Table Of Contents

What Is Buying Power?

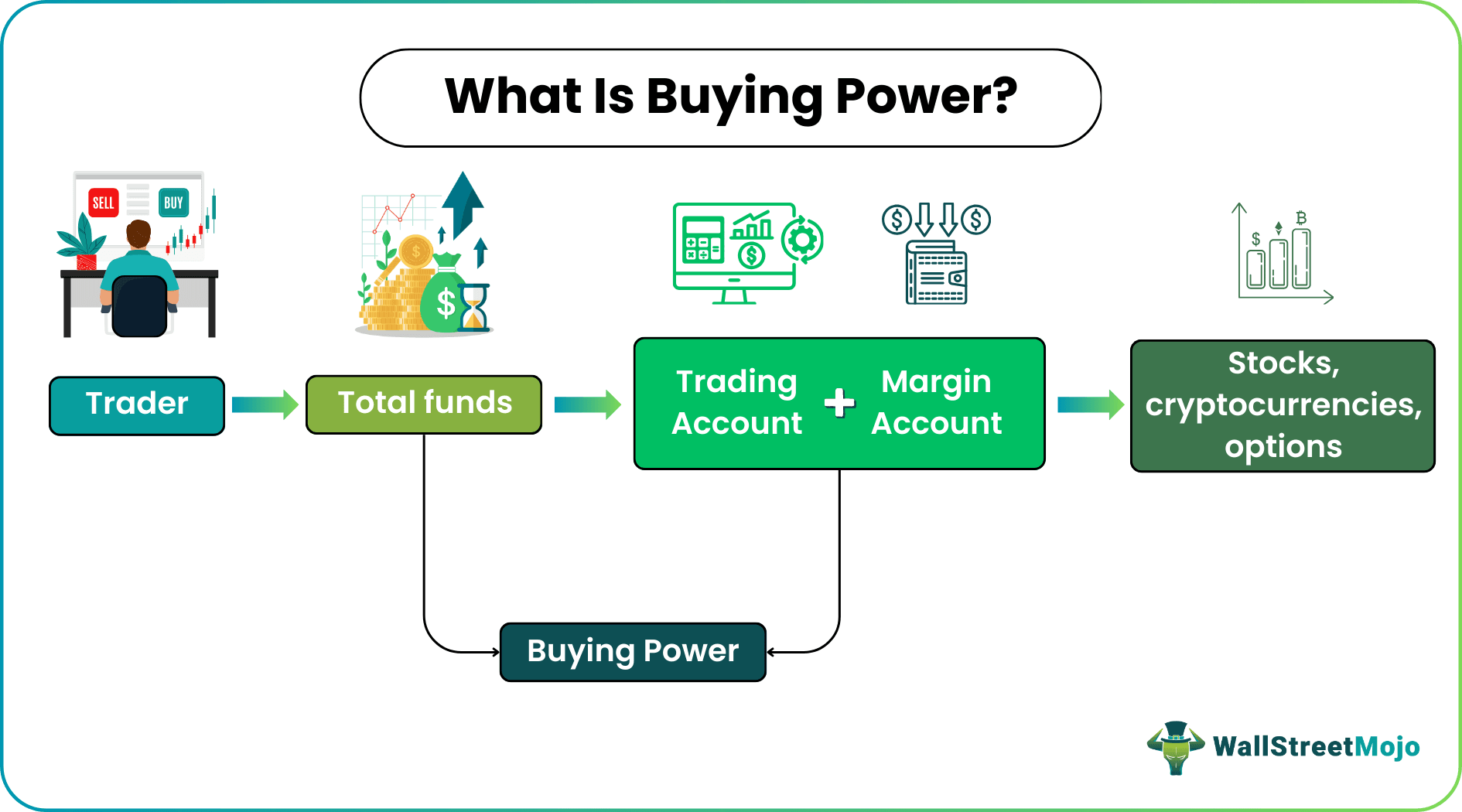

Buying power in trading refers to the funds available in the trading account to trade stocks, cryptocurrencies, options, etc. It includes the money held in the brokerage account and the margin available. A change can greatly affect security prices in the financial market in different forms, such as discount rates.

Investors can devise a trading strategy depending on their buying power, also known as excess equity. A well-thought trading plan will help them select and trade assets while considering their financial objectives, needs, and risks. It is different from purchasing power, implying the consumer’s ability to spend money on goods and services.

Key Takeaways

- Buying power meaning is the total amount of money in an investor’s brokerage account to trade stocks, cryptocurrencies, options, and other financial instruments.

- Investors should develop a trading strategy based on their excess equity as changes can significantly impact security prices.

- One should not confuse buying power with purchasing power, which refers to spending money on products and services.

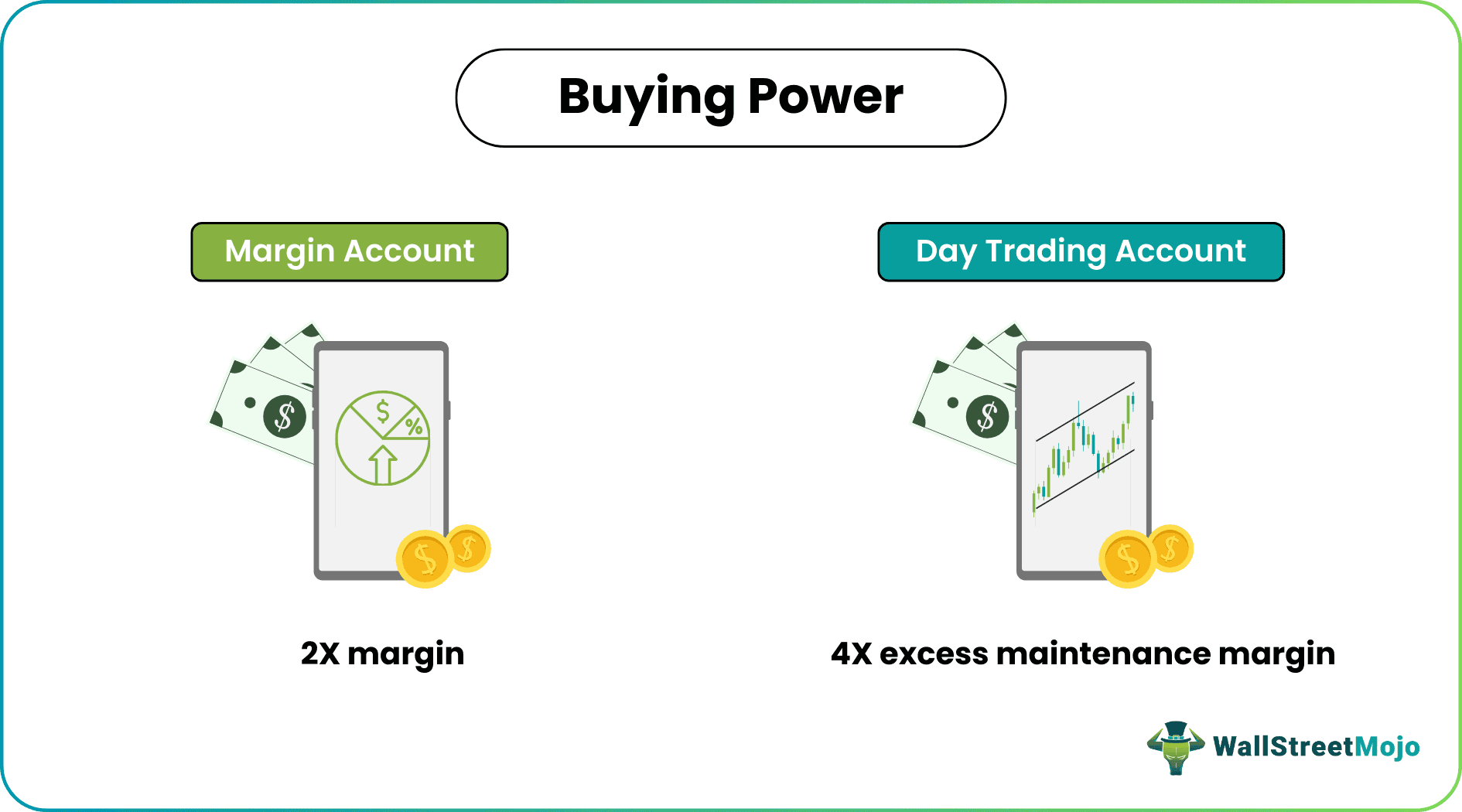

- Traders can have excess equity twice as much as their margin with margin accounts and four times the excess maintenance margin with day trading accounts.

How Does Buying Power In Stocks Work?

Buying power can have different connotations in different contexts, but in trading, it signifies the ability of investors or traders to invest or trade stocks. They can start investing by approaching a brokerage firm and opening a brokerage account. The two types of brokerage accounts are cash (brokerage/trading) and margin.

A cash account allows traders to buy securities only with the cash available, and they cannot borrow more money. So, for instance, if Nicole has $1,000, she can buy $1,000 worth of stocks. The drawback of using a cash account is that it usually takes two to three days to transfer the securities and money to the trading account. But, on the other hand, it means that the $1,000 Nicole used to buy protection on Tuesday can be used for trading again, not before Friday.

On the other hand, a margin or leveraged account allows investors to borrow money from a brokerage firm to buy stocks. The stocks, thus, bought act as collateral for the borrowed funds. The amount they borrow against the cash in their brokerage accounts is called margin. The money investors borrow from the brokerage firm for trading is a margin loan.

Brokerage firms arrange margin loans for traders. As a result, traders can trade more with more money, and brokerage firms can make more commissions. However, these firms charge interest on the funds lent.

How Buyer Power Margin Works?

Let us suppose Nicole purchases a share of XYZ Ltd. for $500 with cash (no margin). If the price rises to $750, she will earn $250 ($750-$500). However, if the price drops to $250, she will incur a loss of $250 ($500-$250).

Now, suppose Nicole decides to buy on margin. She has $500 with her and borrows $500 from her broker. She buys two shares of XYZ Ltd. for $1,000.

If the share price rises to $750, the market value of the two shares will become $1,500 (2x$750). She will earn a profit of $500 ($1,500-$1,000). In the end, Nicole’s profit will double by buying on margin.

If the share price drops to $250, the market value of shares she bought for $1,000 will fall to $500 (2x$250). She will incur a loss of $500 ($1,000-$500).

Thus, the above example shows that excess equity on margin can magnify profits and losses.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Buying Power In Margin Account

Margin buying power is traders' total money in their margin accounts to buy securities. It is the cash in their brokerage accounts plus margin loans. Usually, excess equity is twice as much as the margin amount. So, if traders have $50,000 in their margin accounts, they can buy $100,000 worth of securities on margin. However, the margin can vary with the brokerage firm and the trader.

Margin trading involves using the capital in the brokerage account as leverage. As a result, margin trading can increase funds available for trade, excess equity, and risks involved.

The United States Federal Reserve Board, the Financial Industry Regulatory Authority (FINRA), and the Securities Exchange Commission govern rules related to margin requirements.

According to the Federal Reserve Board Regulation T, the margin account must hold a minimum of 50% of the purchase price of securities when borrowing funds. This amount is called the initial margin. In addition, FINRA requires traders to maintain minimum equity of 25% in their margin accounts all the time. This amount is called the maintenance margin. Here, equity means the market value of securities minus margin loan.

How To Calculate Margin Buying Power?

The following is the buying power calculator and margin loan formula:

Buying Power = Cash or Margin/50%

or

Cash or Margin x 2

Margin Loan = Buying Power - Margin

Case #1

Suppose Nicole has $60,000 in her margin account. However, she wants to buy securities worth $100,000 of ABC Ltd. In this case, she can buy these securities only if she borrows funds from a brokerage firm. Nicole can calculate her excess equity and margin loan using the above formula:

Buying Power = $60,000/50%

Or

= $60,000 x 2

= $120,000

Margin Loan = $120,000- $60,000

= $60,000

Here, Nicole’s excess equity has doubled with a margin account as the brokerage firm will lend her $60,000 more to purchase securities. Now, she can buy securities worth $120,000. However, in this case, Nicole needs only $100,000 to buy the securities of ABC Ltd. It means she will still have $20,000 remaining in her margin account. Thus, Nicole has used only a part of her margin excess equity.

Case #2

Suppose Nicole spends the entire $120,000 on buying securities. In that case, she will use all her excess equity. If the market value of securities falls to $70,000, the equity in her margin account will be calculated as follows:

Equity = Market value of securities - Margin loan

= $70,000 - $60,000

= $10,000

As per FINRA rules, a margin account has a 25% maintenance requirement.

Maintenance margin = 25% of the market value of securities in the margin account

= 25% of $70,000

= $17,500

If the equity in her margin account falls below the maintenance margin, Nicole will get a margin call from the brokerage firm. To maintain the margin requirements, she will have to deposit more money or sell some securities within 2-3 days. In the event of failure, the brokerage firm can sell the securities in her account to sustain the maintenance margin.

Please note that the brokerage firm can sell Nicole’s securities to meet the maintenance margin requirement without waiting for her to act on the margin call.

A word of caution here for all the investors! More leverage means more excess equity and more profits. However, it also means more risk of covering the margin loan and meeting the margin call irrespective of the market price of the securities. So, they must make a well-informed decision.

Buying Power In Day Trading Account

Day trading involves buying and selling securities on the same trading day and profit from short-term price movements. Day traders close their positions at the end of every day and then start the next day again. It is beneficial for margin investors participating in active trading and will increase their excess equity.

As per FINRA rules, a pattern day trader (PDT) must:

- Carry out four or more day trades (amounting to more than 6% of total trades) in their trading account during a five business day period

- Maintain at least $25,000 in their trading account

- Fund 25% of the value of securities bought

If traders fulfill all the above requirements, their brokerage firm will designate them as a PDT. Day trading buying power (DTBP) is four times the excess maintenance margin. Excess maintenance margin is the trading account's value (in cash or securities) before any day trading activity.

DTBP = Excess Maintenance Margin x 4

For instance, Nicole has $25,000 in her trading account. The maintenance margin of her brokerage firm is $25,000. Then, her DTBP will be:

DTBP = $25,000 x 4

=$100,000

It means that Nicole can buy securities worth $100,000, but her account must have at least $25,000 in it by the end of the trading day. Otherwise, she will get a margin call.

Example Of Buying Power

To make the concept much easier to comprehend, let us take one buying power example and put it into different situations:

#1 - In A Cash Account

Suppose Jane’s cash account contains $100,000. Therefore, she can buy $100,000 worth of securities. That is precisely her excess equity.

#2 - In A Margin Account

Now, Jane wishes to buy stocks of ABC Ltd. that are worth $150,000. But, unfortunately, she cannot buy these stocks with $100,000 in her cash account.

However, with $100,000 in her margin account, her excess equity doubles.

Buying Power = $100,000 x 2

= $200,000

Now, she has $200,000 in her margin account for trading. With $200,000, she can easily buy stocks and still have $50,000 remaining.

#3 - In A Day Trading Account

Let us assume that Jane has $50,000 left in her trading account at the end of the day trading session on May 4. If the maintenance margin of the brokerage firm is $25,000, her DTBP will be:

DTBP = $50,000 x 4

=$100,000

So, she will have $100,000 to trade on May 5. That day she purchases 8000 shares of ABC Ltd. at $10 each.

Market value of shares = 8000 x 10

= 80,000

Excess maintenance margin = $100,000 – 80,000

= $ 20,000

Jane’s margin account balance is $20,000 at the end of the day trading session on May 5. Her broker will give her a margin call since her excess maintenance margin has dropped below $25,000. Jane will have to deposit $5,000 into her margin account or sell some shares worth $5,000 to maintain the minimum balance in her margin account before she starts trading on May 6.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Buying power or excess equity reflects funds available in a trading account to trade stocks, cryptocurrencies, options, and other securities. It contains the money in the brokerage account plus the available margin. Investors can develop a trading strategy based on their excess equity, as changes can impact security prices.

Buying power calculator for margin can be calculated as:

= Cash or Margin/50% or Cash or Margin x 2

Excess equity for day trading can be calculated as:

= Excess Maintenance Margin x 4

If a trader’s buying power is negative, it means the equity in their margin account has dropped below the maintenance margin. They will, most likely, get a margin call from their brokerage firm. They will have to add funds to their account or sell enough holdings to cover the balance. If they fail to do so, their brokerage firm will sell their securities to sustain the maintenance margin in their account.