, CRD III, CRD IV, and CRD V. These directives align with the standards set in Basel II and Basel III, regulating capital requirements. These rules apply to credit institutions, such as building societies and some investment firms.

What Is Capital Requirements Directive (CRD)?

Key Takeaways

- The Capital Requirements Directive (CRD) is a set of guidelines issued by the European Union (EU) that outlines the minimum capital requirements for financial institutions such as banks and investment firms.

- CRD replaced the 1993 Capital Adequacy Directive (CAD), and since then, five versions of the directive have been implemented by banks.

- The first version of CRD was introduced in 2000, followed by CRD II in 2006, CRD III in 2010, CRD IV in 2013, and CRD V in 2019.

- The main purpose of the directive is to guide banks and financial institutions on liquidity requirements and ensure they do not hold excessive capital for unnecessary risks.

Capital Requirements Directive Explained

The Capital Requirements Directive refers to the supervisory rules designed to maintain capital adequacy for banks and investment firms. It ensures that banks hold enough financial resources to meet minimum funding requirements during crises. Additionally, the CRD reduces the likelihood of losses for consumers and deposit holders. It also sets liquidity requirements and directs banks on risk assessment procedures when risks arise.

The CRD has undergone multiple versions since its original publication in the EU, replacing the Capital Adequacy Directive (CAD), first issued in 1993. From 2000 to 2019, several amendments were introduced. Let's explore each version in detail:

- CRD I: As a replacement for CAD, CRD I provided clearer guidelines on capital standards and regulations to enhance the clarity of EU legislation.

- CRD II: This directive gained prominence during the G-7 summits and was a response to recommendations from the G-7 Financial Stability Forum (FSF) and the ongoing market crisis. It addressed topics such as the inclusion of hybrid instruments, supervisory arrangements like colleges, large exposures, liquidity risk management, and waivers for banks.

- CRD III: CRD III introduced further amendments, focusing on capital needs for trading books, re-securitizations, and enhanced oversight of remuneration policies.

- CRD IV: Launched in 2013, CRD IV included directives for credit institutions and investment firms and maintained oversight of credit firms’ activities and capital requirements regulations (CRR).

- CRD V: Released in 2019, CRD V addressed the approval and supervision of holding companies, the development of intermediate parent undertakings, and the enhancement of governance regulations for firms. It also introduced new supervisory requirements for measuring, assessing, and managing interest rate risk in the banking book (IRRBB).

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

History

The Capital Requirements Directive (CRD) originally replaced the Capital Adequacy Directive (CAD) in 2000. It was formally adopted on June 14, 2006, and published in the Official Journal (L177/201) on June 30, 2006. At that time, institutions had the option to choose the basic indicator approach, which set a minimum capital requirement of 15%, compared to the previously established 8%. Before these directives were fully enforced, CRD II was amended on November 17, 2009, and implemented on December 31, 2010, ensuring institutions' financial stability.

On November 24, 2010, the EU and the Council drafted the third version of the directive, CRD III, which extended the existing minimum capital requirements. Half of the regulations became official on January 1, 2011, and the remainder by December 31, 2011. In line with this, CRD IV was made public on July 17, 2013. Unlike the Basel capital adequacy standards that apply only to international banks, CRD IV covers all banks and investment firms in the EU.

This regulatory package also included the Capital Requirements Regulation (CRR), which outlines how much capital banks and firms must maintain. On May 20, 2019, the Council proposed further amendments to the CRD guidelines with CRD V.

Regulations

The European Union Council laid down several key regulations when drafting the Capital Requirements Directive (CRD). Let’s briefly explore them:

Pillar 1: Banks must meet minimum capital requirements to fund their assets and liabilities adequately. This includes covering risks related to credit, market, and operational activities.

Pillar 2: Institutions have the right to review whether a firm should hold additional capital for risks not covered under Pillar 1. If necessary, actions can be taken to address firms that require extra capital for such risks.

Pillar 3: This regulation mandates that banks and financial institutions publicly disclose information regarding their risks, capital, and risk management practices. This promotes market discipline and raises awareness about liquidity conditions.

Other Adjustments: In addition to the three pillars, the EU requires all banks to comply with CRD guidelines and ensure they maintain sufficient liquidity to cover short-term obligations. This includes adhering to the Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratio (LCR) requirements.

Importance

The Capital Requirements Directive (CRD) is a vital framework for guiding banks in their daily operations. It helps them assess credit agreement risks and encourages practices promoting financial sustainability. Additionally, CRD ensures that banks maintain a stable financial system that aligns with liquidity standards. By mandating banks to hold a certain percentage of capital, the CRD plays a critical role in preventing financial crises.

The directive discourages firms from taking excessive risks that could endanger investors' and customers' deposits. It fosters a transparent and harmonious system for financial institutions operating across multiple nations. Since CRD primarily applies within the EU, banks and investment firms can easily adhere to its requirements.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.