Table Of Contents

Breakage Meaning

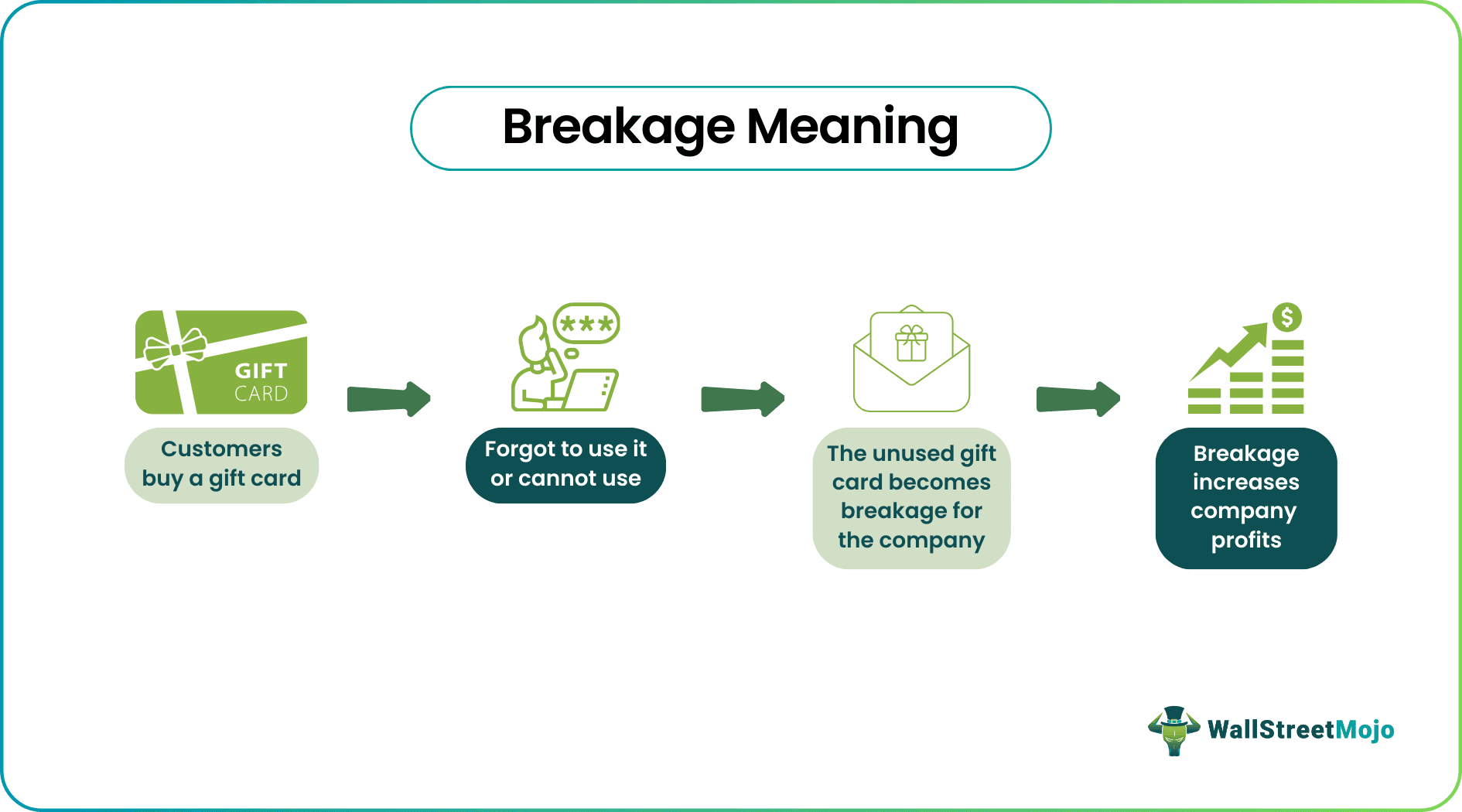

Breakage is an accounting term that refers to the revenues businesses earn when users or customers leave gift coupons or vouchers unused or unclaimed. These are generally prepaid services or benefits that customers do not use despite paying for them in advance. These services vary depending on the business, store, or retailer.

Gift coupons or services are issued to attract and retain customers. Breakage occurs when customers discard or forget about the services or benefits offered. Such services, when unused, increase a company’s profits. From a customer's perspective, it is a loss because they have paid for the services but have decided not to use them or cannot use them. The most common example is gift cards.

Key Takeaways

- Breakage refers to the amount of money a business realizes because a customer paid for a prepaid service and decided not to use it.

- The most common examples are unredeemed gift cards, loyalty points, airline vouchers, free meal coupons, frequent flier miles, etc.

- FASB introduced new accounting rules for breakage that companies were asked to adopt. December 2018 was the deadline for public companies, while nonpublic companies were required to comply with them by December 2019.

- Consumers in the US lose approximately $4 billion annually through unused gift cards, loyalty points, and unredeemed services.

How Does Breakage In Accounting Work?

Breakage is the amount of money realized as profit by a company from any product or service left unused or unredeemed by a customer. Many companies sell prepaid services or additional products to customers with complete awareness that many such services will remain unused and add to the company's profits eventually. At first, such amounts may look negligible, but once accumulated, they become huge.

When customers buy gift cards and do not use them fully, leaving approximately 2% to 3% of a card unused, they consider it normal and unimportant. However, for businesses, such leftover amounts of 2% or 3% may come from thousands of customers. Hence, these amounts become a company’s profits.

The breakage definition is not limited to gift cards. It is observed in many other sectors like airlines, hospitality, retail, etc. It is also seen on online shopping platforms, e-commerce websites, etc. Breakage costs borne by customers vary, depending on whether services or gift cards were purchased from small businesses or multinational brands. However, given accounting problem it causes, the Financial Accounting Standards Board (FASB) introduced new rules regarding prepaid services and goods becoming breakage.

Breakages are roughly 2% to 4% of the total benefit or service a customer has paid for in advance. However, this amount can be higher, depending on a customer's behavior and choices.

Causes

The causes of breakage have been discussed below.

- Customers tend to make impulse purchases and buy gift cards or prepaid services.

- A lack of rational buying behavior often results in customers buying gift cards, even when they do not need them.

- When gift cards are bought by customers and gifted to others, they may not use them properly.

- Not using gift cards fully or properly is considered normal by many customers. Since the impact of such actions on their finances is minimal or negligible, it does not raise the alarm and accounts for almost nothing. However, such unused services/purchases accumulate for companies and retailers and turn into huge profits.

- Businesses earn profits based on the expectation that a certain percentage of people will likely never redeem the gift cards they have purchased or use the points they have accumulated through purchases.

- Customers are known to convert cash into gift cards or coupons, thinking they will use it later.

Examples

Let us discuss a few examples to understand the concept better:

Example #1

Let us assume Mariana just started reading novels and has developed a great interest in them. She visits a local bookstore twice a week to buy new novels. The bookstore manager tells her she can pay $45 and become a lifetime member. Mariana agrees and pays for the membership. She receives a membership card, and the manager tells her that for every book she buys, she will get a discount of 9%. He tells her she will also receive some points against her membership card that can be used later to buy anything at the store. Mariana is happy. For the next few months, she buys new books and adds a few points to her card.

Later that year, Mariana leaves the city and forgets about her membership at the bookstore. She reads daily, but every time she needs a new book, she orders it online and does not visit the bookstore anymore. The lifetime membership fee Mariana paid, and the points accumulated remain unused. The $45 she paid to acquire the membership becomes a breakage for the bookstore. It is now a profit, along with the points she was offered to buy anything else at the store.

Example #2

The concept of gift cards is widespread in the US. Therefore, breakage in business is common. According to reports, consumers lose over $3 billion annually in unspent gift cards. Many customers are unaware of it, but Walmart and Amazon make millions out of unredeemed gift cards yearly.

According to the Mercator Advisory Group, US consumers bought gift cards amounting to $98 billion from Starbucks, Amazon, and Home Depot in 2019. This is an increase of approximately 90% compared to 2005. About 2% to 4% of gift card money is never spent, which generates a profit of $4 billion just in the US.

How To Avoid?

Breakage helps businesses offering services, gift cards, and other points earn profits. Therefore, not redeeming gift cards is a customer's loss. Customers can avoid such losses in the following manner.

- Being rational when prepaid services or gift cards are presented for sale.

- Specific conditions apply to gift cards, loyalty points, or credit card rewards; customers must understand them thoroughly.

- Customers must take the maximum benefit of gift cards before such cards expire.

- It is advisable to use a restrictive payment mode or deal in cash when knowledge about a specific service/product and time to spare while purchasing it are limited.

- Many online payment platforms allow users to link their gift cards with digital wallets to ensure cards are redeemed on time. Using such features is recommended.

- Converting cash for less flexible services is not advisable.

Frequently Asked Questions (FAQs)

In finance, the term breakage cost is associated with loans and debt. It refers to a prepayment penalty charged by banks to cover the interest rate they would have earned from the borrower if the borrower had not foreclosed the loan shortly after taking it. In contrast, the opposite of breakage in business is utilization and offering the service/product a business is liable to offer.

The expected value of breakage or breakage rate refers to the predicted percentage of services a business calculates or anticipates will never be used and will eventually add to its revenue. For example, a company knowingly sells gift coupons to customers, of which around 9% will never be redeemed. This 9% is the expected breakage value.

The impact of breakage on the business is primarily positive. Companies know a certain amount of gift cards, loyalty points, or coupons they have sold will never be used or redeemed. Unused services or cards seem insignificant to individual customers, but it greatly increases a business' profit. They earn money without the need to offer customers the corresponding value (product or service), and they are not liable to pay customers for unused services/cards.