Table Of Contents

California CPA Exam

California CPA (Certified Public Accountant) License authorizes a professional to pursue public accountancy in the Golden State. To attain a CPA license in California, you must fulfill its specific exam, experience, and other requirements.

The state of California follows a one-tier licensing system. Hence, you can apply for the CPA license directly after passing the exam and fulfilling other requirements. Note that the California Board of Accountancy (CBA) is responsible for issuing the license to qualified candidates.

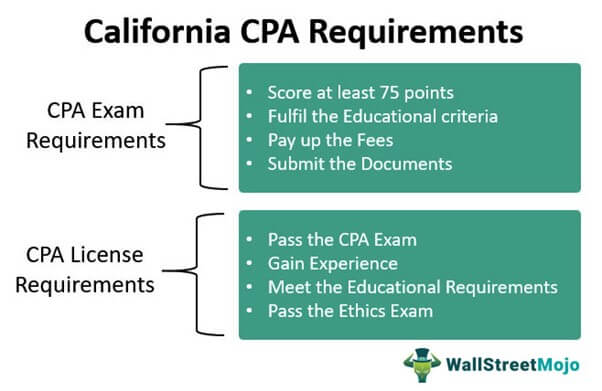

Here are the California license requirements in brief.

| Particulars | Requirements |

| Minimum age | Not required |

| U.S. Citizenship | Not required |

| Residency | Not required |

| Social Security number | Required |

| Education Requirement for CPA Exam | Bachelor’s degree (120-semester units) with

|

| The minimum passing score in CPA Exam | At least 75 points in each exam section |

| Education requirement for licensure | 150-semester units with

|

| Experience requirement for licensure | Minimum 12 months of general accounting experience |

| Ethics exam | Professional Ethics Exam for CPA (PETH) |

Know that the state also participates in International CPA Examination Program. Now, let’s dig deeper into California CPA Exam and License Requirements.

California CPA Exam Requirements

The CPA Exam is a standardized series of computerized tests broken down into four sections. The exam assesses your accounting-related knowledge, skills, and expertise.

For each passed section, you can retain credit for 18 months from the test date. After that, the credit expires. So, you must pass each section within 18 months, beginning from the testing date of your first passed section.

Here are the details.

| Particulars | Details |

| Regulatory bodies | American Institute of Certified Public Accountants (AICPA) |

| National Association of State Boards of Accountancy (NASBA) | |

| 55 State Boards of Accountancy | |

| Total exam time | 16-hour (4 sections of 4-hours each) |

| Exam sections |

|

| The time limit for passing the exam | 18 months |

| Exam structure and question types | Five testlets with

|

| Passing score | At least 75 in each section |

| Testing schedule | Continuous testing (throughout the year) |

Exam Eligibility Requirements

California CPA exam applicants must earn at least a bachelor’s degree from a nationally or regionally accredited institution with:

- 24 semester hours in accounting subjects

- 24 semester hours in business-related subjects

| Accounting subjects | Business-related subjects |

|---|---|

| Accounting | Business Administration |

| Auditing | Finance |

| External or Internal Reporting | Business Communications |

| Financial Reporting | Economics |

| Financial Statement Analysis | Business Law |

| Taxation | Computer Science/Information Systems |

| Accounting courses | Business Management |

| - | Business Related Law Courses (from an accredited law school) |

| - | Statistics |

| - | Mathematics |

| - | Marketing |

Accounting courses include:

- Bookkeeping

- Attestation

- Assurance

- QuickBooks

- Peachtree

- Cost (Cost analysis and Costing)

- CPA Review courses (from regionally or nationally accredited institutions)

Semester units of core accounting subjects in excess of 24 units can be used to fulfill the business-related subject requirement. Note that quarter credit hours are acceptable and are equal to 2/3 of a semester hour.

Candidates with foreign credentials may utilize CBA-approved foreign academic credentials evaluation services or NASBA International Evaluation Services.

Remember to apply directly through the CBA website with the required application fee and education transcripts. To know the complete application process, kindly visit the CBA official portal.

Fees

First-time applicants must pay the required application and examination fees. At the same time, the re-examination candidates must pay the necessary registration and examination fees.

| Particulars | Examination Fees | First-time Applicants Fees | Re-examination Applicants Fees |

|---|---|---|---|

| Application fee | - | $100 | - |

| Registration fee | - | $50 | |

| Exam sections | |||

| AUD | $238.15 | ||

| BEC | $238.15 | ||

| FAR | $238.15 | ||

| REG | $238.15 | $952.6 | $952.6 |

| Total fees | $952.6 | $1,052.6 | $1,002.6 |

The application fees must be submitted to the state board, while the examination fees to the NASBA. Once the state board has approved your application, it informs NASBA of your eligibility. Then, NASBA issues the Payment Coupon.

Make sure to submit the examination fees to NASBA within 90 days of receiving the Payment Coupon. Additionally, if you are pressed for time with studying and preparing, remember that PaperWriter offers research papers for sale online to support your preparation. Also, ensure to sit for the applied section(s) within the Notice-to-Schedule validity period (9 months).

Required Documents

Below is the list of documents to be submitted to CBA:

| Required Documents | Submission |

|---|---|

| Official school transcripts | Your school |

| Foreign academic credentials evaluation report (if applicable) | You or CBA approved evaluation agency |

| Request for Accommodations of Disabilities form (if applicable) | You |

| Medical Consideration Request form (if applicable) | You |

Note that CBA accepts electronic transcripts, provided a CBA-approved provider sends them. Furthermore, the school/evaluation service must submit the official transcripts or evaluations in the original sealed envelope.

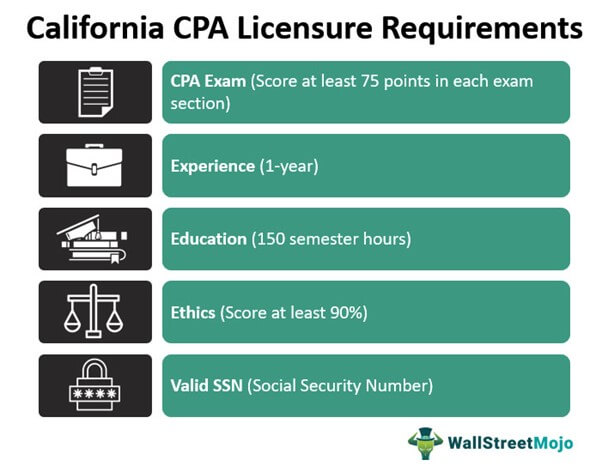

California CPA License Requirements

Let's take a look at the California CPA exam and license requirements.

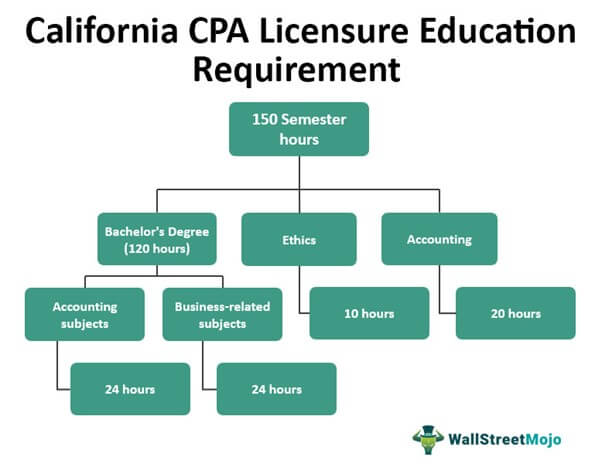

Education Requirements

To qualify for a California CPA license, candidates must complete 150-semester units. This includes:

- A bachelor’s degree or higher from an accredited institute with

- 24-semester units in core accounting subjects

- 24-semester units in core business subjects

- 10-semester units of ethics study

- Upto 7 semesters (11 quarter) units in subjects like auditing, business leadership, business law, ethics, etc.

- At least 3 semesters (4 quarter) units in accounting ethics or accountants’ professional responsibilities

- At least 3-semester units in Philosophy, Religion, or Theology

- 20-semester units of accounting study (accounting and business subjects)

- At least 6-semester units in accounting subjects

- Upto 14 semester units in business-related subjects

Note that excess of the semester units in core accounting and business subjects (required for sitting the CPA exam) can be used to meet this requirement. The business-related subject requirement can also be fulfilled through:

- Maximum 9 semester hours in other academic work in accounting or business-related subjects

- Maximum 4 semester hours in internships/independent studies in accounting or business-related subjects

Please note that a Master’s Degree in accounting, taxation, or laws in taxation is equivalent to the required 20 hours of accounting study.

Exam Requirements

Ensure to pass all four sections of the Uniform CPA Exam within the 18-month window. Moreover, the passing score for each section is 75 on a scale of 0-99. Kindly check the California Exam Requirements section for more information.

Experience Requirements

Candidates must obtain a minimum of one year of relevant work experience in general accounting. This must include 500 hours of attest experience if applicants desire to perform attest engagements as CPAs.

Also, an active CPA license holder must verify her work experience.

Here is the list of qualifying areas:

- Accounting

- Attest

- Compilation

- Management advisory

- Financial advisory

- Tax

- Consulting services

You may gain the required experience in public accounting, private industry, academia, or government. Furthermore, experience gained in academia is considered qualifying only if it fulfills the requirements of CBA Regulations Section 12.1.

Ethics Requirements

Lastly, CPA licensure applicants must pass the Professional Ethics for CPAs (PETH) Exam with at least 90%. Please note that California CPA (CalCPA) Education Foundation administers the examination. Let’s check out the details.

| Particulars | Details |

| Course mode & cost | Online ($175) |

| Text-based ($195) | |

| Format | Self-study course (300-page book) |

| Content | Business ethics |

| Professional Conduct – Concepts & Philosophy | |

| AICPA Code of Professional Conduct | |

| Independence, integrity, & objectivity | |

| Interpretation of Security & Exchange Commission rules | |

| Commissions & fees | |

| Form of practice & name | |

| Advertising & solicitation | |

| Sanctions | |

| Tax Services | |

| California Accountancy Act & CBA Regulations | |

| Study time | 16-hour (approx.) |

| Online prep course | Non-members - $50 |

| Members - Free | |

| Exam format | 50 random MCQs |

| Non-Timed Exam | |

| How to study | Buy the Prep and Main Course (online or text-based version) |

| Go through the study material | |

| Attempt the Exam | |

| Maximum attempts | 6 |

| Duration | Within 1 year from the date of purchase |

| Minimum passing mark | 90% (up to 5 missed Questions) |

| Score validity period | 2 years |

| Score release | Immediate Results |

| Special accommodations | Available |

Other Requirements

1. Valid U.S. Social Security Number or Individual Taxpayer Identification Number (ITIN)

Each applicant must submit a valid SSN or ITIN to the CBA for licensure. If not provided, the CBA notifies and waits for one year before rejecting the licensing application.

2. Criminal history background check (fingerprinting)

Applicants must submit fingerprints to the Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) for checking criminal history.

3. Licensing Fees

Submit your licensure application with the required fees and documents to the State Board.

- Licensure application fee - $250

- Hard copy fingerprint processing fee - $49

Please check out the CBA website for the complete application process.

Continuing Professional Education (CPE)

California CPA license holders must complete 80 CPE credit hours every two years. To earn the required credits, they should only refer to the programs offered by the NASBA National Registry of CPE Sponsors.

Now, let’s check out the below-mentioned details.

| Particulars | Details | |

| License renewal fee | $250 | |

| License renewal date | Last day of your birth month | |

| CPE reporting period | Biennial on the last day of your birth month,

| |

| CPE requirements |

| |

| Ethics requirements | 4 hours | |

| Other requirements | Technical subjects | At least 40 hours |

| Government Auditing | 24 hours | |

| Accounting & Auditing (A&A) | 24 hours | |

| Preparation engagement | 8 hours | |

| Fraud | 4 hours (Excluding the 24-hour Government Auditing or A&A requirements) | |

| Regulatory review course requirement | 2-hour board-approved course is due every 6 years | |

| Credit limitations | Ethics | At least 1-hour long course |

| Instruction | Maximum 50% | |

| Non-technical subjects | Maximum 50% | |

| Published materials | Maximum 25% | |

| Self-study | Minimum passing score - 90% | |

| Technical reviewer | Hour-for-Hour basis |

The path to CPA licensure might seem tiring and bumpy. However, the rewards will be worth the effort. Moreover, your journey does not end here. Always keep a tab on the CBA, NASBA, and AICPA websites for any changes in the CPE requirements.

Pat your back as you have passed the rigorous CPA Exam, met all requirements, and acquired the coveted California CPA license! Now take your time to explore CPE providers and ensure license sustenance. Also, be proactive, build a network, get specialized, and begin your professional life with a positive mindset.

California Exam Information & Resources

1. California Board of Accountancy (https://www.dca.ca.gov/cba/)

2450 Venture Oaks Way, Suite 300

Sacramento, California 95833-3291

(916) 263-3680

Exam: (916) 561-1703

(916) 263-3677 Fax

examinfo@cba.ca.gov

Initial Licensing (Individuals): (916) 561-1701

(916) 263-3676

licensinginfo@cba.ca.gov

License Renewal: (916) 561-1702

(916) 263-3672 Fax

renewalinfo@cba.ca.gov

2. CalCPA (California Society of CPAs) (https://www.calcpa.org/)

CalCPA Education Foundation

1710 Gilbreth Road

Burlingame, California 94010

(800) 922-5272

3. CA.GOV (https://www.ca.gov/)

1303 10th Street, Suite 1173

Sacramento,

California 95814

Phone: (916) 445-2841

Fax: (916) 558-3160

4. NASBA (https://nasba.org/)

150 Fourth Ave. North

Suite 700

Nashville, TN 37219-2417

Tel: 615-880-4200

Fax: 615-880-4290

5. AICPA (https://www.aicpa.org/)

AICPA

220 Leigh Farm Road

Durham, North Carolina 27707-8110

Phone number: 888.777.7077

Fax server: 800.362.5066

Recommended Articles

This article has been a guide to California CPA Exam & License Requirements. Here we discuss the California CPA requirements and license in the Golden State U.S. Furthermore, the U.S. jurisdiction along with its CPE requirements. You may consider the following CPA Review providers to prepare for your exams –