Table Of Contents

What Is Capital Budgeting Techniques?

Capital budgeting technique is the company’s process of analyzing the decision of investment/projects by taking into account the investment to be made and expenditure to be incurred and maximizing the profit by considering following factors like availability of funds, the economic value of the project, taxation, capital return, and accounting methods.

Key Takeaways

- Capital budgeting techniques refer to methods that companies use to determine the viability of a project by analyzing the anticipated inflows and outflows.

- Some popular capital budgeting techniques include IRR, MIRR, NPV, and profitability index.

- A disadvantage of the payback period method is that it does not consider the time value of money.

- A disadvantage of the payback period method is that it does not consider the time value of money.

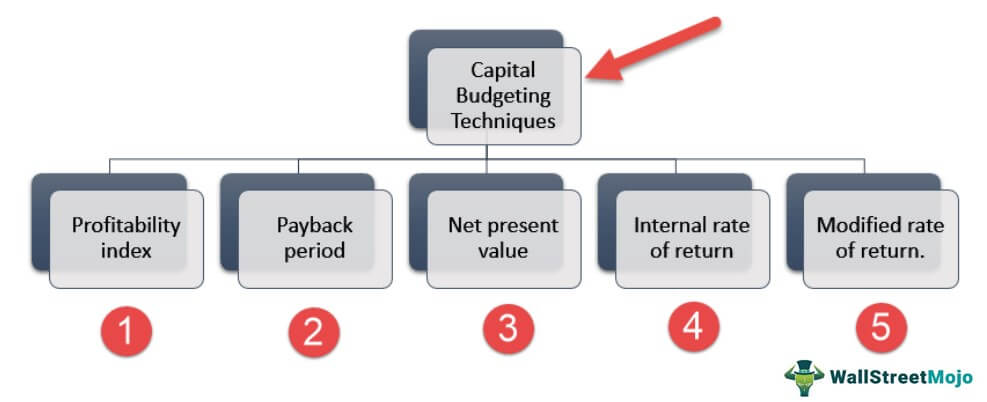

List Of Top 5 Capital Budgeting Techniques (With Examples)

- Profitability index

- Payback period

- Net present value

- Internal rate of return

- Modified rate of return

Let us discuss this one by one in detail along with examples -

#1 - Profitability Index

Profitability Index is one of the essential techniques, and it signifies a relationship between the investment of the project and the payoff of the project. When PI is more than 1, it means that the project is profitable and the business may consider it for investment. That said, if it is less than 1, it means that organizations should consider rejecting it as it is not a profitable investment. If PI is equal to 1, it is up to the company whether it will invest or not.

The formula of profitability index is as follows:

Profitability Index = PV of future cash flows / PV of initial investment

Where PV is the present value.

It is mainly used for ranking projects. According to the rank of the project, a suitable project is chosen for investment.

Example

Suppose there are 2 projects for Company ABC to consider — Project X and Project Y. The initial investment required for the projects is $100,000 and $200,000 respectively. Let us say that for Project A, the present value of the expected future cash flows is $300,000, and the same for Project B is $250,00.

Thus, one can use the above formula to compute Profitability Index for both projects.

PI for Project A = 300,000/100,00 or 3

On the other hand, PI for Project B = 250,000/200,00, i.e., 1.25

Since a higher PI indicates higher profitability, the company can consider investing in Project A.

Advantages

- Profitability index factors in the time value of money

- It can help in evaluating risk associated with multiple investment opportunities.

- Companies can use the method to rank projects on the basis of potential profits.

Disadvantages

- The technique does not factor in a project’s size.

- It is based on the assumption that the discount rate remains the same.

- Profitability index does not consider a project’s duration.

#2 - Payback Period

This method of capital budgeting helps to find a profitable project. The payback period is calculated by dividing the initial investment by the annual cash flows. But the main drawback is it ignores the time value of money. By the time value of money, we mean that money is more today than the same amount in the future. So if we payback to an investor tomorrow, it includes an opportunity cost. As already mentioned, the payback period disregards the time value of money.

It is calculated by how many years it is required to recover the amount of investment done. Shorter paybacks are more attractive than more extended payback periods. Let’s calculate the payback period for the below investment:-

Example

For example, there is an initial investment of ₹1000 in a project, and it generates a cash flow of ₹ 300 for the next five years.

Therefore the payback period is calculated as below:

- Payback period = no. of years – (cumulative cash flow/cash flow)

- Payback period = 5- (500/300)

- = 3.33 years

Therefore it will take 3.33 years to recover the investment.

Advantages

- It is easy to use.

- Risk assessment is easy with this method

- Organizations can compare different investment opportunities by choosing this technique.

Disadvantages

- It does not consider the time value of money.

- The technique does not consider cash flows following payback.

#3 - Net Present Value

Net Present Value is the difference between the present value of incoming cash flow and the outgoing cash flow over a particular time. It is used to analyze the profitability of a project.

The formula for the calculation of NPV is as below:-

NPV = - Initial Investment

Here i is the discount rate, and n is the number of years.

Example

Let us see an example to discuss it.

Let us assume the discount rate is 10%

- NPV = -1000 + 200/(1+0.1)^1 + 300/(1+0.1)^2+400/(1+0.1)^3+600/(1+0.1)^4+ 700/(1+0.1)^5

- = 574.731

We can also calculate it by basic excel formulas.

There is an in-built excel formula of "NPV" which can be used. The discounting rate and the series of cash flows from the 1st year to the last year are considered arguments. We should not include the year zero cash flow in the formula. We should later subtract it.

- = NPV (Discount rate, cash flow of 1st year: cash flow of 5th year) + (-Initial investment)

- = NPV (10%, 200:700) - 1000

- = 574.731

As NPV is positive, it is recommended to go ahead with the project. But not only NPV but IRR is also used for determining the profitability of the project.

Advantages

- It considers the time value of money.

- The technique factors in the timing and magnitude of cash flows

Disadvantages

- NPV calculations’ accuracy is heavily dependent on cash flow projections’ accuracy.

- Organizations cannot apply this technique to compare projects having different lifespans.

#4 - Internal Rate Of Return

The Internal rate of return is also among the top techniques that are used to determine whether the firm should take up the investment or not. It is used together with NPV to determine the profitability of the project.

IRR is the discount rate when all the NPV of all the cash flows is equal to zero.

NPV = - Initial Investment =0

Here we need to find “i” which is the discount rate.

Example

Now we shall discuss an example to understand the internal rate of return in a better way.

While calculating, we need to find out the rate at which NPV is zero. This is usually done by error and trial method else we can use excel for the same.

Let us assume the discount rate to be 10%.

NPV at a 10 % discount is ₹ 574.730.

So we need to increase the discount percentage to make NPV as 0.

So if we increase the discount rate to 26.22 %, the NPV is 0.5, which is almost zero.

There is an in-built excel formula of "IRR," which can be used. The series of cash flows is taken as arguments.

- =IRR (Cash flow from 0 to 5th year)

- = 26 %

Therefore in both ways, we get 26 % as the internal rate of return.

Advantages

- It accounts for the concept of time value of money.

- Interoperation of IRR is straightforward.

- It does not require the hurdle rate.

Disadvantages

- It ignores economies of scale.

- The technique assumes that the reinvestment of the cash flows happens at IRR, which is impractical.

#5 - Modified Internal Rate Of Return

The main drawback of the internal rate of return that it assumes that the amount will be reinvested at the IRR itself, which is not the case. MIRR solves this problem and reflects the profitability in a more accurate manner.

The formula is as below:-

MIRR= (FV (Positive cash flows* Cost of capital)/ PV(Initial outlays * Financing cost))1/n −1

Where,

- N = the number of periods

- FVCF = the future value of positive cash flow at the cost of capital

- PVCF = the present value of negative cash flows at the financing cost of the company.

Example

We can calculate MIRR for the below example:

Let us assume the cost of capital at 12%. In MIRR, we need to consider the reinvested rate, which we assume as 14%. In Excel, we can calculate as the below formulae.

- MIRR= (cash flows from year 0 to 4th year, cost of capital rate, reinvestment rate)

- MIRR= (-1000: 600, 12%, 14%)

- MIRR= 22%

A MIRR in excel is a better estimation than an internal rate of return.

Advantages

- Unlike IRR, MIRR allows managers to specify the reinvestment rate.

- MIRR avoids different solutions, i.e., different rates at which the net present value becomes 0.

Disadvantages

- Choosing an appropriate rate of reinvestment can be a challenge.

- It doesn’t account for an investment’s scale.

One can build a practical understanding of capital budgeting techniques by enrolling in this Financial Planning & Analysis Course. The instructor of the course uses his vast experience and expertise to explain such techniques with the help of examples. The practical approach plays a key role in helping learners gain comprehensive knowledge.

How To Choose The Right Capital Budgeting Technique?

Let us look at some important factors one should consider to pick the right method.

- Business Objectives: Managers must consider if the technique is able to assess projects on the basis of their potential impact on market position, competitive advantage, and business growth. Note that the chosen technique should enable organizations to determine the investment that can advance the organization’s strategic priorities and maintain financial discipline simultaneously.

- Project Scope And Scale: A company needs to assess the size and complexity of projects when choosing a technique. Projects that are more complex should be subject to assessment with the help of advanced techniques, for example, IRR and NPV. That said, companies can assess small projects using simple methods, for example, the payback period.

- Ease of Execution: The choice of method must be based on the expertise and technical capabilities of the company. It is important to take into account whether the team can use the technique effectively without requiring too much time or other resources.

- Cash Flow Consistency: Managers need to select a method that can handle the anticipated cash flow patterns properly.

- Risk Appetite: The capital budgeting technique should be able to help evaluate the risk associated with a project and assist organizations in determining whether it is in line with their risk appetite.

- Project Timeline: Companies must ensure that the method assesses projects on the basis of the estimated duration. Typically, short-term projects require evaluation using straightforward techniques. On the other hand, long-term projects require the use of advanced techniques that factor in the time value of money.

- Capital Constraints: Organizations need to choose a method by factoring in the capital constraints faced by them. The technique should help in optimizing resource allocation even if the has limited funds.

- Financial Aspects In Focus: Companies should proceed with a method that factors in those financial aspects that are most relevant with regard to their business decisions.

Capital Budgeting Techniques Importance

One can understand the importance of capital budgeting methods by going through the following points:

- Improved Decision-Making: These methods offer businesses robust analytical frameworks, which help in the detailed assessment of potential investments. This, in turn, helps organizations make informed decisions.

- ROI Maximization: These techniques allow organizations to figure out which investments provide the highest possible returns. In other words, organizations can use such methods to carry out a comparison of different projects to pick the best option in terms of profitability.

- Risk Minimization: These techniques can help organizations in spotting and assessing possible threats to the success of investments. This is possible because these methods factor in specific aspects like economic conditions and market volatility. When businesses are able to spot the threats or risks, they can implement strategies to eliminate them.

- Prioritization of Opportunities: Using these techniques, companies can rank projects on the basis of strategic importance and possible returns. Thus, the capital budgeting methods allow them to prioritize investments and optimize resource allocation.

In addition, the techniques offer a quantitative foundation based on which companies can make financial planning decisions.

Conclusion

Therefore, capital budgeting methods help us to decide the profitability of investments that need to be done in a firm. There are different techniques to decide the return of investment.