Table Of Contents

Meaning of Branch Accounting

Branch Accounting is a system in which separate accounts are maintained for each branch. These branches are divided by geographical location, and each department has its profit and cost centers. In this accounting system, separate Trial Balance, Profit & Loss Statements, and Balance Sheets are prepared by each branch.

Key Takeaways

- Branch Accounting is a mechanism that companies use to enable separate maintenance of accounting records for branches in different geographical locations in which the company operates.

- Its types include Dependent and Independent. The former means the branch depends on the headquarters, so its costs and profits are redirected to the head office.

- The latter means branches that are separate entities of the main branch and thus maintain separate accounting records.

- Branch accounting benefits the company in the making, analyzing & tracking of decisions according to a particular branch's requirements over time and in controlling each branch’s overall operations.

- Its disadvantages include, chances of mismanagement . Decision-making delays occur due to various accounts. It also increase a company’s expense due to separate setups at different locations.

Types of Branches

#1 - Dependent Branch

Hanging branches do not maintain separate accounts. Ultimately, the Head Office collectively manages its profit & loss statements and balance sheets. Only a few pieces of information have been supported by separate branches like Cash Accounting, Debtors Accounting, and Inventory.

#2 - Independent Branch

Independent branches maintain separate books of accounts. Ultimately, the branches keep their profit & loss statements and balance sheets separate from their Head Office. Therefore, the head office and branches are treated as separate entities in this case. For example:- If the Head Office sends material to its branch, the Head Office will record sales in the HO book and raise an invoice in the name of the component, and the department will mark this as a purchase in-branch books of accounts.

Journal Entries of Branch Accounting

The following are the journal entries of branch accounting.

#1 – Inventory – If the head office transferred inventory of $1,000 to its branch office, the journal entries below would be passed into the head office books.

#2 – Cash Remitted by Branch to Head Office – If the branch office remits cash of $500 to head office.

#3 – Head Office Paid Expenses of Branch – If the head office paid wages of $500, rent of $400, and salary of $300 on behalf of the branch.

Examples of Branch Accounting

Below are the examples of branch accounting

Example #1

ABC Ltd. is a company that has its branch office in Chennai, India, and the following is the transaction between its branch and head office during the year January 2018 – to December 2019. In this example, the head office sends goods to the branch at the cost price.

- Opening Stock at Branch as on January 1, 2018 = 1,000

- Debtors as on January 1, 2018 = 2,000

- Goods Sent to Branch by Head Office = 10,000

- Goods Returned by Branch to Head Office = 50

- Cash Sales = 5,000

- Credit Sales = 8,000

- Cash Collected from Debtors = 7,000

- Salaries and Wages = 60

- Rent = 150

- Sundry Expenses = 40

- Closing Stock as of December 31, 2018 = 1,500

- Debtors as of December 31, 2018 =1,000

Solution

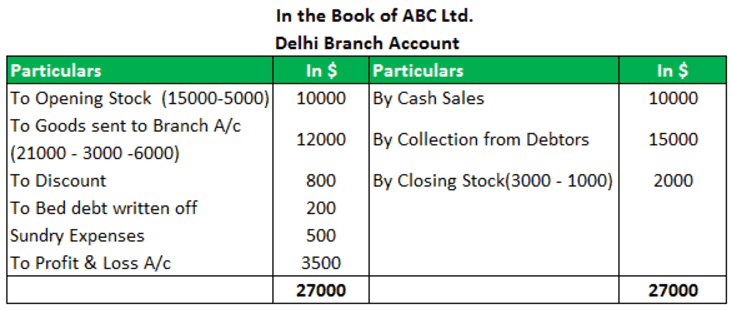

Example #2

Here, the head office sends goods at invoice price, which includes a profit of 20% on invoice price and all branch expenses paid by HO. To ascertain the branch profit, adjustments will have to be made in branch A/c, which is a difference between invoice price and cost price.

Opening Balance

- Stock at Invoice Price: 20,000

- Debtors: 4,000

- Petty Cash: 200

- Goods Sent to Branch at invoice Price: 40,000

Expenses Paid by HO

- Rent: 1000

- Salaries & Wages: 500

- Other Expenses: 200

- Cash Sales: 5000

- Credit Sales: 40000

- Cash Collected from Customer: 39000

- Goods Return by Branch at Invoice Price: 1000

Closing Balance

- Stock at Invoice Price: 25000

- Debtors: 5000

- Petty Cash: 200

Example #3

Here, goods sent to the branch are at a selling price, which is cost plus 50%. The branch remits all cash received to HO, and the HO pays branch expenses directly. The branch only maintains stock and sales ledger. Rest all transactions HO holds in its books.

- Opening Stock at Selling Price = 15,000

- Opening Debtors = 5,000

- Goods Received from HO at Selling Price = 21,000

- Cash Sales = 10,000

- Credit Sales = 15,000

- Goods Returned to HO at Selling Price = 3,000

- Discount allowed to Debtors = 800

- Bad Debts Written Off = 200

- Expenses = 500

- Closing Stock at Selling Price = 3,000

Advantages of Branch Accounting

- It helps to ascertain the profit & loss of each branch.

- It helps to know each branch's debtors inventory and cash position.

- It helps to determine each branch's wages, rent, salary, and expenses separately.

- Separate accounting of each chapter helps to make decisions according to branch requirements.

- By separate branch accounting, it is easy to track the progress and performance of each unit.

- It helps to control the overall branch operation.

Disadvantages of Branch Accounting

- Due to a separate account for each branch, it requires more workforce.

- It requires an individual branch manager for each branch.

- It requires other infrastructure at each location or unit.

- It increases the company's expenses because of a different setup at each location.

- There is a chance of delay in decision-making in this accounting system because of multiple authorities.

- There is a chance of mismanagement in this accounting system because of decentralized operation and minimum control of the head office.

Important Points

- It is a system where accountants maintain a separate books of accounts for each branch.

- Each branch's head office is treated as a separate entity in this system.

- It helps to ascertain the performance of each department separately, which helps in taking necessary action.

- It increases the company's expenses because of the workforce, infrastructure, or operational costs.

Conclusion

It is useful when the business organization operates several branches at different locations because it helps to understand and track the performance of each department. But, at the same time, it involves lots of costs because of a separate setup at each location. Therefore, it affects the profitability of the company also.