Table Of Contents

What Is A Cafeteria Plan?

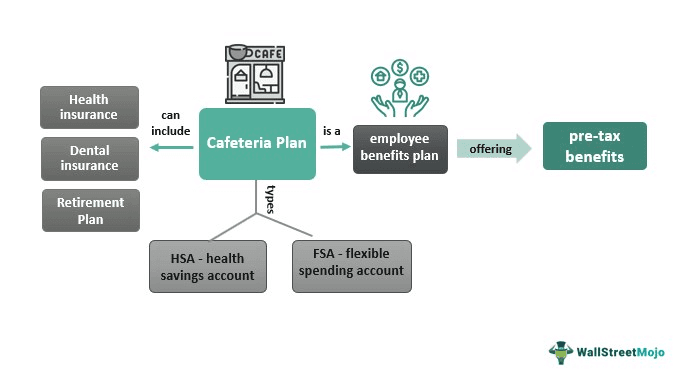

A cafeteria plan, also known as a section 125 plan, is a type of employee benefits plan that allows employees to choose from various pre-tax benefits. These benefits can include health insurance, dental insurance, vision insurance, retirement plans, and other types of insurance.

Cafeteria plans can offer significant benefits to both employees and employers. By giving employees more control over their benefits and allowing them to save money on taxes, cafeteria plans aim to help increase employee satisfaction and reduce turnover. For employers, offering a cafeteria plan is important for attracting and retaining talented employees.

Key Takeaways

- A cafeteria plan allows employees to choose from a variety of pre-tax benefits.

- The cafeteria plan can include HSA - health savings account and FSA - Flexible Spending Account options.

- The plan must meet certain requirements and can have the advantage of selecting benefits from a list of options.

- Certain employees, such as those working less than 30 hours per week or those not completing a waiting period, may be ineligible to participate in a cafeteria plan.

How Does A Cafeteria Plan work?

A cafeteria plan is a voluntary benefits program allowing employees to choose from various benefits, such as health and dental insurance, retirement plans, and flexible spending accounts.

The plan allows employees to allocate a certain amount of their pre-tax income towards different benefits, which can help them save money on taxes. These benefits are typically excluded from an employee's taxable income, although this rule has some exceptions. As a result, a plan is a valuable tool for attracting and retaining talented employees.

A cafeteria plan allows employees to allocate a certain amount of their pretax income toward different benefits. The plan is typically set up as a menu of options, with employees choosing from various benefits. There are two common types of plans:

#1 - HSA Cafeteria Plan

This plan allows employees to contribute pre-tax dollars into a health savings account (HSA), which can be used to pay for qualified medical expenses. These plans are typically paired with high-deductible health plans.

#2 - FSA Cafeteria Plan

This plan allows employees to contribute pre-tax dollars into a flexible spending account (FSA), which can be used to pay for qualified medical expenses, dependent care expenses, or commuter expenses.

Requirements

To comply with section 125 of the Internal Revenue Code, cafeteria plans must meet several key requirements. For example, the plan must be offered on a nondiscriminatory basis to all eligible employees, and employees must be allowed to change their elections during certain designated periods.

To participate in a plan, an employer must establish a written plan document that meets the requirements of section 125 of the Internal Revenue Code. In addition, the plan must be offered to all eligible employees on a nondiscriminatory basis, and employees must be allowed to change their elections during certain designated periods. Employers must also ensure they properly withhold payroll taxes on employee pre-tax contributions.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

Suppose an employee has an annual salary of $50,000 and chooses to participate in a cafeteria plan. The plan allows employees to allocate $5,000 of their salary towards different benefits options, such as health insurance and a retirement plan.

- HSA Cafeteria Plan: The contribution will be pre-taxed if the employee elects to contribute $2,500 towards a Health Savings Account (HSA) through the plan. This means the employee's taxable income will be reduced by $2,500, and the employee will save money on taxes. In addition, the funds contributed to the HSA can then be used to pay for qualified medical expenses tax-free.

- FSA Cafeteria Plan: Alternatively, if the employee elects to contribute $2,500 towards a Flexible Spending Account (FSA) through the plan, the contribution will also be pre-taxed. This means the employee's taxable income will be reduced by $2,500, and the employee will save money on taxes. In addition, the funds contributed to the FSA can then be used to pay for qualified medical expenses tax-free.

- Other Benefits: The plan may also offer other benefits, such as dental insurance, vision insurance, and life insurance. Employees may allocate a portion of their salary towards these benefits, reducing their taxable income and saving money on taxes.

Employers can offer employees a wide range of benefits options while reducing their payroll taxes if they offer a cafeteria plan. In addition, employees can save money on taxes by allocating a portion of their pre-tax income towards different benefits.

Example #2

The state government of XYZ offers its employees a cafeteria plan, allowing them to allocate a portion of their pre-tax income towards different benefits options. The plan is available to all eligible state employees, including full-time and part-time workers.

- HSA Cafeteria Plan: One of the benefits offered through the plan is a Health Savings Account (HSA). Employees can elect to contribute a portion of their pre-tax income towards their HSA, which can be used to pay for qualified medical expenses tax-free. This option is especially beneficial for employees who anticipate significant medical expenses in the future.

- FSA Cafeteria Plan: A Flexible Spending Account (FSA) is another benefit. Employees can contribute a portion of their pre-tax income towards their FSA, which can be used to pay for qualified expenses such as child care, medical, and transportation. This option is especially helpful for employees who have dependents or need to commute long distances to work.

- Retirement Plans: The plan also offers retirement plans such as a 401(k) or a 403(b) plan. Employees can allocate a portion of their pre-tax income towards their retirement plan, which can help them save for the future while reducing their taxable income.

Taxation

Tax benefits chosen through a cafeteria plan can be complex, and employers should work with a qualified tax professional to ensure compliance. However, benefits chosen through a cafeteria plan are typically excluded from an employee's taxable income, which can help employees save money on taxes.

However, this rule has some exceptions, and certain benefits may be taxable if the value exceeds certain limits. Employers must also ensure they properly withhold payroll taxes on employee pre-tax contributions. Proper compliance with tax regulations can help avoid costly penalties and audits.

Advantages And Disadvantages

Let us compare the topic's advantages and disadvantages.

#1 - Advantages

- Employees have more control over their benefits and can choose the benefits that best meet their needs.

- Pre-tax contributions can help employees save money on taxes.

- Employers may be able to save money on payroll taxes.

#2 - Disadvantages

- These plans can be complex and require additional administrative work for the employer.

- Employees may not fully understand the options and may choose benefits that are not the best fit for their needs.

- There may be additional costs associated with offering a plan.