Table Of Contents

What is Bull Call Spread?

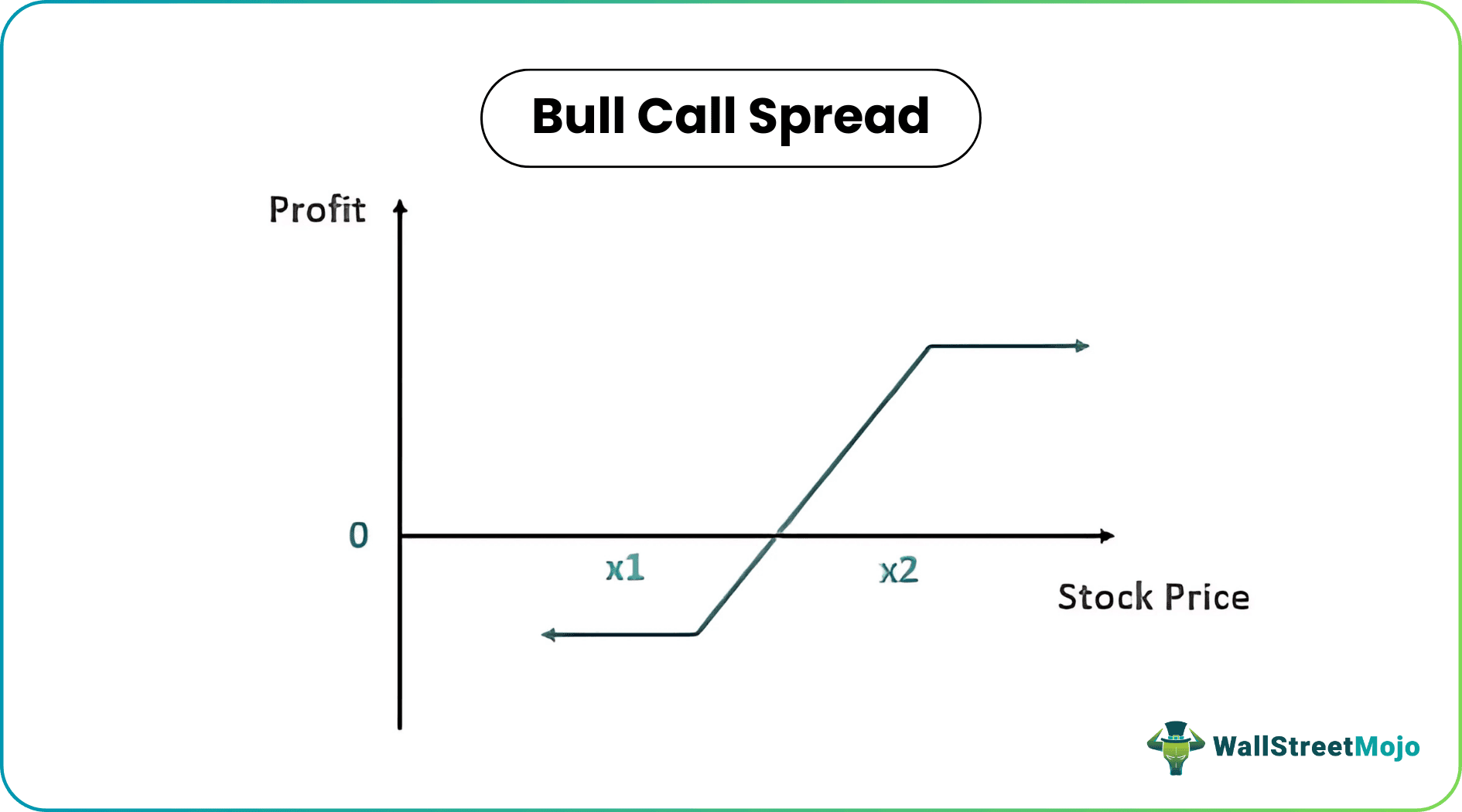

A bull call spread is a trading strategy aimed at making profits from the limited increase in price on the underlying by buying and selling multiple calls across a trading range thereby creating a spread on this trading range.

Key Takeaways

- Bull Call Spreads are bullish options strategies that entail buying a lower strike call option and selling a higher strike call option with the same expiration date.

- Compared to purchasing a single-call option, the Bull Call Spread enables investors to take advantage of the underlying asset's upside potential while paying less upfront.

- When the underlying asset's value is greater than the strike price of the higher call option at expiration, a Bull Call Spread's maximum profit potential is realized.

Formula

Let's try to express this strategy in mathematical terms.

Bull Call spread = Long Call (buy a call at the low strike price) + Short Call (sell a call at a higher strike price)

Normally bullish call spread is executed with the money long and out of the money short calls, but depending on the trading spread and time to expiry, this can be customized to maximize profits and minimize losses.

Example of Bull Call Spread

Let's understand this strategy with the help of an example.

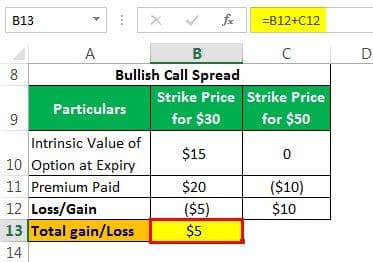

Consider a positional trader who wants to trade on stock options currently trading at $ 30. The trader is moderately bullish on the stock and wants to profit from this movement. The trader believes the underlying stock should rise towards $ 50 in the next month. Hence there is a trading range of $20 in which the stock should trade in the next month.

Solution:

Let's assume the following strike prices trading at the following prices. For both these strikes, the expiration date is the same.

There can be two way to trade this:

- Buying a Naked Call: Traders can buy a call for a $30 strike price by paying a premium of $20.

- Bullish Call Spread: Traders can create a spread by buying a lower strike price (at the money option) and selling out of the money option, in our example, buying a call option at a $30 strike price and selling a call option at a higher strike price of $50.

Let’s see how these positions play out at expiry. Although there can be multiple instances, let’s consider three scenarios for both the trading strategies

#1 - Stock Price Expires within Range of Spread, let's say $5

- Loss/Gain = $15 - $20 = ($5)

Thus even though the trader's view was correct, still the trader had to book a loss.

- Total Gain/Loss = ($5) + $10 = $5

#2 - Stock Price Expires below Lower Strike Price, let's say $20

- Loss/Gain = $0 - $20 = ($20)

- Total Gain/Loss = ($20) + $10 = ($10)

#3 - Stock Price Expires at above Higher Strike Price, let's say $10.

- Loss/Gain = $30 - $20 = $10

- Total Gain/Loss = $10+$0 = $10

Going by the above example, it is clear that even though the trader’s view was correct, he still had to book loss in 2 out of the three cases. Only when the stock rises much above the anticipated level, a trader could book some profit. On the other hand, bullish call spread provides profit in 2 out of 3 scenarios. Also, in the third scenario, when a stock moves opposite to the view, it minimizes the losses.

Trade Parameters

Let's calculate the trade parameters to execute this trade.

#1 - Maximum Risk

The maximum risk of the bullish call spread is limited to the total premium paid in buying a low strike price call. Simply put, it will be the total premium invested in buying the lower leg or lower strike price of this call spread strategy.

#2 - Maximum Reward

The maximum reward of this spread strategy is the difference in the Strike Price of the two call options minus the total premium paid for these two strike prices plus the total brokerage costs. [wsm-tooltip header="Breakeven" description="Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost i.e., the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company, its fixed cost, and the variable cost." is calculated as the Lower Strike Price of the call options bought/sold Plus total Premium Paid plus the brokerage costs.

#3 - Net Position

A bull call spread is a net debit strategy as the trader ends up paying a premium as he is buying an at the money call and selling an out of the money call.

Advantages

- Bull call spread strategy requires less margin to place the trade.

- It aims at profits with not much movement in the underlying asset but with a bullish outlook.

- It takes advantage of the time decay feature by shorting/selling a higher strike call. Such an advantage is not present when a trader buys a naked call. Hence this strategy provides a better gain to loss ratio compared to buying a simple call price.

- Because of fewer margin requirements and include the advantage of time decay future, Bull call spread is one of the best trading strategies that provide good profitability as it has an inbuilt hedging mechanism. Thus, limiting risk and maximizing profits.

- Because of its simplicity to implement and minimum calculations required in calculating the risk-reward ratio

Disadvantages

- The maximum profit of this spread strategy is capped by the higher strike call sold if the price of the underlying rises to a level greater than that anticipated by the trader.

- If the strike price rises much above the higher strike price, then the maximum profit is capped and starts acting as a liability on the trading position.

- The bull call spread can be exited completely simply by offsetting the spread. That is by buying back the lower strike call options and selling the higher strike price call options that were initially bought.

- It can be exited in multiple stages by closing the positions leg by leg depending on the direction in which the underlying stock price is moving.

Conclusion

A bull call spread is a great substitute in comparison to buying a naked call option. It not only reduces the breakeven price but also increases the risk-reward ratio providing an inbuilt hedging mechanism, thus providing a margin of safety to the trader.