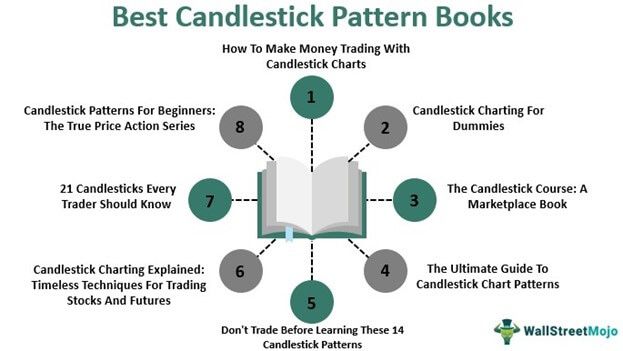

Top 8 Candlestick Pattern Books [2025]

A candlestick pattern is an analysis tool used in financial analysis to represent daily price movement in a graphical format on a candlestick chart. It depicts a whole one-day price movement of stocks, derivatives, and currencies, thus forming a pattern. This pattern helps analysts predict future price movements based on historical price patterns. It is a powerful trading tool, with many books written on it. Some of the top candlestick pattern books are -

- How To Make Money Trading With Candlestick Charts ( Get this book )

- Candlestick Charting For Dummies ( Get this book )

- The Candlestick Course: A Marketplace Book ( Get this book )

- The Ultimate Guide To Candlestick Chart Patterns ( Get this book )

- Don't Trade Before Learning These 14 Candlestick Patterns ( Get this book )

- Candlestick Charting Explained: Timeless Techniques For Trading Stocks And Futures ( Get this book )

- 21 Candlesticks Every Trader Should Know ( Get this book )

- Candlestick Patterns For Beginners: The True Price Action Series ( Get this book )

Let us go through each book and its key points to comprehend the importance of candlestick patterns and how an investor can use them –

#1 - How To Make Money Trading With Candlestick Charts

By Balkrishna M. Sadekar

The book was first published in 2015 and gave a step-by-step process and execution plan to earn money by implying powerful candlestick patterns and techniques.

Book Review

The book focuses on how the Japanese have used candlestick techniques for over four centuries to make enormous money. The book first explains the basics of candlestick patterns and then discusses how to make money. Finally, the author describes how to take advantage of high probability trades and eliminates the factors like gluttony, emotional interference, etc. The book itself is one of the best candlestick pattern books for amateurs and professionals.

Key Takeaways

- The book offers market-tested ideas and the author's personal experiences of using candlestick patterns in trading.

- The author explains the simple mechanical trading system with the help of candlestick techniques.

- He discusses different types of candlesticks and the underlying market psychology.

Though the books help build theoretical knowledge on trading, be it stocks or currencies, there are added materials to enhance your practical knowledge. This FOREX Trading Fundamentals course will help you boost your knowledge of currency trading and the factors influencing the same.

#2 - Candlestick Charting For Dummies

By Russell Rhoads

The book came out in 2008 and explained the candlestick patterns in the most basic format. It enables new traders or investors with minimum knowledge of the stock market to educate themselves.

Book Review

The book gives a brief overview of price action, complex indicators, support levels, trend lines, moving averages, and other concepts and terms. It is a practical guide for new traders and investors inclined to learn more about candlestick patterns. In addition, the author teaches how to combine candlestick patterns with indicators. He believes that one can find the right moment to trade (buy or sell) and profit with the right application of candlestick patterns.

Key Takeaways

- The book explains how to construct candlestick charts, avoiding false signals.

- It discusses the advantages of candlestick patterns.

- The author comprehensively explains bull and bear markets, working on complex patterns and identifying market activities.

Besides books, individuals can take the help of this Advanced Technical Analysis Course to build a comprehensive understanding of candlestick patterns. The course explains different patterns on the TradingView pattern, thus providing key inisghts.

#3 - The Candlestick Course

By Steve Nison

The book was released in 2003, and the author Steve Nison wrote it so that anyone could understand the way candlestick patterns work and their importance.

Book Review

The author explained the complexity of the patterns and how investors can use them to earn money in the stock market more than just the basics. He is reputed in the field of studying candlestick patterns and charts. The book does not hold back theoretical knowledge but gives readers practical insights with proven techniques to improve investing practices. It serves as an all-answer book for people looking for new-age investing.

Key Takeaways

- The book holds many examples, Q&A, quizzes, and tests.

- It deals with the complexity of candlestick construction and understanding.

- The author has information for every level of investor and explains many time-tested investing techniques.

#4 - The Ultimate Guide To Candlestick Chart Patterns

By Steve Burns and Atanas Matov

The book was released in 2021 and hence shares a new age perspective covering all the historical examples for new investors to learn from.

Book Review

The book introduces a candlestick with 30+ detailed candlestick patterns and examples. In addition, the authors share the exit and entry suggestions, trading tips, and all the inside-out information regarding reading, exploring, and understanding candlestick patterns. Steve Burns, one of the authors, has been in stock market investing for over two decades and has authored six other books.

Key Takeaways

- The book is pretty straightforward about candlesticks and does not waste readers' time circling the same topic repeatedly.

- It explains every tiny detail about the body, size, color, part, and highs and lows of candlesticks.

- The authors share collaborative knowledge and insights on candlesticks.

#5 - Don't Trade Before Learning These 14 Candlestick Patterns

By P. Arul Pandi

The book was initially published in 2021 and gave out 14 candlestick patterns that every investor must know about. It is regarded as one of the best candlestick pattern books for people.

Book Review

The book is divided into two sections. The first section explains the body and language of candlesticks. And the second section teaches how to spot patterns and occurrences and their interpretation. The author talks about price movements, moving averages, and timing and offers 85% opportunities with up to 80% win ratio.

Key Takeaways

- The book talks about profit-making techniques using candlestick patterns.

- It is divided into two parts, each dedicated to a definite objective and teaching.

- This book teaches from basics to advanced techniques in candlestick trading, helping new traders to learn and make money consistently in stocks, indexes, commodities, forex, and cryptocurrencies.

#6 - Candlestick Charting Explained: Timeless Techniques For Trading Stocks And Futures

By Gregory L. Morris

The book was published in 1995, and it is known for elaborating on Japanese tools to explain price movements in financial and commodity markets.

Book Review

The book has meaningful insights with practical examples of how an investor can use candlestick patterns to make profits. The book essentially deals with the price movement concept and its occurrence and interpretation through the knowledge an investor can gather. In addition, the book talks about types of candlesticks and their importance with each element of the financial markets.

Key Takeaways

- The book explains western charting analysis and Japanese candlestick analysis.

- The author gives a wide scope of applications through different candlestick analyses.

- He elaborates on grouping candlesticks into families, detecting and avoiding false signals.

#7 - 21 Candlesticks Every Trader Should Know

By Melvin Pasternak

The book was originally published in 2006, and the author has highlighted some of the crucial candlestick patterns for people who are new to this field.

Book Review

The book reveals many important questions that new traders and investors generally have about why candlestick patterns are important and what people can learn by studying them. The author talks about such patterns and handpicks 21 most important patterns from over a hundred patterns and gives a full detailed view of them all to the readers.

Key Takeaways

- The book gives information about the 21 candlesticks every trader should know.

- It has a collection of approximately 100 candlesticks charts.

- The author explains terms like reversal patterns, emerging trends, continuation patterns, etc.

#8 - Candlestick Patterns For Beginners: The True Price Action Series

By Derby Matoma

The book was released in 2021 and hence shares some of the new and unique concepts and examples for beginners to relate to about candlestick patterns.

Book Review

The book teaches beginners how to identify and interpret different candlestick patterns and the types of patterns to study and keep in mind while analyzing charts and other technical indicators. In addition, the author speaks about combining candlestick patterns with technical indicators to denote accurate and proper investing strategies and precise execution. It is not a theory book but can be put with practical knowledge.

Key Takeaways

- The book explains strategies and effective candlestick tools and patterns to make good results.

- It is for people who are very new and do not know much about candlestick trading.

- The author generally dealt with the subject of market behavior.

- It ranks high among the best candlestick pattern books for people.