Table Of Contents

Capital Intensity Definition

Capital intensity is the infusion of high capital in a business or production process. It, therefore, requires a higher proportion of fixed assets (land, property, plant, and equipment) to produce goods and services. Industries or companies that require such large capital investments are known as capital-intensive businesses. Examples of capital-intensive businesses are oil factories, chemical and petroleum plants, power generation plants, aircraft manufacturing, etc.

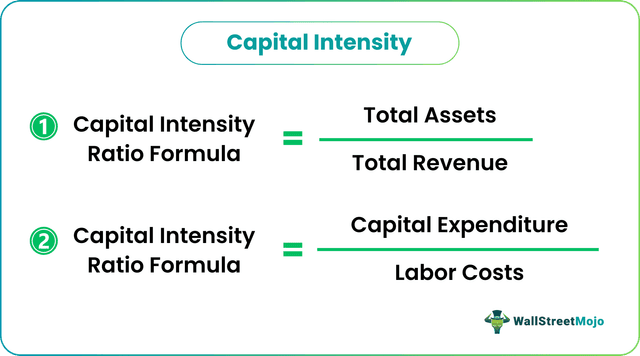

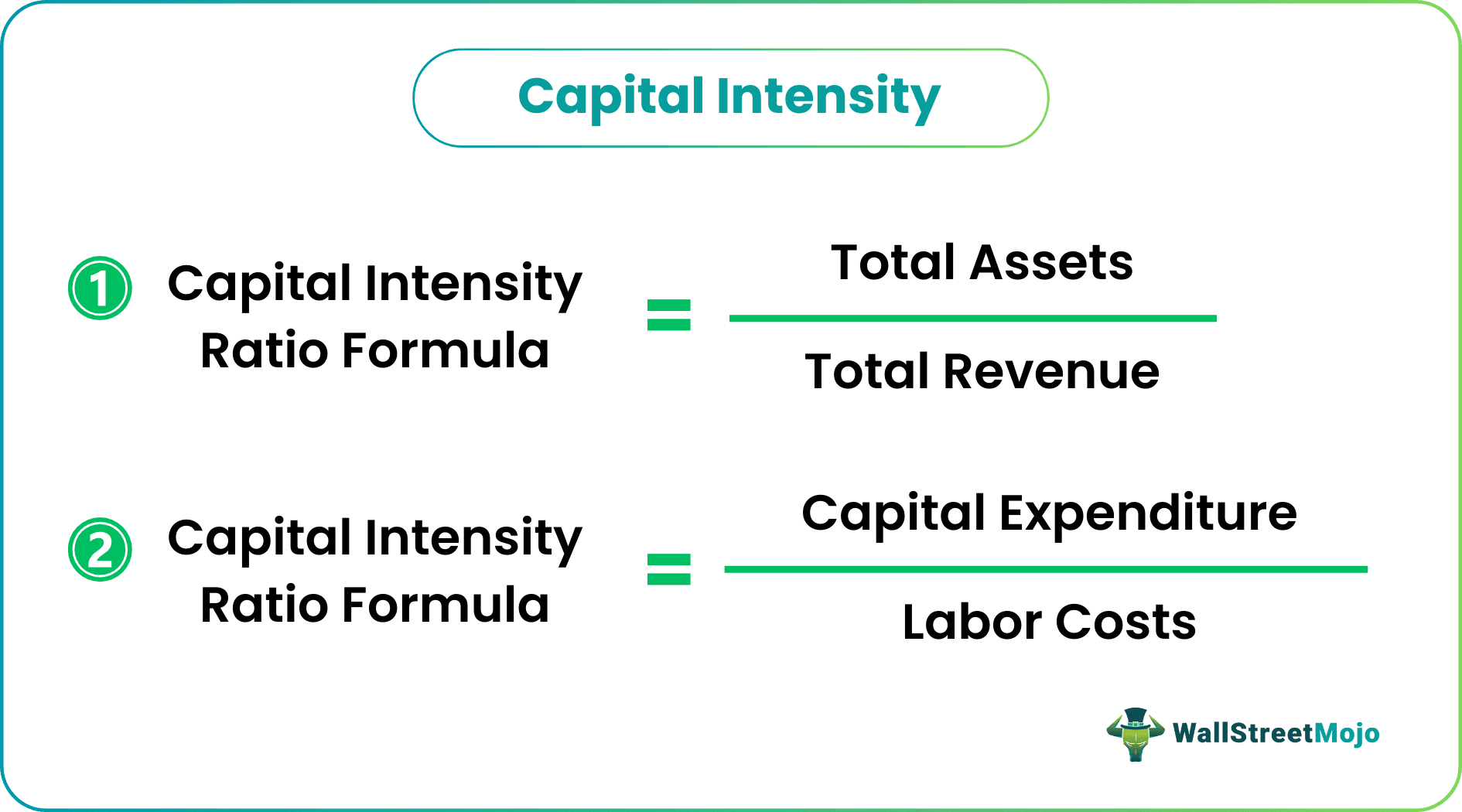

Capital Intensity Ratio Formula

The capital intensity ratio can be measured by the amount of capital infused in a business to produce revenue. Below are the two formulas that are frequently –

Capital Intensity Ratio #1 = Total Assets / Total Revenue

It gives the number of assets needed to produce every dollar in revenue.

Analysts also use it to measure how much capital, as opposed to labor, is required to make specific dollars in sales.

Capital Intensity Ratio #2 = Capital Expenditure / Labor Costs

- If the capital intensity ratio is high, it might mean that the company has to spend more assets in producing revenue. If it is low, the business is utilizing the assets such that assets are generating high values.

- On a similar note, this ratio can be high depending on the nature of the business and the industry it operates.

- Industries or businesses that are more capital intensive have higher operating leverage. Thus, the production or output of such businesses should be voluminous to command a greater return in terms of revenue.

Examples of Capital Intensity

Let's take some examples.

Example #1

For 2018, the following data is available for aircraft and aerospace industry giants Boeing and Airbus group. First, determine the capital intensity ratios for each and comment.

| Data (FY 2018) | Boeing | Airbus |

|---|---|---|

| Total Assets | 101,127 | 115,198 |

| Revenue | 93,496 | 63,707 |

Source: Boeing annual report 2018 (investors.boeing.com), Airbus annual report 2018 (www.airbus.com)

Solution:

Notice that Boeing is a US aircraft maker, and Airbus is a French aircraft maker but has a similar business model for a viable comparison.

Calculation of Capital Intensity for Boeing will be -

For Boeing, CI = 101,127/93,496 = 1.082

Calculation of Capital Intensity for Airbus will be -

For Airbus, CI= 115,198/63,707= 1.808

Since the capital intensity for Airbus is greater in numeric value than Boeing, it means that Boeing has efficiently utilized its assets to generate revenue. For every $1.083 of assets used, $1 of revenue is generated by Boeing.

Example #2

The capital intensity ratios for two detergent manufacturing firms are 1.1 and 1.6. manufacturer with a greater ratio has $2 million in sales, whereas the other firm has $2.1 million in sales. Analyze the efficiency of both firms.

Solution:

Since we have capital intensity ratios given in the question, we are sure that manufacturer A has utilized its assets such that every $1.1 of assets produced $1 in revenue. Whereas for manufacturer B, it was spending $1.6 of assets to make the same revenue.

Further, we can calculate the assets of both the manufacturers;

Calculation of Capital Intensity for Manufacturer A will be -

Manufacturer A, assets = 1.1 x $2.1 million = $2,310000

Calculation of Capital Intensity for Manufacturer B will be -

Manufacturer B, assets = 1.6 x $2 million = $3,200000

Thus, B has more assets but poor asset utilization for revenue generation.

Advantages

Some of the advantages are as follows:

- They help a business determine the usefulness and utilization of its existing assets.

- The capital intensity ratio gives insights into the spread over fixed and variable costs. This further guides the business in strengthening its economies of scale.

- If a company (or industry) is capital intensive, it will have more machinery costs and fewer labor costs.

- It is easy to use because its components are easily available in financial statements.

Disadvantages

Some of the disadvantages are as follows:

- It is not often a good measure because of inflationary effects on its component revenues and assets.

- It becomes difficult to compare firms in different industries because it differs when business and industry differ.

- Their measure can vary with the intervention of technology in business. Hence, the ratio is not a sufficient measure of business efficiency.

- Not every capital-intensive firm outperforms labor-intensive firms in all respects. One reason to support this statement is the utilization of machinery versus the determination of the workforce.

Important Points

- Modern-day technologies like automated production lines, robotics, nanotechnology, and artificial intelligence have changed the landscape of capital and labor intensity tremendously, with industries shifting more towards capital intensive than labor-intensive.

- The factor capital costs-to-labor costs can also be affected by capital investments. A machine that required 10 workers has now become automated and requires only 2 workers.

- Businesses that are in their early life stage can be seen to have high capital intensity ratios. It is because the company is yet to enjoy greater outreach and more significant revenues.

Conclusion

Massive investments in businesses can cause the replacement of labor by mechanized or machine production. Therefore, it can result in short-term or long-term unemployment. However, capital intensity in businesses also brings in new professionals in the picture, such as AI engineers, microcomputer technologists, etc.

Capital intensive production came thudding because of the need to increase profit margins, which was brought about by more mechanized production. The advent of the industrial revolution saw more and more machinery in factories and farmlands. Increased efficiency, reduced production time, and optimized costs made even the labor-intensive businesses shift towards the capital-intensive structure.