Table Of Contents

What Is A Bought Deal?

A bought deal is a type of offering in which an investment bank commits to purchasing the entire share of a public offering directly from the issuer. The primary aim of this arrangement is to eliminate the financial risk associated with the financing process and ensure the successful raising of the intended capital amount.

The origin of this offering can be traced back to the 1980s in the United Kingdom and later gained influence in the United States. By utilizing this offering, issuers could raise capital through underwriters, effectively removing the risk of having unsubscribed shares in the offering process.

Key Takeaways

- Bought deal refers to the promise made by the underwriter (of an investment bank) to the issuer to purchase an entire lot of shares before its launch in the equity market.

- The first bought deal was executed in the United Kingdom in 1981. Later, Toronto-based investment firm "Gordon Capital Corp" in 1982.

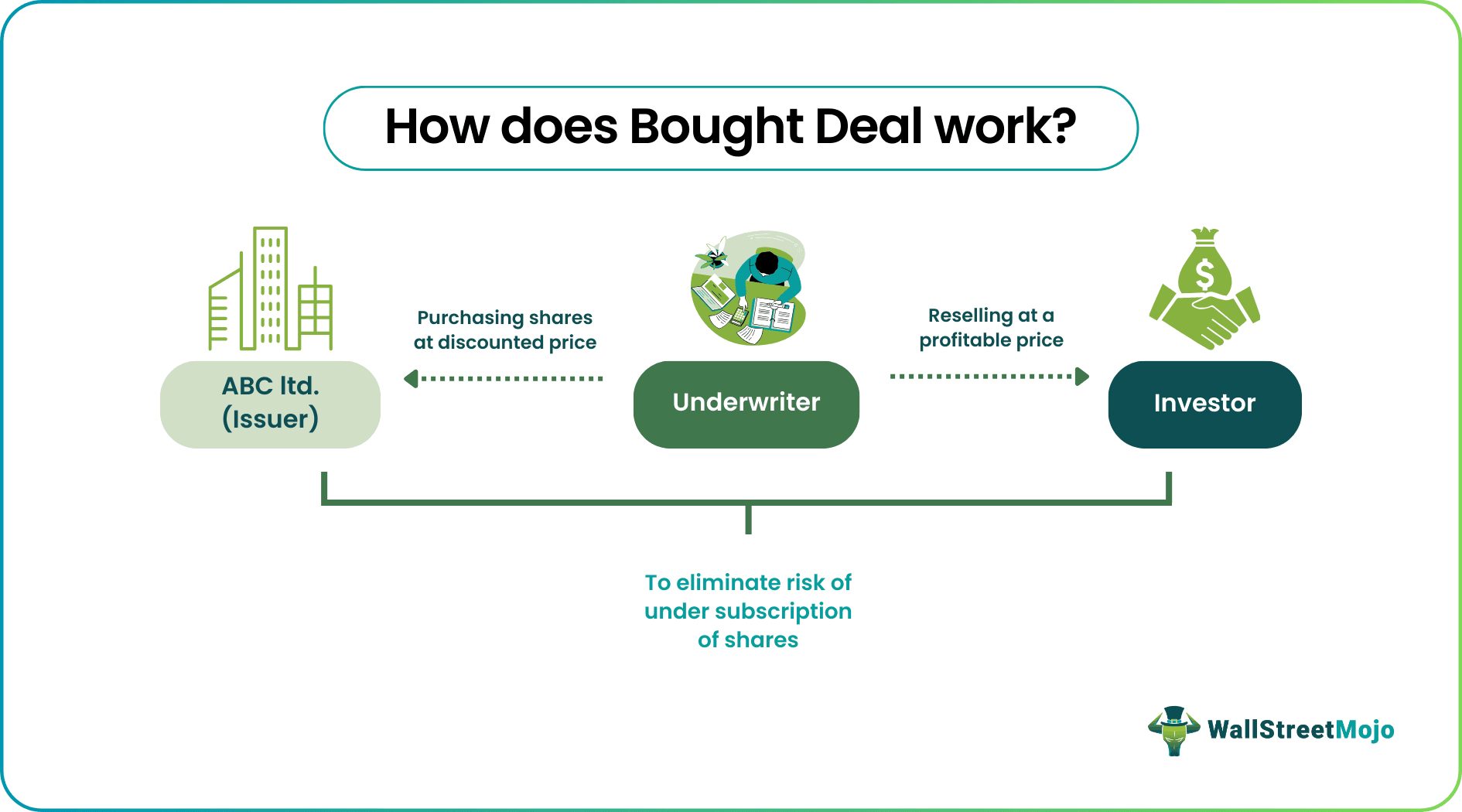

- The issuers sell entire shares to underwriters at a discounted price. Further, the latter sells to the investors to cover the investment cost.

- Although prior marketing is prohibited, underwriters can attempt under the guidelines and standards as per SEC and Regulation D.

How Does A Bought Deal Work?

Bought Deal financing is an offering in which an investment bank, acting as the underwriter, commits to purchasing many shares or bonds directly from the company issuing the securities. The primary aim of this arrangement is to eliminate the financial risk of under-subscription for the issuing company, ensuring that the intended capital amount is raised successfully.

When this offering is executed, the underwriter assumes the responsibility of reselling the securities to other investors. The process typically occurs before the prospectus filing, meaning it must be finalized before the securities' official offering.

Unlike traditional offerings, which may involve a pre-marketing process to gauge investor interest, a bought deal does not rely on prior marketing efforts. Instead, the underwriter must adhere to regulatory requirements and document standards while efficiently executing the agreement within the specified time frame.

In summary, this offering involves the investment bank committing to purchase the entire offering upfront, reducing the financial risk for the issuing company. Subsequently, the underwriter resells the securities to other investors to complete the financing process.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Origin

During the 1980s, the bought deal offering method was first introduced in the Eurobond market. Credit Suisse First Boston made a significant transaction by purchasing shares worth $100 million from General Motors Acceptance Corporation, a subsidiary of "General Motors."

Around the same time, in mid-1985, US wealth management firm "Merrill Lynch" also utilized this structure to acquire a bond issue worth $50 million. Interestingly, Toronto brokerage firm Gordon Capital had already developed the bought deal technique in 1982, showcasing its early pioneering role in this financing approach.

Examples

Let us look at some hypothetical and real-world examples for a better outlook.

Example #1

Suppose ABC LTD plans to launch its shares as fresh issues in the equity market. However, they fear the market movements and subscription of their shares. Therefore, the firm chooses to launch its equity on a bought deal basis. They assign Credit Investments who will purchase the entire lot.

So, for an issue of 120 million shares, ABC Ltd will sell all shares to Credit Investments. Here, the underwriter will purchase the shares at a discounted rate to cover losses. So, if the face value were $10, the deal would be $840 million ($7 by 120 million). Later, the underwriter (Credit Investments) will sell these shares to retail investors in the secondary market.

Now, during resale, the underwriter has to sell at a minimum of $7 to cover the purchase amount. Otherwise, there are chances of net losses for them.

Example #2

On July 13, 2023, Lithium Ionic Corp announced to enter into a bought deal private placement basis with Clarus Securities Inc. and Canaccord Genuity Corp as co-underwriters. As per this deal, the former has 11.9 million shares (11,904,900) as fresh issues at $2.10 per share. However, the underwriters also have access to extra 1,785,735 common shares.

Advantages And Disadvantages

Bought deal private placement has a crucial role in the firm's financing in place of an equity offering. Let us look at its advantages and disadvantages:

| Basis | Advantages | Disadvantages |

|---|---|---|

| Underwriters | Purchase of securities at a discounted price.Chances of huge profits on the resale of these shares at a higher price to the investors. | The capital of the underwriters is blocked unless the shares are sold to the investors. Additional responsibility to resell the entire issue to avoid losses. |

| Issuers | Elimination of financial risk and under subscription. They receive quick funds via bought deals. There is less risk for market movement before launch. | The issuers must finance at a discounted rate instead of face value. The underwriter's failure to resell may create a negative segment about the issuing company. |

Bought Deal vs Best Efforts vs Block Trade

Bought deals and best efforts are a part of corporate financing. However, block trade differs from them. So, let us look at their differences:

| Basis | Bought Deal | Best Efforts | Block Trade |

|---|---|---|---|

| Meaning | It refers to the commitment by the underwriter to purchase the entire issue of the issuing company. | Here, the underwriter makes best efforts to sell as much as securities to the public. | Block trades are bulk trades (purchase and sale) of securities conducted by an investor. |

| Purpose | To eliminate the risk of under subscription. | To sell the securities till a point where the capital requirement is met. | It reduces any price fluctuations in the stock or bond prices due to high-volume transactions. |

| Limitations | The underwriter may sometimes be unable to resell the shares to the investors. As a result, the association with the issuing company may be hampered. | The underwriter does not guarantee an entire sale of securities. | A sudden price movement may cause net losses if the position is on halt. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A bought deal has a crucial role in the equity stock market. Since this deal occurs before the market launch, no investors are involved. However, if the underwriters cannot resell, the company's image will be distorted before the launch. As a result, it will lead to fluctuations in stock prices. Likewise, a similar effect applies to successful subscriptions.

Both terms are almost similar, with a slight difference between them. The offering tries to sell the securities to underwriters at a discounted price. However, in a marketed deal, the underwriters will promise to purchase them, but the cost and amount will be decided once the value is sold to potential investors.

The only difference between the terms is that underwriters promise to comply and file the prospectus during the initial public offering (IPO). However, the latter only involves the purchase of the issue before filing.