Table Of Contents

What is Bull Put Spread?

A bull put spread is a trading strategy associated with put options trading. An investor will buy a put option with a lower strike price and sell another put option with a higher strike price, given that both put options have the same underlying stock and the same expiration date.

There exist various option spread strategies like vertical and diagonal spreads used by investors. Bull put spread is one of them. It is a vertical spread strategy, and an example of credit spread diminishing the risk of an option position. Another name for this strategy is known as short put spread or credit put spread.

Key Takeaways

- A bull put spread is an options trading strategy involving buying a put option at a lower strike price and selling another put option at a higher price.

- Both put options have the same underlying asset and expiration date.

- Bullish traders usually use it to benefit from the moderate rise in the price movement.

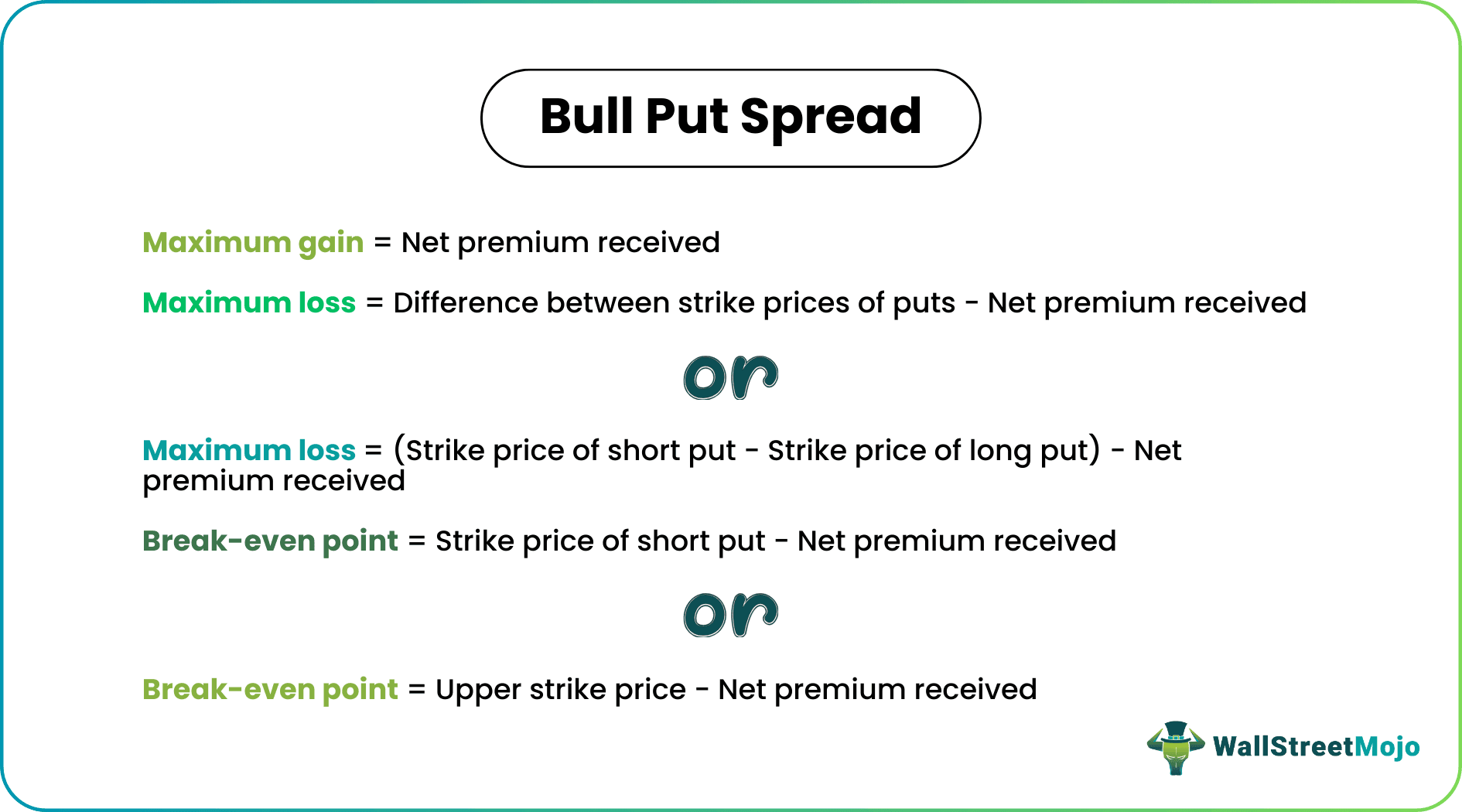

- The maximum gain in this strategy is the net premium received.

- The maximum loss is the difference between strike prices of puts minus the net premium received, and the breakeven point is the difference between the upper strike price and net premium received.

Bull Put Spread Option Strategy Explained

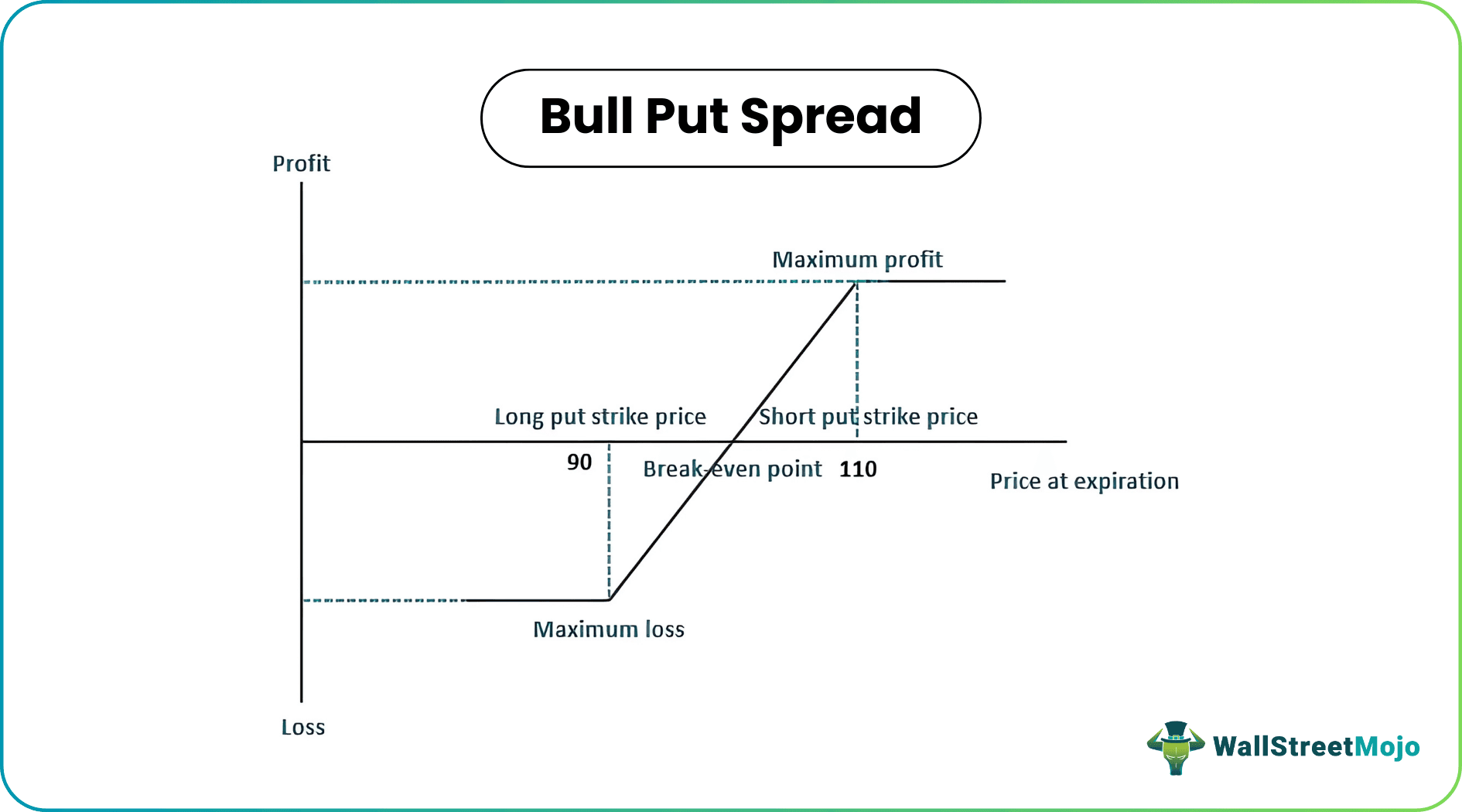

The bull put spread strategy is a vertical spread strategy exampling the formation of a range exhibiting two different strike prices expiring on the same date. Hence it is also a two-leg spread strategy. It is primarily practiced when the specific stock depicts or has a potential for moderate bullish behavior in the stock market. It benefits investors by upfront profit.

The proceeds from selling the put options offset the premium required for buying the other put option hence resulting in a net credit. The net premium from this points to the maximum gain. The strategy caps profit and loss at a particular level, limiting the risk and return.

Examples of other close concepts are the bull call spread, bear call spread, and bear put spread. Bull put spread vs. bull call spread implies that both are opposite concepts pointing to the type of option purchased. Bull call spread involves the buying and selling of call options. Traders use bear call spread to benefit from the underlying asset's price decline. It consists of selling (at a lower price) and buying (at a higher price) a call option. There are instances of investors simultaneously using both these strategies, like in the case of the iron condor strategy. Bear put involves buying a put option at a higher price and selling a put option at a lower price.

How to Construct Bull Put Spread?

The investor deals with two put options to construct a short put spread. First, the investor buys a put option and sells another put option, both having the same underlying stock and expiration date, but the put option sold will have a higher strike price than the put option brought. This two-leg spread strategy is executed by selling the ITM put option (In the Money) and purchasing OTM (Out of the Money) put option of the same stock with the same expiration date.

Breakeven of Bull Put Spread

Let's look into some of the important formulas to get the breakeven concept:

For better understanding, consider a simple example of bull put spread.

Consider a stock that currently trades at $100 per share. The investor:

- Sells one put option with a strike price of $110 (short put) expiring in one month, receiving a premium of $20.

- Buys one put option with a strike price of $90 (long put) expiring in one month, paying a premium of $10. Long put is mainly for protection purposes.

- Note: One equity option contract generally represents 100 shares of the underlying stock.

- Net premium= $20-$10= $10

- Maximum profit: Net premium received = $10

- Here the range formed is (110-90): if the stock price reaches 110 or above, there would be no gain or loss; the profit is capped at a net premium. For instance, if the stock price reaches 120, there would be no gain or loss, and the net gain is the premium of $20. On the other hand, if the stock price falls to 90 or below, the investor loss is capped at $10 since both put options are in the money (ITM).

- Maximum loss = (Strike price of short put - Strike price of a long put) - Net premium received = $110 – $90 – 10 = $10

- Breakeven point =Upper strike price - Net premium received = $110 – $10 = $100