Table Of Contents

What Is Break-Even Price Formula?

The break-even price is defined as the level of price or amount that the seller of the business should quote that enables him to recover the costs of the business operations. . In simple words, the formula helps us calculate the price at which the total cost will equal the total revenue of the business operation.

Thus, the concept refers to a situation where the business has neither profit, nor loss. However, it is the minimum level of revenue that the business requires to cover its cost in order to start earning profit. The formula helps in calculating what should be the minimum price of the goods so that the business can be profitable.

Break-Even Price Formula Explained

The breakeven price formula tells us how to calculate the price level at which the business will be able to cover all the costs and earn profits. It is the level where total revenue of the company is equal to total cost. The revenue earned from producing and selling the goods and services will exceed the cost incurred in it. It is to be noted that at this level of price, both fixed and variable cost is covered.

It is essential to understand the concept of formula for break-even price clearly so that companies can take informed decisions regarding new investment into innovative methods of production, design pricing strategies, plan production levels and calculate the overall profitability of operation. If the selling price is such that it is not able to successfully cover the costs, then it will lead to losses.

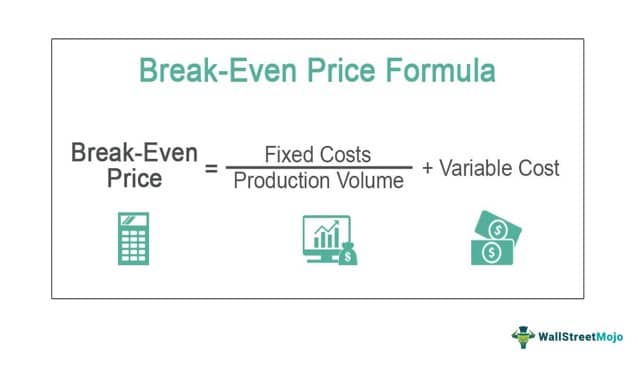

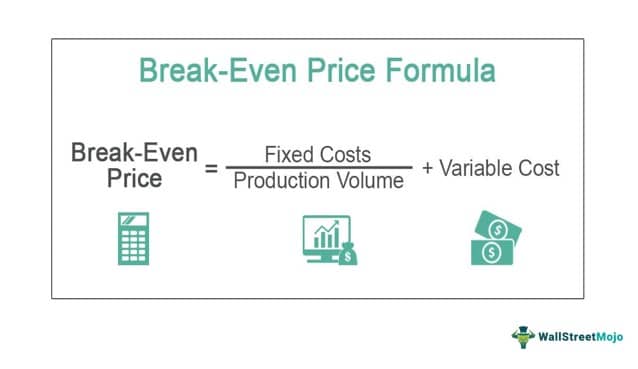

The formula for break-even price for break-even price can be described as follows:

- Fixed costs represent costs that the business or company in manufacturing has to bear to make itself sustainable. The fixed costs are independent of the volume of sales that the business generates on a day to day basis. The fixed costs comprise utilities, rent, insurance, salaries, fee on services taken, and marketing expense.

- The variable costs are costs that vary basis the nature of the production. The variable costs comprise of expenses of direct labor, supplies expenses, and costs on materials.

This formula acts as a tool to interpret the financial health of the business, which is again used by the management, investors, analysts and various other stakeholders while taking investment decisions.

How To Calculate?

The formula used to calculate the break even price of a product or service will answer questions like how many units are required to be sold in order to break even, what should be the ideal price in such situations that will cover the cost based on the volume if sales projected by the company, etc.

However, it will also help in analysing the impact of changes in fixed and variable cost of production and also the sales volume in the profitability levels of the business. It is also estimates what will be the price of products at different profit and sale levels.

The formula for break-even price can be explained by using the following steps:

- Firstly, divide all costs incurred by the business into variable costs and fixed costs.

- Next, determine the production capacity or the volume of the finished goods that the business plans to produce.

- Next, divide the fixed costs by the production capacity.

- Next, determine the manufacturing supplies, direct labor costs, and supplies expenses.

- Now, add the segregated components of variable costs to arrive at the total variable costs per unit.

- Now, add the resulting value in step 3 with the resulting value in step 5 to arrive at the break-even price.

Examples (With Excel Template)

Below are the examples of the Break-even price formula.

Example #1

Let us take the break-even price formula example of a business restaurant. The restaurant business incurs an expense of $3,000 on rental costs. It has to bear $5,000 on salaries and $500 on accountant fees on tallying sales achieved by the restaurants.

The business can cater to a footfall of 1,500 people. It incurs an expense of $30 per unit on account of procuring food supplies. It has to pay for $80 per unit on account of liquor. Help the management determine the breakeven price for the business.

Solution:

Use the below-given data:

Determine the fixed costs as displayed below: -

Calculation of Fixed Cost can be done as follows:

Fixed Cost = $3,000 + $5, 000 + $500

Fixed Cost will be:-

Fixed costs = $8,500

Determine the variable costs as displayed below: -

Calculation of Variable Cost can be done as follows:

Variable Cost =$30 + $80

Variable Cost will be:-

Variable Cost = $110

Determine the break-even price as displayed below: -

Break-Even Price = ($8,500 / 1,500) + $110

Break-Even Price will be:-

Break-even Price for the Business = $115.67

Therefore, the business has to sell at the break-even price of at and above $115.67 per customer order to sustain and to recover over the costs.

Example #2

Let us take the example of a medium-scale furniture business which specializes in making new chairs. The firm has determined that the variable costs per unit are $200. The firm additionally has to bear fixed costs of $10,000.

The business generates 2,000 units of chairs as per its production capacity. Help the management of the company determine the breakeven price for the business.

Solution:

Use the below-given data for the calculation of break-even price:

Determine the break-even price as displayed below: -

Break-Even Price = (($10,000 / 2,000) + $200)

Break-Even Price will be:-

The break-Even price for the business = $205

Therefore, the business has to sell at the break-even price of at and above $205 to sustain the costs of producing 2,000 new chairs.

Example #3

Let us take the example of a manufacturing business that manufactures shoes. The firm incurs Direct Labor expense of $40 per pairs of shoes. It additionally incurs direct materials expense of $55 per pair of shoes and $35 as the costs of manufacturing. The business, on average, produces 10,000 pairs of shoes.

The business additionally incurs fixed costs of $30,000. Help the management determine the break-even price for the business.

Solution:

Use the below data for the calculation of the break-even price.

Determine the total variable costs incurred by the business: -

Total Variable Cost = $40 + $55 + $35.

Total Variable Cost = $130.

Determine the break-even price as displayed below: -

Break-Even Price = ($30,000 / 10,000) + $130

Break-Even Price = $133

Therefore, the business has to sell at the break-even price of at and above $133 to sustain the costs of the manufacturing business.

The above break-even price formula example clearly explain the concept with examples from various scenarios. They show how the formula is used in the production and price estimation process of operation in various sectors, clarifying its applicability.

Calculator

We can use this Break-Even Price Calculator.

Relevance And Uses

Now let us look at some of the important uses of the formula.

- Breakeven analysis is one of the crucial topics in management and cost accounting. A break-even price helps in the calculation of price that the business has to offer to its customers for making a profit and cover its cost. In a simpler sense, it helps in the overall assessment of the situation of profitability for the business or any new projects undertaken.

- It can be referred to as the methodology wherein different price levels, and cost levels are compared to arrive at the best pricing model for the business to attain good levels of profitability.

- The break-even price analysis, therefore, can be regarded as an objective-based analysis of profitability. It can be utilized to determine the pricing levels for a new project in pipelines for an existing business, and therefore it is one of the components of the project management.

- This analysis is regarded as a critical analysis mechanism because it helps the business know how much sales it should achieve to cope up with rising fixed costs and variable costs.

- It helps the marketers to develop an effective marketing strategy as they know the pricing model as per the analysis performed and hence focus their efforts on getting the best results or sales for the business.

- Comprehensive analysis of costs with respect to sales with a derivation of a good break-even model can make an entry for new participants into the markets difficult, as well as it could make existing competitors go out of business.