Table Of Contents

What Is Capital Charge?

The capital charge refers to the amount of capital required to cover the higher risk taken by a bank or insurer. It serves to ensure that financial institutions have enough capital in reserves to withstand any sudden loss and protect the investments of policyholders or bank account holders.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Financial companies use it in risk management and financial planning to remain stable and compliant with regulations. Every country has a designated financial regulator or central bank that sets these charges of capital. Moreover, they vary according to the activities and riskiness undertaken by an institution.

Key Takeaways

- The capital charge represents the specified amount of capital needed to withstand the increased risk that an insurance or a banking company takes for business.

- It aims to guarantee that financial companies have sufficient capital reserves to safeguard policyholders' or bank account holders' investments and thwart any unexpected losses.

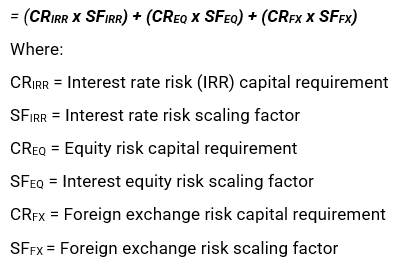

- It is calculated by using the Simplified Standardized Approach consolidating the requirements of capital per Basel 2 classes of risks like equity risk, foreign exchange, and interest rate using the formula:

- charges of capital concerning market risk = (CRIRR x SFIRR) + (CREQ x SFEQ) + (CRFX x SFFX).

Capital Charge Explained

Capital charge definition for the market can be stated as the amount of funds a financial institution has to hold to absorb losses due to market price fluctuations like foreign exchange risk, interest rates, and equity prices. It can be calculated using regulatory frameworks like Basel 2 and 3, which aim to ensure banks have enough capital to cover market shocks.

It can be calculated using the capital charge formula, as stated in the next section, to ensure that institutions sufficiently account for the possible losses built into their trading actions. Moreover, greater capital charges impact banks' profitability and trading strategies. These institutions may decrease their exposure to risk-prone assets or opt for more efficient methods to handle capital, which may affect their pricing dynamics and market liquidity.

Financial firms use it to sustain regulatory compliance and stay stable by complying with regulations pertaining to charges of capital. Furthermore, it also enables the banks to function securely continuously and remain resilient in the backdrop of market turmoil. It has had positive impacts on the financial sector as its implementation has become mandatory per Basel 3. Therefore, its execution has led to the standardization of risk management practices internationally.

Additionally, Basel 3's charge of capital has reduced systemic risk and increased transparency, resulting in the fostering of a highly stable financial system. Hence, it led to the development of solid resilience to withstand economic chaos and recession.

How To Calculate?

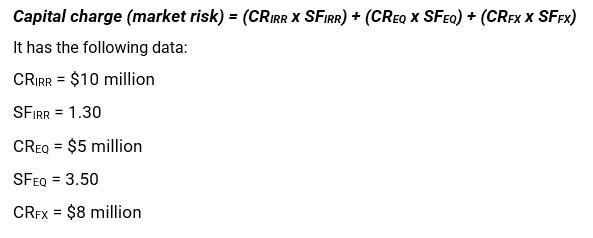

The charge of capital is related to market risk by using a simplified, standardized approach. It is simply the sum of all recalibrated requirements of capital due to Basel 2 classes of risk like foreign exchange, interest rate, and equity risk as utilized in its formula below:

Capital charge for market risk

Moreover, every bank and financial company has to apply a scaling factor (SF) or multiplier to respective capital requirements (CR) concerning every risk class, particularly- foreign exchange risk (FX), interest rate risk (IRR), and equity risk (EQ) as per the table below:

| Risk component | Multiplier |

| General & specific IRR | 1.30 |

| General & specific EQ | 3.50 |

| FX | 1.20 |

Examples

Let us use a few examples to understand the topic.

Example #1

An online article published on 13 May 2024 discusses the difficulties faced by market makers and hedge funds inefficiently trading currencies of Emerging Markets (EM). Further, EM currencies provide good returns but remain volatile because of economic uncertainties and global risk changes. As a result, local governments, like market regulations concerning FX in India and the reserve needs of Brazil, enforce regimes of regulation to stabilize EM currencies.

Additionally, any high charges of capital related to EM currencies exposure prohibit profitability and trading for funds, routing them to lower-risk assets. Hence, the shift from OTS markets to futures contracts aims at increasing liquidity and reducing capital requirements. Thus, it benefits traders by having better risk monitoring and lower trading costs. Consequently, enhanced regulatory clarity and market infrastructure play an important role in attracting institutional investors to EMS against challenges.

Example #2

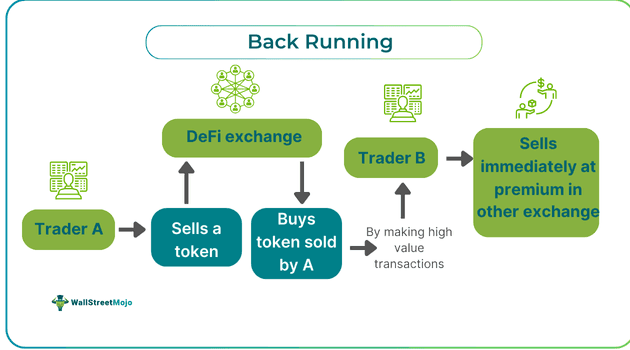

Let us assume that Old York Bank has to calculate its charges of capital related to market risks utilizing the simplified approach formula: