Table Of Contents

What Is A Capital Note?

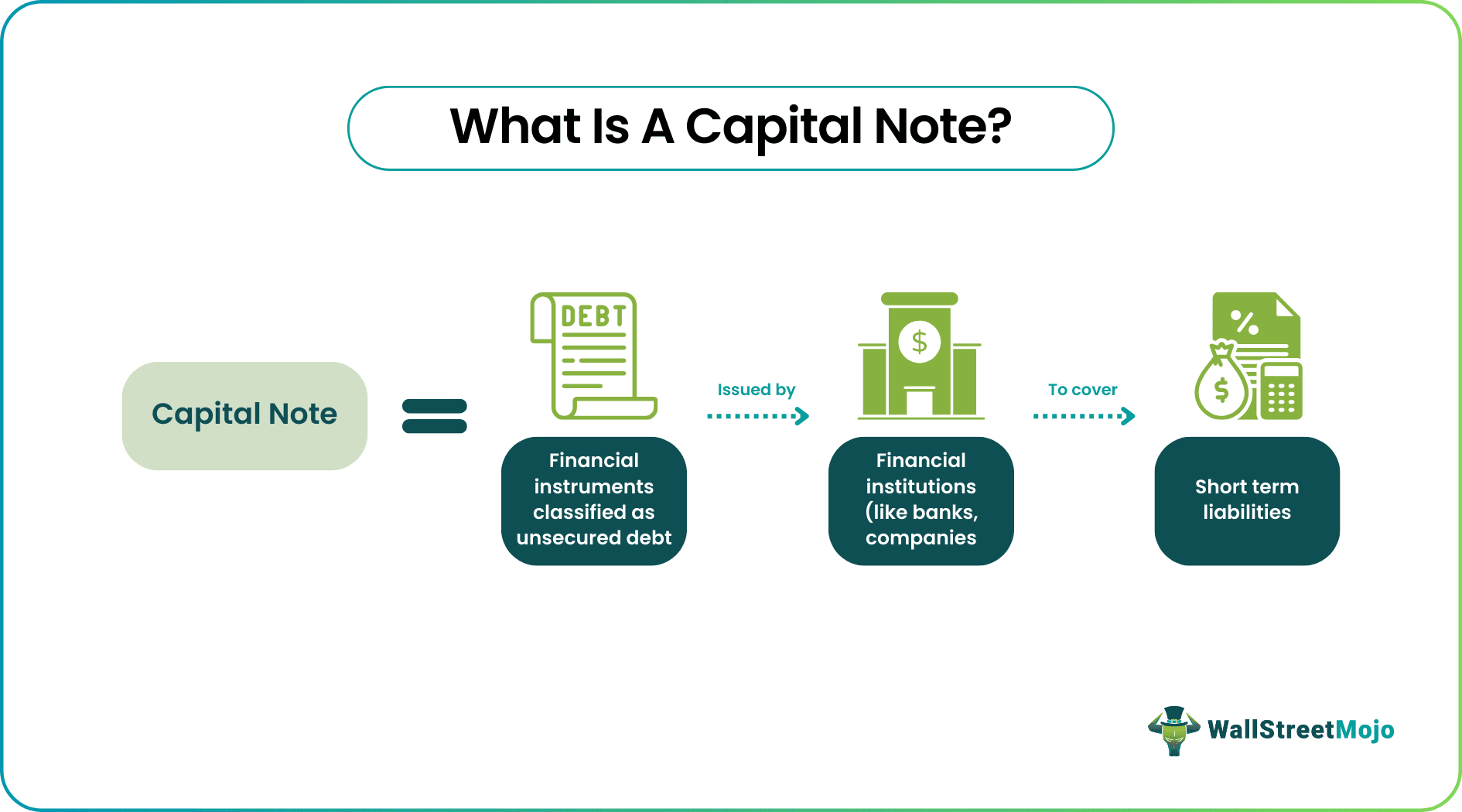

A Capital Note is a debt instrument issued by a company to address short-term liabilities. These are unsecured debt securities commonly employed for financing, including by banks, to meet their capital requirements. Its primary purpose is to raise capital for repaying liabilities and obligations for less than a year.

While they offer potentially higher returns to noteholders due to the associated risk, they lack collateral backing. In the unfortunate event of bankruptcy, these instrument holders rank lower in the hierarchy of creditors, making them the last to receive compensation. Investors should carefully assess the risk and potential returns before investing in this financial instrument.

Key Takeaways

- Capital Note, in finance, is a form of unsecured debt instrument that allows companies to pay off their short-term liabilities.

- They are a hybrid of equity and debt securities. Therefore, these fixed-term securities come with a high level of risk. The returns are also equivalent to the risk undertaken.

- These notes have a more than ten years duration with a margin and coupon rate. The issuer will release interest payments until maturity or repayment.

- Banks also issue notes to meet their capital requirements. However, they may reduce or stop interest payments during the tenure.

Capital Note Explained

Capital Note is an unsecured debt instrument that finances the short-term liabilities of the firm. They are hybrid securities that feature both equity and debt. Here, the note holders provide funds to the firm for a fixed period. Until maturity, they will continue to receive interest income via the issuer. Once a note matures, these payments will stop, and the issuer will repay the entire principal amount. The widespread usage of these notes was notable in the mid-20th century (during 1964).

In contrast to secured debt, it has a higher risk involved, followed by high-interest payments. The interest rate for these notes varies across every issuer. In short, they depend on the issuer's credit ratings. However, the payment terms differ.

In this financing, the firm majorly considered unsecured debt. It means that the debt will be issued in the absence of collateral. In contrast, secured creditors are ranked before them. As a result, during dissolution and bankruptcy, these instrument holders receive the leftover after paying the secured creditors. Therefore, it creates a default risk for the bondholders.

If the firm (issuer) fails to repay the debt, the creditors will receive nothing. Also, the latter will have no collateral to seize. As a result, this instrument and debentures possess a higher risk level than other instruments. However, there is a vast difference between this instrument and debentures. The former has a short-term purpose and may have multiple uses. However, these notes have considerable applications in the banking industry.

Bank Capital Note

Bank capital notes are widely utilized within the banking industry to meet the financial requirements for their operations, providing a safety net to mitigate insolvency risks. However, for investors, this instrument comes with an uncertain risk level exceeding bank deposits. Therefore, it is essential for investors to carefully assess their risk tolerance before investing in them.

According to the Basel system, banks can raise capital through Tier 1 or 2 notes. Tier 1 capital notes fund the bank's core activities, while Tier 2 notes represent supplementary capital held in undisclosed reserves. Additionally, banks can employ Tier 1 notes for credit facilities.

The following are the features of bank capital note:

- The bank may reduce or stop the interest payments during the business presence.

- There is no fixed or guaranteed maturity date. As a result, debt repayment comes with a default risk.

- The interest payments are, by default, non-cumulative. Thus, any missed payments do not account for future compensation. Thus, the noteholder will get deprived of the accrued interest.

- The bank may convert the notes into shares. However, the amount may be less than the original face value of capital notes.

- This instrument is listed on any popular stock exchange (like New York Stock Exchange). But it faces substantial price fluctuations in the market.

- The bank (issuer's) side can only buy back capital notes. Investors, yet, cannot attempt or request such a decision.

Features

This instrument may sound similar to other debt instruments. However, there is a considerable difference between them and their functions. So, let us look at the critical features that distinguish them from others:

#1 - Unsecured, Fixed Income Securities

These are fixed-income securities providing guaranteed returns to investors. They continue to receive interest payments until maturity.

#2 - Floating Coupon Rate

The interest or coupon rate of these securities depends on a floating basis. It varies across the issuers releasing these notes. It also includes a margin. For example, a credit rating firm may decide on a moderate coupon rate after considering the US Treasury rates. However, the rate will differ in comparison with high credit rating agencies.

#3 - Quarterly Interest Payments

Here, the investors will receive interest until the issuer repays the debt. It occurs on a frequent or quarterly basis.

#4 - Hybrid Nature

It possesses a mixed nature of both equity and debt instruments. Considering the risk level of the former, these notes run for a fixed term.

#5 - Longer Maturity

Usually, the duration of these notes lives for a more extended period of more than 10-15 years. For example, in July 1964, the capital notes of First National Bank of Atlanta had a maturity of 25 years with a coupon rate of 3.5%.

Examples

Let us look at the examples for a better understanding of the concept:

Example #1

Suppose XYZ Ltd is a firm with total liabilities amounting to $30 million in this fiscal year, of which $12 million are short-term liabilities. In response to its financial needs, the management and directors decide to issue capital notes worth $40 million, offering a coupon rate of 4% and a maturity period of 20 years.

During the initial ten years, the firm pays the investors quarterly interest of $4 per share. However, by the end of the year, XYZ Ltd successfully repays the debt, along with the principal amount of $800 per share, to the investors.

Example #2

In July 2023, ANZ Group successfully concluded the sale of capital notes, raising $970 million. This development was highlighted in recent updates on investment banks. The primary purpose of this issuance is to replace the previous note 3 with a new capital note offering a 3.6% margin, which was initially launched in 2015.

Advantages And Disadvantages

Capital Notes are an essential debt instrument of the market. However, they do include some positives as well as downsides. Let us look at them:

| Basis | Advantages | Disadvantages |

|---|---|---|

| Investors | They receive higher interest payments for the notes purchased. Constant returns via fixed-income securities. | Banks provide no guarantee of debt repayment to investors. Plus, they might also reduce interest payments. During dissolution, they are paid at the end. |

| Company/ Banks (Issuers) | Source of finance for repaying short-term obligations. Banks use capital notes to meet capital requirements. | There are complexities involved during the buyback of unsecured debts. Credit ratings also impact coupon rates. |