Table Of Contents

Top Capital Budgeting Methods

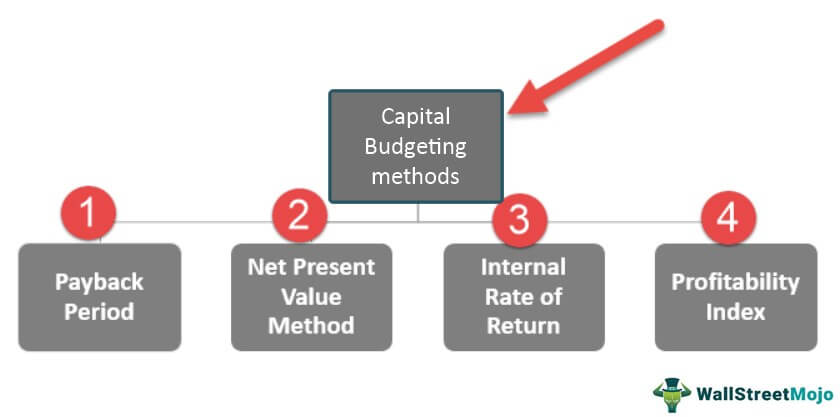

Capital budgeting methods are used to aid the decision-making process in Capital Budgeting. They can be used as non-discounted cash flow methods, including the Payback period, etc., and the discounted cash flow methods, including the Present Net Value, profitability index, and Internal Rate of Return.

Top Capital budgeting methods include -

- Payback Period

- NPV

- Internal Rate of Return Method

- Profitability Index

Key Takeaways

- Capital budgeting methods are helpful in decision-making concerning capital budgeting procedures. In addition, they can be used as non-discounted cash flow methods and discounted cash flow methods.

- The top capital budgeting methods are the payback period method, net present value method, internal rate of return (IRR), and profitability index.

- It is a helpful method in the decision-making process related to long-term investments and may also be used to evaluate a capital investment's economic feasibility.

- These methods are critical for an organization to make informed decisions about long-term investments.

#1 - Payback Period Method

It refers to the period in which the proposed project generates enough cash to recover the initial investment. The project with a shorter payback period is selected.

The formula of payback period is represented as below,

Payback Period = Initial Cash Investment / Annual Cash Inflow.

Example

ABC Ltd has $200,000 additional capital to invest in its Production activity. Options available are Product A and Product B, which are mutually exclusive. The contribution per unit is $50, and Product B is $30. The expansion plan will increase output by 1,000 units for Product A and 2,000 units for Product B.

Thus the Incremental cash flow will be (50 * 1000) $50,000 for Product A and (30 * 2000) $60,000 for Product B.

The payback period of product A is calculated as follows,

Product A = 200000 / 50000 = 4 Years

The payback period of product B is calculated as follows,

Product B = 200000 / 60000 = 3.3 Years

Hence ABC Ltd will invest in Product B as the payback period is shorter.

It is the most simple method. Hence it takes very little time and effort to arrive at a decision.

The time value of money is not considered in the payback method. Generally, Cash flows generated at the initial stage are better than cash flows received later. There might be two projects with the same payback period, but one generates more cash flow in the early years. Hence the decision taken by this method in this particular scenario will not be the most optimum one.

Similarly, projects might have a longer payback period but generate larger cash flows after the payback period. In this scenario, selecting a project based on a shorter payback period without considering the cash flows generated after the payback period by the other project is detrimental to the company.

The rate of return from the amount invested is not considered in the payback method. So if the actual return is less than the cost of capital, then the decision arrived through a shorter payback period will be detrimental to the company.

Benefits

- This technique requires individuals to utilize very few inputs. Moreover, calculating the payback period is comparatively easier than the other methods.

- The calculation of payback period is straightforward and it requires only a few inputs. Hence, managers can compute a project’s payback period quickly and make decisions quickly. This is helpful especially for organizations with limited resources.

- This capital budgeting technique is particularly useful for organizations operating in industries where technological changes occur rapidly.

- The payback period provides valuable information for decision-making. This is because the shorter a project’s payback period, the lower the associated financial risk.

- Generally, it is not ideal for determining the viability of long-term projects.

Limitations.

Limitations

- This method ignores a vital concept in business, i.e., the time value of money. As a result, it distorts cash flows’ true value.

- The technique does not factor in normal scenarios, which may involve the requirement for additional investments in the subsequent years and irregular cash inflows.

- The method does not factor in cash flows beyond a project’s payback period.

#2 - Net Present Value Method (NPV)

Most companies use this NPV method for evaluating capital investment proposals. There might be uneven cash flows generated during different periods. It is discounted at the cost of capital for the company. It is compared with the initial investment made. If the present value of inflows is more than the outflow, then the project is accepted or otherwise rejected.

The time value of money is considered in this method and attributed to the company's objective: maximizing profits for the owners.

Also, it considers the cash flow during the entire tenure of the product and the risks of such cash flow through the cost of capital. It requires the use of an estimate to calculate the cost of capital.

The formula of NPV in excel is represented as below,

Net Present Value (NPV) = Present value (PV) of Inflows – Present value (PV) of outflows

When there are two projects with a positive NPV, select the project with a higher NPV.

Example

XYZ Ltd wants to open a retail outlet with an investment of $ 1 Million. Either the company can open it in Mumbai or Bangalore. For Mumbai, the present value of cash flow is $150,000 per annum for ten years at a discount rate of XX percent is $1.2M. After subtracting the initial outlay of $1 Million, NPV is $0.2 Million. For Bangalore, the present value of cash flow is $175,000 per annum for six years at a discount rate of XX percent is $1.3M. After subtracting the initial outlay of $1 Million, NPV is $0.3 Million.

Hence, the company would select Bangalore for opening the retail outlet as it has a higher NPV.

Benefits

- Unlike payback period, this method factors in the time value of money. As a result, it can provide a realistic profitability projection.

- NPV factors in future as well as immediate cash outflows and inflows, and thus allows for complete financial evaluation. With this method, managers can avoid miscomputations concerning investment planning. This is because it prevents them from unanticipated or hidden costs.

- This method allows organizations to consider market fluctuations and make adjustments to the discount rate.

Limitations

- NPV is not an ideal choice for short-term investments.

- This method does not take into account the scale of the projects when carrying out a comparison. That’s why even if the investment amounts have a significant difference, the projecting having the higher NPV may not necessarily be the better option.

- This technique requires accurate future cash flow estimates. A mistake in projecting inflows can affect decision-making.

#3 - Internal Rate of Return (IRR)

IRR is defined as the rate at which NPV is zero. At this rate, the present value of cash inflow is equal to the cash outflow. The time value of money is also considered. It is the most complex method.

If IRR is greater than the weighted average cost of capital, then the project is accepted; otherwise, it is rejected. In the case of more than one project, then the project with the highest IRR is selected.

Example

ABC Ltd has two proposals in hand with an IRR of 14 percent and 18 percent, respectively. If the company's capital cost is 15 percent, then the second proposal is selected. The first proposal will not be selected as IRR is less than the WACC.IRR considers the cash flow during the entire product tenure and risks of such cash flows through the cost of capital.

But the decision arrived by IRR may not be accurate in the following scenarios.

- For mutually exclusive projects;

- When there is capital rationing;

Also, IRR cannot be used if the sign of cash flows changes during the project’s life.

There is no single formula by which you can arrive at IRR. The trial and error method is the only way to arrive at IRR. However, Excel can be used to arrive at IRR automatically.

If individuals wish to develop a practical understanding of the IRR calculation process, you can consider enrolling in this Financial Planning & Analysis Course. Besides IRR, this program covers other capital budgeting techniques, including NPV. Moreover, it provides a comprehensive understanding of various key topics like financial accounting and ratio analysis, which are essential to build a successful career in finance.

Benefits

- This technique considers the time value of money. Hence, it can offer an accurate assessment of the profitability of a project over time.

- With IRR, comparing investment alternatives is straightforward. Organizations can use this method to determine which project can provide better returns quickly.

- Contrary to the payback period method, IRR factors in every cash flow over the life of a project, which allows individuals to get a clear idea of the investment’s profitability.

Limitations

- IRR does not take into account an investment’s actual size.

- One cannot use this technique to carry out a comparison of projects having different time horizons.

- IRR does not consider external factors, for example, interest rate changes or inflation. These factors can impact the actual returns of a project. Hence, this technique cannot provide a clear financial picture on its own. Experts recommend using IRR with financial indicators, for example, return on investment or ROI and NPV.

- It is based on the assumption that a company can reinvest cash flows at the internal rate of return, which may not make sense from a practical standpoint.

#4 - Profitability Index

Profitability Index is the present value of future cash inflows discounted at the required rate of return to the cash outflow at the investment stage.

The formula of Profitability Index is represented as follows,

Profitability Index = Present Value of cash inflows / Initial investment.

A profitability index lower than 1.0 indicates that the present value of cash inflows is lower than the initial investment cost. Similarly, the profitability index greater than 1.0 means that the project is worthy and accepted.

Benefits

- It assists in decision-making as the technique offers a clear signal as to whether a project is viable.

- This method is easy to understand as it involves using a simple formula. One can utilize it without advanced financial knowledge.

- One can use this technique to compare multiple projects simultaneously and pick the one with the highest profit potential.

- It factors in the concept of time value of money.

- Since this method considers discounted cash flows, it can reduce the chances of poor investment decisions.

Limitations

- This method does not factor in external factors, for example, government control, competition, and the changes occurring in the market.

- It is generally not effective for projects having a long-term investment horizon.

- This technique does not consider qualitative factors, for example, innovation and brand image.

- Businesses cannot apply this method to projects that have irregular cash flows.

- If the initial amount of investment is high, the Profitability Index method can mislead managers.

Conclusion

NPV Method is the most optimum method for capital budgeting.

Reasons:

- Consider the cash flow during the entire product tenure and the risks of such cash flow through the cost of capital.

- It is consistent with maximizing the value to the company, which is not the case in the IRR and profitability index.

- In the NPV method, it is assumed that cash inflows will be reinvested at the cost of capital. The IRR method assumes that it is reinvested at IRR, which is not accurate.