Table of Contents

What Is A Bracket Order (BO)?

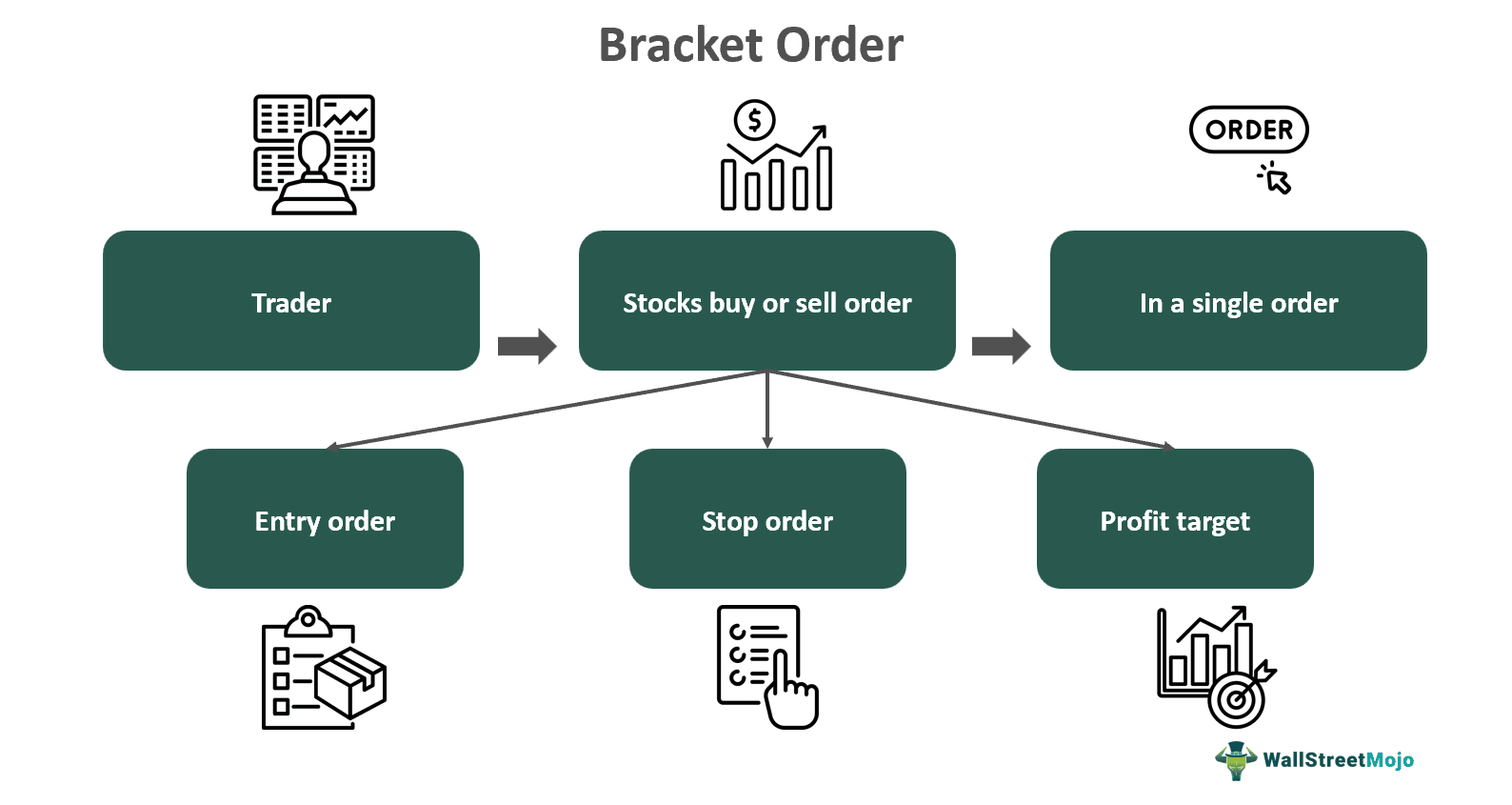

A bracket order (BO) is a trading method that allows traders to place multiple orders around a particular stock position simultaneously or in a single click. The trading order encompasses three components to manage trades effectively: entry, stop-loss, and target orders.

The technique works by automation and requires minimal effort from the user's side. It is beneficial in intraday trading sessions where traders only have specific trading windows for squaring off at profitable positions or stopping loss. This enhances a trader's trading experience and helps in risk and time management.

Key Takeaways

- A bracket order is a trading strategy that enables traders to place multiple orders (first leg, second leg, and third leg) around a desired stock simultaneously.

- This order includes three components: the entry order, which is the first leg; the stop loss order; and the profit target, which becomes the second and third legs.

- There are numerous benefits attached to the strategy. It is automated, allows traders to be laid back as they need minimal intervention, and enhances the trading experience.

- The method minimizes loss and maximizes profit. They are flexible, provide emotional control, and help in leveraging volatility.

Bracket Order Explained

Bracket orders are trading orders that allow traders to execute an intraday trade by stopping losses and booking profits. The trading technique has three components: an initial order and two conditional orders, which are to stop loss and take profits. This enables traders to set profit targets, limit their maximum loss, and manage risks efficiently, all within a single transaction.

It starts with an order to buy or sell an instrument. Once executed, additional orders of stop loss and profit are automatically placed. These secondary orders are set according to a pre-determined price, effectively encapsulated as a bracket. The price set locks in profits by closing trades at favorable prices and automatically triggers stop loss orders if the price moves unfavorably. This balance between profit and loss helps manage risks efficiently.

A limit order, functioning as the first step, is executed initially. The simultaneous triggering of the second and third steps follows this. If the stop loss price is attained, the stop loss order will be executed, and the profit order will be automatically canceled. Conversely, if the profit target price is hit first, then the stop loss is automatically canceled.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Place?

The process involves simple steps such as:

- Selecting the stock: Conduct thorough research before investing funds into a stock. Consider factors like market trends and future movements.

- Choosing the bracket order option: Many trading platforms offer a simplified order option where the traders can select an initial order accompanied by two other orders.

- Main order price setting: Determine the price to sell or buy the desired stock. This is the entry point and the initial order.

- Stop loss and profit target marking: Input the values for stop loss and profit targets. This helps to minimize loss and maximize profit.

- Trade execution: Finalize the order by either clicking the sell button or the buy button.

Examples

Let us look at some examples to understand the concept better.

Example #1

Imagine Daniel is an intraday trader. He executes a BO in the following manner:

He places an initial order of $100, and the future price movements indicate a high value of $150. He orders a target profit of $150 after placing a buy order of $100. At the same time, when ordering a profit point, he also places a stop loss order for precaution at $95.

First, the initial order gets executed, and simultaneously, the target order also gets executed if the price reaches $150. In this case, the stop loss order automatically gets canceled. Suppose the price goes below as soon as the initial offer gets executed, then the stop loss order of $95 will be executed. The target profit will be canceled.

Example #2

A trading platform, Zerodha had sent out a statement regarding the stopping of bracket order in option trading. Although it is a convenient option for traders to leverage situations of volatility, the platforms find it difficult to maintain fair trade. This is because the systems in volatile market conditions tend to execute both orders simultaneously.

Advantages

Some of the advantages of such orders are given as follows:

- Efficiency - These orders are automated, requiring minimal input from the trader's side. This aids them in exercising trading strategies without having to monitor them constantly.

- Risk management - Trades under small windows can make extreme profits or losses. Traders, through the entry, stop loss and profit targets and manage risks efficiently.

- Emotional quotient - The set trades do not require thinking afterward and help save the traders from getting emotional at any time of the day. This also helps in building the discipline of investing or trading, as there is less room for emotional thinking.

- Market volatility - The method helps take full use of market volatility. The automatic trades set helps gain or stop losing positions.

- Maximizing profits and minimizing losses - The method helps to execute three different moves all at a time. Traders use profit targets to maximize the profit they take and simultaneously create a stop loss. This helps them balance gaining and losing money.

- Reduced requirement of monitoring - The orders are made at current market prices, and once the prices are set, they do not require constant monitoring. They do not have to react to every price movement, either. Making them suitable for various types of markets.

Bracket Order Vs. Cover Order

The differences between both concepts are given as follows:

| Aspect | Bracket Order | Cover Order |

|---|---|---|

Concept | These orders allow the clubbing of different orders simultaneously. | A cover order is an order that has two parts: the initial order and the stop loss order. |

| Calculation | Its calculation involves the setting of three orders. It has three legs: the initial offer, the stop loss, and the profit target. | The initial order and the stop loss order calculate the cover order. |

| Square off profit | They are set in a manner that the profits are automatically squared off in cases where the target profit order and the stop order for loss are unsuccessful. | Squaring off the profit in a cover order is dependent on the stop-loss order. |

| Flexibility | Such orders are flexible as they allow traders to set stop losses and profit targets. | Cover orders are less flexible as they allow only stop orders. |

| Suitability | They are best suited for people who are quite seasoned. These traders know the point where they want to minimize the losses incurred and maximize their profits. | Cover orders are best suited for traders with low-risk appetites and who want to minimize losses. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.