Table Of Contents

What Is Business Budget Template?

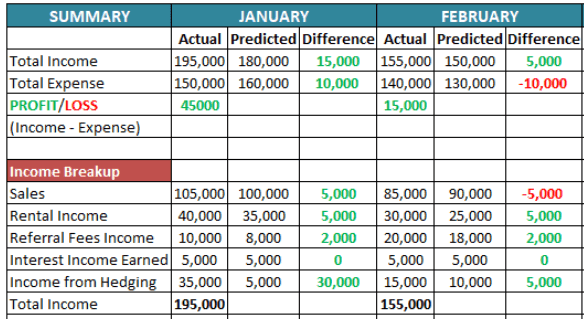

The Business Budget Template is a quarterly template that a business prepares to keep track of its revenues and expenses to be able to see the deviation in the estimate of expense and income. It will be helpful for small businesses that want to keep track of expenses and income.

Creating a business budget is one of the significant parts of a business plan, and having a standard template makes it easier for businesses to have a well-maintained dataset that keeps the transaction and cash flow-related information readily available to them.

Business Budget Template Explained

A business budget template shows the deviation from a budgeted expense and income for businesses. It does not contain an exhaustive list of all expenses and income. One can add expenses and income at the convenience of the person maintaining the template.

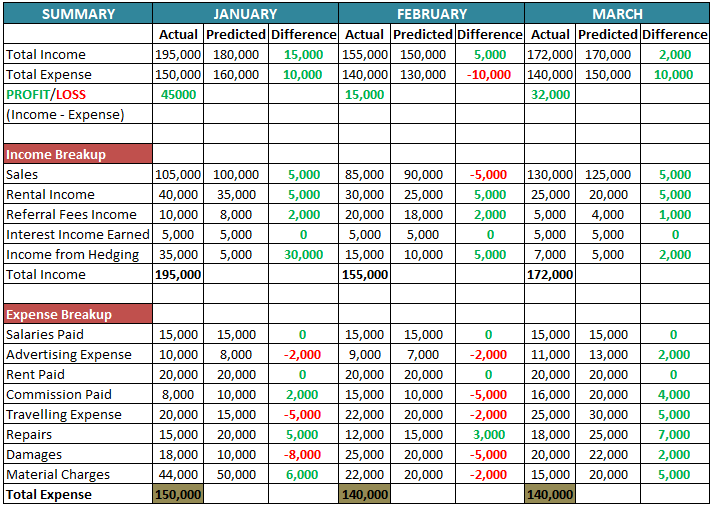

The template starts with the proper display of month-wise profit or loss. It will help the person viewing the template to have an idea of the month-wise profit or loss. Every month there should be an expected valuation estimation of the profit or loss. So the topmost tier helps to display the projected total profit/loss and what is the actual profit/loss.

One should maintain every separate quarter template so they can check the total quarterly estimation of profit/loss with the projected earnings of the business. Quarterly earnings are a critical estimate that decides the movement share price movement.

In the above example, you can see that in the first quarter, the business managed to garner profit for three consecutive months. In January, a large portion of the profit was contributed by “Income from Hedging.”

This kind of income is not sustainable, and one should prepare businesses in case they face loss in “Hedging.” “Interest Income” is as per prediction for the whole quarter. So, it indicates that money invests in good sources and regular interest income flow.

Reasons

There are multiple reasons that make these business budget templates an important addition to the business set-up. Some of the reasons include:

- Businesses, when maintain the budget information on the template, their financial data is readily available to and trackable for them.

- The liabilities and reserves are clearer when data is organized and filtered.

- Many financial or banking institutions require this as a document when businesses apply for a loan or grant. This is because such information reflect the financial position of an organization in the market.

Components

Today, many online business budget templates are available, which could be downloaded and used for free trial or paid usage. However, no matter which template one chooses, there are some common elements that would be there. These include:

- Annual budget, which gives an idea about the amount of money that a business brings in every year. This is the space provided to firms to enter their annual revenues and expenses.

- The next component is the monthly budget, which is auto filled, depending on the details filled in for annual budget section. The monthly estimates are calculated based on the monthly totals of the above section.

- Monthly actuals, which records the actual revenue and expenses of every month.

How To Create?

Before a business is ready to introduce putting the data into a standard format or template, it is important to understand how this budget should be created to be segregated into a template further. Let us check out a series of steps below that helps firms create a well-organized budget template for their business:

Set the objective

The budget goal signifies how much a firm is willing to spend or invest in its business. It is one of the most vital aspects as having a clarity in the very beginning of how to utilize the finance paves the path towards success. Determining the amount one is ready to pay for growth should be known before examining the revenue or expenditure figures.

Segregation of Expenses

When it comes to a business, organizations incur multiple expenses. For instance, hiring a moving company during office relocations can be classified as a one-time expense. Each of these expenditures can be classified into different categories. Some would be fixed costs while the other may be variable costs, which keep on changing throughout. Furthermore, firms can also identify the one-time expenses and the ones that they require paying at regular intervals throughout the year. This makes creating budget easier.

Loss Estimation

This is the section that would require proper analysis of the business finances, and then identifying the span of time until which the business is likely to survive without profits. Calculating the overhead costs can help organize data. Assessing this data makes it convenient for businesses to plan for future in a better way to avoid struggles even in the worst of the scenarios.

Organize budget

When all pieces of information are accumulated, they are ready to be put in the template or the standard format. Maintain the same for a clearer picture of the financial status of the firm.

The above steps when followed helps have accurate and reliable data to be put in the template for ready reference in the future.

Examples

Let us consider the following examples to understand the concept better:

Example #1

Suppose Company X decides to apply for a loan to implement future plans for growth and provide its startup a broader horizon to ensure better reach. It applies for the finance at a banking institution, which asks it to present its business budget for the last three quarters.

Joseph, the owner of the company, had an experience as an accountant, which made him start recording the transactions and putting them in the business budget template that he already prepared based on his understanding. This document being an important element in the loan approval process was presented to the bank and the process proceeded.

This is how business budget templates become a savior for several businesses.

Example #2

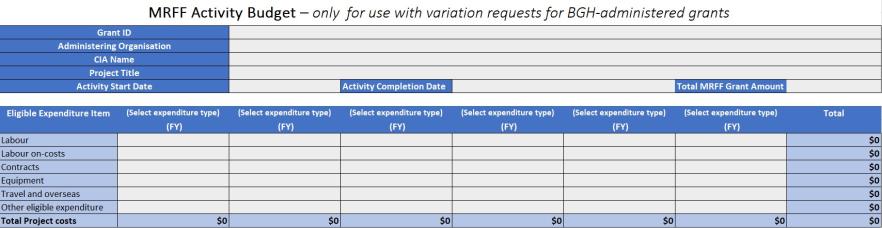

Australian Government’s Department of Health and Aged Care’s official website published the latest business budget template asking grantees to use that version of the template to request for a change or modification to the Medical Research Future Fund (MRFF) grants. These grants are offered by the Business Grants Hub (BGH). The image of the format has been shared below:

How to Use?

The template is simple to use. First, one needs to plug in the expenses and income month-wise. Then, the profit and loss shown in the top section will be calculated automatically as the total expenses. It will pull total income from lower sections after the summation of individual items. Deviations from the predicted estimation will be calculated automatically. The benefits of having a business budget template include the way these can be used and prove useful for the firms:

The template will help to show the deviation of actual expenses/income from the estimates. So, whoever does the estimation should be able to correct their estimation from the next quarter. Positive variance means performing more than estimation is a good surprise and will boost the company’s share price.

The template will also help to break down all expenses and income month-wise. Following the trend will enable an analyst to prepare individual curves and predict the movement of individual items for the next quarter.