Table Of Contents

What Is Capital Growth?

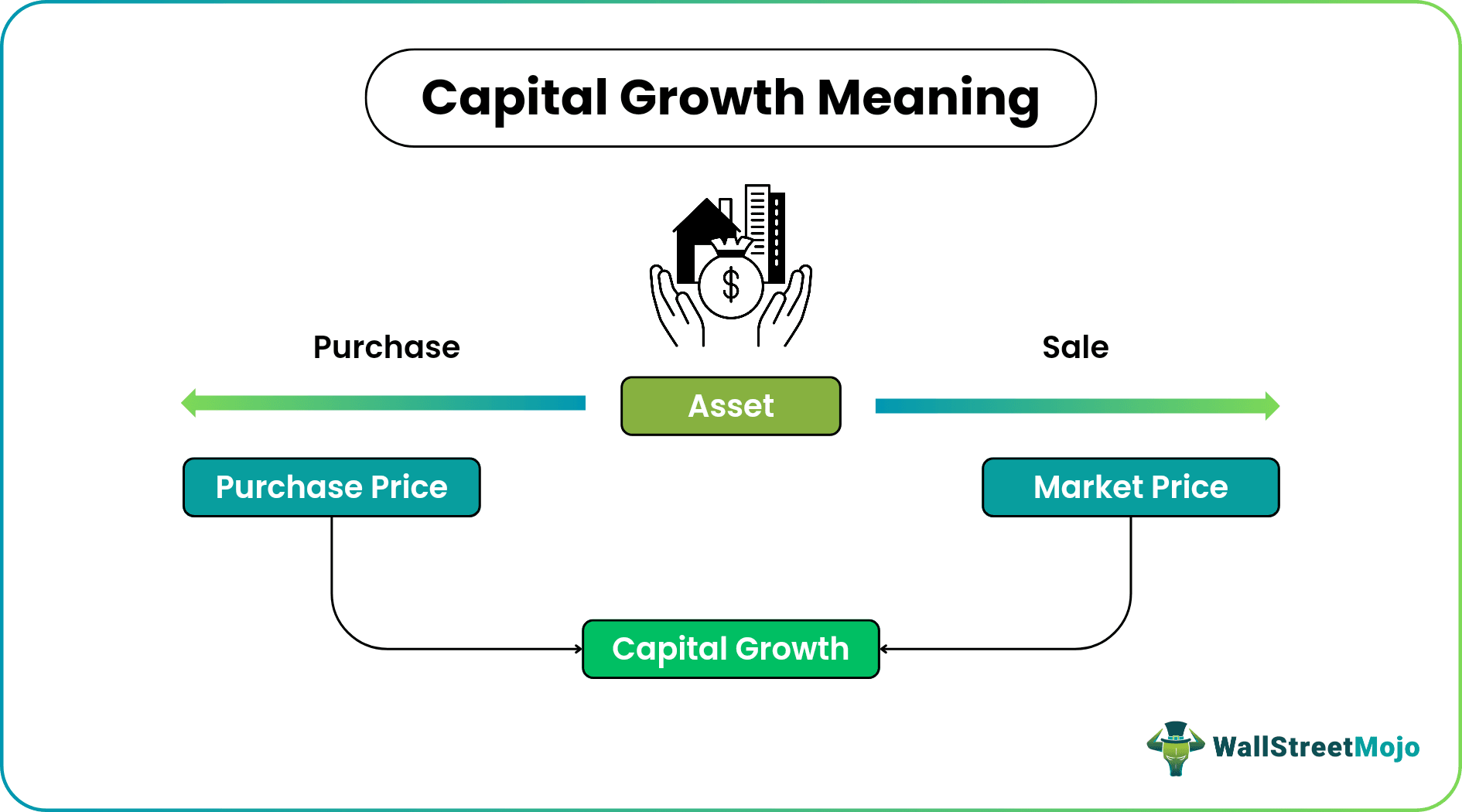

Capital growth refers to an appreciation of an asset's or an investment's economic value. The growth in capital can be calculated as the difference between the current market price and the purchase price. Capital growth investment examples include funds, bonds, equities, and real estate properties.

The extent of growth depends on the asset type and investors' risk tolerance. Usually, people seeking capital growth are in for the long term, and thus they would be ready to take higher risks. However, capital growth is not the same as income from assets.

Key Takeaways

- Capital growth, or capital appreciation, is the increase in the economic value of an asset. The asset is usually a real estate property or marketable security.

- It can be high or moderate, or low and often takes years to grow significantly.

- Property capital growth is different from the rental income the owner receives regularly. Growth implies the appreciation of the value of the building or the land.

- Investors look out for value appreciation, along with income, when they hold an investment for years.

Capital Growth Explained

Capital growth investment can increase market value. These investments include stocks, funds (ETFs and mutual funds), bonds, and real estate properties. It is important to note that investors/ owners can simultaneously receive income from these assets while it keeps appreciating. It is because one can only realize any appreciation in value at the time of sales.

So what does the investor receive for holding the asset? The answer is income. Income from investments is paid as dividends or interest. Higher-income motivates investors to hold the asset while it grows. Income from real estate is the rental yield. It is the payment received for letting the house to other parties.

Now let's analyze why capital growth occurs. When an investor holds a stock for, say, ten years, it is subject to all the economic changes during the decade. The economy grows, inflation contributes largely to price rises, and the company or real estate prospers. Or even a pandemic can occur, which takes innovative companies to new heights and destroys traditional companies reluctant to change to the new normal.

However, it is important to remember that not all assets grow. For significant appreciation in value, one should give it time. Only those investors who are risk tolerant will be able to enjoy the value of their investment when it grows multi-fold while at the same time generating income.

Formula

The formula to calculate capital appreciation or growth is pretty simple.

Capital growth = Current Market Price of Asset – Original Purchase Price.

The prices include total cost, taxes, brokerage, and other expenses incurred on the purchase or sale of the asset. Thus, the net growth in capital reflects the net gain made in holding the asset.

How To Calculate?

Given below are the steps to calculate the capital growth in an asset:

- Step 1: First, consider the price at which a person purchased the asset. To this, add the taxes incurred in the purchase of the asset. Also, add the commission or brokerage charges. This is the total purchase price. Let's call this value V1.

- Step 2: Next, estimate the current market price of the asset. This is the price at which it can be sold. One should also consider the expenses incurred in selling the asset. Let this value be V2.

- Step 3: Deduct V1 from V2. It gives the net appreciation in the capital.

- Alternatively, an online capital growth calculator can help accurately find the asset's appreciation.

Examples

Let's discuss some examples to understand the concept better. First, let's consider a hypothetical example to understand the calculation and then move on to a real-world example.

Example #1

Karen bought the stock for $500 in 2017. The following is the annual dividend (income) she received.

| Year | Income |

|---|---|

| 2017 | $102 |

| 2018 | $113 |

| 2019 | $98 |

| 2020 | $95 |

| 2021 | $89 |

In 2022, she planned to sell the stock as it did not perform up to her expectations. The current market price of the stock was $849. Thus, the capital appreciation can be calculated as,

Current market price – Original purchase price – (Processing fee + Taxes)

- = 849 – 500 – (10 + 75)

- = $264

Example #2

Let's look at the example of home price appreciation in the United States. In June 2022, the monthly appreciation reached an annual high of 18.8%. But since then, the pace has slowed. In August, the growth was estimated at 12%. Real estate has appreciated by a 16.7% over 2021. Though the average price is at a historic high of $338,692, the appreciation is slow.

Capital Growth vs Income vs Rental Yield

Capital growth can be easily confused with income or rental yield. But there are some striking differences between the three. They are:

- Capital appreciation is the net increase in the value of an asset or investment over time. It is a person's gain in selling their property or asset. On the other hand, income and rental yield are the gains in holding an asset.

- When an asset appreciates, the benefit is realized only at the time of sale. But income and rental yield are steady sources of income that can be collected regularly.

- Investors looking for capital growth invest their time too. They do not intend to benefit from short-term or overnight variations in trends. They are likely to invest for years and simultaneously earn income too. However, investors seeking only income are more likely to be day traders or swing traders.

- Rental yield is income earned from renting or leasing a property. Similar to investments or securities, real estate can provide ROI. Usually, income can also be earned from investments in dividends or interest.