Table Of Contents

Capital Asset Pricing Model (CAPM) Definition

The Capital Asset Pricing Model (CAPM) measures the relationship between the expected return and the risk of investing in security. This model is used to analyze securities and price them given the expected rate of return and cost of capital involved.

Key Takeaways

- The Capital Asset Pricing Model, known as CAPM, serves to elucidate the interplay between risk and anticipated return for investors. It facilitates the computation of security prices by considering the expected rate of return and the cost of capital.

- CAPM comprises three core components: the risk-free return, the market risk premium, and Beta.

- The CAPM model enjoys widespread recognition for its effectiveness in assessing the risks and potential returns associated with stock investments.

- Despite being grounded in a set of assumptions, its logical framework and user-friendly nature have solidified its standing as a favored and reliable instrument, assisting investors in their decision-making endeavors.

CAPM Formula

The (capital asset pricing model) CAPM formula is represented below

Expected Rate of Return = Risk-Free Premium + Beta * (Market Risk Premium)

Ra = Rrf + βa * (Rm – Rrf)

Individuals new to finance often think that the CAPM and financial modeling are the same thing. However, that is not true. To eliminate their confusion, they can consider taking the help of this Financial Modeling Certification Course.

Video on Capital Asset Pricing Model (CAPM)

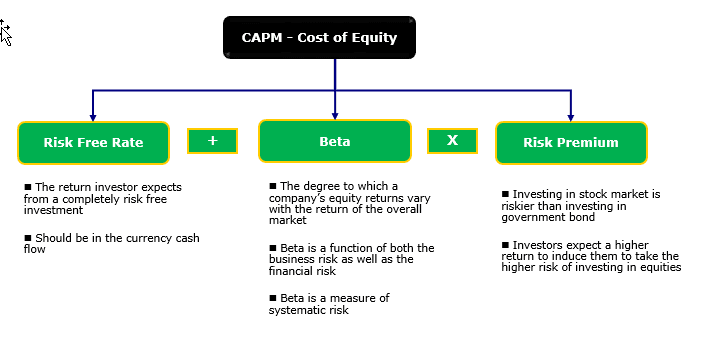

Components of CAPM

The CAPM calculation works on the existence of the following elements

#1 - Risk-free return (Rrf)

Risk-Free Rate of Return is the value assigned to an investment that guarantees a return with zero risks. Generally, the value of the risk-free return is equivalent to the yield on a 10-year US government bond. Investments in US securities are considered zero risks since there is a minimal chance of the government defaulting.

#2 - Market Risk Premium (Rm – Rrf)

Market Risk Premium is the expected return an investor receives (or expects to receive in the future) from holding a risk-laden portfolio instead of risk-free assets. The premium rate allows the investor to decide if the investment in the securities should occur and, if yes, the rate he will earn beyond the risk-free return offered by government securities.

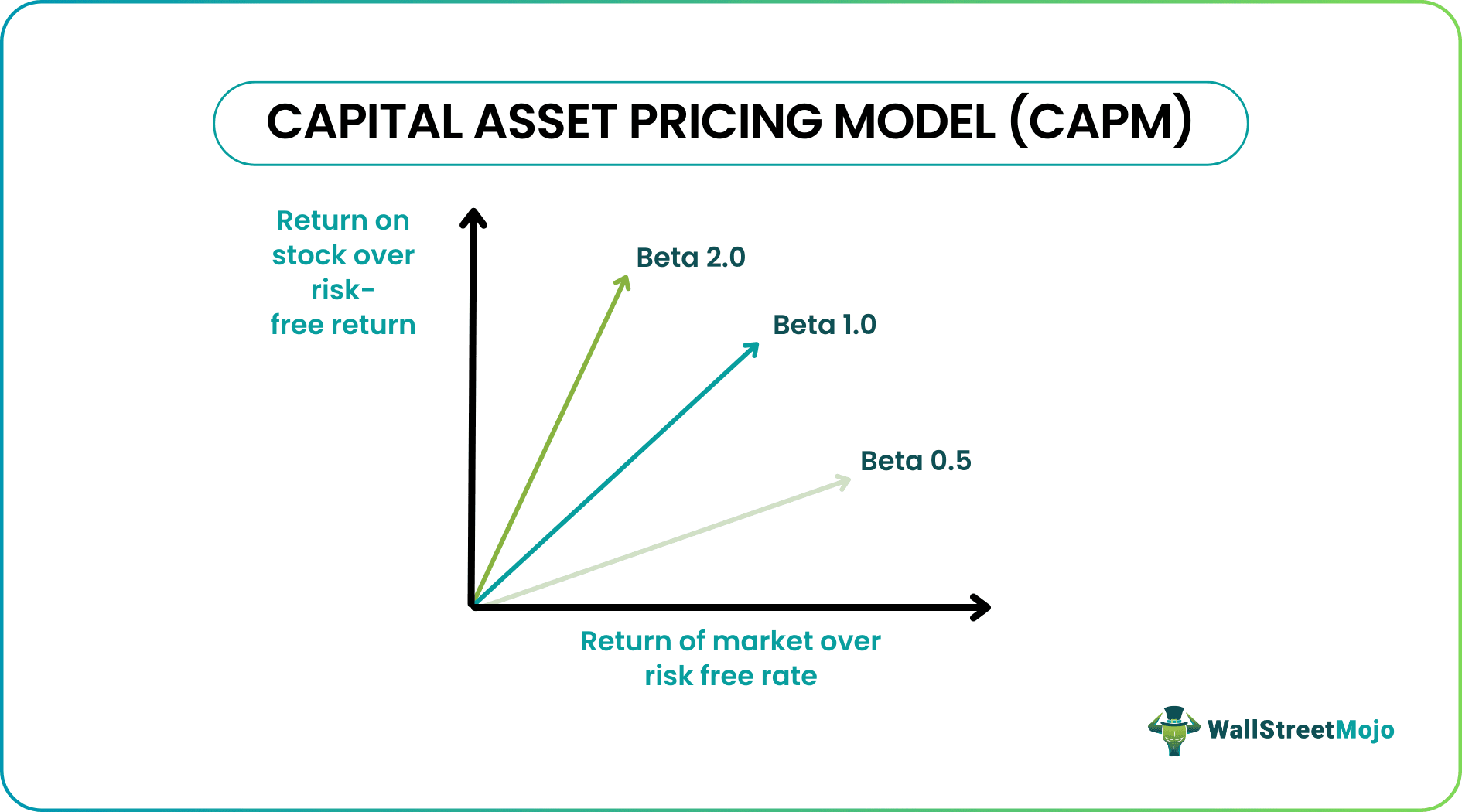

#3 - Beta (βa)

The Beta is a measure of the volatility of a stock concerning the market in general. The fluctuations that will cause in the stock due to a change in market conditions are denoted by Beta. For Beta, which is equal to 1, the stock is in sync with the changes in the market. For example, if the stock's Beta is 1.2, it would cause a 120% change due to any change in the general market. The opposite is the case for Beta less than 1.

Examples of CAPM (Capital Asset Pricing Model)

The following are examples of CAPM (capital asset pricing model)

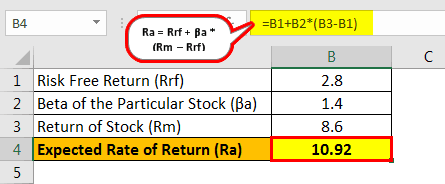

Example #1

Suppose a stock has the following information. It is listed on the London stock exchange and operates throughout Europe. The yield on a UK 10 year treasury is 2.8%. The stock in question will earn 8.6% as per historical data. The Beta for the stock is 1.4, i.e., it is 140% volatile to the changes in the general stock market.

The expected rate of return of the stock will be calculated as below.

CAPM Formula (Expected return) = Risk free return (2.8%) + Beta (1.4) * Market risk premium (8.6%-2.8%)

- = 2.8 + 1.4*(5.8)

- = 2.8 + 8.12

Expected Rate of Return = 10.92

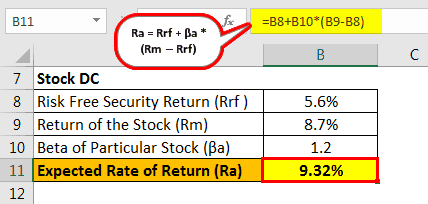

Example #2

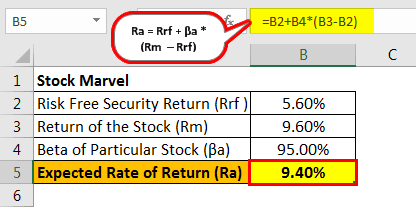

Thomas has to decide to invest in either Stock Marvel or Stock DC using the CAPM model illustrated by the following screenshot from work. Thomas has to decide to invest in Stock Marvel or Stock DC with the given information available to him. Marvel – Return 9.6%, Beta 0.95. DC – Return 8.7%, Beta 1.2. As measured by the return on government stock, a risk-free return in the market is 5.6%.

The expected rate of return of the stock marvel will be calculated below.

Formula - Expected return = Risk free return (5.60%) + Beta (95.00) * Market risk premium (9.60%-5.60%)

Expected Rate of Return = 9.40%

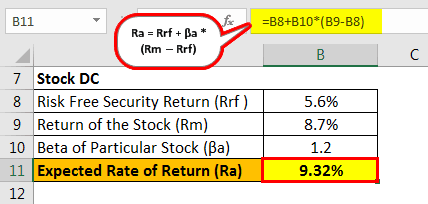

The expected rate of return of the stock DC will be calculated as below.

Formula - Expected return = Risk free return (5.6%) + Beta (1.2) * Market risk premium (8.7%-5.6%)

Expected Rate of Return = 9.32%

Thus, the investor should invest in Stock Marvel.

Advantages of CAPM

- CAPM considers only the systematic or market risk or not the security's only inherent or systemic risk. This factor eliminates the vagueness associated with an individual security’s risk, and only the general market risk, which has a degree of certainty, becomes the primary factor. The model assumes that the investor holds a diversified portfolio, and hence the unsystematic risk is eliminated between the stock holdings.

- It is widely used in the finance industry to calculate the cost of equity and ultimately the weighted average cost of capital, which is used extensively to check the cost of financing from various sources. It is seen as a much better model to calculate the cost of equity than the other present models like the Dividend growth model (DGM)

- It is a universal and easy-to-use model. Given the extensive presence of this model, this can easily be utilized for comparisons between stocks of various countries.

Disadvantages of CAPM

- The capital asset pricing model is hinged on various assumptions. One of the assumptions is that a riskier asset will yield a higher return. Next, the historical data is used to calculate Beta. The model also assumes that past performance is a good measure of the future results of a stock’s functioning. However, that is far from the truth.

- The model also assumes that the risk-free return will remain constant throughout the stock investment. If the return on the government treasury securities rises or falls, it will change the risk-free return and potentially the calculation of the model. It is not taken into account while calculating the CAPM.

- The model assumes that the investors have access to the same information and have the same decision-making process concerning the risks and returns associated with the securities. It assumes that the investors will prefer low-risk securities to high-risk securities for a given return. Investors will prefer higher returns to lower returns for a given risk. Although this is a general guideline, some of the more extravagant investors might not be in agreement with this theory.

Limitations of the Capital Asset Pricing Model

Apart from the assumptions directly related to the factors around the stock and the capital asset pricing model calculation formula, there is a list of general assumptions that the model takes, which are worth looking into.

- Only the returns and risks involved in the securities are the decision-making factors for an investor. There is no accountability for the long-term growth or qualitative factors around a stock that could influence the investor to take an alternative step.

- There is perfect competition in the market, and no single investor can influence a stock's prices or returns. There is no limit on the short-selling short-selling of a stock; neither is their control on the divisibility of the purchase and selling units.

- There are nil taxes regarding the returns earned or any borrowing costs concerning the amount utilized to earn interest on the investment.

- Finally, the model assumes that the investor is risk-averse, and he is supposed to act as a rational being and maximize his utility.

Conclusion

CAPM is widely regarded as one of the foremost models for calculating the risk and returns associated with investing in stocks. Although it utilizes a few assumptions, the rationale behind the model and the ease of use makes it one of the accepted and logical ways to help investors in their decision-making.