Table Of Contents

Process Of Capital Budgeting

The capital budgeting process is a structured method of planning used by organizations to evaluate potential investments or expenditures whose amount is significant. It helps determine a company’s investment in long-term fixed assets such as the addition or replacement of the plant and machinery, new equipment, research, development, etc. This process involves the steps of identifying investment opportunities and making decisions regarding the sources of finance and then calculating the return earned from the investment.

Key Takeaways

- Capital budgeting helps organizations evaluate and commit to long-term investments by identifying various investment opportunities and selecting them based on expected returns, not just short-term gains.

- The most profitable one is selected based on techniques like NPV, IRR, etc. that ensure that investment decisions are data-driven, minimizing risk and maximizing value.

- Capital budgeting aims to determine the projects that are the most financially advantageous in the long run. It helps identify and manage risks before committing capital.

Objectives of Capital Budgeting

- Capital budgeting process is the planning process utilized to calculate the potential investments or expenditures whose amount is significant.

- It helps estimate the company’s investment in long-term fixed assets like the plant and machinery addition or replacement, new equipment, research, development, etc.

- This capital budgeting process is the decision regarding the sources of finance and then calculating the return earned from the investment.

- It starts with identifying different investment opportunities. Then, after collecting and calculating other investment proposals and choosing the best profitable investment, the decision for capital budgeting and apportionment is to be taken.

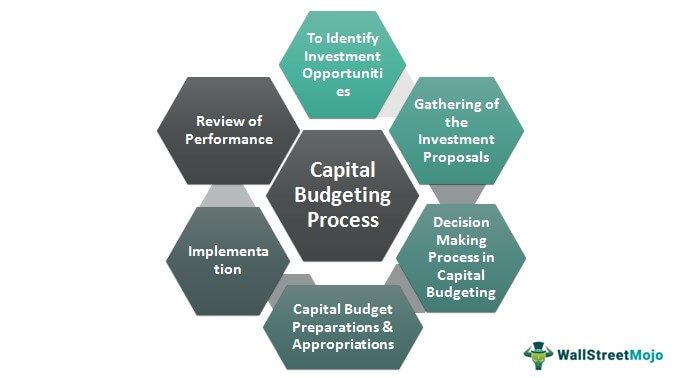

Six Steps To Capital Budgeting Process

#1 - To Identify Investment Opportunities

The first step is to explore the available investment opportunities. Next, the organization’s capital budgeting committee must identify the expected sales shortly. After that, they recognize the investment opportunities keeping in mind the sales target set up by them. One must consider some points before searching for the best investment opportunities. It includes regularly monitoring the external environment to get an idea about new investment opportunities. Then, define the corporate strategy based on the organization’s SWOT analysis, i.e., analysis of its strength, weakness, opportunity, and threat, and seek suggestions from its employees by discussing the strategies and objectives with them.

Example:

Identification of the underlying trends of the market, which can be based on the most reliable information before selecting a specific investment. For instance, before choosing the investment to be made in the company involved in gold mining, firstly, the underlying commodity’s future direction needs to be determined. Whether the analysts believe that there are more chances of price getting declined or the chances of price rise is much higher than its declination.

#2 - Gathering of the Investment Proposals

After identifying the investment opportunities, the second process in capital budgeting is to collect investment proposals. Before reaching the committee of capital budgeting, these proposals are seen by various authorized persons in the organization to check whether the bids given are according to the requirements. Then the classification of the investment is done based on the different categories such as expansion, replacement, welfare investment, etc. This classification into the various types makes decision-making more comfortable and facilitates budgeting and control.

Example:

The real estate company identified two lands where they could build their project. Out of the two lands, one land is to be finalized. So, one will submit the proposals from all the departments. Then, various authorized persons will see the same in the organization to check whether the bids are multiple requirements. Also, the same will then be classified for a better decision-making process.

#3 - Decision Making Process in Capital Budgeting

Decision-making is the third step. In the decision-making stage, the executives will have to decide which investment needs to be made from the available investment opportunities, keeping in mind the sanctioning power open to them.

Example:

For instance, the managers at the lower level of management, like work managers, plant superintendents, etc., may have the power to sanction the investment up to the limit of $10,000 beyond the permission of the board of directors or senior management required. If the investment limit extends, the lower management must involve the top management to approve the investment proposal.

#4 - Capital Budget Preparations and Appropriations

After the decision-making step, the next step is to classify the investment outlays into higher and smaller value investments.

Example:

When the value of an investment is lower and approved by the lower management level, then for getting speedy actions, they are generally covered with blanket appropriations. But, if the investment outlay is of higher value, it will become part of the capital budget after taking the necessary approvals. These appropriations aim to analyze the investment performance during its implementation.

#5 - Implementation

After completing all the above steps, it implements the investment proposal, i.e., put into a concrete project. Several challenges can be faced by the management personnel while executing the tasks as they can be time-consuming. For the implementation at a reasonable cost and expeditiously, the following things could be helpful: -

- Formulation of the project adequately: Inadequate formulation is one of the main reasons for the delay. So, the concerned person should consider all the necessary details in advance and one should do a proper analysis well to avoid any delay in the project implementation., the concerned person should consider all the necessary details in advance, and one should do a proper analysis well to avoid any delay in the project implementation.

- Use responsibility accounting principle: For the expeditious execution of the various tasks and the cost control, one should assign specific responsibilities to the project managers, i.e., the timely completion of the project within the specified cost limits.

- Network technique use: Several network techniques like the Critical Path Method (CPM) and Program Evaluation and Review Technique (PERT) are available for project planning and control, which will help monitor the projects properly and efficiently.

Example:

For prompt processing, the capital budgeting committee must ensure that management has done the homework on the preliminary studies and the concise formulation of the project before its implementation. After that, it implements efficiently.

#6 - Review of Performance

A review of performance is the last step in capital budgeting. But, the management must first compare the actual results with the projected results. The correct time to make this comparison is when the operations get stabilized.

Example:

With this review, the capital budgeting committee concludes on the following points: -

- To what extent the assumptions were realistic.

- The efficiency of the decision-making.

- Suppose there are any judgmental biases.

- Either it fulfills the hopes of the sponsors of the project.

Thus, the process is complex, consisting of the various steps required to be followed strictly before finalizing the project.

Conclusion

The companies use capital budgeting to make decisions related to long-term investment. It starts with the identification of different investment opportunities. Then, after collecting and evaluating various investment proposals and selecting the best profitable investment, the decision for capital budgeting and apportionment is to be taken. Lastly, one should implement the decision taken and review the performance timely.