Table Of Contents

Formula to Calculate Break-Even Point (BEP)

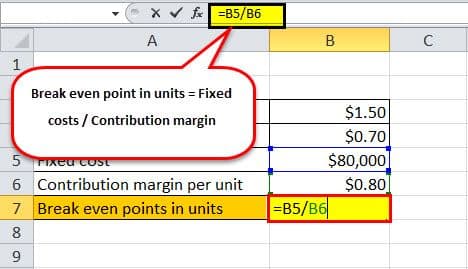

The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured.

Break Even Point in Units = Fixed Costs/Contribution Margin

The contribution margin per unit can be calculated by deducting variable costs towards the production of each product from the selling price per unit of the product. Mathematically it is represented as,

Contribution margin = Selling price per unit – Variable cost per unit

Therefore, the formula for break-even point (BEP) in units can be expanded as below,

Break Even Point in Units = Fixed Costs/(Selling price per unit - Variable cost per unit)

Steps to Calculate Break-Even Point (BEP)

- Firstly, the variable cost per unit has to be calculated based on variable costs from the profit and loss account and the quantity of production. Variable costs will vary in direct relation to the production or sales volume. The variable costs primarily include raw material cost, fuel expense, packaging cost, and other costs that are directly proportional to the production volume.

- Next, the fixed costs have to be calculated from the profit and loss account. Fixed costs do not vary according to the production volume. The fixed costs include (not exhaustive) interest expense, taxes paid, rent, fixed salaries, depreciation expense, labor cost, etc.

- Now, the selling price per unit is calculated by dividing the total operating income by the units of production.

- Next, the contribution margin per unit is computed by deducting the variable cost per unit from the selling price per unit.

- Finally, the break-even point in units is derived by dividing the fixed costs in step 2 by the contribution margin per unit calculated in step 4.

Examples

Example #1

Let us assume a company ABC Ltd which is in the business of manufacturing of widgets. The fixed costs add up to $80,000, which consists of asset depreciation, executive salaries, lease, and property taxes. On the other hand, the variable cost associated with the manufacturing of widgets has been calculated to be $0.70 per unit, which consists of raw material cost, labor expense, and sales commission. The selling price of a widget is $1.50 each.

The below-given Template contains the data about ABC company.

| Particulars | Amount |

|---|---|

| Selling Price Per Unit | $1.50 |

| Variable Cost Per Unit | $0.70 |

| Fixed Cost | $80,000 |

Contribution Margin Per Unit

Contribution margin per unit = $1.50 - $0.70

- Contribution margin per unit = $0.80

Based on the above, the calculation of the break-even point can be done as-

i.e. Break-even points in units = $80,000 / $0.80

- Break-even points in units = 100,000

Therefore, ABC Ltd has to manufacture and sell 100,000 widgets in order to cover its total expense, which consists of both fixed and variable costs. At this level of sales, ABC Ltd will not make any profit but will just break even.

Example #2

Let us consider a restaurant PQR Ltd selling pizza. The selling price is $15 per pizza, and the monthly sales are 1,500 pizzas. Additionally, the following information for a month is available.

Variable cost -

Variable cost = $8,000 + $1,000

- Variable cost = $9,000

Therefore, Variable Cost per unit = $9,000 / 1,500 = $6

Fixed Cost -

i.e. Fixed cost = $4,000 + $3,000 + $1,300 + $700

- Fixed cost = $9,000

Contribution Margin Per Unit -

Therefore,

Contribution margin per unit = $15 - $6

- Contribution margin per unit = $9

Based on the above, calculation of the break-even point can be determined as,

i.e. Break-even points in units = $9,000 / $9

- Break-even points in units = 1,000

Therefore, PQR Ltd has to sell 1,000 pizzas in a month in order to break even. However, PQR is selling 1,500 pizzas monthly, which is higher than the break-even quantity, which indicates that the company is making a profit at the current level.

Relevance and Uses

It is very important to understand the concept of break-even point formula as it is used to determine the minimum volume of sales quantity required to achieve no profit any loss situation so as to cover the fixed and the variable costs associated with the manufacturing.

In other words, it is used to assess at what point a project will become profitable by equating the total revenue with the total expense. At this point, you need to decide whether the current plan is feasible or whether the selling price needs to be raised or whether the operating cost needs to be controlled or both the price and the cost needs to be revised. Another very important aspect that needs to address is whether the products under consideration will be successful in the market.

In short, the break-even point should be conducted before the start of a business, whether a new venture or a new product line, in order to have a clear idea of the risks involved and decide whether if the business is worth it.