Table Of Contents

What Are Call Options Examples?

Call Options examples clarify how the derivative contracts enable the buyer of the option to exercise his right to buy particular security at a pre-specified price, popularly known as the strike price, on the date of the expiry of such a derivative contract.

It is important to note that the call option is a right, not an obligation. . It benefits the investors from an increase in the price of the underlying asset without buying the asset itself. The following call option examples outline the most common call option examples and their utility in the ordinary course of business and for speculation.

Key Takeaways

- Call options give the holder the right—but not the obligation—to purchase the underlying asset at the predetermined strike price within a predetermined time frame.

- Investors frequently employ call options to speculate on the appreciation of the underlying asset's price or to protect their portfolios from possible losses.

- Elements like the cost of the underlying asset, the strike price, the remaining time until expiration, and market volatility impact the value of a call option.

- Call options may be advantageous if the price of the underlying asset increases above the strike price, enabling the option holder to purchase the asset at a discount and sell it at a premium.

Call Option Examples Explained

The call option with example help in understanding the type of financial contract in which the holder of the contract has the right but not the obligation to purchase a particular quantity of the underlying asset at a previously fixed price which is known as the strike price and within a fixed time period, which is called the expiration date.

The asset is usually a stock or a commodity, indices or any other financial asset. Through the examples of a call option later in the article, we will understand how the traders bet on the price of the asset when they anticipate that it will rise in the near future. If the price increases, then the call buyer exercise the option and buy the asset at the strike price which is lower than the market price and sell it later at the market price, thus earning profit.

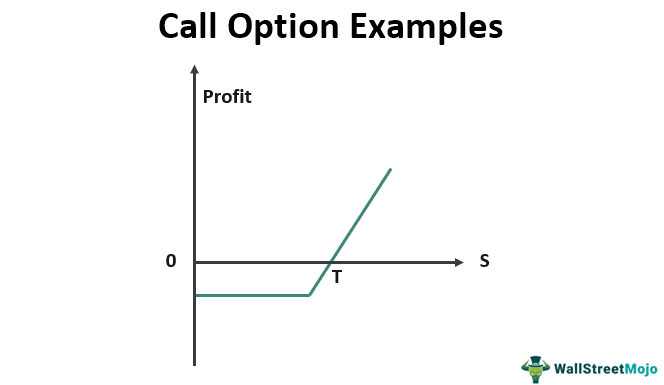

The graph given below is a representation of the examples of a call option.

Examples

There are innumerable situations where call options can be used by investors to increase their return or to minimize their risk.

Let us understand call option with example.

Example #1

Alex, a full-time trader, lives in Chicago and is bullish on the S&P 500 index, which is currently trading at 2973.01 levels on 2nd July 2019. He believes that the S&P 500 index will surpass the levels of 3000 by the end of July 2019 and decided to purchase a call option with strike price of 3000. Details of the same are mentioned below:

- Current Price: 2973.01

- Strike Price: 3000

- Current Date: 2nd July 2019

- Expiry Date: 25th July 2019

- Call Premium: $12

- Lot Size: 250

S&P 500 Index closed at 3020 levels on the date of expiry. In such a case, the profit made by Alex provided he held the option till the expiry date is equivalent to $8 (after adjusting for the $12 paid by him)

Points gained at expiry = 3020 - 3000 = 20 points

On the contrary, if the S&P Index expires below 3000 levels on the expiry date, the call option will be worthless, and loss to Alex will be equivalent to the premium paid by him for acquiring the call option.

Example #2

SIRI is an Investment Management firm and specializes in managing a portfolio of a basket of securities on behalf of its clients spread across the globe. The firm is holding stock of Facebook in its portfolio at an average cost of $150. The firm believes that Facebook stock will continue to remain in the range of $140 to $160 during March 2019 and decided to sell the call option of strike price $170 at an average cost of $3. At the end of the March month, the stock ended at $168. Since the stock price is below the strike price, the option ended worthless for the call option buyers, and SIRI was able to pocket the $3 premium per lot by selling the call options. This is one of the reasons behind the selling of call options.

Thus, from the above example, it is clear that the call option is worthwhile for the buyer if the price actually rises for the underlying asset, but it renders useless if the price falls. However, the fall in price is useful to the call seller who can earn the profit equal to the amount of premium that they have paid for the option.

Example #3

Buying Call Options is an excellent way to take leverage positions with low investment. Through the below call option buy example, let’s understand the same:

Greg is bullish on the stock of HDFC Bank and expects the company to deliver excellent results for the quarter ended March 2019. The stock of HDFC Bank is trading at $200, and Greg is having $10000 to invest in the same. Greg expects the stock of HDFC Bank to reach $250 by the end of the month. He has two options:

Option 1: Buy 50 shares of HDFC Bank in cash and thereby invest the $10000.

Option 2: Buy one call option with a strike price of $200, which is available for $20, having a lot size of 500 shares.

In both of the above cases, his total investment will be $10000 only.

Now let’s assume the stock reached the level of $250 at the end of the month.

| Option 1 | Profit | Total Investment | Monthly Return |

| $2500 | $10000 (50 x $200) | 25% | |

| Option 1 | Profit | Total Investment | Monthly Return |

| $15000 | $10000 (500 x $20) | 150% | |

Thus we can see call options, being leveraged trades, have the capacity to magnify the returns as compared to actual investment in the underlying asset, if the stock moves in the direction of the option buyer. It allows the trader to participate in the potential upside of the price movement in the asset and limits the downside risk only upto the premium paid. In this call option buy example we see that with a relatively low upfront investment the trader is able to control a larger quantity of the underlying asset. The percentage gain is much higher than the direct investment.

Example #4

Call Options along with put options can be combined for Hedging as well with limited Risk. Let’s understand this utility with the help of another call option hedge example:

Ryan, an investor, feels that the price of RELIANCE, currently valued at $55 by the market, will move significantly in the next three months, either upside or downside. He intends to make money through this move but without actually buying the stock and also by taking less risk.

Ryan created a straddle by buying a call and put off a strike price of $55 expiring in three months. The call of $55CE cost him $9, and the PUT of $55PE cost him $6 with a lot size of 500 shares.

Thus his total cost is as follows:

Now by entering into this strategy, Ryan profit/loss potential on expiry will be as follows:

Thus, from the above call option hedge example, the concept is clarified.

Example #5

Call Options are also used by institutions to enhance portfolio returns by writing call options. Let’s look at an example to understand this:

The share of TCS is trading at $120 on 1st March 2019. Max Mutual Fund is holding 100000 shares of TCS and doesn’t expect the price of TCS shares to move very much over the next few months. Max Mutual Funds decided to write (sell) call options against the shareholding.

Let’s assume that the March $130 calls are trading at $8, and Max Mutual Fund sells 100 lots (1000 shares each) as an option writer, max mutual fund receives a premium of $800 and takes on the obligation to deliver 100000 shares at $130 each if the buyer exercises the contracts on expiry.

Now let’s assume in March the share price hasn’t moved and the option expires worthless. The value of the underlying portfolio of shares is unchanged, but by writing the call option, the max mutual fund has made $800, which will increase the overall portfolio return for the max mutual fund. Thus call options help in magnifying returns.

Example #6

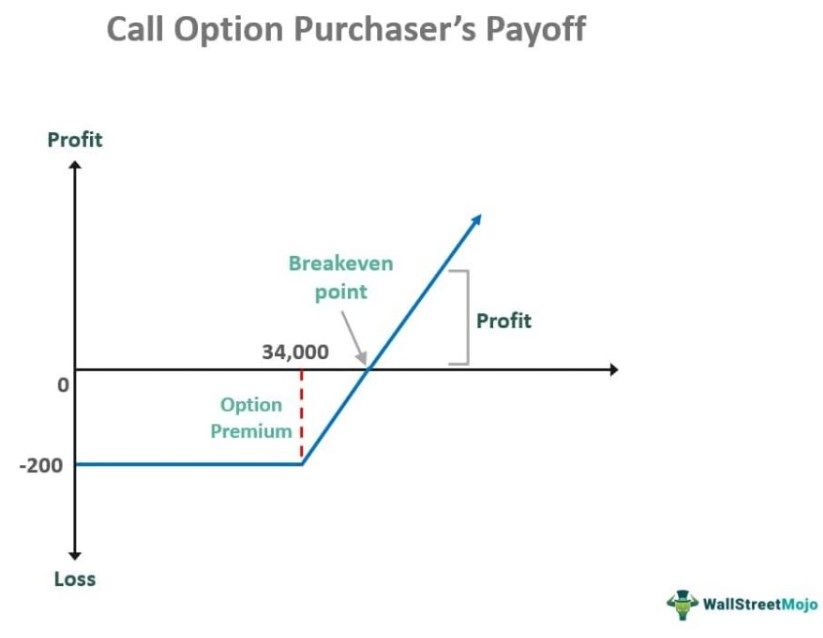

Suppose Sam, an options trader, purchases a 3-month ABC index call option at a 34,000 strike price for a $200 premium. In that case, the call option payoff graph will look like this:

As one can observe, the diagram clearly shows the profits or losses of the call option’s buyer. The horizontal line denotes the movement of the ABC index. On the other hand, the vertical line in the graph represents the profit or loss earned.

As the ABC index increases beyond the 34,000 mark, this call option turns in the money or ITM. In case, on the expiry date, the closing of the index takes place over the 34,000 strike price + option premium, Sam can exercise the option, and the potential profit can be up to the difference between ABC’s index’s closing value and the strike price. At any level under the breakeven point, this option will be unfavorable to Sam because he would end up making losses on the options contract.

Note that the above diagram shows that the profit potential is unlimited from a theoretical standpoint. That said, if the ABC index closes under $34,000 on the date of expiry, Sam will have to bear a loss, which cannot exceed the option premium paid.