Table Of Contents

What is Cap Rate Formula?

The formula for the Cap Rate or Capitalization Rate is straightforward. One may calculate by dividing the net operating income by the asset’s current market value and percentage. Investors use it to evaluate real estate investment based on one year’s return and to help decide whether a property is a good deal.

According to analysts and experts, a good cap rate ranges between 5%-10%. It is important to note that a cap rate of 4% or lesser would indicate a lower risk of investment. However, it would take a longer time frame to recuperate the profits from the investment.

Key Takeaways

- The Cap Rate or Capitalization Rate formula is straightforward. The calculation is done by dividing the net operating income by the asset’s current market value and percentage.

- Investors utilize it to determine real estate investment based on one year’s return and decide if a property is a good deal.

- This principle distinguishes various real estate investment opportunities. In addition, it shows the property trend that indicates if there is a need for an adjustment based on the estimated rental income.

- For an investor, a rising Cap Rate for property shows a rise in rental income vis-à-vis the property’s price. Conversely, the investor may experience a decline in this Rate as lower rental income relative to the property’s worth.

Cap Rate Formula Explained

The cap rate formula indicates the yield of a property for a period of one calendar year. It is calculated by dividing the net operating income by the value of the property. It is pivotal in fixing rental agreements, understanding the value of the property in a particular vicinity, and making setting aside investments easier because data about the income that has been generated from the property is made easier to avail.

You can do the calculation in the following three simple steps: -

- Firstly, one must estimate the real estate property's rental income correctly. Based on that, the net operating income calculation is done, which is the annual income generated by the real estate property minus all the expenses incurred during the operations, which include tasks like managing the property, paying taxes, insurance, etc.

- Secondly, the property's current market value must be appropriately assessed, preferably by a reputed valuation professional. The current market value of the property is its worth in the marketplace.

- Finally, one can calculate the Cap Rate by dividing the net operating income by the current market value of the investment property.

Formula

Mathematically, one may represent the Cap Rate formula as:

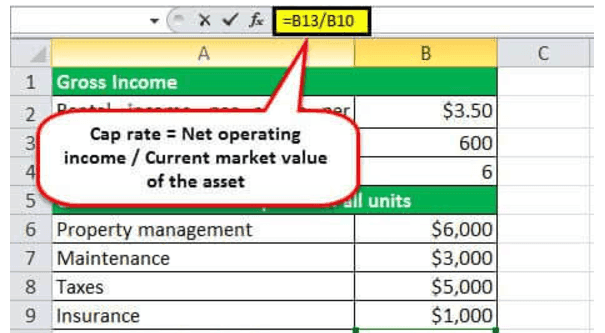

Cap Rate Formula = Net Operating Income / Current Market Value of The Asset

Examples

Let us understand the concept of market cap rate formula with the help of a couple of examples as discussed below.

Example #1

Let us assume that an investor plans to buy a real estate property. The investor intends to decide on an effective metric for evaluating real estate properties based on the Cap Rate. The investor finds three properties with their respective annual income, expenses, and market values, as mentioned below: -

| Property | Annual Income | Annual Expense | Market Value |

|---|---|---|---|

| A | $150,000 | $150,000 | $1,500,000 |

| B | $200,000 | $40,000 | $4,500,000 |

| C | $300,000 | $50,000 | $2,50,000 |

Now, let us do the calculation of the Cap Rate for the respective properties,

Property A

So, Cap Rate for property A = ($150,000 – $15,000) ÷ $1,500,000

= 9%

Property B

So, Cap Rate for property B = ($200,000 – $40,000) * 100% ÷ $4,500,000

= 3.56%

Property C

So, Cap Rate for property C = ($300,000 – $50,000) * 100% ÷ $2,500,000

= 10.00%

Therefore, the investor should buy property C since it offers the highest Cap Rate of 10%.

Example #2

Let us assume that another investor wants to buy a real estate property, and the investor has the below-mentioned information. The investor will invest in the property only if the Cap Rate is 10% or higher.

We have calculated the following values based on the above information, which we may use further to calculate the Cap Rate.

Annual Gross Revenue-

Annual Expense

Net Operating Income

In the below-given template, we have used the calculation of the Cap Rate equation.

So the calculation will be -

Now, investors can invest in the concerned real estate property since the calculated cap rate is higher than the investor's target rate (10%). Therefore, based on the calculated rate, one can infer that they will recover the entire investment in = 100.00% ÷ 12.38% = 8.08 years.

Relevance and Uses

Let us understand the relevance and uses of the cap rate formula through the explanation below.

- The principal use of a Cap Rate is to distinguish different real estate investment opportunities. Let us assume that a real estate investment offers around 4% in return while another property has a cap of about 8%. Then, the investor will most likely focus on the property with a higher return. Moreover, it can also show the trend for the property, which will indicate if there is a need for an adjustment based on the estimated rental income.

- From a real estate investor’s point of view, a cap is an essential tool as it enables an investor to evaluate a real estate property based on its current market value and net operating income. It helps in arriving at the initial return on an investment property.

- For an investor, a rising Cap Rate for a property can indicate a rise in rental income vis-à-vis the property's price. On the other hand, the investor can see a fall in this rate as lower rental income relative to the property's price. It can be a critical factor for an investor to decide whether the property is worth buying.

- Further, it can also indicate the time a real estate will take to recover the entire investment in that real estate property. Let us assume that a property offers a Cap Rate of around 10%, which means it will take ten years (= 100% ÷ 10%) for the investor to recover the entire investment.