Table Of Contents

What Is A Bridge Loan?

A bridge loan is a type of short-term credit. It is availed by owners trying to buy a new home to replace their current home. The current property acts as collateral. The loan bridges the interval between the purchase and sale of the property.

The loan comes with two payment options. Borrowers either pay interest each month or opt for a lump sum interest to be paid when the loan is paid off. Due to the risks, interest rates are quite high. The loan has to be paid within a year. To assess the cost-effectiveness of each option for your specific situation, consider using a bridging loan calculator that compares total expenses, including interest rates and fees, against potential tax benefits of alternatives.

Key Takeaways

- A bridge loan refers to a short-term source of finance. Individuals and companies can meet urgent cash requirements by obtaining this loan.

- Usually, borrowers opt for this option when there is a delay in the disbursement of a permanent loan or sale of a property.

- Lenders secure these loans by demanding collateral—inventory, real estate, and other assets.

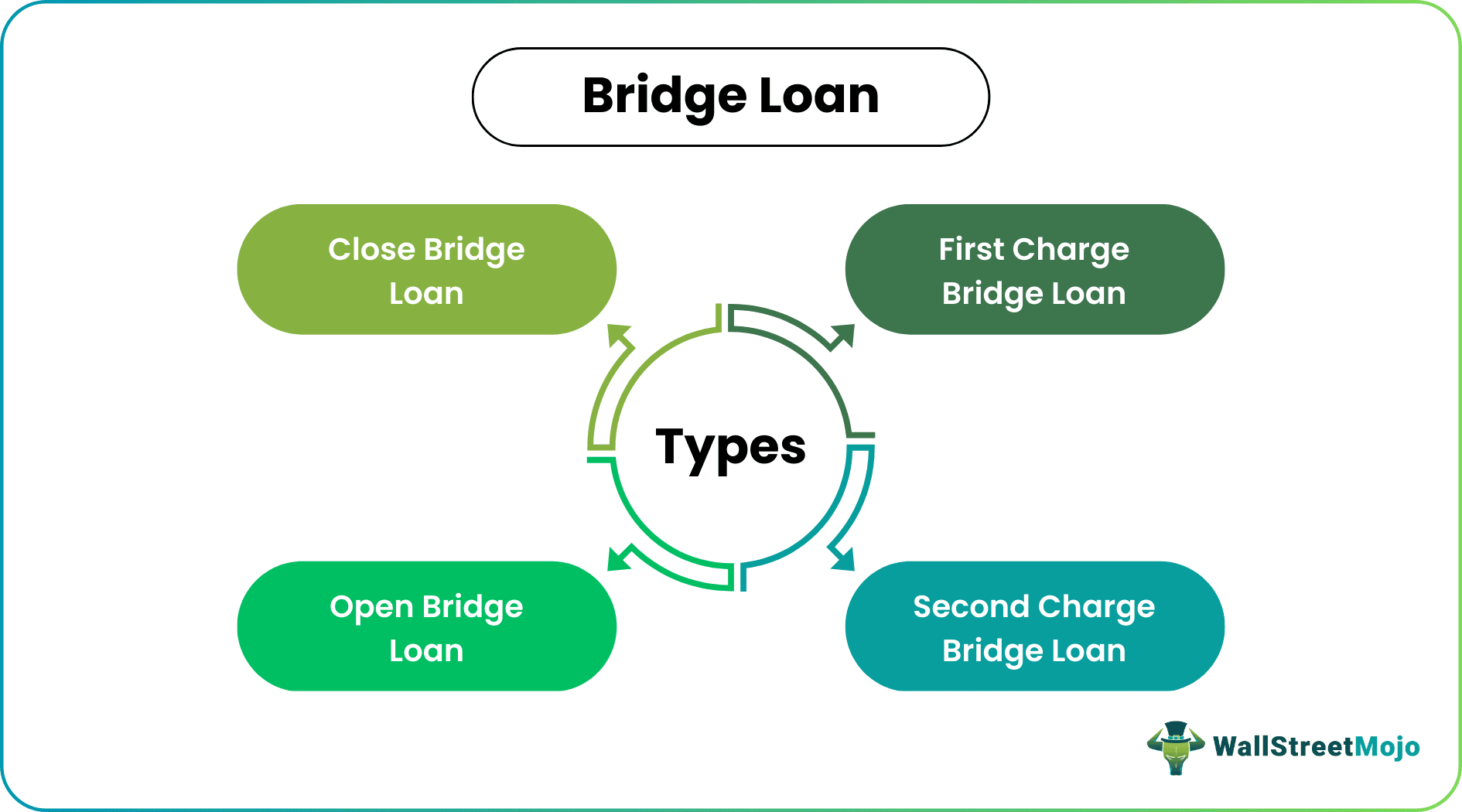

- There are four subtypes—closed, open, first charge, and second charge bridge loans.

Bridge Loans Explained

A bridge loan is offered to a company or individual for a short term until the borrower pays back the previously borrowed fund or acquires a permanent source of funds. It is offered by commercial banks. It is usually extended for a period of three to twelve months. It bridges the gap between urgent expenses and cash inflow in the immediate future.

These loans are secured by the hypothecation of movable assets, immovable assets, personal guarantees, and promissory notes. For individuals, the bank offers a loan against the property that the borrower is buying. However, for companies, inventory or real estate act as collateral.

The amount of loan allowed for each borrower depends on the loan to value ratio. For example, the maximum loan to value ratio for commercial property is 65%. For residential property, the maximum is set at 80%.

The interest rate on these loans is significantly higher than normal loans. Moreover, they are short-term loans and, therefore, carry additional risk.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Requirements

Borrowers are eligible for the loan if they meet the following criteria:

- Resident individual.

- Legal ownership of the collateral—asset, real estate, or inventory.

- Low debt-to-income ratio.

- Low loan-to-value ratio.

- Excellent credit score and credit rating.

- The borrowing company must hold at least 20% equity.

Types

The different subtypes are as follows:

#1 – Closed Bridge Loan: The finance period is fixed and is mutually agreed upon by both parties. Lenders prefer closed loans over open loans and hence offer lower interest rates.

#2 – Open Bridge Loan: The date of repayment is not fixed in such a loan. When borrowers are uncertain of when they will secure finance, they prefer open loans. Since the repayment date is not confirmed, lenders charge higher interests.

#3 – First Charge Bridge Loan: The loan provider has a primary right to the collateral when borrowers obtain a first charge loan. If the borrower defaults, then the loan provider has the first right to sell the property for loan recovery. Due to the minimal underwriting risk, interest rates are kept low.

#4 – Second Charge Bridge Loan: In this loan type, the lender has a second charge on the property. Due to high levels of uncertainty, interests are high.

Examples

Let us look at some examples, to understand the practical application of the concept.

Example #1

Let us assume Laura plans to buy a new house replacing the one she currently owns. Laura, therefore, needs to sell the old house—a time-intensive process. The new house will cost her $600,000. Her current house is valued at $800,000.

In such a scenario, Laura can obtain a 12-month bridge loan of $600,000 (which is less than 80% of the current house's value). With this money, Laura can buy a new house. Within twelve months, she can sell the old house to settle the bridge loan (both the principal and interest amount).

Example #2

ABC Ltd. is a vehicle manufacturer, and the company plans to build a factory worth $15000,000. Therefore, the company can issue corporate bonds to finance this requirement.

But the issuing of corporate bonds may take up to six months. The company feels that they may not get the best deal for the land or the location if it gets delayed—the management wants to start the construction immediately.

In such a scenario, the company opts for a bridging loan. The company obtains $15000,000 credit for six months and will repay the amount when the bonds are issued.

Bridge Loan vs. HELOC

Bridging loans and Home Equity Line of Credit (HELOC) are sources of short-term finance—they facilitate the purchase of the private and commercial real estate. However, they have different purposes and limitations.

The former is a short-term availability of funds until the permanent loan is disbursed. The latter is credited as a lump sum—the borrower withdraws it partially depending on the need. Bridging loan collaterals are usually assets like real estate or inventory. HELOCs are secured against equity interest in the respective property.

Bridging loans are comparatively expensive—interest rates are high, and so are the risks. HELOCs are cheaper—they allow itemized deduction in tax payments. Bridge loans need to be repaid within a specific tenure—it has to be closed within a year. But, HELOCs can stay active for a long period, say ten years.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.