Table Of Contents

Buyout Meaning

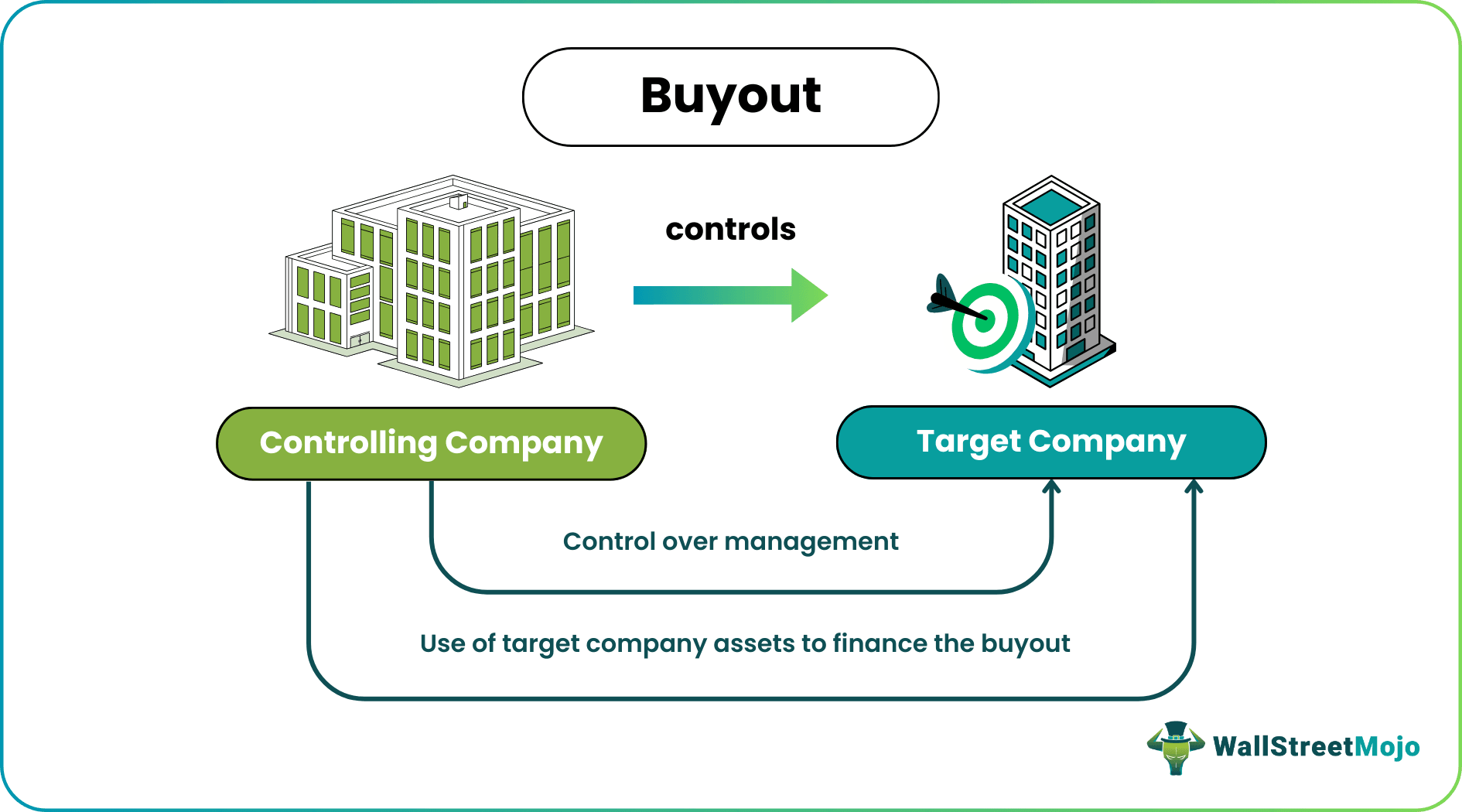

The buyout is the process of acquiring a controlling interest in a company, either via out-and-out purchase or through the purchase of controlling equity interest. The underlying principle is that the acquirer believes that the target company's assets are undervalued.

Usually, buyout takes place when a purchaser acquires more than 50% stake in the target company resulting in a change of management control. If the company's management acquires the stake, it is known as a management buyout (MBO). On the other hand, if the acquisition is funded through a significant level of debt, then it is known as a leveraged buyout (LBO). Usually, companies opting to be private go for buyouts.

Table of contents

How Does Buyout Work?

Buyout is a process in which one company acquires a stake in a target company which enables it to have a control in the management and decision-making process of the target company.

The process of buyout clause is initiated by the interested acquirer who makes a formal buyout offer to the target company's management. It is then followed by rounds of negotiations between the acquirer and the management of the target company. The management shares their insights with the shareholders and advise them on whether or not to sell their shares.

They are common among private equity firms or investment firms and they aim at improving the management performance, add value to the business and increase profitability through improvement of production process. It gives an opportunity to drive the management decisions in the right direction, so that there is operational improvement. However, there is also some amount of risk in the process. In case of leveraged buyout, the debt levels for buyout funds make the transaction risky. The transaction has the possibility of being successful if the target company is of good quality, having strong financial structure and the acquiring company has proper expertise.

Wealthy private individuals usually provide the funding used in transactions, private equity investors, companies, pension funds, and other financial institutions. In some cases, the target company's management is not very willing to go ahead with the acquisition, and such buyouts are considered hostile takeovers, while, the rest is seen to be friendly takeovers.

Types

There are two major types of buyout clause – Management and Leveraged buyout.

- Management: Here, the company's existing management gains control of the company from its owners through the purchase of management control. The management finds the potential of the company to be attractive and hence intends to earn higher returns by becoming owners instead of employees of the company.

- Leveraged: In this type, a significant portion of the acquisition is backed by debt. As the acquirer gains control of the target company, its assets are often used as collateral for the debt to arrange for buyout funds. In this way, the purchasers can acquire companies that are quite large as compared to their funding ability.

Examples

Let us try to understand the concept of buyout contract with the help of some suitable examples.

Example #1

In the year 2013, Michael Dell got involved in one of the nastiest Tech buyouts. The founder of Dell joined hands with a private equity firm, Silver Lake Partners, and paid $25 billion to buy out the company he had originally founded. In this way, Michael Dell took it privately to have better control over the company operations. It is a classic example of a management buyout.

Example #2

In the year 2007, Blackstone Group acquired Hilton Hotels in a $26 billion LBO deal. The deal meant that each shareholder got a 40% premium over the prevailing share price. The acquisition was largely backed by debt funding of $20.5 billion, while the remaining was equity by Blackstone. Some of the banks in the consortium lending included Bank of America, Lehman Brothers, Goldman Sachs and Morgan Stanley.

Advantages

Every financial concept has its own advantages and disadvantages. Let us analyse them in detail so that we can get a better insight into the process.

- These buyout contract help eliminate product or service duplication that can significantly reduce the operating expenses and in turn, increase the profitability.

- The purchaser can enjoy the benefits of economies of scale acquiring the competitors.

- The companies can increase their profits by buying their competitors, eliminating the need for competitive pricing.

- In some cases, both the acquirer and the target company mutually benefit through sharing each other’s resources.

- Since the acquiring company gains a control on the target company, decisions regarding strategic changes and new policy implementation for betterment of the process is possible without any interference.

- The acquiring company usually have a long-term focus regarding value creation; Thus, they are not influenced by only the objective of profit maximization. They aim at bringing permanent positive changes for operational improvement.

- The interest of both the parties are aligned with one another, resulting in stronger and better decision making and commitment.

Disadvantages

The disadvantages of the process are as follows.

- In most cases, the buyouts are backed by a large amount of debt that affects the capital structure of the acquiring company. It results in higher leverage and increased obligation in the acquirer’s books.

- In some cases, the target company's management is not in favor of the buyout, and hence they quit. So, it is no surprise that many of these acquisitions are followed by the resignation of some of the key personnel of the target company. It sometimes becomes a great challenge for the acquirer to find a replacement.

- Although both acquirer and target company may belong to similar businesses, the corporate cultures and operating methods can still be significantly different. It may lead to resistance to change within the target company, which may result in costly problems.

Evaluation of the benefits and limitations of every financial procedure is very important for an organization before implementing them. It helps in taking informed decision after weighing the positive and negative effects of the procedure in the business and thus, avoid any unnecessary cost or resource wastage and at the same time use opportunity to increase profits.

Buyout Vs Acquisition

The two financial terms are widely used in the field of corporate transactions. Both signify purchase of one company by another but with some differences. Let us try to identify the differences.

- The buyout agreement involves transaction in which one company buys a controlling stake or the entire equity of another company. The latter involves any kind of transaction that includes buyout as well as any other type of purchase of one company by another.

- The buyout agreement are normally either made in the form of management or leveraged buyout, but acquisition can be many types and can be done in a friendly or hostile manner.

- The former is done to improve company performance or generate revenue but the latter is done for many reasons like expand business, add operation process, create synergy, improve strategy, gain competitive advantage or reduce cost, etc.

- Buyout is a form of acquisition but the acquisition encompasses a much wider range of business transactions.

Thus, the above are some basic differences between the two processes, which is important to understand so as to get a clear idea about the various corporate transactions that take place.

Recommended Articles

This has been a guide to Buyout and its meaning. We explain it with examples, differences with acquisition, types, advantages and disadvantages. You may learn more about financing from the following articles –