Table Of Contents

What is a Broker Dealer?

A broker-dealer can be considered as a single entity person, company, or any other business organization who deals with the business of trading and execution of financial securities, stocks, commodities, or derivatives on behalf of its own or of its customers for which it charges a certain commission which is the main source of income.

Broker-dealer are the key people one will interact with when it comes to our investing needs. They are on a paid basis but duly help the customers to execute the trade and also make money. They also offer intelligent advice based on their experience so that the customers don’t end up losing money.

Key Takeaways

- A Broker-Dealer is any entity, institution, and organization that indulges in the trading, facilitating, and execution of financial securities, shares, commodities, and derivatives.

- The Broker-Dealer is the middleman between the investor/trader and the security provider/seller.

- The Broker-Dealer generally charges a commission on the trade value as a premium on the brokerage/trading/underwriting services.

Broker Dealer Explained

A broker dealer is simply a person or a business firm who helps investors buy and sell securities, offer them intelligent information regarding trade, and help them book profits while charging a certain amount of fees like commission which are their main source of revenue generation. With the advent of technology, broker-dealers have also gone online, where an investor can buy, sell securities, and book profits without even speaking to them. In the same way as offline brokers here, the marginal commission is deducted from the investor's profit.

There is a thin line of difference between broker and dealer, though; a broker supports security trade on behalf of the investor. On the other hand, a dealer engages in trading activities on behalf of it.

They make sure that the portfolio of the customer is built in the most efficient manner where there is ample scope of diversification too.

A broker dealers license allows also allows them to publish investment research materials specific to shares or trading related, which help their customer get a brief idea about their portfolio.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Let us understand the different types found on a broker dealers list through the discussion below.

- Wirehouse: This type of broker-dealer generally operates on a big scale and has a large and expanded service. They typically have their own set of products that they further sell to their customers and make money.

- Independent: They perform more of an agency or an agent's relationship. They are independent contractors to the customers and generally sell products not owned by them but are procured from outside. They help the customer connect to such outside products, buy and sell them and book the profits. In return, they charge the customer with a certain margin or commission based on the overall trade.

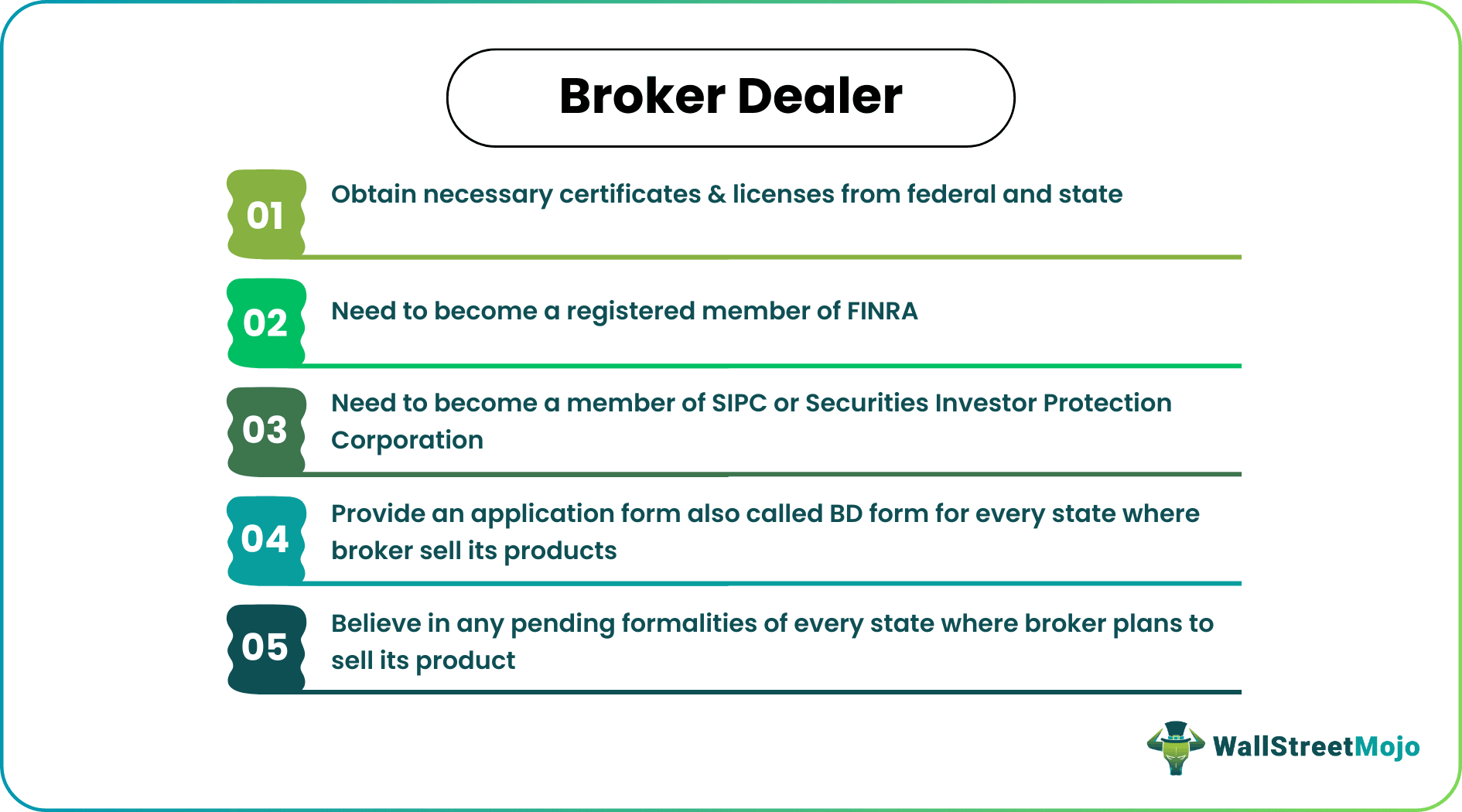

How to Become a Broker-Dealer?

There are overall five steps to gain the broker dealer license, which are as follows:

- Obtain necessary certificates and licenses from the federal and state

The first and foremost step here is to obtain the necessary certificates and licenses from the federal and state, which will permit the person or business to deal with investment products. These generally vary by the type of product involved. Along with this, the broker-dealer has to pass a certain level of examination, which is compulsory for selling any security directly to the client or customer.

- Become a registered member of FINRA

The next step requires you to become a registered member of FINRA, i.e., the Financial Industry Regulatory Authority, which acts as a regulator or any other self-regulatory organization.

- Become a member of the SIPC

The third process is that you have to become a member of the SIPC or Securities Investor Protection Corporation. SIPC helps investors to be compensated in case of the investment company goes bankrupt or becomes solvent.

- Provide an application form, also called the BD form.

The fourth step is to provide an application form, also called the BD form, for every state where the broker has decided to sell its products. This form is provided to the SEC, which helps identify the broker's personal information like contact and any conflict of interest.

- Adhere to any pending formalities of any state where the broker plans to sell its product.

The final step is to adhere to any pending formalities of any state where the broker plans to sell its product and thus duly complete the certifications if required. SEC has a complete set of guidelines about all the formalities, which may vary from state to state, and the broker-dealer has to follow that duly.

Salary

As of 2019 data, the average salary of an independent dealer from the broker dealers list working for a firm can be around $90,000 per year. It can also go as high as $180,000 based on the experience and expertise one possesses. The primary way they make money is via the brokerage fees too. It is the fee charged for executing a trade. A full-time serviceable broker can charge anything close to 2% of the total transaction money. On the other hand, the online broker charges comparatively less, which may be like $5 - $20 on a trade to trade basis.

Functions

A Broker dealers license allows them to perform a variety of activities. Let us understand the major functions through the explanation below.

- A broker initiates the trade on behalf of its customers and is involved in the trade cycle.

- On the other hand, a dealer is representative of the brokerage firm and will initiate the trade on behalf of the account that the firm owns.

- The broker has to ensure there is enough liquidity in the market in the market and cater to the requirement of what its client desires.

- The broker has to make sure it provides effective advice about the client's portfolio diversification and suggests different avenues to park their money.

- The broker-dealer has to maintain the confidentiality of every client and ensure that no bank details or any personal information are being misused.

- Broker-dealers also help publish investment research materials specific to shares or trading related, which help their customer get a brief idea about their portfolio.

- Brokers also play a key role in raising capital for companies by going into the free market and seeking investors to invest in a particular company.

- A broker functions as an agent to its customer, and dealers act as the principal to its account.

Roles

Apart from their basic functions, dealers on the broker dealers list help their clients raise funds and other capital requirements. Let us understand their roles in detail through the points below.

- They act as the intermediary between investors and the company where one wants to invest.

- They also play a key role in helping a company raise its finance in capital requirements.

- Dealers are the ones who act on the stance of the brokerage firm itself and initiate the transaction for the account of the firm.

- They play a key role in providing liquidity to securities by supporting the trade of securities in a free market and, at times, making transactions, i.e., Buying or selling securities from their accounts, to ensure the marketability of the security.

- They also get themselves involved in the underwriting process of the securities concerned.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Investment Banks such as Goldman Sachs and Morgan Chase are considered Brokers-Dealers since they provide underwriting, IPO, and many related services.

Charles Schwab continues to proclaim itself as the largest brokerage firm. They have over $7.6 trillion in assets under management (AUM).

Brokers-Dealers make money by charging a commission on the services they provide on the trade value. Their services include brokerage, trading, capital raising, underwriting, etc.

Individual investors require a broker to carry out these transactions since only investors and businesses registered with an exchange can trade on exchanges. The brokerage firm may receive a commission, fee, or payment from the exchange itself in return for this service.