Table Of Contents

What is Capital Lease Accounting?

Capital Lease accounting follows the principle of substance over form, wherein the assets are recorded in the lessee's books as fixed assets. The lease rent payments are divided into principal and interest and charged to the profit and loss account. Depreciation is charged on the asset as normal over the term of the agreement.

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the asset. The capital lease accounting journal entries are entered in such a way that the lessee owns the asset and is recorded accordingly in their balance sheet.

Capital Lease Accounting Explained

A capital lease accounting entry is passed when a renter or lessee is entitled to the temporary use of the asset. It is considered as if the asset was purchased according to the Generally Accepted Accounting Principles (GAAP).

The lessee is required to book the assets and liabilities connected to the lease if the contract terms meet the requirements specific to this deal. This can be considered a contrast to an operating lease where this transaction is dealt with as a true lease in accounting terms.

Despite the fact that it is a rental agreement of sorts, GAAP directs such transactions to be recorded as if a purchase has been made, provided the requirements are fulfilled. Therefore, these transactions can have an effect on the company’s financial statements and expenses relating to the interest, depreciation, liabilities, and assets relating to this specific transaction.

Since these transactions can be complex to manage and document manually, in the modern day, capital lease accounting software is used to ensure the level of errors are lesser and it is more convenient to record, maintain, and file as per requirements.

Capital Lease vs Operating Lease - Explained in Video

Criteria

Below are the criteria for Capital Lease Classification

- Ownership- The ownership is shifted to the lessee at the end of the lease period.

- Bargain purchase option- Lessee, can buy an asset at the end of term at a value below market price.

- Lease term- The lease term comprises at least 75% of the asset's useful life.

- Present value- The present value of the lease payment is 90% of the asset's fair value at the beginning.

Accounting Treatment

The capital lease accounting journal entries are adversely different from their counterparts’ accounting. They have an adverse impact on the balance sheet, income statement, and cash flow statement. Let us understand each of them in detail through the explanation below.

Effect on Balance Sheet

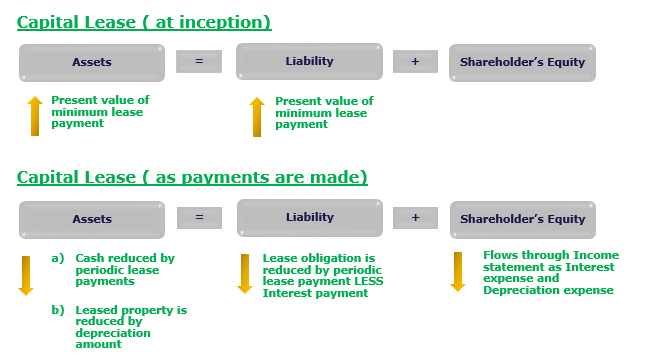

There are two ways the balance sheet is affected by Capital Lease.

- At Inception (Start of the Capital Lease) - The company records the present value of minimum lease payments as the value of the Assets and an equal amount as Liability.

- After Lease Payments are made – lease payments are made, cash is reduced on the asset side, and the rental property is reduced by the depreciation amount. On the liabilities side, it has two effects. Lease obligation is reduced by the lease payment LESS the interest payments, and the shareholder’s equity is reduced by the interest expense and depreciation expense amount.

Effect on Income Statement

- Interest Expense - The periodic payments to pay the lease needs to be broken down as per the interest payments at an applicable interest rate. Interest expense is calculated as the Discount rate times the Lease liability at the beginning of the period.

- Depreciation Expense - Since the leased asset is fixed, it is liable to depreciation. It, therefore, also needs to calculate the useful life of the asset and, ultimately, its salvage value.

Effect on Cash Flows

- Only the portion of lease payment that is considered interest payment reduces Cash flow from Operations (CFO)

- Part of the lease payment considered payment on principal reduces Cash flow from Financing (CFF).

Examples

Now that we have a clear understanding of the basics, criteria, and accounting treatment, let us put the theoretical knowledge into practical application with the help of the examples below.

Example #1

The value of the machinery is $11,000, and its useful life is seven years. The scrap value of the asset at the end of its useful life is nil. The monthly lease payment at the end of each month is $ 200. The lease term was six years, and the interest rate stood at 12%. Pass the journal entries in books.

Solution: We need to check the basic four criteria to check if it's a capital lease.

- The ownership is shifted to the lessee at the end of the lease period.

- The lessee can buy an asset at the end of the term at a value below market price.

- The lease term comprises at least 75% of the asset's useful life.

- The present value of the lease payment is 90% of the asset's fair value at the beginning.

There is no title transfer at the end. Neither is there a bargain purchase option. The lease term is six years, while the useful life is seven years, so the criteria are met here. For checking the fourth criterion, we need to calculate the present value of monthly payments of $200. The present value* The lease payment is $1,033, which is greater than 90% of the asset's fair value. Therefore, it’s a capital lease.

- Number of months = (6*12) i.e. 72 months

- *Present value of minimum lease payment= $1,033

- Depreciation= ($11,000/7) i.e. $1,571

- Interest for 1st month @ 1% of present value= $10

- Lease liability- interest expense= 200-10= $190

Journal Entries

#1 - During the First Month

#2 - During the Remaining Months

Example #2

A vehicle has a value of $16,000 and a lease term of 3 years. The lease's monthly payment is $500, out of which $50 relates to maintenance. The interest rate in the market is 4%. The useful life of the vehicle is eight years. At the end of the lease contract, the lessee can purchase the asset at $1000. What type of lease is this?

Solution: We need to check the basic four criteria to check if it's a capital lease.

- The ownership is shifted to the lessee at the end of the lease period.

- The lessee can buy an asset at the end of the term at a value below market price.

- The lease term comprises at least 75% of the asset’s useful life.

- The present value of the lease payment is 90% of the asset’s fair value at the beginning.

There is no title transfer at the end. Neither is there a bargain purchase option. The lease term is three years, while the useful life is eight years. Three years is less than 75% of 8 years, so the three capital lease accounting tests are unmet. For checking the fourth criterion, we need to calculate the present value of monthly payments of $450 (excluding maintenance). The present value* The lease payment is $15,292, which is greater than 90% of the asset’s fair value (90% of $16,000 is $14,400). Therefore, it’s a capital lease.

- Number of months = (3*12) i.e. 36 months

- *Present value of minimum lease payment= $15,292

- Depreciation= ($16,000/8) i.e. $2,000

- Interest for 1st month @ 4% of present value= $50

- Lease liability- interest expense= 450-50= $400

Journal Entries

#1 - During the First Month

#2 - During the Remaining Months

*Present Value = MLP + MLP* (1- (1 + Monthly Interest Rate)^(- No. of Periods+1))/Monthly Interest Rate

Capital Lease Vs Operating Lease

While both these scenarios involve an asset being lent to the lessee, there are a few differences in the fundamentals and implications of these concepts. Let us understand them through the comparison below.

Capital Lease

- The ownership of the asset might be transferred to the lessee after the conclusion of the term.

- The term of the lease must be equal to or greater than 75% of the useful life of the asset being leased.

- The lease negotiation also usually includes the option of purchasing the asset at less than the fair market value.

- Lessee becomes responsible for expenses relating to the asset such as taxes, maintenance, and depreciation.

- The asset is considered as if the lessee had purchased it and is accounted for accordingly through capital lease accounting software or manual means.

- Since this transaction considers the lessee to be the owner of the asset, they can claim taxes against depreciation and interest expenses.

Operating Lease

- The transfer of ownership does not occur in this sort of lease- both during and after the term.

- The lease agreement does not have a bargain or negotiated purchase option.

- The lessee only has the right to use the asset. The risks and benefits of the asset remain with the lessor, while the lessee bears the cost of maintenance.

- The term is usually lesser than 75% of the economic life of the asset or equipment.

- Since the asset is not owned by the lessee, it is accounted for as operating expenses and is shown in the profit and loss account instead of the balance sheet.

- Since it is treated as a true lease, the expenses are treated as rental expenses and cannot be claimed against taxes.

Recommended Articles

This has been a guide to what capital lease accounting is. Here we discuss how to record journal entries for capital lease along with examples. You can learn more about accounting from the following articles –