Table Of Contents

Buy the Dips Meaning

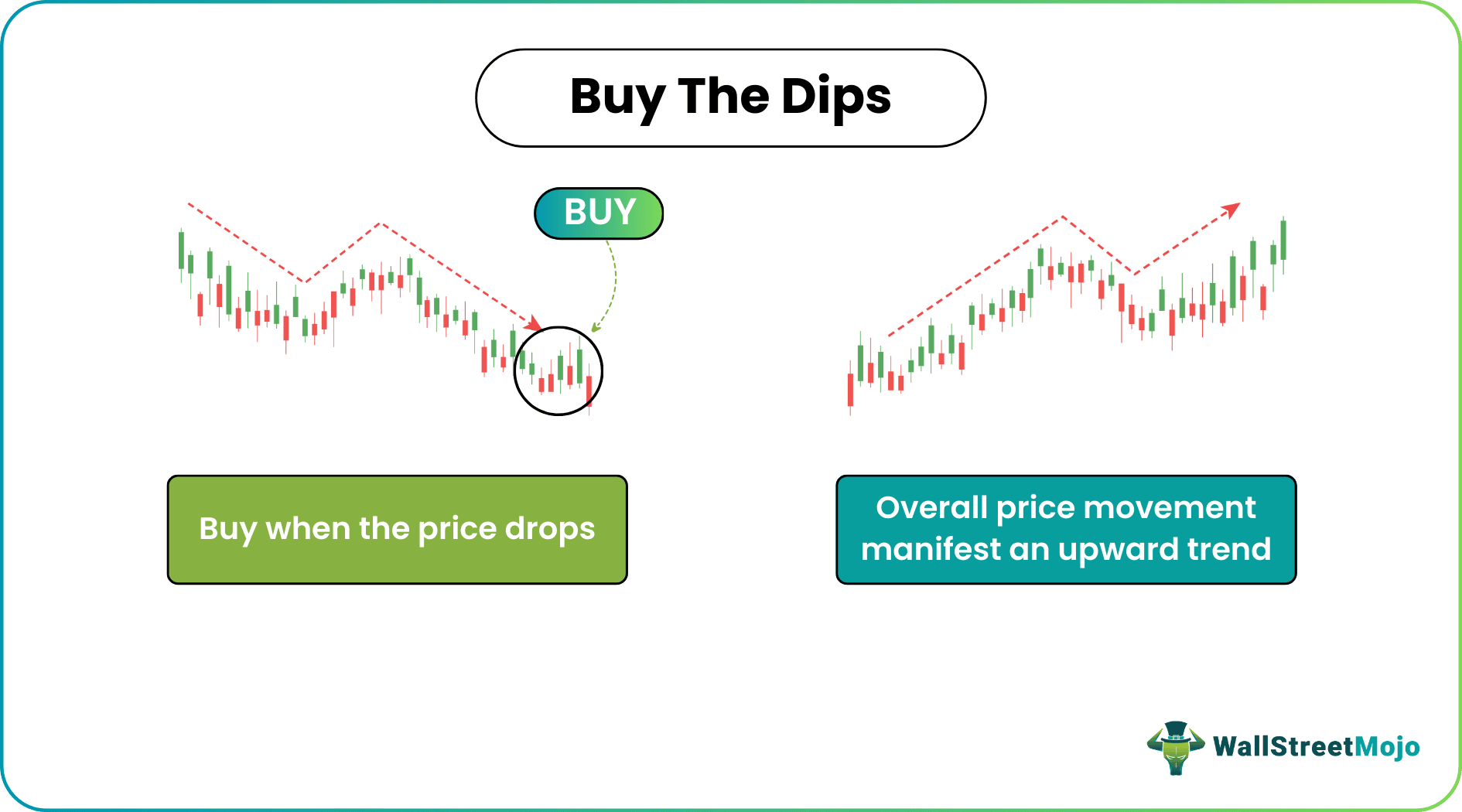

"Buy the dips" refers to an investment strategy where an investor buys an asset when its price decreases, and overall, the price movement indicates an upward trend. In this strategy investor’s goal is to invest when the stock experiences a short-term price drop indicating buying at a bargain price.

The investors focus on making a profit by selling the assets collected at low cost when their price has increased substantially following the anticipations. The winning of the strategy greatly depends on the market timing process and technical and fundamental analysis, which leads to the selection of entering and exiting market decisions.

Key Takeaways

- The "buy the dips" strategy refers to the technique of buying an asset when its price drops to a lower level and selling it at a profit when its price has bounced back to higher levels.

- It is preferable when the primary trend is bullish.

- The effectiveness of this short-term strategy depends on correctly timing the market for asset purchase and selling activities.

- Investors should integrate fundamental and technical indicators to understand better when to enter or exit a market.

How Does Buy The Dips Strategy Work?

"Buy the dips" is more like a short-term investing strategy prolific for the day traders. To buy the asset when the price drops, an investor should focus on perfectly timing the market by monitoring significant factors like economic events, stock price, trading volume, and fundamentals. The strategy to go long on a stock is primarily based on the assumption that the price will rebound after dropping for a short duration to continue the uptrend or hope that a new uptrend will happen in the future.

To get a dip during a bullish period, investors wait for a specific contingency to occur rather than purchasing risky assets. During this waiting time, investors miss several other opportunities emerging in the market. In this scenario of prices manifesting an uptrend when bad news appears like the Omicron wave, the market participants overreact, and prices plummet. At this point, investors initiate BTD and profit by selling the asset when the market bounces back after a short period.

The "buy the dips stocks" technique is repeated severally. As one trades incessantly, the more experience they get and the more they can reap in profits. If the price doesn't bounce back as expected, the investor will face a setback. To mitigate this scenario and minimize the loss use of fundamental and technical tools to create a risk management strategy is significant.

Practical Examples

To practice, the Buy the Dips strategy trader has to identify a well-performing stock. Then they would then need to watch it and wait for it to dip to its maximum point before it starts appreciating again. Then, it would be the best moment to get a long position.

Consider the stock prices of Alphabet Inc. (GOOGL), Ambarella, Inc. (AMBA), NIKE, Inc. (NKE). Their stock charts for one year or five years depict an uptrend. However, the price increase is not linear; some peaks and troughs lead the stock price to higher levels over time. All these companies presented strong earnings amid Covid 19 pandemic. However, a small piece of information about the economy, like inflation, can cause a fall in their stock prices. It is the dip scenario traders wait for. Once a long position is entered, the investors patiently wait for the price to start appreciating again. Sometimes, the price may dip a few more times before starting to appreciate.

Buy the Dips phrases are extensively used in online platforms. For example, buy the dips memes rules virtual financial communities to trigger investors to purchase whenever an asset price decreases, specifically crypto prices. Also, the cryptocurrency market's highly volatile and uncertain nature causes tumult in online platforms whenever a crash occurs, resulting in heavy selling by one section of investors and another section of investors daring to Buy the Dips in cryptocurrency, waiting for a rebound to happen soon.

Indicators of Buy the Dips

Generally, the market recovers after crashes, and the Buy the Dips strategy is always hopeful. Methods like buy the dip, short the VIX, etc., require attention to many indicators, specifically market-timing indicators. Furthermore, technical indicators like moving averages also help investors make purchase decisions. Some of the important indicators are listed below.

- Check for primary bullish trends, make positions during a bullish trend, and range bound markets. The latter should be around defined fundamentals such as price support areas and ascending moving averages. Never purchase at dips when the primary trend is bearish. Checking the trading volume and price actions will help identify the momentum and confirm the trend.

- Invest in stock market indices, fundamentally strong and leading stocks rather than firms in fundamental decline. It requires a great emphasis on financial analysis reports and news. Check whether the price drop is due to incessant decline in financial performance or it is influenced by poor financial performance in a quarter.

- Buying when there is fear in a market and selling when the fear passes. It is possible to reap profit by that time because prices will return to normal historical ranges. However, one should use this in combination with other technical indicators.

Frequently Asked Question (FAQs)

BTD refers to the investment strategy of collecting an asset when its price has plummeted. The notion is that the new reduced price is a part of short-term fluctuation, and the asset price will recover and improve in value over time.

It is a good strategy to buy low and sell high. However, past prices are not always a perfect indicator of future prices, and the scenario of price continuing to fall without bouncing back is also possible. In such cases, investors will face severe losses.

Purchasing a stock when its price drop is known as BTD in stocks. Dip indicates the drop in stock price. As the stock's price plunges, it may provide a chance to purchase shares at a discount and boost future profit when the stock returns to its former level and increases.