Table Of Contents

What is Capital Gains Yield?

Capital Gains Yield is the increase in the value of an asset or portfolio because of the rise in the price of an asset (not the dividend paid because the owner has held the asset), combined with the dividend yield, it gives the total yield, i.e., profit because of holding an asset. Here, the returns are computed only on the basis of the price appreciation of assets.

The capital gains yield expression is used either to figure out the original price of the asset or the current price of it in the market. In accordance with the same, the value appreciation percentage of the security is figured out.

Capital Gains Yield Explained

Capital Gains Yield (CGY) signifies the changes in the value of assets with respect to the change in the price of the assets in the market. When investors invest in an asset, there are two things that they must be aware of. One is the value of the asset and the other is the total return they can expect to receive.

Though assessing CGY does not include evaluation of dividends, the dividends may include certain portions of the total return with respect to the stocks. To be more precise, capital gains is a component of the total return. The capital gains yield is the amount with which the asset value appreciates or depreciates. However, this amount remains equal to the total returns if no cash flow occurs.

CGY is expressed in terms of percentage. CGY is highly affected by when the asset is being transacted, i.e., bought or sold. Determining this helps assess the frequent changes in the prices of the asset and accordingly remain prepared for the surprises in the market beforehand.

Formula

We use this formula when we want to know how much return we will get only based on the appreciation or depreciation of stock.

Here, P0 = price of the stock when we invested in it, and P1 = price of the stock after the first period.

We look at the beginning stock price and the stock price at the end of the first period. And then, we will compare these two stock prices and find out the differences. Then we will find out the percentage of the differences based on the beginning stock price.

This formula can also be crafted as –

Capital Gains Yield Formula = (P1 / P0) - 1

Capital Gains Yield Video Explanation

Explanation of Capital Gains Yield Formula

Examples

Let's take a practical example to understand this concept in detail -

Example 1

Stella wants to see how much she has earned on a particular stock only based on capital appreciation/depreciation. She has seen that when she bought the stock, the price was $105. After two years, the stock price has appreciated to $120 per share. What is the Capital Yield on that particular stock?

All we need to do is to put in the data into the formula for capital gains yield calculation.

- Capital Gains formula = (P1 – P0) / P0

- Or, Capital Gains = ($120 - $105) / $105

- Or, Capital Gains = $15 / $105 = 1/7 = 14.29%.

Using this formula, we understand that Stella got 14.29% capital gains after two years of investment.

If the company offers a dividend, we can also calculate the dividend yield and determine the total return on investments.

Example 2

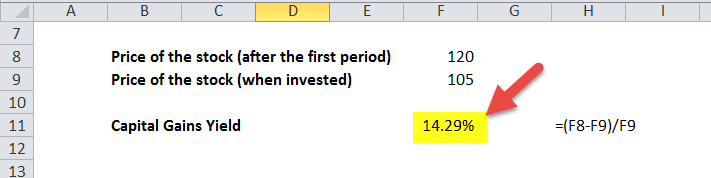

Let us continue with Example 1 and try and check how it can be calculated in Excel as well:

It is very simple. All you need to do is to put in the data into the formula.

Uses

For every investor, the capital gain is an important measure.

Many companies don't pay dividends. In that case, the investors can only get the capital gain yield as the return on investments.

Since this Yield can be positive or negative, it affects the investors' total returns.

For example, if Mr. A gets a total return of 25% on the stock, it can be the result of a negative capital yield of – 5% and a dividend yield of 30%.

So, here's what we consider while calculating the total returns - Capital and Dividend yield

We already know the calculation.

To calculate the dividend yield, we need to use the following formula –

Dividend Yield = Annual Dividend / Price

Capital Gains Yield vs Dividend Yield

Capital gains yield and dividends yields are two types of returns that investors must know of when they invest in an asset or security. There is a wide range of aspects in which these two terms differ. Listed below are a few differences between the two types of yields which when known to investors, have proper clarity on the returns they may expect:

- Dividend yield completely focuses on the amount invested in the asset or financial instrument. On the other hand, capital gains yield revolves around the current changes in the price of the assets in question.

- The capital gains yield gets influenced by the cash flows taking place in between for the total return to be determined based on when the assets are bought or sold in the market, while the dividend yield does not get impacted by the transactions happening in the market. The latter is all about the dividend promised to investors at the time of making investment.

- For investors who aim at reaping long-term stable returns from time to time, dividend yield is for them. On the contrary, the ones who are fine with significant short-term profits or returns, capital gains yield is recommended for such investors.