Table Of Contents

What Is Business Combination?

Business Combination is a type of transaction in which businesses aim to grow in size using one organization acquiring the other organization and, therefore, taking control of the business activities and the employees of the other organization. In simple terms, it is a consolidation of two or more businesses to achieve a common goal by eliminating competition.

In the process, there is a purchase of one business by another which results in acquiring assets, equity, cash, goodwill, expertise, etc. The company gets more market share that leads to cost reduction and economic improvement. The customer base also increase, leading to more sales and revenue. The financial statements of the respective entities get combined for future purpose.

Table of contents

Business Combination Explained

A business combination agreement happens when two or more entities combine together. In th process, one entity acquires another entity that helps them to grow in size, expand the market, expand the customer base and diversify.

This is an external process, where the one business is acquiring the other for the growth and expansion, unlike organic growth, that is internal and requires the use of company's resources.

It helps the acquiring company access more assets, goodwill, cash and other valuable benefits of the target company. The liabilities are also incurred during business combination accounting them. The contact is made for the process to take place. However, it is essential for the target company to be in a business that can cater to customers' needs and generate value. But the acquiring company does not get total control.

Characteristics

The characteristics below are of utmost importance in the business combination, which involves one organization taking control of another business.

- Target Business Viability - The target business should have assets, processes, or other inputs that can be viable for the acquiring organization to benefit from the transaction.

- Consideration - The business combination accounting transaction is completed only when the acquiring organization transfers a pre-agreed amount as cash, equities, or liabilities receivables to the target business, which is termed as Consideration.

- Control of the Business - The acquiring organization needs to own 50% stakes of the target organization to have the organization's controlling rights.

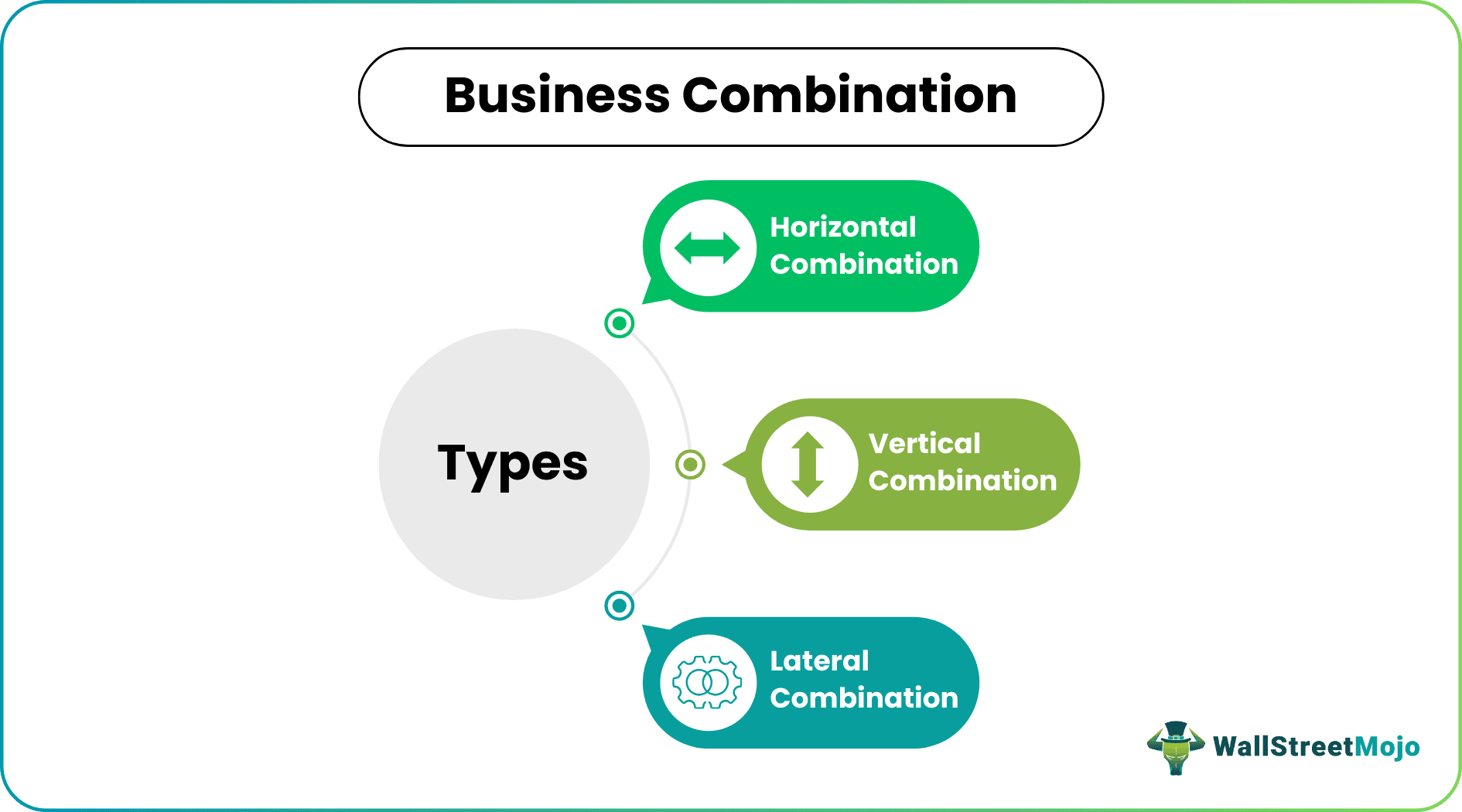

Types

Let us look at the forms of the business combination.

#1 - Horizontal Combination

This type of consolidation is done with the objectives of business combination of two or more organizations operating in the same line of business. This combination results in a reduction of competition and larger market capitalization.

#2 - Vertical Combination

The vertical combination is a combination of different stages of the same business. For example, many businesses operate independent businesses at different stages. This is also known as sequence combination or process combination. It combines different departments under one single control point. The key objective is to reduce the per-unit cost of production.

#3 - Lateral Combination

This type of business combination is the combination of two businesses that deal in a different line of business; however, they are connected in some way or another.

3a) Convergent

A convergent combination is the combination of different business units, say suppliers of raw materials to a major firm. In this type of combination, the larger firm benefits from supplying raw materials and its inventory under its control.

3b) Divergent

A divergent combination is the combination of major firms that operate in related businesses that use the major firm's products as raw material.

3c) Diagonal

Diagonal combination refers to a combination of the manufacturing companies with a service-related business. The objectives of business combination in this case is to provide service for the products that have been sold and creates a sense of customer satisfaction and trust since the customer can expect after-sales service at the hands of the organization itself.

3d) Mixed

Mixed business combination agreement are also termed Circular combinations. These unrelated businesses combine to form a new business called a mixed combination. The new business form will have insights from the management of both the organizations, which will help create an organizational and functional structure that creates the most efficient way to operate the business.

Examples

Example #1

A combination of two major sugar manufacturers, 'Sugar bell' and 'Crystal Sweeteners', operating in the same line of business is an apt example of a horizontal business combination. This would result in the termination of the competition.

Example#2

'Mountain Mist,' a packaged water manufacturer, combines with a PET bottle manufacturer 'Beige Plasto.' This type of combination will bring two different processes under single management. In addition, the inclusion of the bottle manufacturing unit under the same management will reduce per-unit cost.

Example#3

Supplier A deals in printer ink, papers, and folders, and Supplier B deals in the same business. 'Pressfit' is a leading printing press. Supplier A and B with Press Fit will be a concurrent combination.

Advantages

Let us look at the advantages to understand the reasons for business combination.

- Managing the business becomes efficient since decisions can be made based on a holistic view of the key areas of business.

- The major advantage of a business combination is the economies of scale, which refers to reducing the per-unit cost of production.

- Reduced competition, in other words, refers to increased market capitalization and a relative spike in the profits gained.

- The businesses' customers would benefit from the combination since the new organization will engage in activities to enhance the current procedures to deliver a better product to the customers is one of the reasons for business combination

Disadvantages

- Loss of employment – Since processes will be combined, the workforce required for certain tasks will be reduced.

- It can result in a disparity of the economy since the economic power would be transferred to a few people managing the industry. Thereby creating differences in the income distribution in the economy.

- At the initial phase, communicating effectively and bringing each department or business unit on the same page is a mammoth task since there can be cultural differences among the employees of the organizations. This can result in inefficient coordination and require rework for a simple task.

Business Combination Vs Asset Acquisition

In business combination, the acquirer purchases the assets and equity of another company whereas asset acquisition is purchase of assets of an entity by another. Let us look at their differences.

| Business Combination | Asset Acquisition |

|---|---|

| There is acquisition of business. | Assets are acquired. |

| Assets and liabilities are measured at fair value. | Purchase price include transaction cost and relative value of assets. |

| Transaction cost is treated as expense. | Transaction cost is capitalized. |

| Goodwill is recognized. | Goodwill is not recognized. |

| Intangible assets are recorded at fair value. | Intangible assets are recorded at fair value. |

Recommended Articles

This has been a guide to what is Business Combination. We explain its types with examples, difference with asset acquisition, advantages & disadvantages. You can learn more about Corporate Finance from the following articles –