Doing Business in Hungary: Overcoming the Challenges

Table of Contents

Introduction

Hungary is a landlocked nation located in the heart of Europe, serving as an important transit nation. Its geographical position makes it an important crossroads concerning trade between eastern and western Europe. On account of the location, if one is considering starting a business in the country, one can get a direct way to all European countries.

Besides the position on the map, there are various other factors that make it easy for individuals to establish a business in Hungary. That said, there are multiple challenges that one needs to overcome at the same time. We’ll explore such hurdles in detail in this article. But first, let’s look at some of the key aspects related to doing business in Hungary.

Why Hungary? The Economic Case

Foreign investments in the country breached the €3 billion mark in Q1 2019. Thus, it is clear that foreign investment accounts for a significant portion of Hungary’s economy. Since Hungarians are aware of the impact it has had, the business environment within the nation is accommodating and welcoming to foreigners. In addition to the favorable geographical location mentioned above, the country has more to offer, including low taxes, great opportunities, low export barriers, and cheap real estate.

The tax system for companies is quite accommodating. Moreover, the payment procedures are simple and accessible. We’ll discuss more about taxes payable for doing business in Hungary later on in this article. Hungary is also a place where one can find an innovative and skilled workforce, mostly in the fields of science, technology, engineering, and mathematics (STEM). The nation makes significant investments in education related to these fields. Additionally, the labor costs are quite low, which makes starting a business and expanding operations easy for entrepreneurs.

The Hungarian government also provides various incentives to assist businesses in succeeding. Also, there are European Union cash grants for new organizations, which are non-refundable. Besides these, Hungary provides various trade benefits since it is a member of the EU. Such benefits lower costs for companies and include fewer rules and regulations. This, in turn, can have a positive impact on the business’s profitability. Moreover, doing business in Hungary allows companies to explore the EU market, which has more than 400 million consumers.

Company Formation in Hungary – What to Expect

Company formation in Hungary is straightforward. Generally, establishing the entity takes around five days. Let us look at some of the key things you would need for hassle-free Hungary market entry.

- A registered office address in the country

- An accountant who speaks English

- A Hungarian bank account

- Valid identity documents

Note that doing business in Hungary does not require any local business partner. Also, there’s no reason to worry about substantial capital requirements. This is because Hungary has one of the lowest minimum requirements in Europe with regard to capital. This lower capital requirement allows you to have more money to invest in key areas of the business, which can provide a competitive advantage against global competitors.

When doing business in the EU, if a business goes past the VAT threshold, it must get VAT registration per the EU regulations. In all EU countries except Hungary, generally, the time for VAT registration can be 4-6 weeks for foreigners. That said, at the time of registering a business in Hungary, the entrepreneur gets the VAT number without paying any fee. This saves significant time and money and makes the Hungary market entry straightforward.

Working in Hungary as a Guest Investor

If you qualify for Hungary’s guest investor program, you and your family will obtain a 10-year residence permit that is renewable. This program includes permits for your spouse, parents, children (below the age of 18 years), and parents-in-law. Note that the beneficiaries will have the right to work, study, and live in Hungary.

Additionally, they can the have the benefit of visa-free travel in the Schengen area. Besides this, the beneficiaries do not have to fulfill any minimum requirement with regard to staying in Hungary.

The Financial Advantage – Payroll and Taxes

Let us elaborate on the discussion of taxes in this section. Also, we’ll explore the payroll aspect. As noted above, Hungary is known for its favorable taxation policies. Its corporate tax is 9%, which is extremely low compared to the taxation rates of a lot of countries around the world.

Additionally, the nation has an extensive network concerning double taxation treaties. Such treaties assist organizations in Hungary to steer clear of double taxation. Thus, the management of funds across geographical boundaries becomes easier for the companies.

Moreover, the local business tax ranges from 0% to 2% across the country. Indeed, local businesses may not need to pay any tax.

Common Challenges – And How to Overcome Them

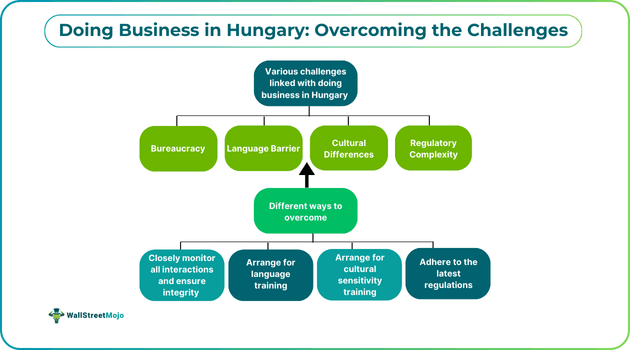

Some common business challenges in Hungary are as follows:

#1 - Bureaucracy

Significant corruption and high bureaucracy are some noteworthy economic challenges that businesses face when doing business in Hungary. The administrative barriers can raise costs and delay processes. Corruption practices within the system can act as a roadblock to fair competition. Businesses can overcome such challenges by following the regulations carefully and executing robust controls. Additionally, organizations must consider tracking interactions to maintain integrity and transparency concerning business operations.

#2 - Language Barrier

The language barrier is a significant business challenge in Hungary faced by foreign entrepreneurs. A lot of people may find learning the Hungarian language difficult.Hence, business owners must consider spending money and time on language training for themselves and foreign employees.

#3 - Cultural Differences

The cultural differences in terms of etiquette and business practices between Hungarians and non-Hungarians can cause problems in the business environment. Companies must allocate optimal resources to ensure proper training concerning cultural sensitivity across all departments. This will ensure that all employees carry out business operations effectively.

#4 - Regulatory Complexity

Hungary’s tax system, laws, and regulations can be complicated for some entrepreneurs. As a result, they might face difficulty in complying with the various rules and regulations, and non-adherence can have a significant impact on business operations and lead to serious legal consequences. Moreover, businesses may have to pay hefty fines, and their reputation could be damaged. Companies can overcome such challenges by staying updated regarding the regulatory changes taking place to avoid disruptions and fines. They can even consider getting legal help when doing business in Hungary to ensure compliance.

Hungary: A Risk Worth Taking

Considering the benefits like geographical location, low corporate tax rate, potential workforce efficiency, EU market exposure, and low labor costs, doing business in Hungary can be an option worth considering for aspiring entrepreneurs around the world. Having said that, they need to overcome the challenges discussed above to ensure smooth operations and legal compliance. By taking the right measures suggested in the above section, individuals can cross the barriers and growth their business effectively.

Overall, given the potential opportunities, future business prospects, and technological advancements, there’s ample scope for businesses to be successful from a global standpoint. Hence, starting a business in Hungary can be a wise move.