Table Of Contents

What Is CANSLIM?

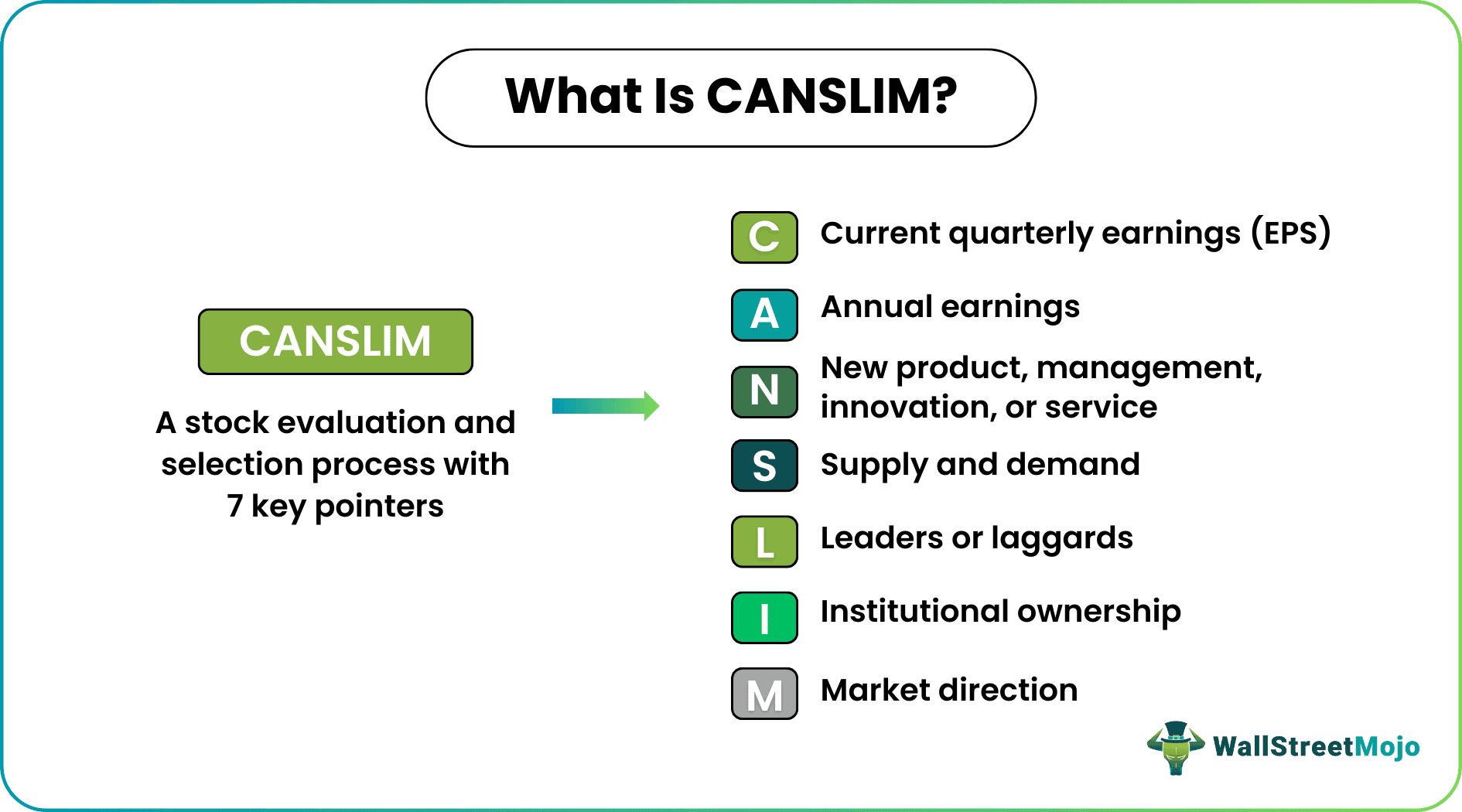

CANSLIM is a stock selection system that combines technical and fundamental analysis methods to identify high-growth stocks. It refers to a process that helps outline stocks with higher growth than average in fast markets. It is also written as CAN SLIM sometimes.

Many investors use the CANSLIM method to spot high-growth stocks for investment to earn better and early returns on them than their other investments and assets. Each letter of the term CANSLIM signifies an attribute that defines how stock analysis and selection should be done, ensuring that only the right stocks are picked by an investor following the defined 7-step principles or recommendations.

Key Takeaways

- CANSLIM is a seven-step process that allows investors to identify high-growth stocks and make investments to generate considerable profits.

- Each letter in the word indicates an attribute and is a defined metric or parameter covering seven factors that help identify high-growth stocks in fast markets.

- The technique was introduced by William O'Neil, founder of the Investor’s Business Daily, in 1950.

- It allows investors to spot and invest in high-growth stocks before institutional investors make their move, invest in such stocks, and capitalize upon them.

CANSLIM Strategy Explained

The CANSLIM strategy is an efficient investing technique to identify high-growth stocks and earn maximum returns by investing in them following bullish trends. William O'Neil developed the strategy in the 1950s. He founded the Investor’s Business Daily (IBD), an American equity research firm.

Retail investors in the US welcomed the CANSLIM method, and it remained one of the most widely used methods, especially from 1998 to 2009. It is considered a practical method that is not based on theory or assumption. It employs technical indicators and fundamental analysis to assess public company stocks and filter them as high-growth stocks.

The CANSLIM investment criteria have seven attributes:

- Current quarterly earnings

- Annual earnings

- New product, management, innovation, or service

- Supply and demand

- Leading stocks (leaders or laggards)

- Institutional investors support

- Market trend or direction

An investor must look for stocks that check every box (pointer or factor) listed above to be considered a CANSLIM stock worthy of investment in a bullish market. The main purpose is to allow investors to spot stocks offering possibilities of high growth and take advantage of such stocks by investing in them early before institutional investors zero in on them. When institutional investors invest in such stocks, their demand increases, and consequently, the stock price begins to increase.

Not many stocks meet the parameters defined under the CANSLIM method—they do not perform or underperform in extreme market conditions. Therefore, this investment technique is mostly applied to, recommended for, or associated with experienced investors with a high risk appetite who can stay long in the market and monitor and manage the strategy from time to time, depending on the existing market scenario.

How To Trade Using CANSLIM?

To apply the CANSLIM technique, an investor should follow the steps listed below:

- Current quarterly earnings - The stock must have at least 20% EPS growth in the current quarter compared to the same (corresponding) quarter in the previous year. It can be determined by the ratio of net profit to outstanding shares. If not, the stock is not qualified for investment under CANSLIM.

- Annual earnings - Like EPS, the company must have increased its annual earnings constantly in the past three to five years.

- New products, innovation, or management - An investor must check a company’s consistency in terms of innovation and development, including positive events, the introduction of a new management team, etc. Businesses with high levels of operational, growth-oriented activities have a higher chance of achieving a price rise in the stock market.

- Supply and demand - The company should have a business structure where a perpetual demand for the underlying product or services in the market is observed. This demand should always be above the supply levels. For more clarity, verifying any recent increase/s in a company’s trading volume alongside the supply or availability of shares is recommended to make sound investment decisions.

- Laggard stocks - The stock must be a leader in its industry or business sector. Investors can confirm this using the momentum indicator called the Relative Strength Index (RSI). The RSI value lies between 0 and 100; the higher the value, the better it is to invest in such stocks.

- Institutional sponsorship - The stock must have reasonable support from new equity firms and receive an expression of interest from institutional investors. If institutional investors are backing a stock, they are indirectly helping the company expand its business. Eventually, this support will lead its stock to high growth and profit.

- Market trend - The last attribute to check for is the market direction. If a stock qualifies for all six aspects, an investor must check whether the market is bullish or bearish. To deduce this, investors must study the average market levels. CANSLIM stocks perform better in a bullish market.

Examples

Below are two examples of CANSLIM that explain the concept in greater detail.

Example #1

Suppose Ryan is a wise investor and observes that the stock market is bullish. He believes he will be able to earn good profits under such conditions. For this, Ryan needs to identify high-growth stocks. He knows about the CANSLIM investing technique and decides to employ it. Ryan checks several companies for all the seven CANSLIM investment criteria and chooses stocks of a company with the following features:

- It has a high EPS.

- It is supported by institutional investors.

- It is an industry leader.

- It posts good annual earnings.

- It has recently introduced new products and appointed new management.

Ryan invests in the stock, and within the next three weeks, the company makes a profit. This allows him to earn 27% returns on the amount he originally invested.

It is important to note that in the real world, many other factors may disrupt or affect the CANSLIM process and subsequent results. It may also be challenging to find CANSLIM stocks in the market at times.

Example #2

Assume Robert is a new investor. He studied the CANSLIM investing strategy because he wanted to make short-term profits by investing in high-growth stocks. Robert checked for every attribute for some stocks and listed a few that seemed high-growth per the CANSLIM method.

Robert invested in these stocks, but the stock market was bearish when he did so. He missed applying the last principle of CANSLIM, which highlights the importance of observing the market direction. Due to this, Robert's CANSLIM investing technique failed, and he had to incur a loss. CANSLIM is known to work only in a bullish market. Also, it is not suitable for all kinds of investors. Only practiced investors with reasonable risk tolerance levels can usually follow this method and succeed.

Advantages And Disadvantages

The advantages of CANSLIM are:

- It helps identify high-growth stocks in fast markets.

- Investors with a high-risk appetite can apply this strategy to earn the maximum possible profits in the short term.

- The strategy is based on seven different practically applied attributes. Therefore, it is not based on assumptions or theory.

- Analysts use it to gauge the growth of stocks and understand the stock market direction in an imbalanced market.

The disadvantages of CANSLIM are:

- It is not for everyone; not every investor can apply it because its application and use require experience and technical knowledge. At times, accurately tracking the current CANSLIM stocks may be tough for new investors.

- The strategy is not built for a bear run and can only be used for spotting opportunities in a bullish market.

- CANSLIM stocks cannot be bought and held for a long time; it is for profit-making and not a long-term investment.

- The effects and results of this strategy can be adversely affected if a sudden market shift occurs.

Frequently Asked Questions (FAQs)

According to IBD, the CANSLIM strategy offers around 20.7% average annual return, but no evidence backs it. The Innovator IBD 50 ETF and CANGX have underperformed in the market. In contrast, the IBD 500 ETF gave a 42% return in the last seven years till 2022. Per the chart patterns, the IBD 50 ETF was hardly ever ahead of the S&P 500 in terms of performance.

The relative price strength indicates a particular stock's growth and performance compared to other stocks of the same industry. The relative strength varies between 1 to 99; the higher the value, the better the stock has outperformed in the market. For CANSLIM, the stock must have a price strength value of at least 70.

Institutional investors are firms and companies that invest in other companies and organizations. They invest a large sum of capital and have different investment goals. Pension funds, banks, hedge funds, insurance companies, and mutual funds are typical examples of institutional investors. When institutional investors support a stock, it generally means the business has high potential and is in the interest of every market participant.