Table Of Contents

What is Bridge Financing?

Bridge financing is defined as financing that helps procure short-term loans to cater to immediate business requirements until long-term financing is secured. Bridge loans or finance are procured to cater to the business’s working capital needs or solidify any short-term business requirements. As a result, they have high finance costs or rates of interest.

These financing methods bridge the time frame when the business faces a cash crunch and is about to get capital infusion from long-term financing options. The tenure of the loan can range from two or three weeks to a maximum of 12 months. Before this period comes to an end, the business must secure a long-term loan.

Key Takeaways

- Bridge financing is a short-term loan that provides immediate funds to meet urgent business needs until long-term financing is acquired. They have high finance costs or interest rates.

- The types of bridge financing/loans include bridge financing for debt, bridge financing for IPOs, close bridge financing, open bridge financing, and first & second charge bridge financing.

- Bridge financing is generally used to finance a business's working capital requirements or obtain tangible assets.

- It can also be used to finance IPOs and ensure the business entity retains good and comprehensive deals.

Bridge Financing Explained

Bridge financing or bridge loans are short-term or interim loans that serve the immediate requirements of a business until a long-term loan is secured. It bridges the gap of securing finances with the immediate cash flow requirements of the company.

The interest rates for bridge financing loans are significantly higher than other conventional loans as they are secured for a short period and only in situations where the finance is absolutely necessary.

Bridge financing is the method of arranging finance to bridge short-term business requirements. These are normally employed to finance the business's working capital needs or acquire tangible assets. Bridge financing is also used for IPOs and financing of good deals. It ensures that the borrowing entity does not miss out on good, lucrative, and comprehensive business deals.

These are short-term loans with a time frame of 3 weeks to 12 months.

The loans are repaid once finance is arranged from the existing arrangement.

Since the cost of lending is high for such loans, these loans are refinanced from the traditional lender.

These loans are not regulated under any main regulatory body.

Such loans are non-standard. There are no concrete covenant arrangements between the lender and borrower.

Types

Different organizations have different situations and needs of financing. Naturally, one type of funding would not be efficient for all organizations. Let us understand the different types and bridge financing rates through the discussion below.

#1 - Bridge Financing for Debt

One can arrange the bridge financing in the form of high-interest debt for a short-term time frame. However, such loans increase the financial crisis and woes of the business.

#2 - Bridge Financing IPOs

One can use the bridge financing before initiating the initial public offering. Such loans may cover the floatation costs arising from the initial public offering. The floatation costs are costs borne by the business for undertaking the services of underwriting to initiate the process of IPOs.

#3 - Closed Bridge Financing

This bridge financing arrangement ensures that the period for servicing the loans is fixed between the lender and the borrower. These types of arrangements ensure that loans are serviced on time. This type of arrangement is bound through a legal contract.

#4 - Open Bridge Financing

In this variant of bridge financing, the period for servicing the loans is not fixed. Therefore, this arrangement cannot guarantee the timely servicing of loans.

#5 - First & Second Charge Bridge Financing

In this loan arrangement, the lender demands a first or second charge corresponding to the collateral basis on which the business procures the bridge loans. If the lender orders the first charge, then the lender would have the first right towards the collateral in the event of defaults made by the client. If the lender demands the second charge, the lender would have the second right toward the collateral if the business defaults.

Examples

Any concept is better understood when practical scenarios and daily factors are brought into the picture. To understand the concept of bridge financing loans in depth, let us take the help of a few examples.

Example #1

Richie Rich Ltd is currently under a severe cash crunch, but it has provided a new business opportunity. However, a $600,000 shortfall is required to initiate a new business project. Therefore, they approached a venture capitalist for bridge financing.

The venture capital assessing the business opportunity and its profitability approves bridging loan. Accordingly, they agree to finance but at a high cost of 15% interest rate, with the loan being serviced from one year of the disbursement of the loan.

Suppose a business is about to go into the initial public offering. However, there are approximately three months to initiate the initial public offering. The company requires an additional $1,000,000 cash to maintain the business's operations.

The business, therefore, has approached the underwriter currently working on the initial public offering of the business. The underwriter agrees to finance the bridge provided the company provides its shares to the underwriters at a price lower than the issue price but equivalent to the amount of the bridge.

Example #2

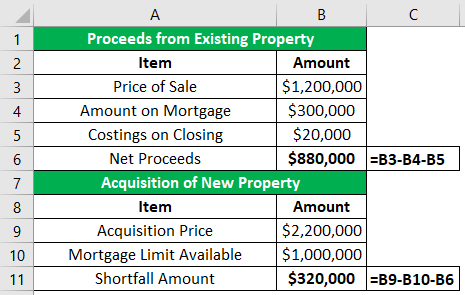

Suppose an individual has an old residential property that he wants to dispose of. The property is under the mortgage, and the closing costs would range around $20,000. The old property is valued at $1,200,000 and has a pending balance of $300,000.

The individual plans to buy a new residential property amounting to $2,200,000, wherein it can procure up to $1,000,000. The individual still has some deficit amount to meet up the purchase of the property, which one can finance through an arrangement of bridge funding.

The following would be the deficit amount as displayed: –

Therefore, the business immediately requires a bridge loan of $320,000 to acquire the new property.

Example #3

Brex Inc, an American financial corporation and technology company that delivers credit cards and financial services to IT companies. It is headquartered in San Francisco.

Brex received requests for over $1 billion in March 2023 following the collapse of the Silicon Valley Bank (SVB) for payroll debts. The companies that have requested for a billion-dollar loan collectively had a deposit of over $10 billion with SVB.

Therefore, recovering the amount loaned out to them would not be an issue. However, the developments with regard to the bank would be closely looked at by both Brex and the companies in Silicon Valley.

Henrique Dubugras, the CEO of Brex said that they were not looking to earn profits from these deals as they are working towards fixing an interest rate that works as an advantage for everybody involved.

Criticism

The high bridge financing rates are difficult to manage for companies with existing cash flow issues. As a result, they can be difficult to manage. Let us discuss the criticism of this concept through the explanation below.

- The borrower with a bad credit profile may not access bridge loans.

- The lender may ask for collateral before providing bridge loans to ensure borrowers with bad credit profiles.

- The lender may additionally charge high fees on originations and foreclosures.

Advantages

Let us understand the advantages of securing a bridge financing loan with such high interest rates through the explanation below.

- These loans are processed very quickly and instantly.

- They can help improve those with a bad credit profile if the entity serves timely loan payments throughout the loan tenure.

- It helps in quick finance pursuing auctions and immediate business needs.

- The terms and conditions of bridge loans depend on the lenders' flexibility.

- It enables the borrower to manage its payment cycles.

Disadvantages

Despite the help with cash flow and short-term financing for organizations, there are factors that prove to be a hassle for organizations irrespective of their size. Let us understand the disadvantages of bridge financing rates and other implications through the points below.

- Bridge loans carry a high-interest rate and are very expensive.

- Since the loans are costly, they pose a high default risk from the borrowers' end.

- The lenders charge high fees for late payments.

- The balance keeps compounding with the finance rate for each unpaid loan.

- The borrower may be unable to exit such loans as he may fail to get loans from traditional lenders. So, how does a bridging loan work in practice? The lender provides quick capital secured against an asset while the borrower arranges their permanent financing solution.