Table of Contents

What Is Buying-Off-The-Plan?

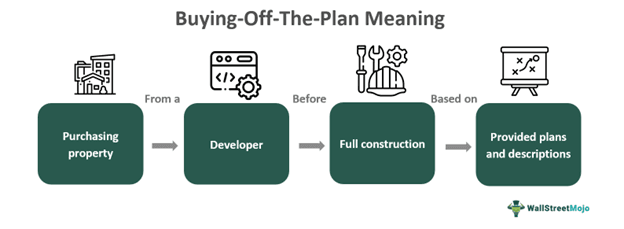

Buying off the plan in the property market refers to an arrangement where the buyer enters into an agreement of purchase with the property developer before the full construction of the property. The buying decision is primarily based on the descriptions provided by the developer.

The primary benefit offered by the arrangement is that the option of purchasing the property is often cheaper depending on market conditions. However, this can be a gamble, provided other factors come into play when purchasing a property. Factors influencing buying decisions may include value depreciation, developer issues, and other uncertainties.

Key Takeaways

- Buying off the plan refers to the arrangement of buying properties that are yet to be constructed. The agreement is based on the developer's descriptions.

- The arrangement usually involves a payment of upfront 10% of the property value and the remaining amount is to be paid at the end of the construction.

- The primary benefit of getting into such an arrangement is that they are cheaper.

- They are an investment that can yield rental income and can provide property appreciation.

- This arrangement also has disadvantages, including uncertainty in completion, value depreciation, etc.

How Does Buying-Off-The-Plan Work?

Buying off the plan is a buying arrangement in the property market that involves the purchase of properties that are under construction. The buyer can buy the property before completion based on the ideas shared about the final product. The buyer will be able to view the plans, designs, and vision of the developer without seeing the completed physical structure.

It can be done typically in two ways: buying an apartment and a home off the plan. In the case of buying an apartment, buyers typically need to deposit 10% of the property's purchase price. The remaining amount shall be paid after the construction begins. The amount paid and rules may vary by the local laws. It shall, however, be noted that apartment values are more volatile compared to separate houses. This means that by the time the construction is finished, there is a high chance that the property value has changed.

Buying a home off the plan is similar. There is an upfront payment, and the remainder is paid upon completion. There are legal protections in place for both types of buyers. These laws tend to vary with different jurisdictions.

Checklist

Given below are some of the items that need to be ticked off while considering buying an off-the-plan property:

- Completion date: Buyers need to get confirmed dates of completion from the developer. This ensures the buyer has a clear timeline for when the property will be ready in accordance with the needs.

- Sunset clause: The sunset clause enables the buyers to cancel the agreement in cases where the property is not ready by the due date. In such cases, buyers can get their deposits back. Clarity in the use of this clause is important, as it often requires a court order unless agreed upon by the purchaser.

- Input level: Buyers must be on clear terms with the level of input they can share in terms of property completion. This includes inputs on fittings, furnishings, the choice of paint colors, etc. This helps in managing expectations from both sides.

- Proposed schedule for finishing: Buyers must be on clear terms with the developer regarding the schedule they intend to finish the property building and the stages involved. This helps bring clarity regarding the progress of the building process.

- Developer history: Buyers should be aware of the developer's history and evaluate their track record. This helps them assess the reliability of the developers before agreeing.

Examples

Let us look at some examples to understand the concept better:

Example #1

David wants to own an apartment, as buying a property would save him commute expenses and time. However, he works in a posh locality, and buying a property at skyrocketing rates is not affordable. David then comes across an option of paying 10% of the property price and owning it after construction, a buying-off-the-plan arrangement.

David diligently researched the developer and included a sunset clause in the agreement. As a first-time buyer, he also received a concession on stamp duty. Entering into such an arrangement, despite the uncertainty, allowed him to fulfill his dreams.

Example #2

The New South Wales housing grants and schemes introduced new provisions to the First Home Buyer Assistance Scheme (FHBAS) in 2023. The transfer duty exemption was increased from $650,000 to $800,000, and the concessional rate was raised from $800,000 to $1 million. However, the government closed off the first home buyer choice program. This ceased the option given to owners to pay the transfer duty or property tax.

As of July 1, 2023, those purchasing houses for $1 million or more are ineligible for transfer duty concessions or exemptions. The resident requirements were also changed. It now requires the purchasers to move into the property within 12 months of settlement and live for at least 12 months continuously in it.

Advantages And Disadvantages

Given below are some of the advantages and disadvantages of buying an off-the-plan property:

Advantages

- Since developers do not have the finished products, buyers can compare purchase prices with similar established properties to get the cheaper options. This is because developers tend to offer lower prices as there is no actual estimate of construction costs.

- Buyers have more time for payment. The arrangement involves payment in parts. The initial amount is paid at the beginning of the construction, and the remaining amount is paid after the construction is complete. This gives the buyers ample time before settlement.

- The property might increase in value before the construction is complete. Since there is no full balance payment, it is considered higher profits for the buyer.

- Various governments, such as stamp duty reduction, provide tax incentives. New properties have tax depreciation, and this can help the buyers gain tax cash.

Disadvantages

- Buyers can incur damages if the agreement does not include a sunset clause.

- The major deterrent factor here is the uncertainty. Buyers cannot guarantee value appreciation, income, or satisfaction from the purchased property. A guarantee in terms of completion from the developer's end is also not possible as it depends on their ability to finance it, etc.

- In cases where the project doesn't take off as expected, the buyer may incur a loss even if they get their deposit back. This is because the amount they had deposited could have been utilized on other investments.

- Similarly, construction delays may tie the buyer's money for long periods. The money could have been used to cover their other expenses.

- There may be difficulties in getting bank approval for the required mortgage.

- The property's value can depreciate in the future.