Get one step closer to your dream of becoming an FP&A (Financial Planning and Analysis) analyst. Receive multiple benefits with unlimited access to the course content and modules for one year. Plus, with a versatile learning experience, watch these tutorials anywhere, anytime, with pre-recorded modules. Besides, upgrade your skills and industry knowledge on the concept and its relevant application with multiple case studies and real-world examples given. Last but not least, you also receive a certificate of completion that further enhances your career opportunities in this field.

Financial Planning & Analysis Course!!

Comprehensive Budgeting, Forecasting, Cost Analysis | Dynamic Financial Model Creation | $300+ in Exclusive Benefits | Excel and Automation Tools TrainingFLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS OF FINANCIAL PLANNING & ANALYSIS COURSE

Highlights of the Course

Budgeting & Cost Management Mastery

Budgeting & Cost Management Mastery : Learn to build effective budgets and control costs for strategic financial planningDynamic Financial Modeling

Dynamic Financial Modeling : Create robust financial models used by top investment banks and Fortune 500 firms.Excel & Automation for FP&A

Excel & Automation for FP&A : Leverage Excel and automation tools to streamline financial planning and analysis.FP&A in M&A & Investments

FP&A in M&A & Investments : Understand the role of FP&A in mergers, acquisitions, and investment strategies.1,000+ 5-Star Ratings

1,000+ 5-Star Ratings : The most trusted FP&A program worldwide.Certification

Certification : Earn a prestigious certificate to stand out to top recruiters.HURRY UP!

Unlock Premium Course Benefits Worth $300+!

FP&A Essentials (Benefits Included)

FP&A Essentials (Benefits Included) :Advanced Financial Modeling for FP&A (Benefits Included)

Advanced Financial Modeling for FP&A (Benefits Included) :Strategic Cost Management & Budgeting (Benefits Included)

Strategic Cost Management & Budgeting (Benefits Included) :Data-Driven FP&A & Financial Statement Analysis (Benefits Included)

Data-Driven FP&A & Financial Statement Analysis (Benefits Included) :FINANCIAL PLANNING & ANALYSIS COURSE PREVIEW

Sample Videos

TRY FOR FREE

Subscribe to Financial Planning & Analysis (FP&A) Masterclass NOW!

Cost-effectiveness

Comprehensive Learning

Structured Learning Path

BENEFITS AND FEATURES

Benefits & Features of the Course

Look at some of the top-tier career benefits you will receive with our curated courses for FP&A professionals:

#1 - Expertise:

Embarking your FP&A analyst journey with us will bring in enough familiarity on the subject of financial planning and analysis. It gives immense knowledge on concepts like budgeting, forecasting, cost accounting, financial management, and many others.

#2 - Skills Development:

Strengthen your grip in this field with FP&A online training program. Enhance your ability to analyze budget and assist in financial decisions to management when required. Also, this course brings a new source of confidence within you when it comes to having financial knowledge.

#3 - Real-Time Application:

With the various case studies and real-world examples provided, witness a practical application of the concept in the industry. Notably, you also get familiar with unpopular Excel tricks and formulas to speed up your modeling work.

#4 - Career Enhancement:

Open doors for various job opportunities with the ground-level learning experience received in our financial planning and analysis online course. You can soon practically include the concepts in your current job as well. Plus, you can also enroll for other FP&A modeling course with a constant urge to upgrade your knowledge.

#5 - Other Benefits:

Enroll in our best courses for FP&A to gain certification for financial planning and analysis. Engage with experts and industry titans to seek immense knowledge about budgeting, financial planning, costing methods and trends on-going in the industry.

QUICK FACTS

Industry Trend

SKILLS COVERED

What Will You Learn?

Equip yourself with the skills required to assist companies in their financial planning with our Financial Planning and Analysis training course. Learn about popular concepts like capital budgeting, cost accounting, cost management, forecasting, FP&A, and many more with us. Also, find the appropriate job prospects to become a financial planning and analysis (FP&A) analyst. Not only that, but you also get familiar with Excel tricks and tips to prepare financial models in a quick span. Lastly, with a strategic thinking mindset, make informed investment decisions on vital projects.

PROGRAM OVERVIEW

Course Description

As popularly stated by American businessman Phineas Taylor Barnum (P.T. Barnum), “Money is a terrible master but an excellent servant.” You cannot follow the footsteps of money, but definitely decide where it should flow. To a greater extent, when we prepare budget or plan finances, we do face cash crunches. Be it firm or personal finance. And if we fail to handle our finances (money) well, losses are bound to happen! But, don’t worry, this problem could be solved with this course!

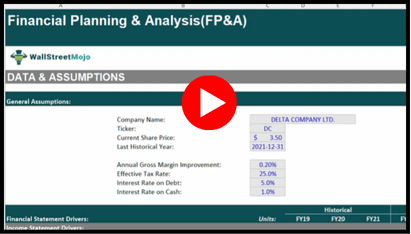

In this comprehensive Financial Planning & Analysis certification course, learn how to budget, forecast, analyze, and track finances in a detailed manner.

Commence your journey with the capital budgeting and forecasting methods to prepare budgets for that period. Additionally, with popular case studies like JPMorgan and other firms decode their FP&A struture and learn to perform ratio and financial statement analysis. Nonetheless, you also get familiar with the basic accounting techniques, principles, and practices followed by FP&A analysts worldwide.

ROLES FOR FINANCE

Careers With Budgeting Certifications

#1 - FP&A Analyst:

A Financial Planning & Analysis (FP&A) analyst is responsible for analyzing the various parts of the corporate industry for projecting the future financials and cash flow of the business. As a part of their work, they closely interact with the executive teams and help in strategic decision-making for the board of directors, like the CFO & CEO, etc.

Usually, the average annual salary of an FP&A analyst lies between the range $67,805 and $132,092 as recorded until August 19, 2024.. Generally, companies like JPMorgan Chase, Amazon, Wells Fargo, and Deloitte are a few of them to hire such individuals.

#2 - Financial Analyst:

Financial analysts are professionals who specialize in creating financial models and forecasting financial statements. They incorporate the company’s financial data and create valuation models as well. Well-known companies like JPMorgan Chase, WellFargo, Amazon, Deloitte, and similar others mostly hire such individuals. For the role offered, the analyst receives around $53,221 to $112,410 annually as of August 19, 2024, depending on the seniority level.

#3 - Budget Analyst:

A budget analyst is a finance professional who analyzes spending, budgets, and forecasts future costs. They keep a track finances and help public and private organizations with funding requests. Additionally, they prepare budget reports and help firms in managing finances within budget. Usually firms such as Capital Group, Oracle, Goldman Sachs, JPMorgan Chase & Co., hire such analysts. In fact, every private and public organization tends to hire them for an average salary of $71,000 to $100,000 annually as of June 6, 2024.

#4 - Financial Controller:

A financial controller is a senior-management-level executive who looks after an organization’s accounting and financial functions. These individuals ensure a company’s financial documents are accurate, reliable for auditors to validate, and stakeholders to go through before making major decisions.

Such professionals work at global giants like Google, Cisco, Oracle, KPMG, and Deloitte. Their salary is around $96,000 to $200,000 annual basis as recorded until June 6, 2024.

#5 - Private Equity Analyst:

This category of equity analysts is more connected with private firms. Here, analysts conduct research, forecast the performance of private firms (not listed on the stock exchange), perform valuation, and give interpretations on private firms. They use financial modeling techniques and valuation methods to assess the advantages of investing in a private company.

Mostly, companies like Goldman Sachs, Blackstone, General Atlantic, and other private equity firms hire them. Generally, their average salary here is $1,01,206 on an annual basis. The data is as recorded until June 6, 2024.

Got Questions?

Still have a question? Get in Touch with our Experts

WHAT WILL YOU GAIN IN THIS COURSE?

Course Curriculum

FP&A Essentials

Building Effective Budgets

Mastering Forecasting Techniques

Understanding Financial Statements

Take our FP&A training courses to learn financial planning and analysis in detail. You will get access to a bunch of topics like financial planning and analysis, capital budgeting, forecasting, cost accounting, different types of costing, and cost management. As the journey commences, learn how to make projections for financial models with DCF (discounted cash flow) modeling. Nonetheless, this certificate program in financial planning and analysis also covers financial reports and the role of FP&A in mergers and acquisitions and financial risk management.

CERTIFICATION

Earn a certificate on completion of this course

Complete our corporate financial planning and analysis certification to evidence your knowledge on FP&A. Master the subject and restore the knowledge through MCQ-based exercises and final assessment. On completion, receive FP&A analyst certification badge to enhance your resume’s worth. Also, you will gain unlimited access to the course content, Excel templates, and related resources with 1-year validity.

WHAT SHOULD YOU KNOW?

Prerequisites For Financial Planning & Analysis Course

At WallStreetMojo, our curated online course on financial planning and analysis does have some minor requirements:

This financial planning and analysis online course does require some prerequ

- Basic knowledge of financial terms and concepts

- Good, stable internet connection

- A laptop, desktop, tablet, mobile, or any device for content access

- Access to Microsoft Excel software for reference